These days, besides the “pale yellow dress and fluffy hair” that went viral in the entertainment industry, the automotive industry is also making headlines with a movement towards technological evolution in the field of power batteries. During a press conference, BYD unveiled a long, approximately 2-meter-long power battery, also known as a “blade battery,” accompanied by a series of dazzling phrases such as “redefining industry safety standards,” “eradicating self-ignition from new energy vehicles,” “making changes to collapsed industries,” and “correcting the development path of power batteries.”

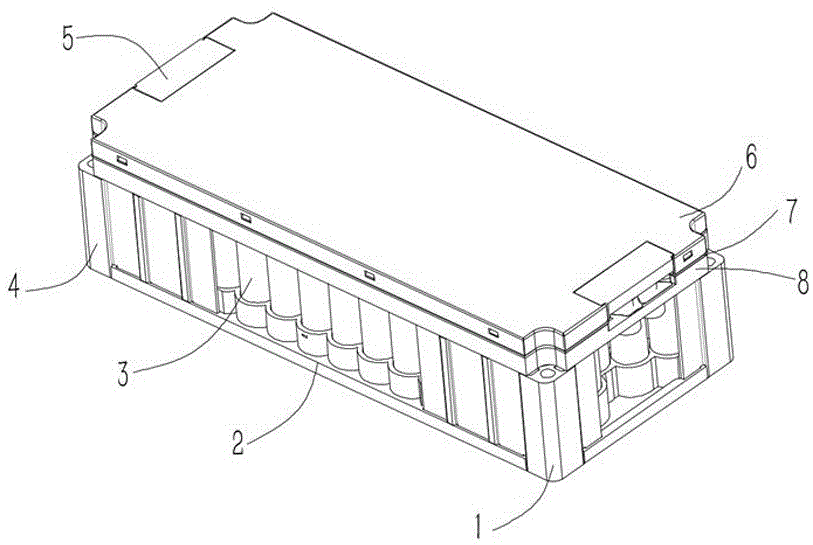

This new battery is the largest single cell in a power battery to date. According to BYD’s patent, the product’s height is 118 mm, thickness 13.5 mm, and length is customized between 435 mm-2500 mm. Its long and thin shape, resembling a blade, earned it the name “blade battery.”

Due to its complete avoidance of battery module design, BYD has become the first company to mass-produce batteries without the module. By iterating the production process, the space utilization rate and energy density of the battery system can be improved while still being cost-effective. This means that the blade battery isn’t so much a breakthrough in the material itself but rather an iteration and evolution of battery production and technology.

Thus, the question arises: can the blade battery become BYD’s secret weapon in regaining the top spot in the domestic power battery market?

A Marketing Gimmick or Technological Innovation?

In fact, the industry’s discussions regarding the blade battery have been ongoing for several months. After the press conference, the conversation gained more traction, leading to various opinions. There are mainly two camps with differing views: “the blade battery doesn’t offer any technological improvements, it is simply a marketing gimmick by BYD” and “the blade battery solves multiple practical needs and has pioneering significance.”

The division of the market’s opinion on the blade battery is actually easily understandable. Those who view it as a gimmick are approaching the issue from a materials science perspective. Although this interpretation is not entirely wrong, it does make things difficult for BYD.

Due to their limited knowledge of basic chemistry, material innovation is quite restricted. Even if there is occasional news on this front, such achievements are only possible in a laboratory environment and cannot yet be mass-produced. Therefore, major battery manufacturers worldwide are currently unable to make significant breakthroughs in material science.

In the field of power batteries, there are numerous technical details to consider beyond the materials. One such area is the integration of battery modules, which is most frequently mentioned. By improving this technology, extended range can be achieved, which is innovation in production and technology.

First, let’s understand a concept:

What is CTP? CTP technology, or Cell to Pack, is also known as module-less technology, which has two different technical routes: one is a completely module-less route, and the other replaces small modules with large ones.To put it simply, BYD’s blade battery is a type of CTP technology, and CATL also has a CTP technology scheme, so CTP technology itself can be a path that any manufacturer can choose. It can be understood as cherry-flavored cola and strawberry-flavored cola, but they are both called cola.

It is not to say that CTP is the technology of BYD or CATL, but the common name of non-module technology.

Let’s learn about another concept:

What is a battery module? To give an example for ease of understanding, when we buy eggs, we all know that there will be egg trays to prevent cracking. With this concept in mind, let’s talk about battery modules. Eggs are like single battery cells, with 30 eggs per tray, and 6 trays of eggs in a box. Therefore, there will be space waste between the trays. If you want to pack more eggs, you need to remove the egg tray, which is like a module.

In the past, a box can only hold 6 trays of eggs, which is 180 eggs. But now, after removing the egg tray, it can hold 200 eggs. This is the space utilization rate with or without modules.

The egg box is like PACK packaging technology, that is, battery packs. Blade batteries adopt a non-module design, which means that it is an innovation in battery production and technology.

Simply put, just like the Nanfu battery you buy, a single blade battery is a single battery.

Can the non-module design process be called innovation?

As we mentioned above, the so-called non-module is similar to removing the egg tray to pack eggs. This brings about more problems because there is no individual fixing of the egg tray, and the eggs are more likely to break. The same applies to non-module dynamic battery, and solving heat dissipation, strength, etc. is necessary for safe use.

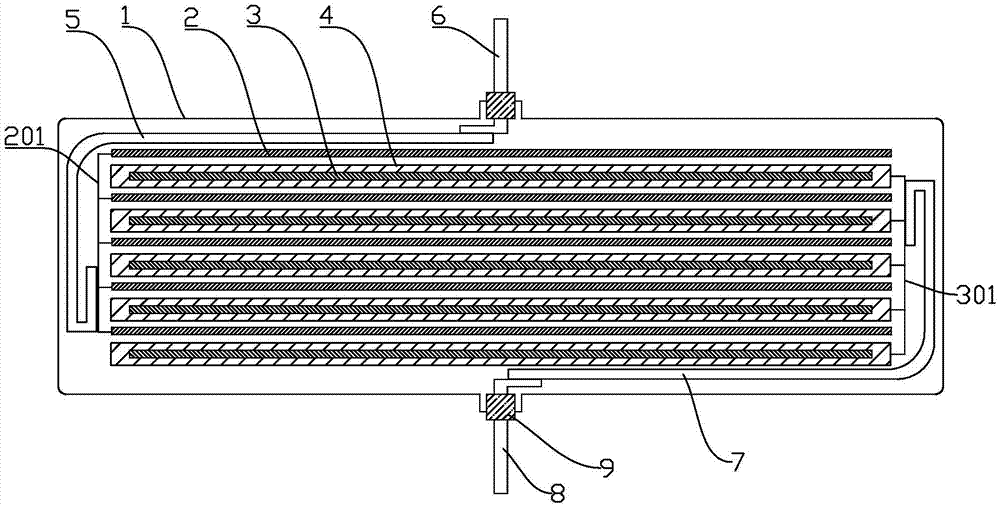

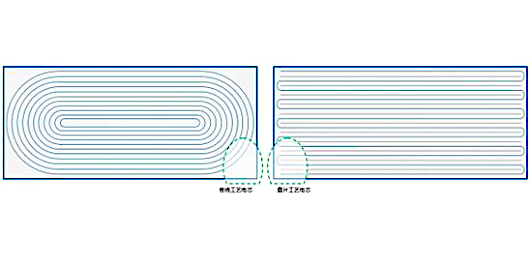

The blade battery uses BYD’s dominant lithium iron phosphate battery cell, just “elongating” the previous single battery cell and installing a high-strength plate on the side of the blade battery spine. This way, the side of the battery can bear the supporting role and doesn’t need to arrange structural parts so that “the blade battery is both an energy storage device and a structural part, which can directly support the beam of the battery pack”.Place the single-cell directly on the bottom plate, fixing the ends of the cell on the terminal plate, and providing support for the cell with the two side frames. Simply put, the cell is very precious. In traditional manufacturing, a bunch of modules are designed to protect the cell from knocking and touching. However, the blade cell has a high-strength support force on the side ridges of the cell itself, and the encapsulation frame can provide support force for the cell again, which is double protection.

Therefore, each cell can be arranged separately in the battery pack, greatly improving the space utilization rate of the battery pack.

By increasing the space utilization rate of the battery from 40% to 60%, this feature directly increases the energy density of the blade cell system by 50% when grouped. The BYD “Han” equipped with this battery has a range of 600 km, while mainstream electric vehicles currently have a range of only 500 km to 600 km.

And because the cell uses lithium iron phosphate, it has greatly improved battery cycle life, reaching 8 years and 1.2 million kilometers. Blade cells have no difference in life, range, and performance compared to today’s NCM/NCA 811 ternary lithium batteries.

This is also why BYD said that they want to “wipe out spontaneous combustion” from electric vehicles. The several spontaneous combustion incidents of electric vehicles in 2019 caused a brief crisis of trust in electric vehicles. Of course, there are many factors that cause spontaneous combustion, from materials, cells, systems to actual road conditions, and although lithium iron phosphate itself cannot guarantee zero accidents, it still has advantages in cell stability. The heat dissipation area of the blade cell is larger, and the heat generation capacity decreases when punctured, so the impact of the battery thermal runaway is smaller.

Ironically, ternary batteries are the mainstream technology adopted by the market, which is also the reason why BYD said they want to “correct the development path of power batteries.” Because of the range, ternary batteries are widely used in the market, which makes lithium iron phosphate, dominated by BYD, temporarily lose its luster. Now, the range of the blade cell is almost the same as that of the ternary cell, and the stability of lithium iron phosphate is even better than that of the ternary cell.

This is what BYD calls “forcing the industry to make changes.” This is the voice that BYD has stockpiled for many years!

In terms of design, the blade cell has extremely high requirements for technology, because the production process of large cells and the material of the cell body are new technologies, plus how BYD solves the structural fixation of the cell and the connection process between the cells. Therefore, although CTP is not a completely new technology, BYD’s blade CTP is also an absolute technological evolution.And this technology also has a highlight, which is the flexible scheme of the battery. The space for the battery on the vehicle is limited, and the chassis space is just that big. In addition to meeting the requirements of interior space, it is necessary to increase the driving range. In the past, the length and width space of the battery module were squeezed. The “blade battery” considered the adaptability of multiple specifications from the beginning. The narrow side of the “blade” is made as small as possible, which means that the vertical height is more easily adaptable to various high and low chassis models. This also reserves a lot of design space for automakers.

A Top-down Innovation System

As we mentioned above, the non-module design of the blade battery is actually a very bold move, and this innovation poses new challenges for production lines, processes, and manufacturing. In other words, it can be designed in engineering, but how to actually make it is a big problem.

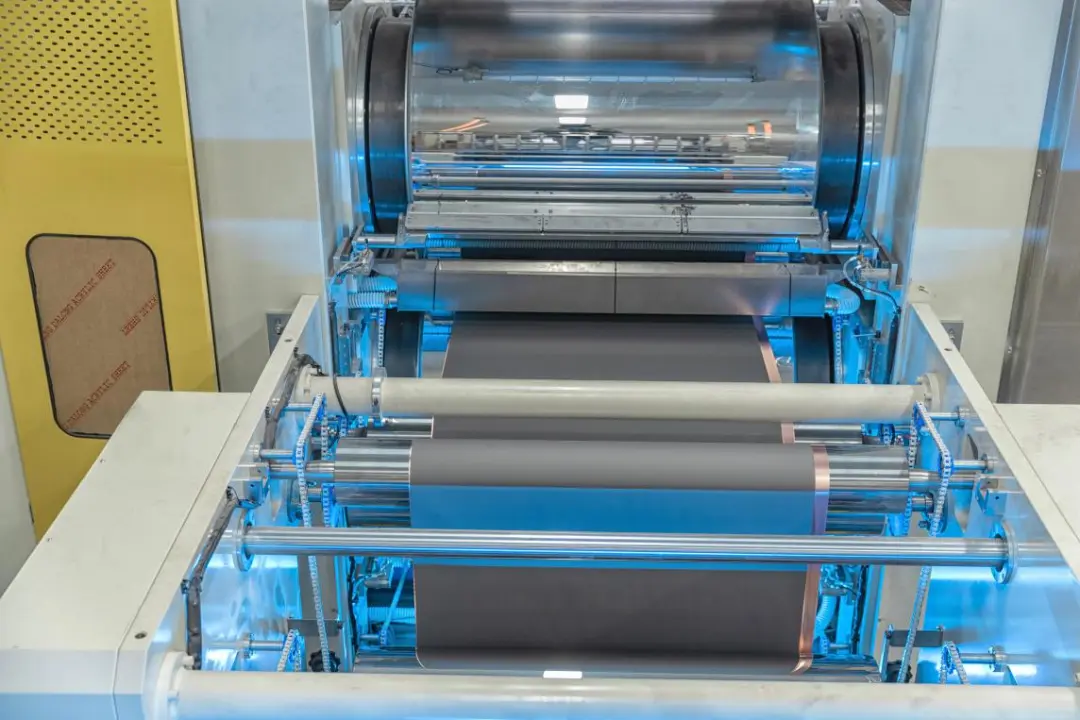

As a large-scale manufacturing industry, the production process of the power battery is also very complicated, including: uniform slurry of positive and negative electrodes, coating, rolling, cutting, baking, lamination, winding, packaging, injection, testing, formation, capacity separation, etc. Each process requires a proprietary device to operate.

The pioneering design of the blade battery has also brought difficulties to the production process. The length of the blade battery can be made from 400 mm to 2500 mm, making manufacturing a challenge.

Currently, common stacking machines, winding machines, formation machines, and injection machines cannot produce blade batteries.

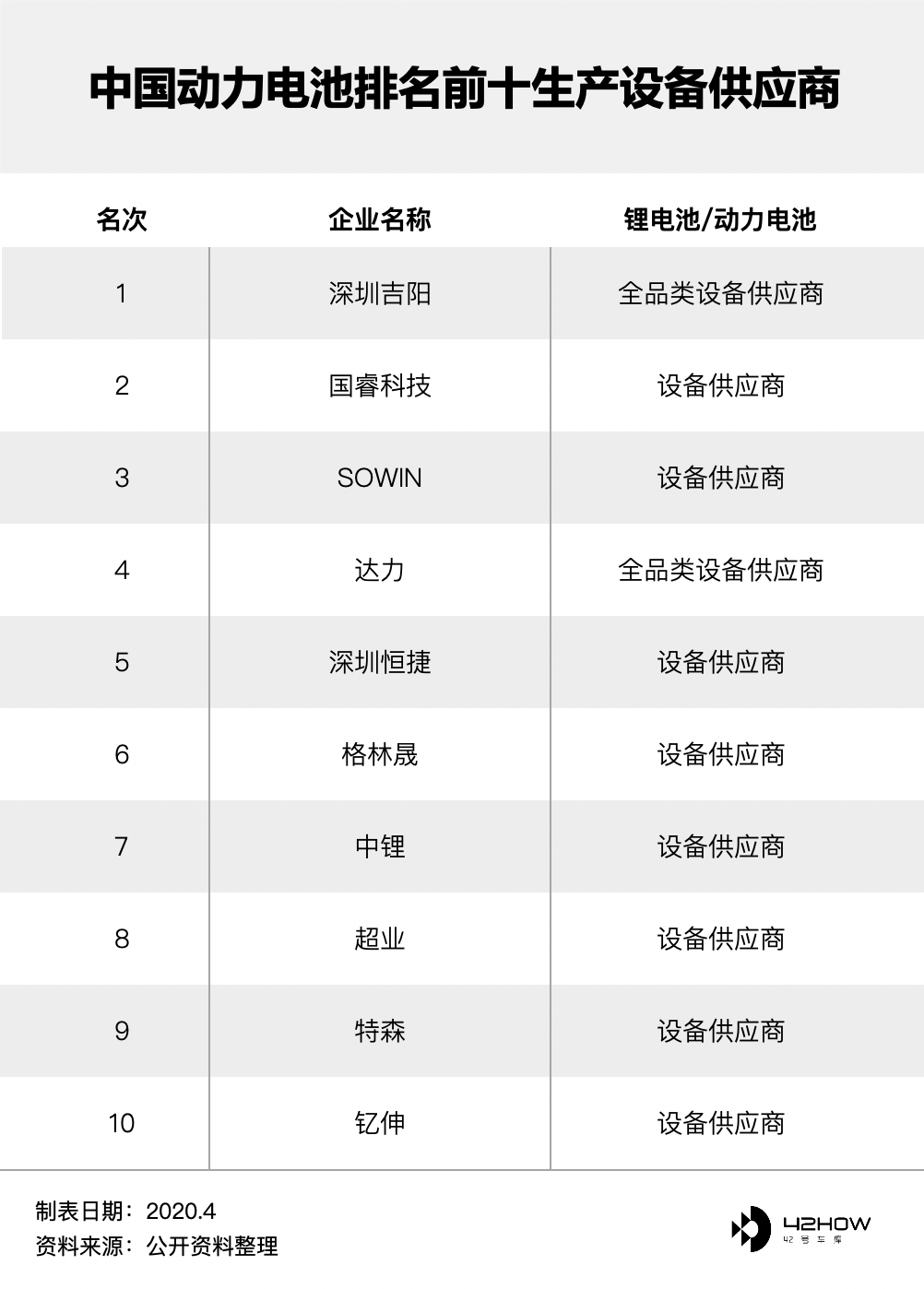

Most of the actual production equipment needs to be customized and redeveloped. The product specifications of the largest stacking machine provided by these suppliers cannot meet the production requirements of blade batteries.

Therefore, the blade battery should not only be seen from the perspective of design and process, but also from the perspective of manufacturing, because in order to achieve the desired effect, equipment and production lines must be improved.

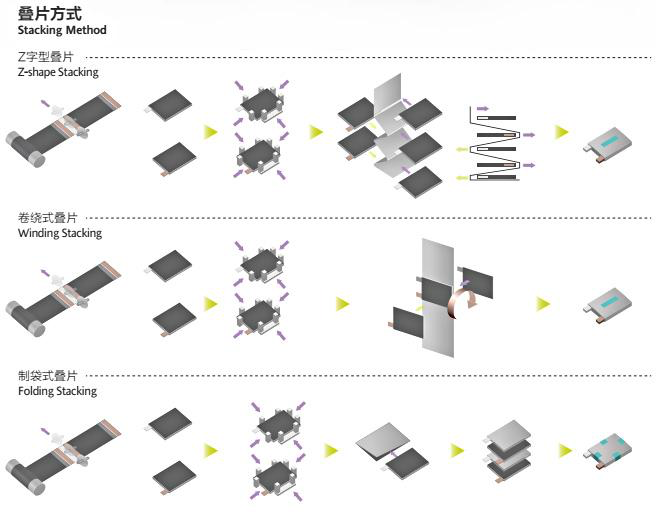

What is the stacking process? It is to cut the positive and negative electrodes into small thin slices, then put the separator in the middle to form a small single cell, and then stack the individual small cells together in parallel to form a large cell. According to the design, stacking a certain number of cells is the actual required battery.

You can understand it as a hamburger, with three layers of upper, middle, and lower, and a hamburger is a small battery. Stacking several hamburgers together is a large battery.

The force distribution of the stacked cell is more consistent, with similar expansion in each layer, a flat interface, and relatively low safety risks, thereby extending the cycle life of the battery.

Actually, the winding process and stacking process are both technologies for the bare cell stage. Stacked cells have a unique shape that provides higher energy density and interface stability. During the cycle process of lithium-ion batteries, both the positive and negative pole slices of the battery will undergo varying degrees of expansion.

Winding technology, affected by the inconsistent internal and external stresses of the winding corner, can cause deformation of the wound cell and even folding or fracture at some corners. As the use time of the entire vehicle increases, the risk of thermal runaway of the battery will increase, which can cause safety hazards.

From the technology itself, the optimal solution for such a large-sized blade cell is to use a stacking process. However, the high-speed stacker required for engineering is currently a major obstacle. Only Fenghuo Energy has completed the development and importation of the first 45-degree rotating high-speed stacker. How to solve the manufacturing problems brought by important production equipment such as high-speed stackers is something that BYD has not elaborated on.

But it is not difficult to imagine that whether it is transforming the factory or not, this is almost no different from building a new factory. Machine re-development, the width and height of the production line may all need to be adjusted.

Therefore, driving engineering innovation often requires the cooperation of top-level design. In fact, the difficulty of doing internal innovation in large enterprises is even greater, and it cannot be promoted without the cooperation of internal resources. Innovation also requires the overthrow of oneself. Therefore, experience is often an engineer’s shackle. It can be imagined how much Wang Chuanfu personally expects from the blade battery.

This is an iterative innovation process from design to production technology, and BYD deserves praise for this.

Why Launch the “Blade Battery” Now

This may be an opportunity that BYD and even Chinese power battery manufacturers cannot miss. Although Chinese battery manufacturers such as BYD and CATL have developed rapidly, the competition in power batteries around the world has not ended.

Although the competition at the cell level of power batteries has come to a temporary end due to technical bottlenecks, the demand for high mileage has not stopped, so improving volume utilization is the main competition of this stage.The evolution of power battery module standards has determined why BYD is launching the “Blade Battery” at this moment. Standardization of power battery modules is an inevitable product of the deep development of the entire vehicle industry. In the early stage of exploration, the size of each company’s battery cell and the space requirements of vehicle models were different. Therefore, for a long time, the form, size, and arrangement of battery modules on the market were diverse, which could not achieve cost reduction and efficiency improvement under a standardized mode.

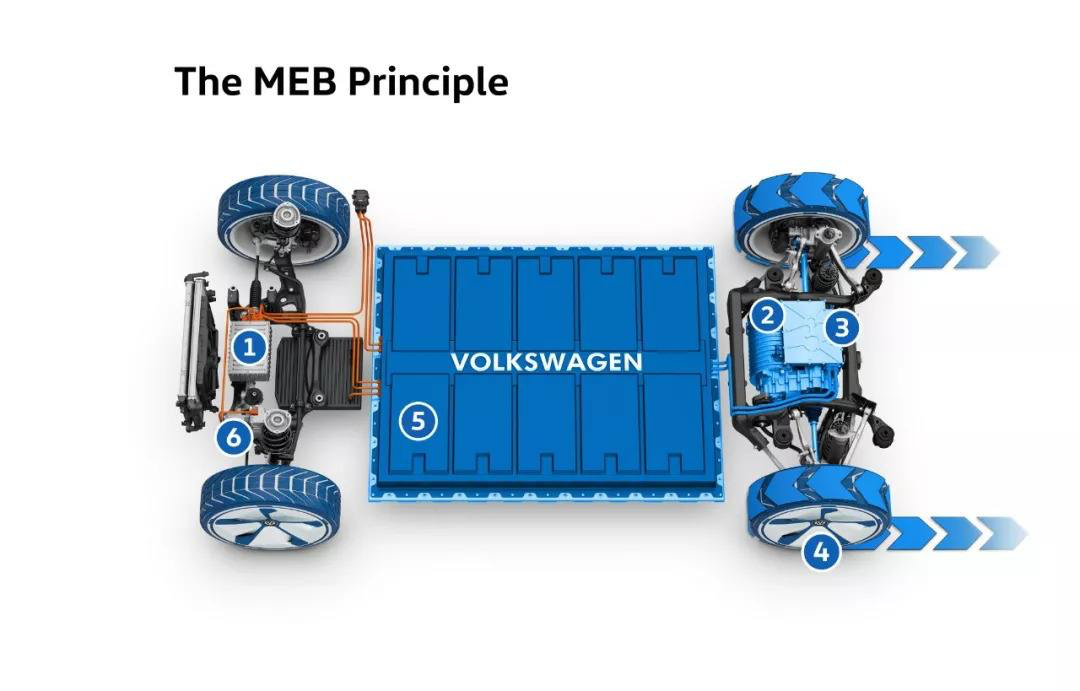

Therefore, the market is pushing the process of module standardization, and the company’s discourse power in the market determines the degree of compromise that suppliers make. There is no doubt that Volkswagen is the one with the discourse power. In the early days, Volkswagen released a volume of 300 GWh to establish its own standards. Power battery companies have also standardized their supplies based on this number.

What’s interesting is that Nissan provides square-shaped large soft-packed battery cells with the same end for positive and negative terminals, and Tesla provides 18650 and 2170 batteries. General Motors and Ford are both using square-shaped large soft-packed battery cells with the same end as the positive and negative terminals. Kia and Hyundai provide two types of soft-packed battery cells, one with the same end and the other with positive and negative terminals on both sides. BMW has PHEV-1 and BEV, while Daimler provides customized soft-packed battery cells. Volkswagen has defined its own specifications for battery cell size.

This is also the reason for the failure of battery cell standardization. Everyone has their own standards, and in the end, there is no standard. Moreover, different vehicle models have different requirements, making it difficult to standardize battery cells. If battery cells don’t work, then choose standardizing modules.

Module standardization can be a big deal. Module standardization is equivalent to giving the vehicle manufacturer a box, and how to place the battery cells inside is the responsibility of the battery company.

What is the earliest 355? The so-called 355 is nicknamed after the length of the module, which is 355 mm. Including the later 390 and 590.

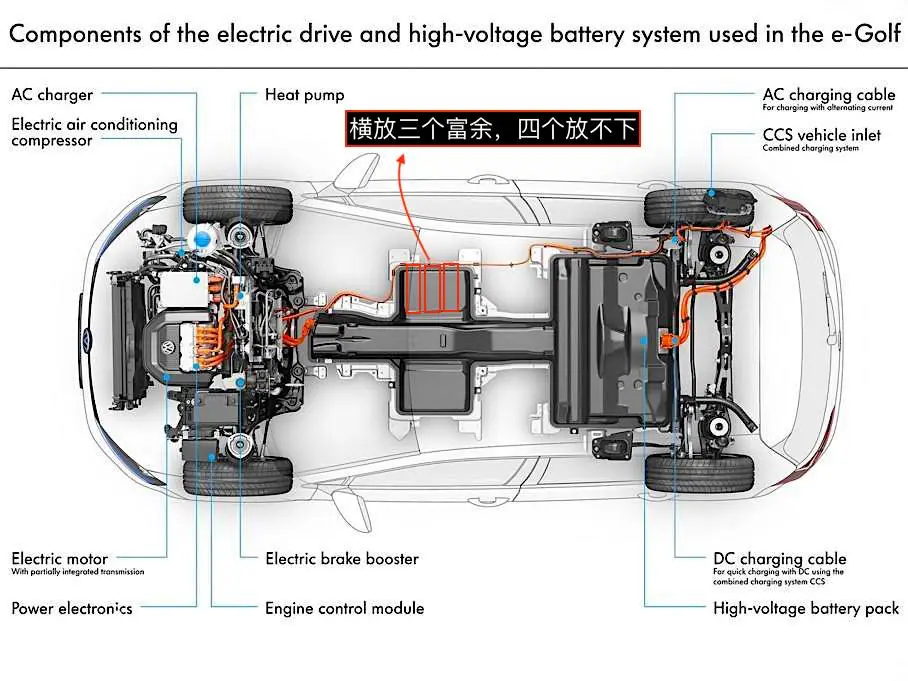

Volkswagen’s 355 module is also the most widely used standardized module. It was used in the early e-golf and Audi Q7 e-tron. Among them, the Q7 e-tron module had a significant impact domestically because China was still following the clamshell route at the time. Therefore, 355 is also the most widely used module platform in China.

As the development of product types continues, the problems of 355 have gradually emerged. Because 355 is a module that caters to both the PHEV and EV needs, it is too long and wide to cater to both of them. This means that there is a surplus when putting three modules horizontally, and it cannot fit four modules.### 390 Module: Improving Space Utilization and Ensuring Safety

The 390 module was born from evolution, and further extended its length. By placing 3 390 modules horizontally, it can not only improve space utilization, but also ensure safety. For example, the 95 kWh version of the e-tron has 4 modules placed in front and behind on the first layer, and 5 on the second layer, bringing the total quantity to 36. This provides a larger range and simpler structural components. Through the evolution from 355, the 390 module gradually became the main module solution for the Volkswagen Group.

The PHEV versions of the Audi A8/A6 and the Audi e-tron BEV follow the specifications of this module.

The difference between the 355 and 390 specifications lies in placing more energy within a similar volume and fine-tuning the cell energy and size as much as possible under the original cell specifications.

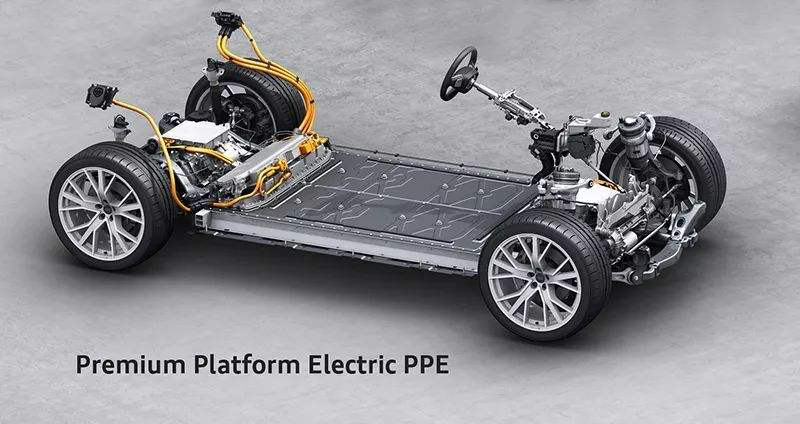

The 590 module is a product of the MEB era of Volkswagen. On the one hand, the demand for larger modules has substantially helped current designs. “If one module is missing in the same width range, space utilization can be improved, structural components can be reduced, and costs can be lowered”.

The 590 module has the same width as the 390 module and achieves increased energy density by compressing the battery pack horizontally. Apart from CTP, the evolution from 355 to 590 represents three 3-module horizontal placement solutions, while the 590 represents two-module horizontal placement solutions.

Therefore, considering what we mentioned about egg trays earlier, the essence of the 355, 390, and 590 modules is the iteration of the battery module, which enables the optimization of the battery pack space through the reduction of module structural components, thus achieving the improvement of range and performance. Of course, there must be a super-strong manufacturing process to cooperate with it.

Next, let’s talk about CTP. The release of blade batteries has to some extent enabled domestic or BYD to take a leading position in battery module integration technology. The mass production of BYD’s blade batteries also marks a new high point in the development of module integration technology.

If BYD can guarantee the quality and installation effects, blade batteries will bring significant impact to the market. As mentioned at the press conference, almost all manufacturers are currently in talks with BYD regarding cooperation on blade batteries.

In addition to 590 and CTP, PPE of Volkswagen also employs dual-row large modules to compress battery pack width. Therefore, although China’s companies lag behind in battery materials, BYD and even China’s companies may lead in terms of production processes and battery pack integration.

BYD has established itself in the lead position of power battery technology, and it is rumored that in April, Tesla and others will release black technologies in the battery field. The blade battery is an attempt to win this power battery competition.

In conclusion

BYD’s “blade battery” is not a technological innovation in the material of the battery cell itself, but it is leading the market in the iteration and evolution of PACK integration technology.

In terms of the market, the ternary battery has always been considered as the mainstream technological route. If the blade battery performs well after being put on the market, will lithium iron phosphate make a comeback? If so, then the series of upstream and downstream suppliers established by the ternary battery will be greatly impacted.

Why does the blade battery have pioneering significance? Firstly, in the second round of competition in power batteries, the blade battery has the opportunity to lead China’s power battery technology, which will greatly promote the development of China’s new energy automobile industry. It can also promote the diversified development of power batteries to meet different levels of demand.

Secondly, BYD has undergone a top-down organizational innovation, facing difficulties in research and development, production, process, and equipment. In the past, when Lu Qi left Baidu, it was largely due to the failure of internal resource allocation and top-level strategic confusion.

Finally, at this stage, the “blade” must also become BYD’s weapon, from the leader of power batteries in China to losing its leading position, BYD is definitely not satisfied. Therefore, before Tesla and others release their battery technology, BYD needs to stand in a good position and throw a “bomb” into the market at the appropriate time.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.