The data for April’s new energy vehicle insurance has come out, and I’ve compiled it based on a few data sources.

1) Tesla is really struggling in the short term in China. Based on insurance and production data, the 25,000 units reported by the China Passenger Car Association are not accurate, and the actual number is around 12,000.

2) The sales numbers of many models, such as Wuling Hongguang Mini, Hei Ma, and Benben, are still affected by the supply chain, and only those that can overcome the constraint will stand out. Currently, traditional OEMs are particularly active this year, and there may be a wave of recovery. We can discuss this separately, mainly focused on BYD, BAIC, SAIC, Geely, and GAC.

Tesla’s situation

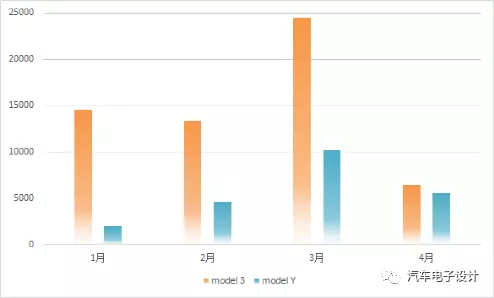

Tesla is the most closely watched, so let’s focus on it first. The insurance data for April is particularly bad, as shown in the following figure. Model 3 dropped from 24,495 in March to 6,431 units (partially exported to Europe), which is understandable. However, Model Y dropped from 10,140 in March to 5,520, which is very hard to understand as the demand for Model Y exceeds supply.

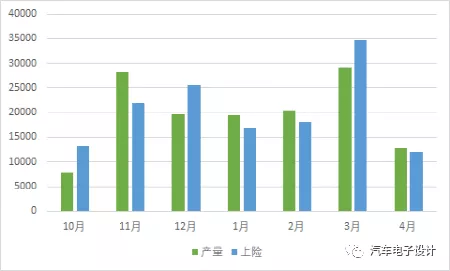

This problem is actually very obvious when comparing the production and insurance data. Tesla’s production and insurance data are usually in sync, so the data reported by the China Passenger Car Association is a bit confusing (the reported data of 25,845 units includes 14,174 units, and the actual number in China is 11,670 units). I think there are several reasons for this:

1) Tesla registered 6,783 vehicles (including 4,627 Model 3s and 2,156 Model Ys) in Shanghai last month, which makes data discrepancies significant, especially after the new policy takes effect in May.

2) Tesla’s recent negative publicity has caused a significant drop in sales.

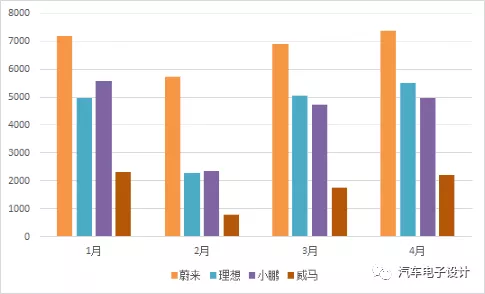

Overall, new companies that were established around the same time as Tesla maintained stable sales numbers, as shown in the following figure. As public opinion and attitudes change, more and more demand is being diluted.

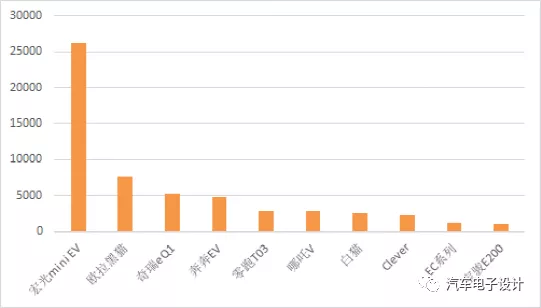

Sales by modelIn the micro electric vehicle market, the number of front-runner vehicles has reached 56,600, and the proportion of new energy insurance in each month is very high.

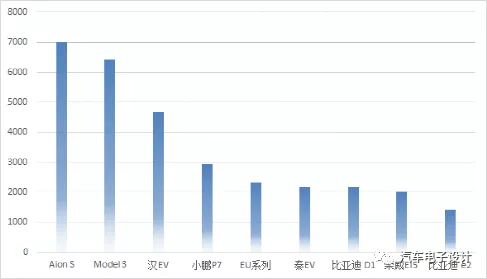

In the passenger car market, as the demand for Model 3 declined, Aion S rushed to the first place, while Han EV and XPeng P7 diverted part of Model 3’s demand, with a total of 31,000 units in the top 10. The demand for 2B-end taxis and ride-hailing has indeed recovered in 2021, and it is estimated that the demand in the 2B-end will be the main force supporting deliveries in the next step when private consumption is influenced by public opinion.

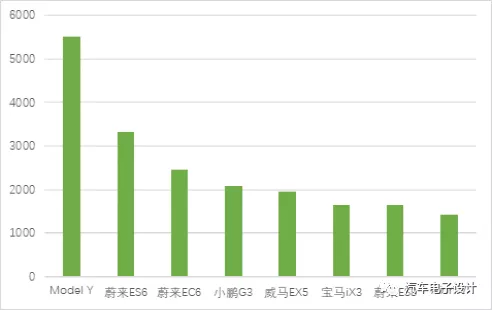

In the pure electric SUV market, we did not see the Model Y taking the lead as we had hoped, as newly established car companies’ SUVs ranked ahead. Currently, the performance of BMW’s iX3 is still excellent, while the ID4 from Volkswagen needs to catch up.

Conclusion:

We will stop here for today. Tesla’s recent events have both advantages and disadvantages for the development of new energy vehicles. This year’s wave may need to be discounted. For Tesla, becoming a low-cost manufacturing center in China is not an issue. Whether it can become a super-sized market after cost reduction still requires development in all aspects.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.