Author: Wang Lingfang

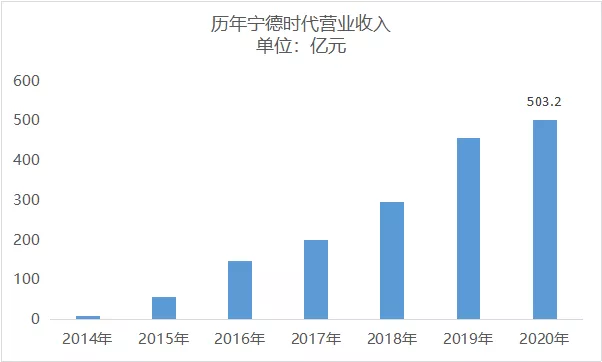

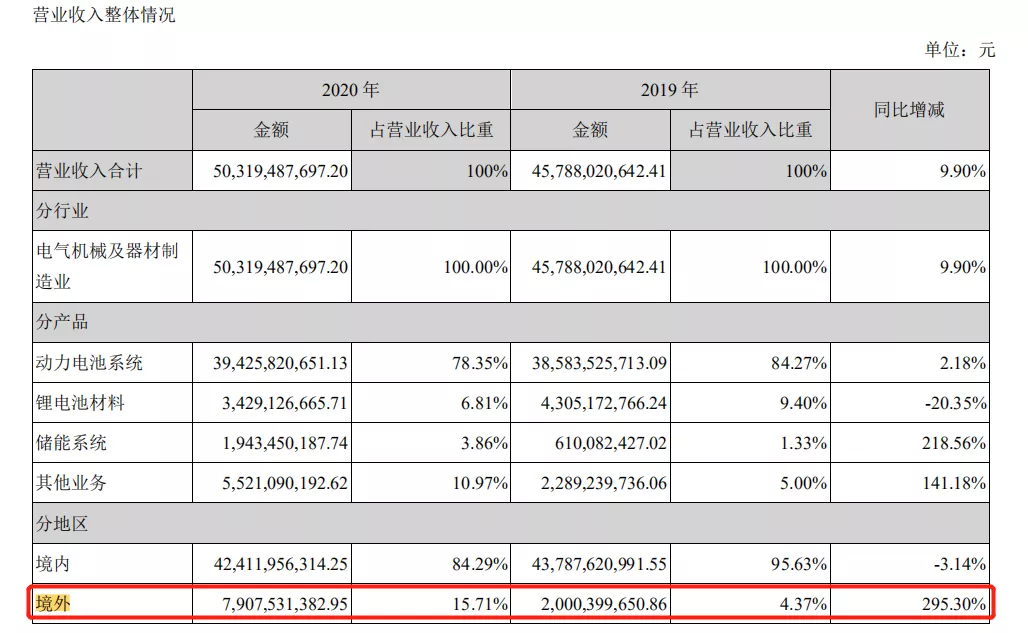

In 2020, CATL achieved a total operating revenue of 50.32 billion yuan, a year-on-year increase of 9.90%, and a net profit attributable to shareholders of the listed company of 5.58 billion yuan, a year-on-year increase of 22.43%.

On the evening of April 27, CATL released its 2020 annual report. The annual report showed that overseas business and energy storage business were the main highlights of CATL:

The sales volume of energy storage business reached 2.39 GWh, a year-on-year increase of 236.62%;

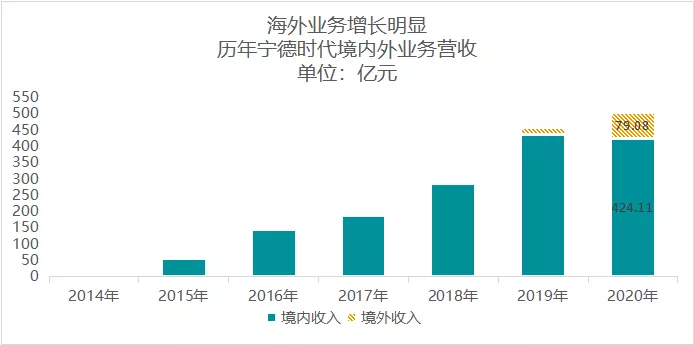

The revenue of overseas business was 7.908 billion yuan, accounting for 15.71% of the revenue, compared with only 4.37% in 2019, a year-on-year increase of 295.30%.

Performance Exceeded Expectations

Last year, under the influence of the epidemic, CATL’s revenue still achieved positive growth.

In 2020, CATL achieved a total operating revenue of 50.32 billion yuan, a year-on-year increase of 9.90%, and a net profit attributable to shareholders of the listed company of 5.58 billion yuan, a year-on-year increase of 22.43%. Last year, CATL realized lithium-ion battery sales of 46.84 GWh, a year-on-year increase of 14.36%, of which power battery system sales were 44.45 GWh, a year-on-year increase of 10.43%.

In 2020, the Ministry of Industry and Information Technology announced a total of more than 6,800 effective new energy vehicle models, of which more than 3,400 models were equipped with power batteries from CATL, accounting for about 50%, which is the power battery manufacturer with the most supporting models.

According to the data of the certificate of conformity issued by the vehicle factory, the total installed capacity of power batteries in China in 2020 was 63.6 GWh, of which CATL’s installed capacity was 31.9 GWh, with a market share of 50%.

In 2020, affected by the epidemic, CATL’s revenue in the first three quarters fell significantly year-on-year, and net profit was also in negative growth year-on-year.

This data turned red in the fourth quarter, with a 10% increase in full-year revenue and a 22.43% increase in net profit. In addition, the gross profit margin also increased compared with the first three quarters.

Significant Price Reductions but Difficulty in Reducing Costs

With the revenue and sales volume, the selling price can be calculated. In 2020, the average price of CATL power battery systems was 0.89 yuan/Wh, compared with 0.94 yuan/Wh in 2019 and 1.15 yuan/Wh in 2018.According to the business cost of RMB 28.956 billion for power batteries, the average unit cost of Ningde Times’ power battery system in 2020 was about 0.65 yuan/Wh, while the figure for 2019 was 0.67 yuan/Wh, with a small decrease.

There are two reasons for this: First, the cost reduction of power batteries has entered a bottleneck period, and it is difficult to achieve significant breakthroughs in the short term. Second, the rising prices of raw materials for power batteries in 2020 have pushed up the production and manufacturing costs of batteries, with upstream materials prices for lithium batteries doubling, such as lithium carbonate, electrolytes, lithium hexafluorophosphate, and other raw materials.

Significant growth in energy storage and overseas revenue

In 2020, Ningde Times achieved significant growth in energy storage and overseas markets.

(1) Significant growth in energy storage

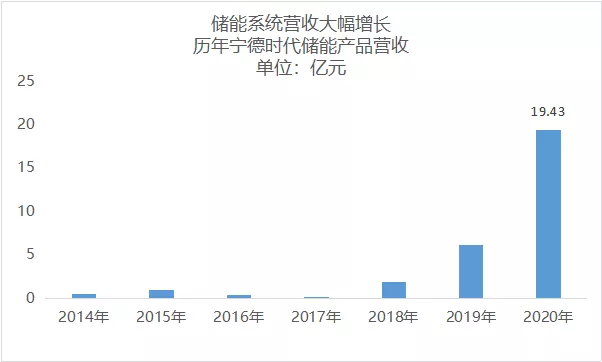

As the layout of the energy storage market has gradually been established, Ningde Times achieved a sales revenue of RMB 1.943 billion for energy storage systems throughout last year, a year-on-year increase of 218.56%.

According to the annual report, the sales volume of Ningde Times’ power battery system was 44.45 GWh, and the sales volume of the battery system mentioned later was 46.84 GWh. Therefore, the company’s energy storage system sales volume was 2.39 GWh, compared with only 0.71 GWh last year.

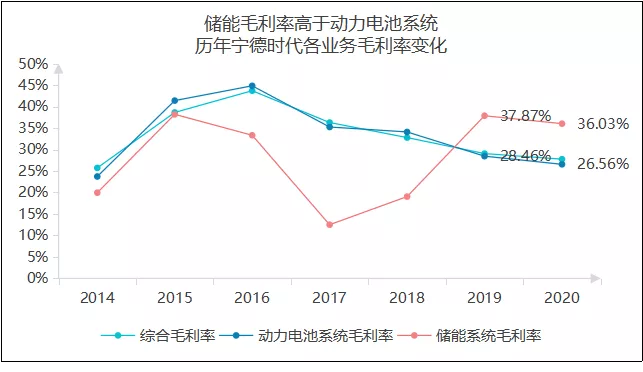

Moreover, in comparison with the gross profit margin of Ningde Times, the gross profit margin of the energy storage system in 2019 and 2020 was significantly higher than that of the power battery system.

In 2019 and 2020, the gross profit margins of the power battery systems were 28.46% and 26.56%, respectively, while the gross profit margins of the energy storage systems were 37.87% and 36.03%, respectively.

From the data, it can be seen that the energy storage market of Ningde Times has already started to grow significantly in 2018 and achieved a breakthrough growth in 2020.

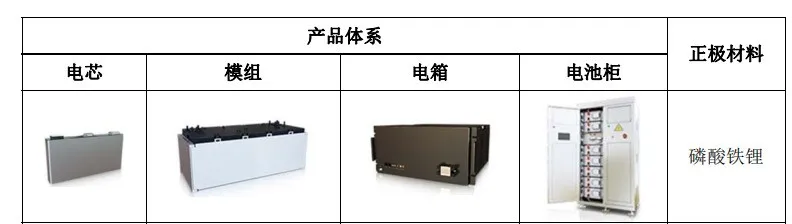

According to the annual report, in overseas markets, Ningde Times has transformed from providing components to providing battery systems, and has launched the EnerOne outdoor system product based on long-life cell technology and liquid-cooled CTP cabinet technology, which leads the industry in safety, economy, and other indicators.# Overview

In terms of the domestic market, the first national high-quality engineering project executed by CATL, the decentralized 1000 MW hour-level lithium energy storage project on the power generation side, and the tariff configuration project of Tala-Tan Subsection at the Hainan UHV transmission base implemented by CATL have been put into operation.

In addition, the Zhuhai Hengqin frequency modulation energy storage project with the battery system provided by CATL has been put into operation, helping the successful start-up of the energy storage for the 9F combustion engine.

Source: CATL Financial Report

In 2020, CATL’s revenue from overseas business was CNY 7.908 billion, accounting for 15.71% of the total revenue, a significant rise from 4.37% in 2019, representing a year-on-year increase of 295.30%.

This is mainly because CATL has won multiple key clients and key platforms, and the 811 system products have achieved large-scale delivery overseas.

The international automotive companies currently cooperated with by CATL include BMW, Toyota, Daimler, Hyundai, Jaguar Land Rover, PSA, Volkswagen, and Volvo.

CATL’s overseas market is expected to continue to expand this year.

According to Gao Gong Lithium Battery, CATL Customs statistics show that in the first quarter of this year, CATL declared a power battery shipment value of CNY 2.517 billion for export at the Ningde Customs, a year-on-year increase of 28.7%.

Slightly Declined Utilization Rate

In recent years, CATL’s production capacity has grown very rapidly. In 2015, the production capacity was only 2.6 GWh. By 2020, this figure had grown to 69.1 GWh. However, the utilization rate has decreased from 90% to 74.83%, which is likely due to the impact of the pandemic.

Source: CATL Financial Report; Calculated by Electric Vehicle Observer## Continued Increase in R&D Investment

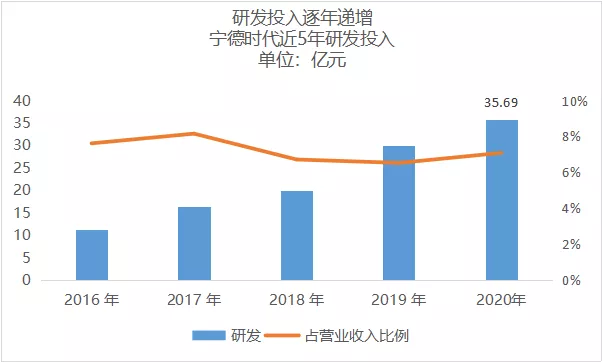

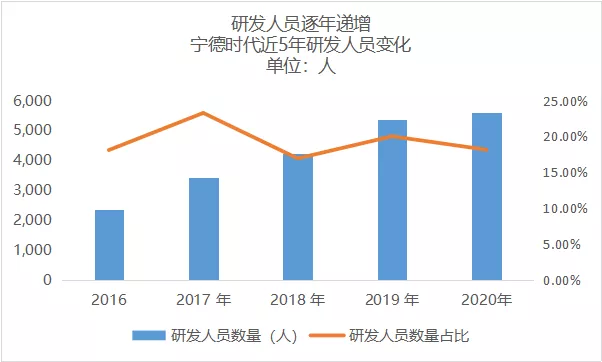

Despite the significant increase in revenue, CATL’s R&D investment not only did not decrease in proportion, but also showed a growth trend.

In 2020, CATL’s R&D investment accounted for 7.09% of revenue, with 5,592 research and development personnel.

As of 2020, CATL and its subsidiaries have a total of 2,969 domestic patents and 348 foreign patents, with a total of 3,454 domestic and foreign patents under application. In addition, CATL’s 21C Innovation Laboratory under construction will benchmark against leading international laboratories, focusing on the development of next-generation batteries such as lithium-metal, solid-state and sodium-ion batteries.

Abundant Cash Reserve

In 2020, CATL recorded a total impairment of RMB 1.169 billion, government grant of RMB 1.136 billion, indicating that the profit basically reflects the true operating level. Impairment in 2020 includes RMB 342 million credit impairment loss, RMB 625 million inventory write-down, RMB 59 million long-term equity investment impairment loss, and RMB 143 million fixed asset impairment loss.

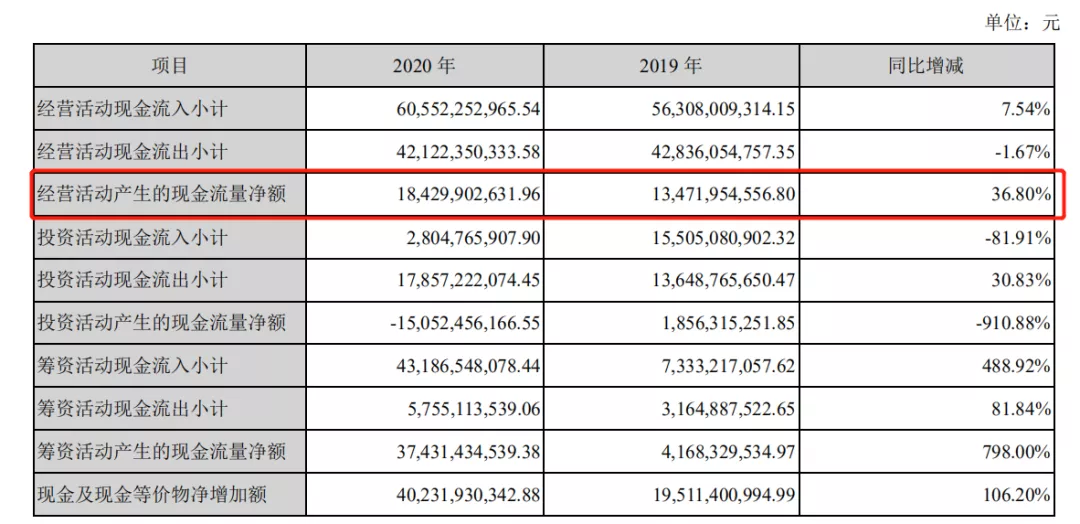

However, CATL has a very abundant cash flow. In 2020, CATL’s operating cash flow was RMB 18.43 billion, a year-on-year increase of 36.8%, 3.02 times that of net profit, and the operating cash flow for the fourth quarter of 2020 was RMB 8.124 billion, a year-on-year increase of 158.1% and a quarter-on-quarter increase of 81%. The report states that this is primarily due to good product sales and partial customer payments.

Perhaps due to sufficient cash flow, CATL can further expand its industrial chain. In its annual report, CATL announced that it intends to invest in high-quality listed companies in the domestic and foreign industrial chains through securities investment to meet the long-term development needs of the company’s business and to promote global strategic layout and guarantee the supply of key resources in the industry, with a total investment of no more than CNY 19 billion or its equivalent in other currencies.

Perhaps due to sufficient cash flow, CATL can further expand its industrial chain. In its annual report, CATL announced that it intends to invest in high-quality listed companies in the domestic and foreign industrial chains through securities investment to meet the long-term development needs of the company’s business and to promote global strategic layout and guarantee the supply of key resources in the industry, with a total investment of no more than CNY 19 billion or its equivalent in other currencies.

Replacing Fossil Fuels with Renewable Energy as the Strategic Direction

In the 2020 Annual Report, there was also a very obvious change: CATL upgraded its development strategy.

Before 2020, CATL focused on the R&D, production and sales of power battery systems and energy storage systems for new energy vehicles. Today, its strategy has been adjusted to replace fossil fuels with renewable energy.

In its 2020 annual report, CATL has clearly defined its three major strategic development directions and four innovative systems.

The three major strategic directions are: replacing fossil fuels with renewable energy and energy storage based on fixed systems, replacing fossil fuels with mobile systems based on power batteries, and application scenarios based on electrification and intelligence.

At the 125th anniversary celebration of Shanghai Jiao Tong University’s founding, CTO Dr. Yuqun Zeng provided a deep analysis of these three strategic directions.

Firstly, the company hopes to combine energy storage and power generation, particularly in new types of solar cells, to replace fixed fossil fuels, such as coal-fired power.

In the field of energy storage and solar power, Yongfu Corporation, in which CATL has already acquired shares, represents a prime example.

As early as December of last year, CATL entered into an equity partnership with Yongfu Corporation. On December 8th, Yongfu Corporation announced that the controlling shareholder of the company had signed a share transfer agreement with CATL, transferring 14.57 million shares of the company (accounting for 7.9998%) at a price of CNY 212 million. CATL now becomes the third-largest shareholder of Yongfu Corporation.

Yongfu Corporation has already established a presence in energy storage technology and the construction of integrated charging stations, where it is making strides in large-scale energy storage facilities.

In February of this year, Yongfu Corporation announced that it intends to increase capital with CATL in Fujian Yongfu Diantong Technology Development Co., Ltd., a joint investment plan aimed at deepening cooperation and supporting industrial development in new energy fields, especially photovoltaics and energy storage.

Secondly, the company aims to make power batteries the core, with the goal of replacing mobile fossil fuels. For example, vehicles or robots rely on batteries. The battery is an efficient energy storage device.

Thirdly, the company will collaborate on electrification and intelligence in certain fields, such as mines, where the entire process from mining to crushing to transportation can be automated and electrified.The establishment of a joint venture between CATL and Henan Yuxin Intelligent Machinery Co., Ltd. in 2020 is a typical case. By integrating resources, the two parties provide a complete solution for the technology research and development and industrial promotion of electric intelligent unmanned mines.

Based on this, CATL has proposed four innovative systems.

- The first is the material system innovation of in-depth material micro-mechanism research and high-performance material development.

- The second is the system structure innovation of energy consumption reduction, efficiency improvement, and cost reduction through system optimization, such as CTP and CTC.

- The third is to build a flexible, efficient, low-cost, high-quality, and self-upgrading extreme manufacturing innovation.

- The fourth is the business model innovation of connecting the entire industry chain from raw materials, battery manufacturing, operation services, to material recycling.

This strategic adjustment explains why CATL is developing rapidly in the energy storage field, and the proportion of its future energy storage business may not be lower than that of its power battery business.

Overall, CATL’s performance was outstanding last year, as it recovered comprehensively in the fourth quarter after three consecutive quarters of negative revenue and net profit growth, achieving positive growth for the whole year. It can be seen that CATL still has great potential, and overseas customers and energy storage will become another growth engine for its future.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.