*Author: Michelin

The term “software-defined car” has raised expectations for different functions and scenarios, but the change it brings to the automotive industry is nothing short of revolutionary, even altering the nature of cars and transforming them into electronic products and mobile terminals.

More and more enterprises are participating in automotive software development, and in this fierce battle, our attention is often drawn to various interesting and innovative software features, while the contributions made by underlying architecture and basic software are overlooked. To address this, we will focus on a company called Neusoft Reach, which specializes in automotive software technology and how they are responding to this battle.

What does the Warring States period of automotive software require?

Many refer to the current situation of intelligent car software as a period of numerous contenders. Various software companies, traditional automakers, and suppliers are deeply involved in the development of software functions, which involves both the directly used application software as well as middle and lower-level basic software.

For example, in recent years, whole vehicle OTA upgrades have gradually become standard on new cars. When we want to upgrade an Easter egg via OTA while calling the central control screen, ambient lighting, or even the functions outside the cabin, it requires not only communication between the underlying electronic architecture but also lower-level software to coordinate and call these functions. This is the role of middle and basic software.

The richness of automotive software functions not only decouples the software and hardware of the car but also decouples different software levels.

Specifically, automotive software can be divided into three categories:

The first is universalized products that every automaker needs, such as basic software, BMS, engine control systems, etc. These automakers can purchase directly;

The second is reusable modules, such as autonomous driving modules, which automakers usually develop with closely cooperative suppliers;

The third is the key to creating differentiation during the software-defined car era, which automakers do themselves or jointly develop with partners.

Unlike the third type of software which requires differentiation and being “ahead of the pack,” basic software and middleware require standardization and universality. Downward compatibility with different electronic architectures enables software platforms to be used and iterated on different car models and even different brands. Upward provision of standardized platforms and interfaces reduces thresholds, allowing different automakers to develop different functions on the same basic software platform to meet their customized requirements.

These tasks cannot be completed by a single automaker. As the general manager of Neusoft Reach, Cao Bin, said, “As automakers move more towards software, the need for basic software, tools, and middleware increases. Automakers should not focus too much on doing these things themselves. Furthermore, the products in this area must be industry-standardized and their maturity will continue to increase.”

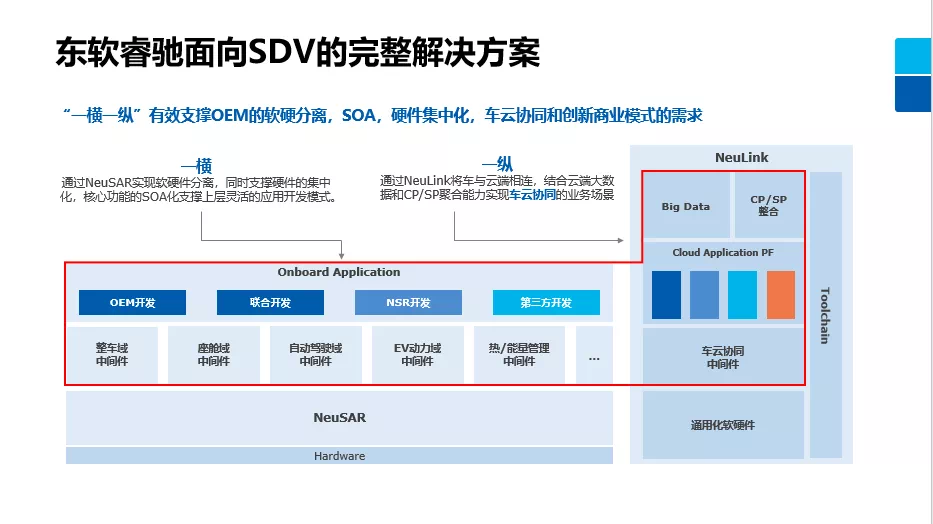

Therefore, we can see that Dongfeng Venucia’s new generation automotive software platform, NeuSAR, is compatible with the latest version of the AUTOSAR standard. It is developed for traditional ECUs, even domain controllers and future more centralized EE architectures, to meet the demand of continuously updated electronic architecture.

Different OEMs can develop and upgrade their own software products in automated driving, intelligent cockpit, vehicle control, and other aspects according to their own needs, focusing on building differentiated products themselves.

If we compare the competition of automotive software to the Warring States period, then basic software and middleware connecting the underlying architecture and upper-layer software together are like uniform measurement nearly two thousand years ago, enabling the previously separated camps to communicate and participate in the battle of “software-defined cars” with lower threshold and jointly promote the development of automotive software.

Software Enables Cars to Enter Tier0.5 Mode

When cars enter the era of software, we cannot do without a word – “data”.

When we use a function, software can provide personalized services to users based on the data they usually use, like apps in our smartphones that recommend similar new content based on our browsing history. Auto manufacturers can also iterate and update software based on users’ big data to meet the needs of their own user groups and achieve differentiation. Partners like Dongfeng Venucia also need data support when helping automakers optimize and improve systems.

It can be said that data makes the relationship between collaborators in the automotive industry closer and inspires new forms of partnership, transforming from one-time product delivery to a continuous service relationship, which is commonly known as Tier 0.5 mode.

When it comes to a collaborative relationship, Dongfeng Venucia has given the following answer: “There may be at most 2-5 automakers that can work closely together. This approach requires Dongfeng Venucia to invest a large amount of high-quality resources, to store the data in the joint venture company, while the software and algorithms are updated and iterated, and then handed over to the collaborative automakers. Local optimization of the system and data perfection could be done in the joint venture or innovation center before updating and iteration.”

This means that when the collaboration between the two sides is further deepened, they can jointly establish an innovation center or even a joint venture. Dongfeng Venucia, as the software support party, provides the core team, offering common technology, and collaborates with automakers to develop differentiated technology for jointly completing the iteration and evolution of new functions. Under this cooperative growth, both sides can focus on improving the product itself.

This cooperative model is even more evident in the familiar field of autonomous driving.

Although at this year’s Shanghai Auto Show, various car companies have put forward “LiDAR”, “L4 autonomous driving” and other hardcore labels, set off a wave. However, from a software perspective, intelligent driving obviously needs to be more “conservative”. Cao Bin believes that from L2 to L3, it will still be the main competitive focus in the market for a considerable period of time.

When hardware such as sensors and chips have the ability to achieve autonomous driving, what is needed from “can do” to “do well” is the improvement of the software level. For example, using technology and platform to build a self-evolution system, training and optimizing in the cloud to improve the adaptability and user experience of autonomous driving in different scenarios.

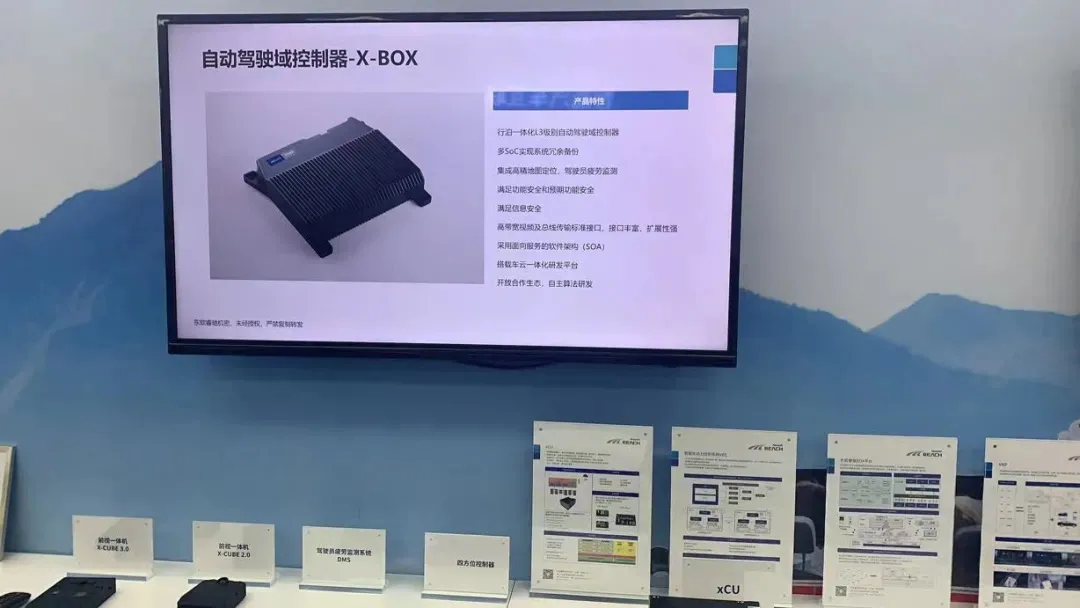

In this regard, Dongsoft Ruichi provides a full-stack autonomous driving software solution, including basic software, perception algorithms, planning and control algorithms, and a vehicle-cloud collaborative evolution system. The system architecture can be split into different modules to provide for different customers’ needs, or it can also provide platforms and technical services to allow professional technical personnel to learn, iterate, and upgrade autonomous driving algorithms on the backend.

Finally

In 2020, under the guidance of the Ministry of Industry and Information Technology, the China Automotive Basic Software Ecology Committee (AUTOSEMO), led by more than 20 mainstream car companies and supplier enterprises, was established. The committee started to explore issues such as the application and promotion of autonomous automotive basic software, the construction of standardized software architecture, application frameworks, and interface specifications in China. Chinese automotive software is moving from “disorderly” to more standardized and universal “orderly”.

On this road to “orderliness”, facing China’s intelligent automotive headquarters, software suppliers are not only facing huge market space but also unprecedented attention and challenges. Years of technological accumulation, localization background that better understands Chinese user needs, continuously iterated products, and new cooperation models, can Dongsoft Ruichi help establish its own “protective moat” in the fierce market?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.