In recent days, the reconciliation between LG Energy Solution and SK Innovation has become a milestone event, with the following background:

1) The dispute between the two companies actually affected the progress of Volkswagen and Ford’s electric vehicle deployment in the United States. With the United States preparing to aggressively promote new energy vehicles, this reconciliation was also mediated based on this government background.

2) The reconciliation of the two companies, which mainly make soft pack batteries, also gives hope for the development of soft pack in the next step. Recently, due to Volkswagen’s casing route, there have been doubts about future technological directions. This reconciliation also enables the two Korean companies to continue to expand their investments in Europe and the United States and expand in the two markets with demand.

The struggle between the two Korean battery companies has come to an end, which is good news for the direction of soft packs.

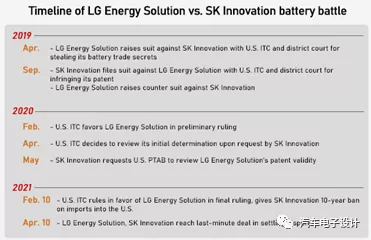

SK and LG’s dispute resolution

The amount negotiated this time was KRW 20 trillion, which includes KRW 10 trillion in cash and KRW 10 trillion in license fees (equivalent to RMB 11.7 billion), and both decided to withdraw all lawsuits filed both domestically and internationally and promise not to file lawsuits related to this matter in the next 10 years. In order not to affect the financial structure, the two sides negotiated to pay KRW 0.5 trillion twice by the end of 2022. The remaining KRW 1 trillion in license fees will be paid in installments over 5 to 6 years.

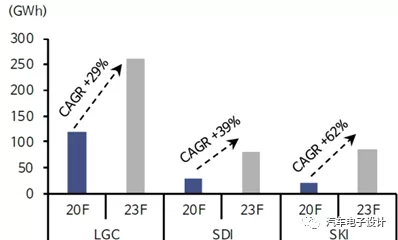

After resolving the dispute, both soft pack companies plan to increase their production capacity. LG Energy Solution, in last year’s earnings presentation, hoped to increase its total production capacity to 260 GWh. Most of it was previously in Europe and China. After this mediation, it also plans to invest over KRW 5 trillion alone to ensure that the battery production capacity in the United States reaches 70 GWh or higher by 2025, and plans to invest in the second factory of the factory in General Motors’ joint venture.

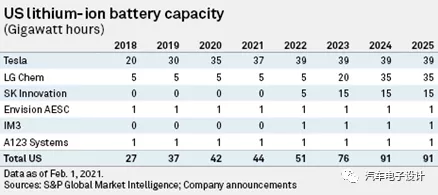

Due to the dispute, SK Innovation’s production expansion in 2020 has been delayed. However, with the dispute successfully resolved, it is expected that SK Innovation’s battery production capacity will significantly increase from 30 GWh in 2020 to 85 GWh in 2023 and 125 GWh in 2025. The production capacity in the United States is planned to reach 15 GWh by 2023.

Note: The production capacity surveyed by the consulting company below is based on the original data, and the subsequent production capacity added by Tesla and the new production capacity added by LGChem are not included.

Cylindrical capacity of Korean companies

I recently read a report and found something very interesting. Previously, LG’s cylindrical battery capacity was mainly used for Tesla’s China factory and energy storage in addition to consumer use. However, this time, in addition to following Tesla’s 4680 battery, they also continue to follow 46110. Therefore, there are signs that after investing heavily in soft packs, LG’s future direction may also compensate in the cylindrical direction to cope with the decline in short-term soft pack demand.

BMW has diversified vendors from Samsung SDI to CATL and BYD, and recently towards LGES’ 46110 cylindrical battery for BMW.

Another interesting thing is Apple’s electric car plan, which may be supported by the joint venture LG Magnae-Powertrain between Magna and LG Electronics in the early stages. This deal will be very small because Apple plans to produce electric cars for the test market for evaluation, mainly supporting small-scale production in the early stages of the project.

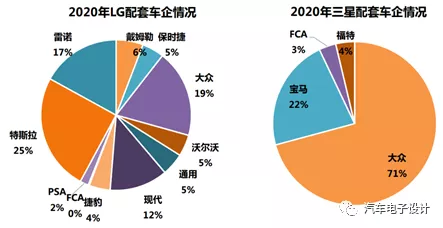

On the other hand, there is good news for SDI. Previously, its usage was mainly concentrated in Volkswagen and BMW, with a relatively small proportion in FCA and Ford. Samsung has not had a good breakthrough in the US market. The cooperation with the US startup Rivian on the R1T pickup and R1S SUV made all three Korean battery companies achieve breakthroughs in the US market. Currently, it seems that Europe’s plan is to cultivate its own power battery industry chain (many Chinese battery companies are preparing to land), while the actual situation in the United States (except for Tesla) is to invite Korean battery companies to land.

ConclusionIn the dynamic battery market, changes are taking place too fast. Domestically, the dynamic battery market is basically unable to be completely protected. In overseas markets, the growth rate in the US will be relatively larger. This time, the US government’s mediation also shows the invisible hand in the process of reserving the industrial chain. The US and Europe should also learn from the strategic value of the dynamic battery industrial chain in East Asia, including China, Japan, and South Korea. It is estimated that future competition will not be merely a corporate behavior.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.