Author: Qiu Kaijun

“China will never be like Europe and America, where almost every adult owns one car.”

Many people hold this view, and the current situation seems to be developing in this way. After several years of rapid growth, the total number of vehicles in China has reached 287 million. However, the number of vehicles per thousand people has just exceeded 200, which is still far from the 800 in the United States and the five to six hundred in Western Europe and Japan.

At the same time, China’s economic growth is also slowing down, and people’s pockets are not being filled as quickly as before.

However, changes have emerged.

In the era of traditional fuel cars, micro-cars, which were almost eliminated, are making a comeback in the era of electric cars. A batch of micro electric car models have emerged, winning consumer recognition. On April 12, Redding Motors, which has been deepening the short-distance travel market, rolled off the first mass-produced car, the Mango, at its factory in Weifang, Shandong. This pure electric mini car, with a pre-sale price of 29,800 yuan, has added fuel to the fire of micro-electric cars.

Redding Motors General Manager Shu Xin revealed that the sales target for its medium and short-distance products is: 100,000 vehicles this year, 400,000 next year, and 600,000 the year after that – China’s overall auto trend is a moderate decline or slow increase, but Redding is pursuing explosive growth.

Their logic is: A large group of people who were originally unable to afford a car life – such as the 600 million urban population – also have a demand for driving, but lack corresponding products. As long as the product fits their needs, these 600 million people will also buy cars.

The result is: China’s car ownership group is going to expand greatly. How big? Japan may be a reference: the number of K-cars (micro-cars) accounts for nearly one-third of Japan’s total vehicle ownership. If China can also create one-third of the new car demand, it is not difficult to reach a car ownership of 400 or 500 million.

China’s automotive history may be opening a new chapter.

New Micro-Electric Vehicle: Redding Mango

Weifang, Shandong, the world kite capital. On April 12, a “Mango” was born here.

At Redding’s factory in Changle County, Weifang, the Redding micro pure electric passenger car Mango, was rolled off the assembly line.

The Mango is refreshing and attractive: with clever colors like dewy green, malt yellow, cloud white, moon rock gray, etc.; small size: with a length of 3.6 meters and a wheelbase of 2.4 meters; and low cost: starting at RMB 29,800 for a 100 km charge costing only RMB 5 at home.

Compared with the popular compact electric vehicle Hongguang MINI EV, the Redding Mango, although also positioned for short-distance commuting, has a larger size. Hongguang MINI EV has two doors and can seat four people, with a wheelbase of less than two meters, mainly designed for 1-2 person commuting. In contrast, Redding Mango has a wheelbase of 2.4 meters, four doors, and seats four people, which is enough for a family’s short-distance travel. Unlike Hongguang MINI EV’s almost non-existent trunk, Redding Mango provides 420L of cargo space.

Compared with the popular compact electric vehicle Hongguang MINI EV, the Redding Mango, although also positioned for short-distance commuting, has a larger size. Hongguang MINI EV has two doors and can seat four people, with a wheelbase of less than two meters, mainly designed for 1-2 person commuting. In contrast, Redding Mango has a wheelbase of 2.4 meters, four doors, and seats four people, which is enough for a family’s short-distance travel. Unlike Hongguang MINI EV’s almost non-existent trunk, Redding Mango provides 420L of cargo space.

In terms of performance, Redding Mango can be considered comparable to Hongguang MINI EV and even surpasses it. Hongguang MINI EV has two versions of endurance: 120 km and 170 km, while Mango has two versions of endurance: 130 km and 185 km, which outperforms Hongguang MINI EV. In addition, Mango also has a 300 km endurance version that supports both fast and slow charging.

If you choose the high-end version of Mango, there are also four major intelligent driving assistance systems, including lane changing assistance, vehicle blind spot monitoring, rear horizontal incoming vehicle warning, and door opening danger warning.

In terms of safety, Mango adopts a high-strength steel cage-type body and has passed the collision test of the Ministry of Industry and Information Technology.

Overall, Redding Mango and Hongguang MINI EV, these micro-electric vehicles, focus on the short-distance commuting market, but Mango has more space and functions. As the first car for urban families, it is also sufficient.

The Rise of Micro Electric Vehicles

In China, micro electric vehicles used to be the main force of new energy vehicles.

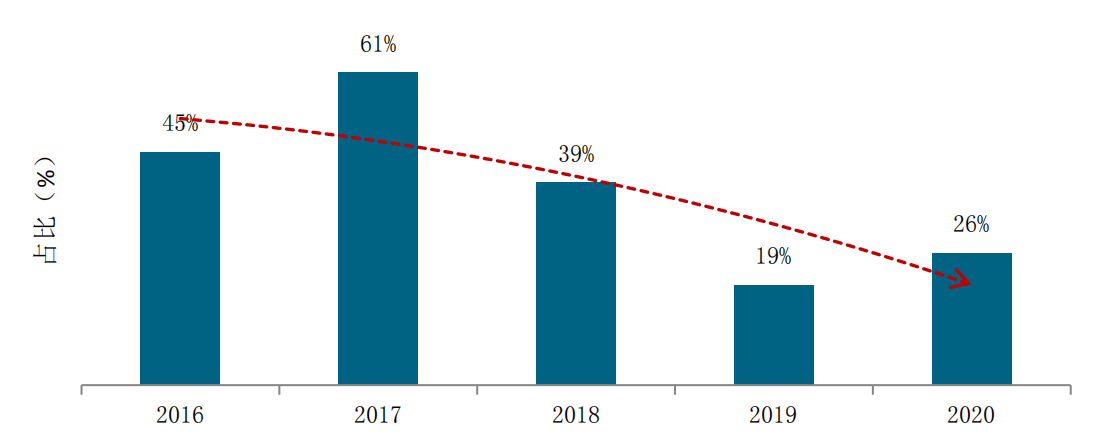

Before 2017, small electric vehicles represented by BAIC EC series, Chery eQ1, Zhidou D series, etc. were popular. At its peak, the market share reached 61%.

Market share of small pure electric passenger cars in the new energy passenger car market

However, with the subsidy policy encouraging long-endurance electric vehicles and the substantial subsidy cuts for micro electric vehicles, many automakers have given up this market, leading to a significant decline in the market share of small electric vehicles.

But since 2020, some companies with a firm belief in the demand for micro electric vehicles have launched products suitable for short-distance travel, winning market acclaim.

Among them, SAIC-GM-Wuling’s Hongguang MINI EV is a hot seller. After overcoming the production ramp-up phase, it surpassed the Tesla Model 3 and became the champion of China’s new energy vehicle market. Although it was only launched in July 2020, it sold 127,700 units that year, making it the fastest single electric vehicle model to break through 100,000 units in China.The popularity of the Changan Oushang MINI EV has opened up the industry’s imagination for this category. Many car companies are contemplating or have already launched similar models. Just among the 343 car announcements that were released, seven car companies announced nineteen micro-electric vehicles.

One of these seven companies is Leiting.

However, unlike many newly discovered companies in this market, Leiting has been cultivating this market since 2008, with over one million cumulative users.

With this extensive expertise in this market, Leiting has a strong understanding of user needs. There is a need for short-range transportation, both for personal and household use. Leiting’s experience in the micro-car field shows that the market tends to seek cost-effectiveness and has no small demand for vehicle space.

Mango embodies Leiting’s understanding of the market. This model is priced from 29,800 yuan, seemingly more expensive than the Changan Oushang MINI EV, which starts at 28,800 yuan. However, Mango is a four-door four-seater, while the actual sales of Changan Oushang MINI EV are mainly for the mid-range model, which starts at 35,800 yuan. In addition, many users of Changan Oushang MINI EV are young people in first-tier and second-tier cities. The demands of families in third-tier or even lower-tier cities have not been addressed.

Shu Xin explained that in third-tier and lower-tier cities and towns, Leiting has over 3000 primary terminal stores and over 10,000 secondary terminal stores. Their primary stores refer to county-level stores. Leiting’s depth of terminal penetration and radiation will provide the strongest guarantee for Leiting to promote short-range transportation in this market.

Allowing 600 Million People to Enter the Automotive Society

In the memory of Chinese people, the earliest cars to enter households were the traditional three: Jetta, Santana, and Fukang, and there were also micro “miracle cars” from domestic brands starting out, such as Chery QQ, BYD F0, Changan Alto, and Geely Panda.

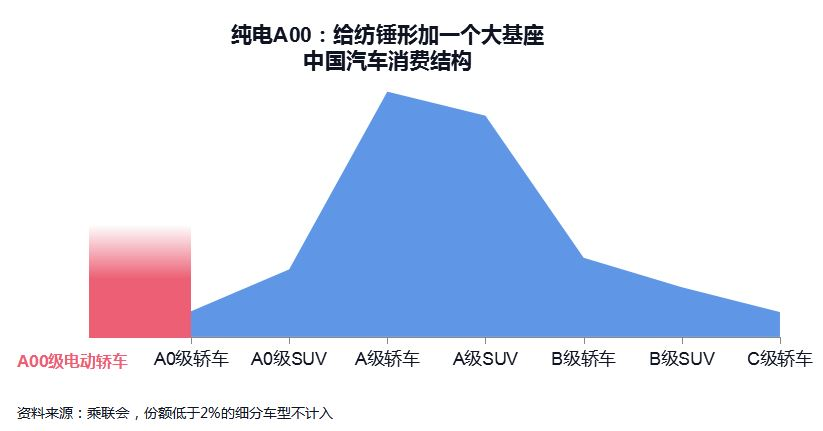

However, soon after, with the rise of domestic brand strength, small models of traditional fuel vehicles are no longer popular. The A00 market accounts for less than 2%. Entry-level vehicles now cost around 60-70,000 yuan. These entry-level cars have great value and quality, fulfilling many people’s car dreams.

However, a price tag of 60-70,000 yuan is still quite high, and many families with limited purchasing power are still unable to reach this threshold. China’s car ownership is currently at about 200 cars per thousand people, reflecting the relationship between people’s purchasing power and automobile product supply.

How can China’s automotive population continue to increase? How can more people achieve a car-owning lifestyle?

To take China’s automotive population to the next level, we should not focus solely on existing car products but should tap into incremental markets.Looking closely at entry-level gasoline cars, on one hand their prices are still high, on the other hand, they come with complete functionalities and are suitable for short-distance commutes with some room to spare.

Under the entry-level gasoline car category, can another entry-level category be created?

There is no doubt about the demand. Specifically, among the 600 million urban population targeted by Leiding, their demand for medium-to-short-distance commutes could create a market of over 200 million cars. However, main electric car models are priced between 50,000 to 150,000 yuan ($7,634 to $22,902), which indicates a mismatch between supply and demand.

The immense success of the Hongguang MINI EV indicates a great demand for cars priced below RMB 50,000 ($7,630). Its sales have only continued to rise, indicating high demand and a need for more space, which cannot be met by a single car model alone.

Leiding’s Mango, with its projected pricing between RMB 30,000 to RMB 50,000 ($4,580 to $7,630), has a different functional positioning than that of the Hongguang MINI EV, and hence is complementary in product offering. Combined with other car manufacturers’ mini electric cars, a new entry-level market may completely change the structure of China’s car consumption.

Moreover, as the purchasing threshold for this category is low and the potential user base is large, if the demand for these cars is fully unearthed, it may expand China’s car society.

China’s car ownership per thousand people is far below that of developed countries, ranking roughly around the top 10 in the world with only 200 vehicles per thousand people. In 2019, Japan, ranking fifth in the world, had 591 vehicles per thousand people, of which K-Car models occupied one-third of the market.

K-Cars were products designed solely for the domestic market by the Japanese automotive industry after World War II. From the outset, their goal was to have lower displacement and lower prices, while still being able to accommodate four adults. Their eventual form was that of the K-Car, which could not be longer than 3.4 meters and wider than 1.48 meters.

This type of car was deeply loved by the Japanese people, with a market share of over thirty percent. Shuxin also said, “In 2019, I conducted a market survey specifically in Japan, and the market share of K-Cars has increased year by year, reaching about 40% in 2019.”

Today, mini electric cars represented by Hongguang MINI EV and Leiding Mango can be said to be China’s version of K-Cars. They not only meet people’s travel needs, but also come with low purchase and usage costs.Compared to traditional mini cars powered by gasoline, mini electric cars can also help alleviate China’s reliance on foreign oil and air pollution issues.

We hope that mini electric cars become the new people’s car, allowing more people to enjoy the convenience of car ownership and contributing to a sustainable development of China’s automotive industry.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.