*Author: The First Yan Know Wisely Vehicle Annual Meeting

At the First Yan Know Wisely Vehicle Annual Meeting, Xu Changqing, the Wireless Car Networking Market Director of Huawei, shared his thoughts on the C-V2X industry and the role of 5G in car networking, especially in roadside infrastructure, with the topic of “Development Thinking of C-V2X in the 5G Era”. He hopes to use 4G vehicle-borne incubation applications to improve the penetration rate of 5G vehicle networking, accelerate the industrial process, and start the commercial operation of car networking as soon as possible.

The Continuously Evolving 5G Standard Needs to Show Its Value

Xu Changqing said that Huawei has several businesses in intelligent networked vehicles, including roadside infrastructure and T-Box and intelligent gateways. His focus is on roadside infrastructure and related industrial levels.

The 5G era defines three major scenarios: eMBB (Enhanced Mobile Broadband), URLLC (Ultra-Reliable and Low-Latency Communication), and mMTC (Massive Machine-Type Communications). Huawei has also proposed the concept of 5.5G beyond the triangle structure, exploring how to achieve high-precision positioning and radar detection with 5G.

He believes that “we need to seriously discuss how the key value of 5G should be reflected and which direction it should focus on. On the other hand, with the continuous evolution of the 5G standard, we should enable 5G to show more vitality. However, the current status of 5G is still a strengthened version of 4G, and eMBB has not demonstrated the greatest value of 5G.”

Why Hasn’t C-V2X Really Landed Yet?

Xu Changqing said that after several years of development, the domestic C-V2X industry has reached a certain level of maturity. In 2018, it had 3 major cross-overs, followed by 4 in 2019, and the current year will see 4 major crossovers as well. There are over 200 enterprises in the entire industrial chain, including suppliers. Basically, the domestic C-V2X industrial chain has been fully connected.

Before the Shanghai Auto Show in April 2019, 13 automakers and two suppliers had announced their C-V2X mass-production plans, with pre-installed cars launched between the second half of 2020 and the first half of 2021. Now there are 8 automakers that have landed, and one is planning to mass-produce next year.

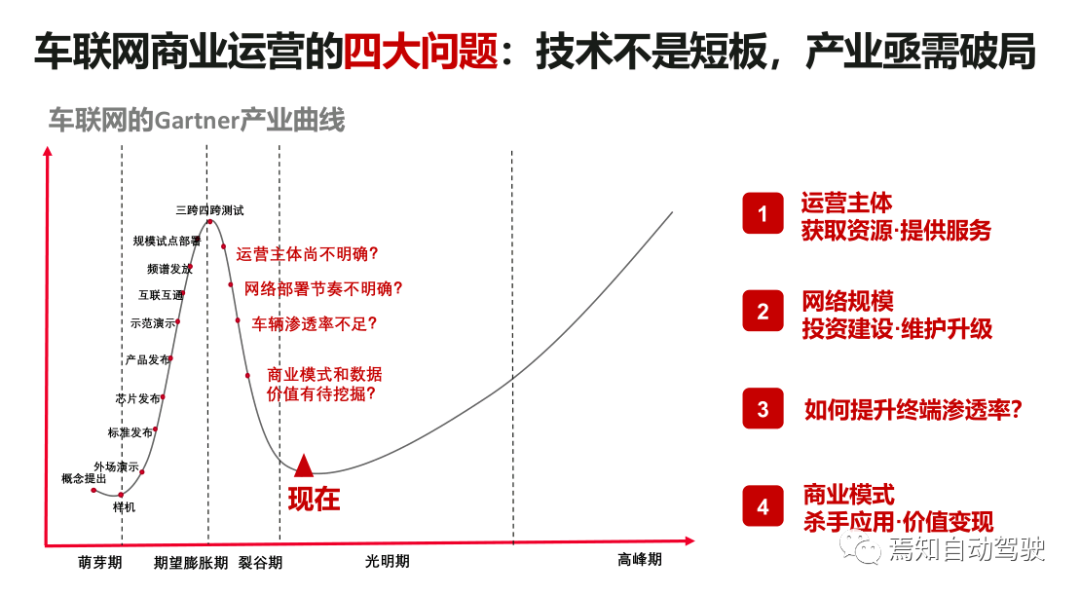

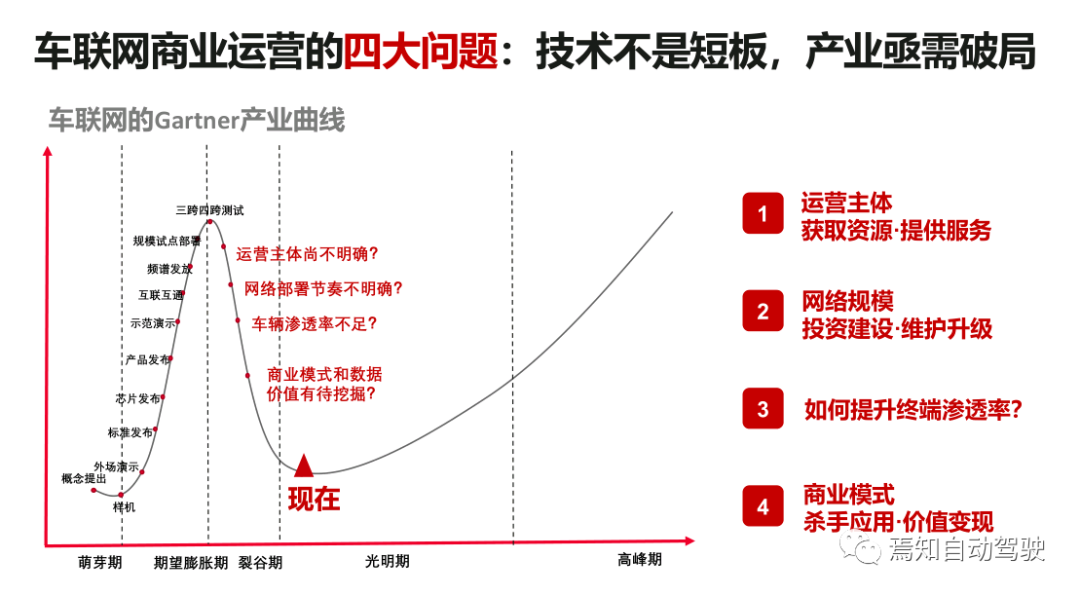

The domestic C-V2X industry is developing rapidly, with standards, evaluation plans and so on following up. Xu Changqing pointed out: “Although we have made very significant progress compared to previous years, there are still significant problems in the industry. Many demonstration areas have been built and cross-overs have been made, but why haven’t we seen a city using C-V2X in full swing? Do we really have to wait until 10 years later when automatic driving is popularized?”He believes that the value of C-V2X lies not only in its application in autonomous driving, but also in its potential value in Advanced Driver-Assistance Systems (ADAS). C-V2X can enhance autonomous driving capabilities and perform tasks that autonomous driving cannot yet achieve, which are the possibilities of the future.

So, what are the current challenges of C-V2X?

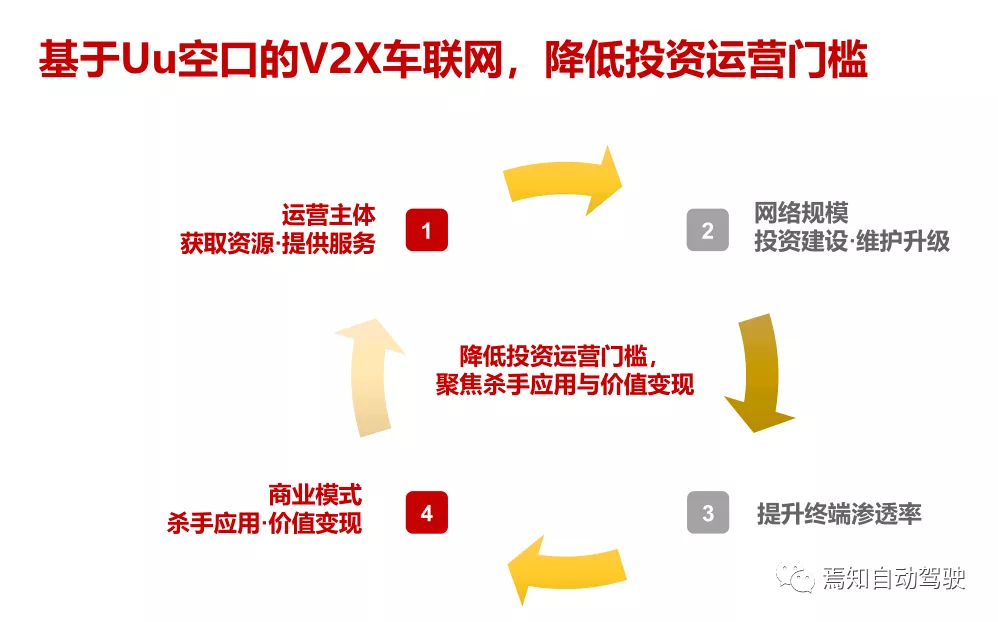

Firstly, the lack of clear operating entities, or there are many operating entities. Everyone is enthusiastic and eager to make a career in this field, but with so many operating entities, there has yet to be a commercial operation. The issue is that it is not clear how many people are using it, or what problems they may be experiencing, and the effectiveness is not obvious.

Secondly, the scale is dispersed, with many companies investing. Recently, due to the support of policies, investments are also significant. There are more than 50 projects throughout the country, and even as many as 100 projects of varying sizes. Some larger projects cover a prefecture-level city, while smaller ones only involve a few stations. After several years, we are still in the testing phase and haven’t moved towards true commercial use.

Thirdly, the lack of terminal penetration. Looking back, DSRC was proposed in 1999, yet the industry has yet to take off. C-V2X has been designated as the only Chinese standard, so how do we avoid the failure of DSRC? How can we increase the terminal penetration rate?

Fourthly, how to find a suitable business model? By creating a killer application to realize value.

These issues require careful consideration and answers.

ADAS makes C-V2X shine

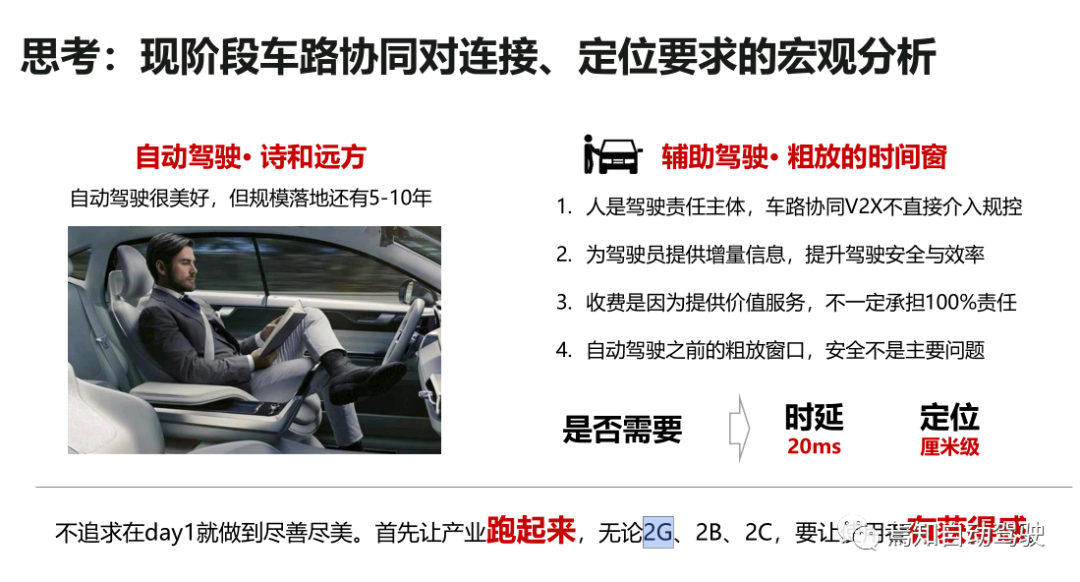

Regarding the current requirements for connectivities and positioning for vehicle-road coordination, as well as how to accelerate the deployment of C-V2X applications, Xu Changqing proposed a rather alternative view: “Autonomous driving will come, but its project implementation might have to wait until 2030. Because C-V2X can serve ADAS, not all V2X indicators need to be realized according to the requirements of autonomous driving. Likewise, the standardization of C-V2X and its integration into autonomous driving must progress side by side.”

During the ADAS stage, humans are still the responsibility entities. The C-V2X vehicle-to-everything system does not directly intervene in the regulation, and vehicles can only receive information from several types of intelligent driving sensors (such as cameras or millimeter-wave radar). The problem and benefit are:

The first is that if the vehicle receives any information from the roadside, can it integrate the received information into the regulation? Currently, it cannot. There is no standardization, and it is still in the ADAS testing phase. At the ADAS stage, humans are responsible for driving, not the vehicles.Secondly, the incremental information provided by C-V2X is beneficial for improving safety and efficiency for drivers, including C-V2X entertainment information.

Thirdly, information may be charged for, but charging does not necessarily mean that the sender bears 100% of the responsibility. Sometimes information is valuable, but it cannot be charged for; sometimes information is valuable, it is charged for, but it is not necessarily 100% accurate.

Fourthly, now is a rough window period, there is no need to pay special attention to performance indicators, just look at what the widest indicator is. Then, under this indicator, we can meet which use cases and incubate what valuable applications to connect the business loop, let this thing really begin to run, and let everyone have a sense of gain, whether it is 2B, 2G or 2C. We urgently need to use this technology to solve problems in life and work, and cannot always put this thing in the research topic.

Can 4G support C-V2X?

When it comes to the issue of commercializing C-V2X as soon as possible, it also relates to 5G. Xu Changqing raised a question: “Is the latency necessary to be 20 milliseconds? Does the positioning need centimeter-level accuracy? C-V2X testing can achieve a latency of 20 milliseconds, but do we need 20 milliseconds for all use cases?”

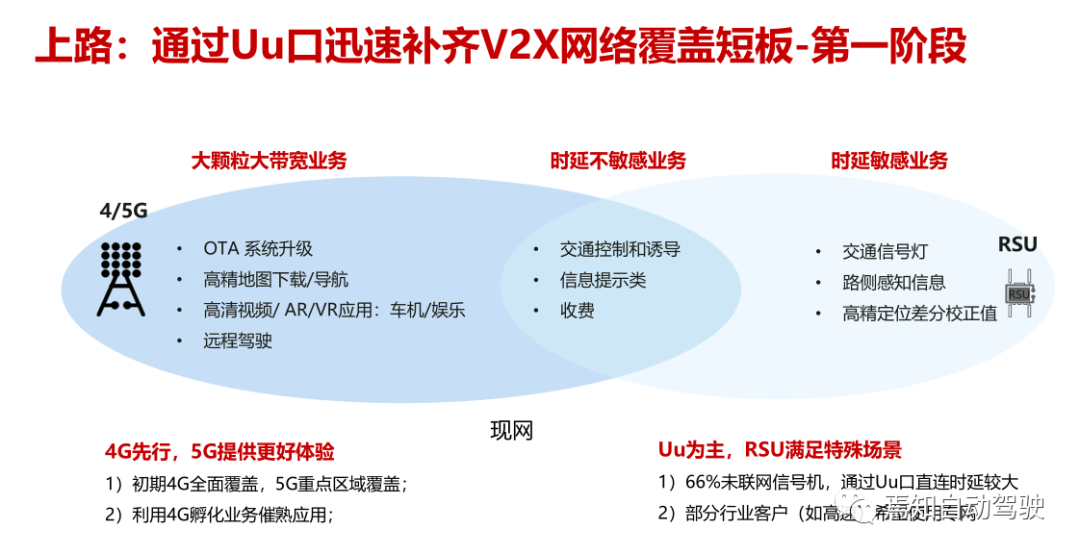

Why don’t we need 20 milliseconds? Because if we classify the basic use cases, some of them can be solved using the Uu interface, of course, some cannot be solved. These basic use cases may be able to achieve more coverage with the Uu interface, and the reason why a few latency-sensitive businesses were originally placed in the RSU (roadside unit) was because the Uu interface did not have such functionality.

If we optimize 4G/5G (mainly 4G at present, because the current 5G network has not yet achieved ubiquitous coverage), basically, LTE-V can cover all use cases now, which means that the current 4G and 5G networks can support C-V2X. “Then, with the support of 4G network, we have achieved a relatively good result, and it is easier to expand the scale. If Suzhou has deployed 5G, Shanghai has not deployed it, and the intersection does not deploy it, then it is not possible. If 4G also supports V2X, there are millions of base stations, even on the Himalayas,” he said.

## How to improve the penetration rate of V2X?

## How to improve the penetration rate of V2X?

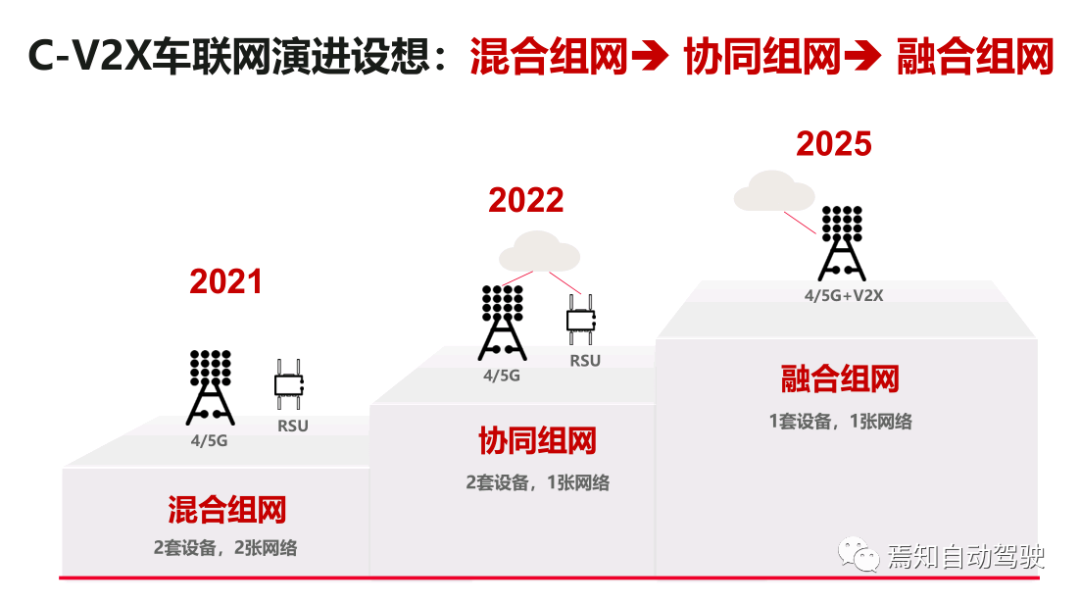

According to Changqing Xu, Huawei will discuss with some potential operators how V2X could be developed. The first stage is to create a hybrid network using 4G, 5G, and RSU; while the second stage is to build a collaborative network, and the third stage is to integrate the network.

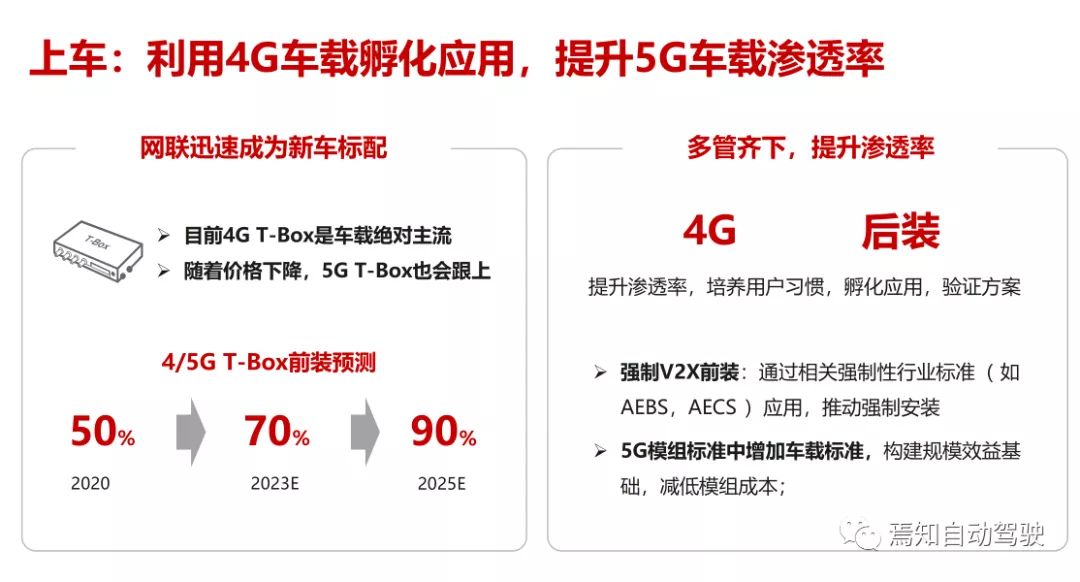

The biggest problem at the terminal side is the penetration rate. Although car manufacturers are already installing C-V2X T-Box onboard terminals, they are still limited in scale and are not installed in all car models. Fortunately, some car manufacturers are willing to roll out T-Box on a large scale. At least, some domestic car manufacturers have such plans in place.

With regards to the T-Box for 4G/5G, the current penetration rate is 50%. The industry’s forecast is that it will reach 70% by 2023 and 90% by 2025. By then, if the authorities mandate the installation of T-Box, it may become a standard feature in vehicles. From this perspective, Uu-T-Box can currently be used to improve the industry’s penetration rate, but this is only for OEMs.

Changqing Xu proposed that “To increase the penetration rate, we should strive to achieve both pre and post-installation. Although the user experience with post-installation equipment is not as good as that of pre-installation, this is not important because T-Box provides additional information, like using maps for navigation, which is very useful and does not impose fees, but once it directs users in the wrong direction, it is not responsible, so can you claim compensation? No.”

Therefore, commercial organizations that produce products will definitely want to increase the number of their users and create value for them. If they cannot generate economic value, then they can create social value first. From this perspective, post-installation is straightforward, where each mobile phone can act as a terminal, with a penetration rate of over 100% in China.

Once the network side and the terminal side problems are solved, operators can focus on breaking through the final challenge, which is the application and realizing its value. “I think C-V2X has great value. Even in assisting driving stages, detecting road-side ghostheads (unmanned radar used for traffic speed detection) or scattered debris, etc., are very valuable, so operators can focus on these valuable things and see if they can create some commercial models.”

What is the vehicle’s positioning achieved by?

About Vehicle Localization

According to Xu Changqing, when it comes to vehicle localization, autonomous driving is currently not a consideration. Instead, the focus should be on vehicle localization. The behavior of a vehicle is completely different when it is in different lanes within the same lane. Therefore, the decision-making process should also be different.

In the case of vehicles in different lanes, if the front vehicle brakes, the rear vehicle generally will not brake, as it assumes the front vehicle is not in its path. Therefore, the decision-making process of a vehicle must be combined with its position. The lowest requirement for effective relationship is actually lane-level localization. For our current assisted driving, lane-level localization is already sufficient.

Lane-level localization requires a reliable and high-precision lane-level map. However, full domain localization is still missing in scenarios such as elevated bridges and underground parking lots. Currently, all solutions such as inertial navigation, multi-factor integration on the vehicle side, and location cost on the field side are too high. Relying on expensive cost to deploy radar to parking lots presents a high requirement, which is a problem that plagues the industry’s prospects.

Regarding lane-level localization, there is no problem in open spaces. Currently, there are at least three or four domestic service providers offering nationwide lane-level localization. But what about scenarios like “urban canyons”? Even if assisted by a camera, the difficulty is not significant, even for camera manufacturers doing retrofits.

The two categories of manufacturers of maps and localization suffer from the fact that no one buys lane-level localization services, and no one integrates their business. Why is that? It is stuck at the installation rate of C-V2X. On the one hand, we will wait for the vehicle manufacturers to install PC5 terminal equipment to achieve direct connectivity between vehicles, which must be decided by the vehicle manufacturers themselves. On the other hand, if we use the Uu interface to access, the installation rate will rapidly increase, allowing cars to start running.

After the cars start running, it doesn’t matter if the user experience declines. Aftermarket products can be free of charge, allowing everyone to try them out, cultivate new businesses, find a business model, and make money in this industry. With some promotion methods, there will be a large number of users subscribing to this service, so as long as someone can connect these links, C-V2X will be able to run.

The Operating Network Should Have Three Layers

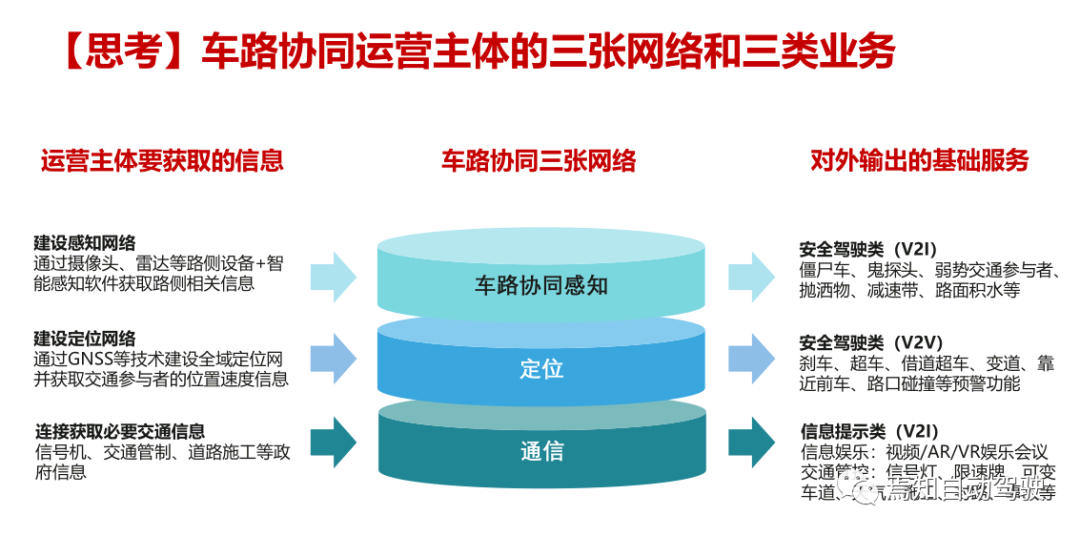

Xu Changqing’s last thought is how many layers the operating network, acting as the main body, should have. He believes that there should be at least three layers:

The first layer is the communication network: Whether it is through Uu interface or PC5 and so on, the role of this network is to drive the operation entity, acquire information sources through this network, and then send them to the vehicle to enable various services.

The second layer is the positioning network: Several companies are already doing positioning networks, which should be said to have been commercialized. The key is to activate them and then provide some services that car companies are interested in.

The third layer is the perception network: This network is the most challenging because road ecology involves many issues. It is the hardest to break through the top layer, but it provides the greatest value and is most likely to result in closed-loop charging in commercial applications.

He hopes to use the Uu interface to collaborate with operators and other industry partners in a particular location to achieve scalability for commercial use. It cannot be called testing because testing has been going on for several years, and it went to Europe in 2016 and returned to China in 2018. Apart from testing some new services, basically everything has been tested.

Xu Changqing emphasized that “without the C-V2X cake, no products can be sold. The key now is to focus on the big and small, accelerate the industrial process, and start the commercial operation of the vehicle networking as soon as possible. In the final analysis, the need is for industrial breakthroughs to promote commercialization processes.”

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.