Author: Wang Lingfang

Power batteries are entering a new round of expansion competition.

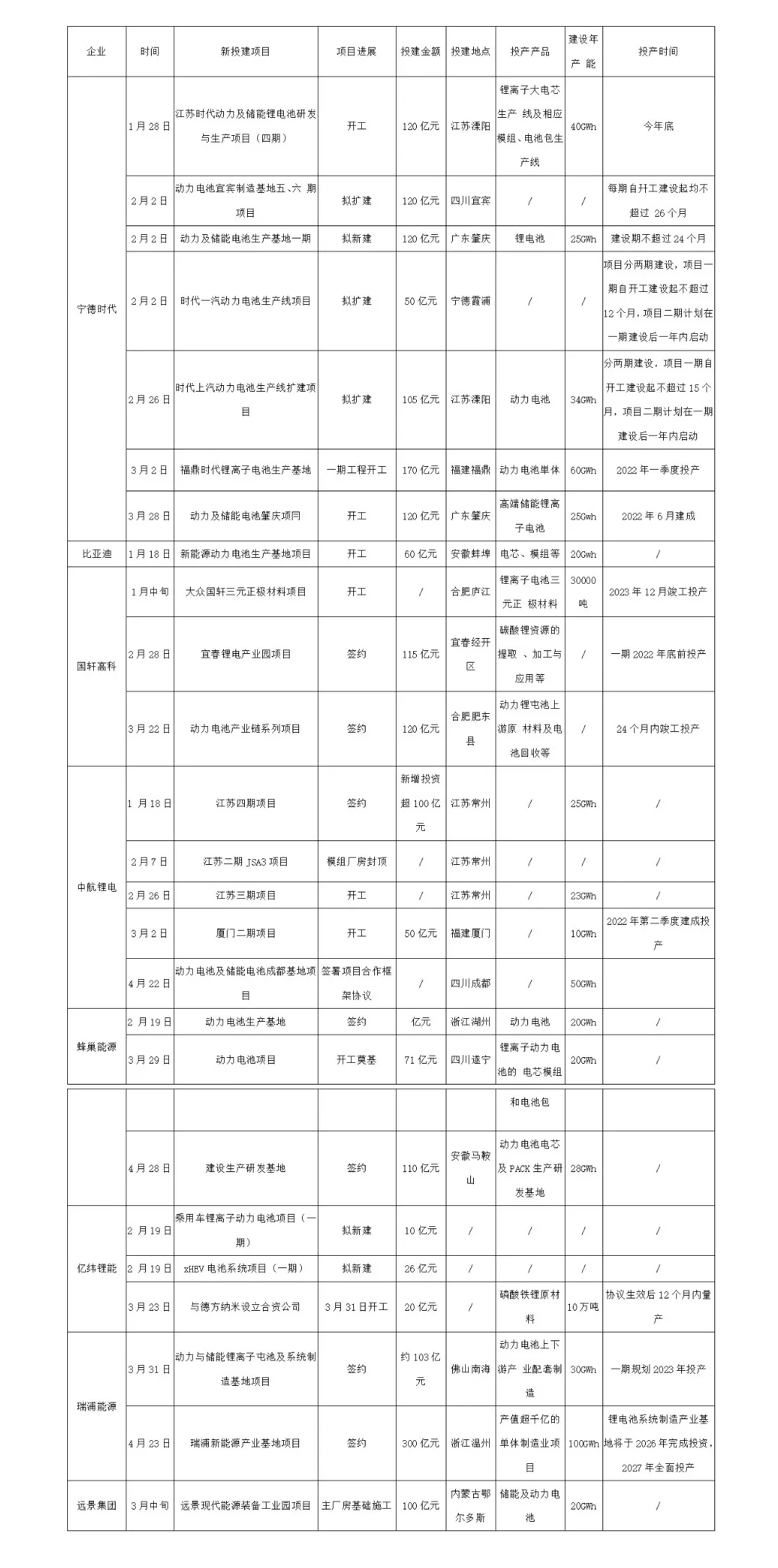

CATL’s expansion exceeds 184 GWh;

BYD expands 130 GWh;

CALB expands 100 GWh…

Based on incomplete statistics, more than 20 newly built power battery-related projects were invested in China from January to April this year, with investment exceeding 190 billion yuan and annual capacity exceeding 450 GWh.

In 2021, powerful battery companies are investing heavily in capacity construction. Many projects require billions of yuan in investment.

With the coming period of explosive growth in the new energy vehicle market, power battery companies without production capacity will undoubtedly miss opportunities. Zeng Yuqun, chairman of CATL, said that the power battery market will enter the era of TWh (1000 GWh) in 2025. According to this calculation, without building production capacity of several hundred GWh, bosses of other battery companies won’t be able to sit at the same table with the former richest man.

Rapid Expansion of Production Capacity

Since the beginning of this year, CATL’s capacity construction scale has been the largest. The expansion scale has reached 184 GWh in just the first four months.

BYD has announced a 130 GWh expansion plan. The 100 GWh capacity in Wenzhou will be completed by investment in 2026 and put into full production in 2027. The 30 GWh capacity in Foshan will start construction this year and be completed in two stages.

CALB also announced an expansion plan of nearly 100 GWh. Phases III and IV in Jiangsu have successively started and signed contracts, and Phase II in Xiamen has also started. It also announced a contract with Chengdu of Sichuan Province and plans to build a 50 GWh capacity.

Following closely are companies such as EVE Energy. It has expanded to four locations in just half a year, planning to exceed 70 GWh in production capacity. It is not only accelerating the expansion of the Jintan plant, but also quickly entering Europe, Suining of Sichuan, Huzhou of Zhejiang, and Ma’anshan of Anhui.

It is worth noting that CALB, EVE Energy, BYD and other companies have set their production capacity targets for 2025 at 200 GWh.

Image source: Corporate announcement and news report

In addition to this, enterprises such as LS group, which are controlled by China Chengtong Holdings, are also preparing for expansion; Jebsen Power’s 8 GWh project in Jiaxing will also be launched.

Mo Ke, the President of ATL Research, summarized the recently expanded companies into three categories: Firstly, companies with relatively large market share, such as CATL and BYD; Secondly, companies that have closer contacts with overseas battery companies and automakers, such as EVE Energy, Guoxuan Hi-Tech,and Funeng Technology; Thirdly, companies with capital support, such as EVE Energy and LS group.

These companies are undoubtedly the seed players in the next round of power battery competition.## Why Massive Expansion

The number of power battery companies supporting China’s automotive industry is not small. As many as 73 battery companies were involved in 2020.

However, according to Yang Hongxin, Chairman and CEO of Hunan APEC Hitech Co., Ltd. (Hunan APEC), quantity does not represent quality.

At the very beginning of Hunan APEC’s establishment, Yang Hongxin pointed out that the structural overcapacity is a common issue across China’s power battery industry, with a severe lack of high-end resources.

Yang Hongxin believes that the future production capacity of power batteries will be increasingly concentrated, to truly concentrate on enterprises that can do the technology well and represent the next generation of technology. Many companies will be eliminated in the process, which is precisely the process of the explosive growth of global new energy vehicles taking place.

From Hunan APEC’s perspective, global new energy vehicles have already experienced explosive growth, and the demand for power batteries will also reach TWh scale. Therefore, early deployment is necessary.

The relevant person in charge of Hunan APEC stated in an interview with “Electric Vehicle Observer” that Hunan APEC’s expansion is mainly based on several factors:

First, the company’s strategic development positioning and market demand prediction. Hunan APEC is centered on battery systems, covering the entire new energy battery industry chain, including passenger cars, energy storage / commercial vehicles, light power, HEV, and other fields. Their future development goal is to reach the industry’s top 3, so production capacity is inevitable.

Second is based on the demand plan of Hunan APEC’s strategic customers and future customer development plans. Hunan APEC said that their production capacity planning is mainly aimed at meeting the needs of their current customers and future customer development plans. At present, Hunan APEC has already designated 25 major original equipment manufacturers at home and abroad. The demand for customers in the next few years will gradually be released, so production capacity digestion is not a problem.

RiPur Energy’s market director, Zhang Xiaocong, stated that RiPur Energy’s production capacity is not achieved in one step but realized in stages. Their products’ main feature is cost-effectiveness, and cost advantages can only be achieved through scale. Relatively scattered production capacity will increase enterprise management, personnel, and other costs.

Zhang Xiaocong said that in the future, RiPur Energy’s production capacity planning in a region will be at least 20-30 GWh, and production capacity below this scale will have no competitive advantage.

In MOKO’s view, there are two reasons why battery companies are expanding at this time. On the one hand, the prices of square and soft packs are still decreasing despite the rise in raw materials prices. Small-scale battery factories are actually difficult to survive under such circumstances. Those companies that are slightly financially powerful or leading the industry now want to expand production, ready to receive the market gap left by the elimination of these small and medium-sized battery factories.## On the other hand, under the dual-carbon target, the large market led by electric heavy-duty trucks is beginning to emerge, and other markets will also open up one after another, so companies’ capacity construction should be appropriately advanced.

The biggest representative of this is the cooperation between CATL and State Power Investment Corporation.

Zeng Yiqun advised at the two sessions last year to vigorously promote the electrification of vehicles in public service fields such as construction machinery and heavy-duty trucks.

On February 26th this year, at the “Green Future” media day and the 2020 social responsibility report release conference held in Beijing, Zu Bin, Deputy Secretary of the Party Group and Director of State Power Investment Corporation, stated that the total planned new investment scale by 2025 is 115 billion yuan, and 200,000 heavy-duty trucks will be promoted.

Subsequently, on March 13th, CATL and State Power Investment Corporation signed a strategic agreement, which is most likely this cooperation.

The stronger ones become stronger, and the elimination game continues

As an investor, Wang Rongjin, a partner of Shanghai Jingbang Equity Investment Management Co., Ltd., is familiar with the situation of various battery companies.

In Wang Rongjin’s view, this expansion is structural, mainly reflected in two aspects. On the one hand, the current expansion is mainly a few leading power battery companies; on the other hand, the production capacity of lithium iron phosphate batteries has increased far more than that of ternary batteries.

Wang Rongjin revealed that in addition to a few leading companies, the survival status of many battery companies is not good, and some are seeking opportunities for hosting or sub-contracting.

As Wang Rongjin said, these expanded companies are already at the forefront of the installation ranking, and most of them are among the top 10 companies.

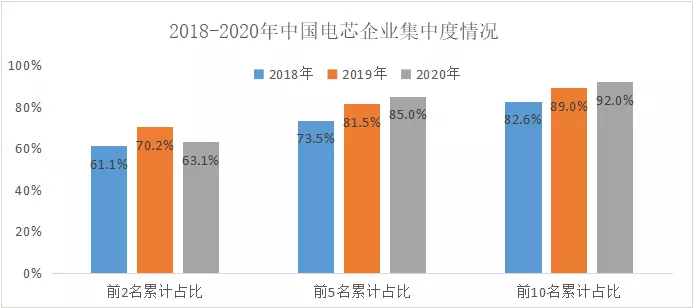

Data source: According to whole vehicle factory certificate data

With the rise of new production capacity, the Matthew effect in the battery field has become more and more obvious.

According to the whole vehicle factory certificate data, except for the market share of the top two battery companies in the previous year which decreased slightly compared to 2019, the market share of the top 5 and top 10 companies has increased significantly, which shows that the concentration of battery companies is constantly improving.

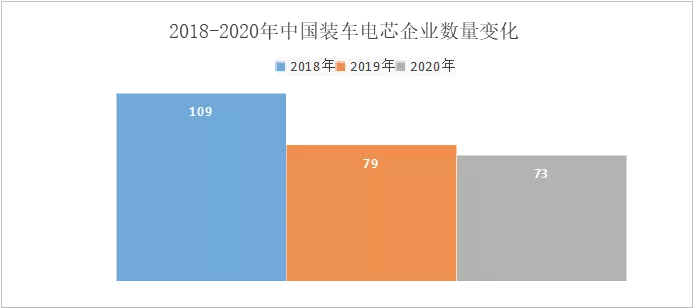

In addition to the increasing proportion of leading companies, the overall number of battery companies is also decreasing. In 2018, there were 109 battery companies supporting the whole vehicle, which decreased to 79 in 2019, and then further decreased to 73 in 2020.

Although new forces are constantly emerging, the trend of overall decrease in the number has not changed.

Wang Rongjin said that battery companies with lower installation rankings are either not highly recognized in the market or have had past problems with their products. Vehicle manufacturers are very cautious in selecting them, and these companies will gradually withdraw from the field of automotive power batteries.

Wu Hui, the head of the research department of Yiwei Economic Research Institute, has a similar view to Wang Rongjin’s. Wu Hui believes that, first, power batteries have already formed brands, and the use of batteries from top companies is also a highlight for vehicle sales; second, the stability and consistency of products from companies with lower rankings still have problems, and such companies have obvious lacked experience and are not capable for large-scale vehicle manufacturers.

However, Wang Rongjin believes that even top companies are not so stable. To establish a foothold in the field of power batteries, at least one of two aspects must be emphasized: either having low costs or having enough high-quality downstream customers so that there is no shortage of market demand. “For companies that don’t have a foothold in either area, their future survival prospects are worrying.”

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.