As the scale of electric vehicles from European car companies expands, a very interesting phenomenon has emerged. Stellantis’ CEO Carlos Tavares began to describe a self-sufficient future, which means that the agreement between FCA and Tesla is starting to enter the countdown (in 2020, FCA spent 300 million euros to purchase carbon emission credits, of which 200 million euros were paid to Tesla).

Starting in 2021, they will no longer purchase carbon emission credits from Tesla. In fact, the essential problem is still from Stellantis’ perspective. In the current operating environment, they still want to spend less money.

Stellantis’ 2021 plan for new energy vehicles

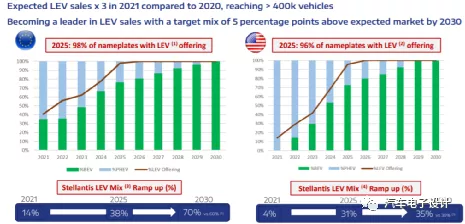

According to data on EV-Sale, in Q1 2021, Stellantis’ new energy vehicle sales volume reached 66,600 units, ranking among the top five globally. According to the plan in April 2021, the overall plan for 2021 will reach 400,000 units, three times that of 2020, and 111,000 units will be achieved each quarter thereafter.

If we break it down, Stellantis’ sales in the US were 1.842 million units in 2020, with an expected growth rate of 8% in 2021. According to the proportion of 4%, this data is 79,500 units. Sales in Europe were 3.038 million units (with expected sales growth of 10% in 2021), this 14% figure exceeds the 400,000 units.

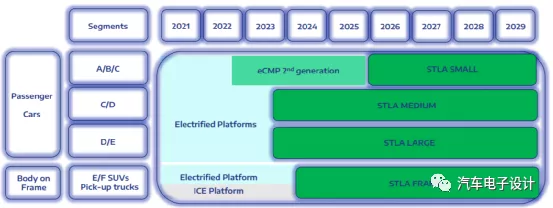

Based on the above plan, Stellantis has set the sales of BEVs to account for approximately 35% of total sales, which means that of the planned 400,000 units, about 140,000 are BEVs (7GWh demand corresponds to a 50 kWh battery). Therefore, it is expected that PHEVs will dominate most of the sales this year. According to the combination of Figure 1 and Figure 2, the proportion of BEVs can only be increased to 50% under the STLA platform in 2023.

In the following definition, eCMP platform will transition to eCMP2, which may occupy a relatively large amount. STLA is a brand new platform which starts with mid-to-large electric vehicles.

## Long-term Electrification Plan

## Long-term Electrification Plan

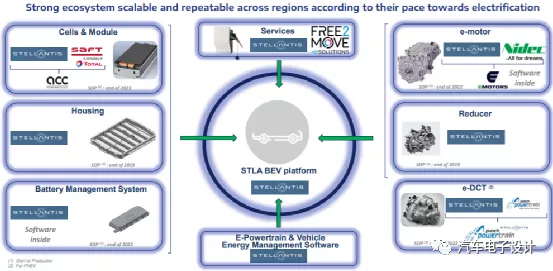

In terms of the three-electric system, Stellantis is currently adopting a gradual internalization approach, including battery casings, motors, gearboxes, and PHEV transmissions. On the STLA platform, it is built around the ACC joint venture with SAFT. Currently, Stellantis’ suppliers mainly include CATL, LG Chem, SDI, and Wanxiang A123 in China.

Note: The start time of the supply of honeycomb is unknown.

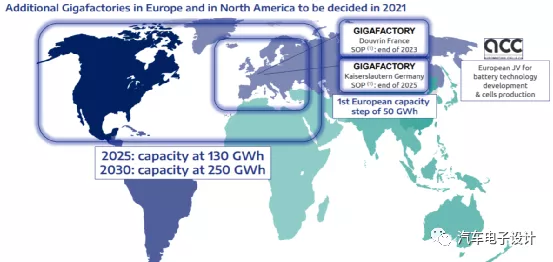

At present, the European automobile industry mainly exists in France, Italy, and Germany. So, just like Volkswagen, Stellantis is also making battery cells, and the overall scale is similar (both in Europe are currently over 3 million+). So, from the current point of view, the plan is to produce 130 GWh of battery cells in-house in 2025 and 250 GWh in 2030 (this is slightly higher than Volkswagen’s 240 GWh). As Volkswagen has a strong foundation in China, the overall voice is relatively loud, but Stellantis only sells around 50,000 vehicles per quarter, so not many people care.

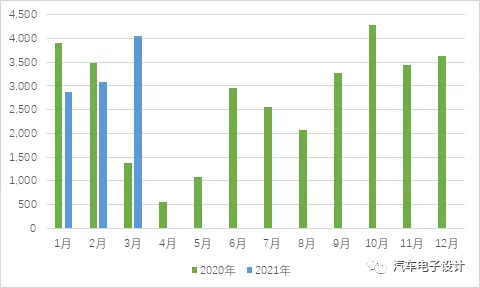

Sales of e-208

Currently, the demand for the BEV model of Stellantis’ e-208 has increased to about 4000 units per month, along with other derived BEVs. Based on the ratio of 66,000:1/3, the estimated actual sales for Q1 are 22,000 units (corresponding to 1.1 GWh).

Note: The current Fiat 500e uses a 42 kWh battery.

Conclusion

According to the current efforts of European car companies, there may be a significant increase in Q2-Q3, but overall, 2021 is a big year for PHEVs, and it seems that PHEVs are more popular.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.