The content of this article is sourced from 42how and has been translated by ChatGPT

Weekly Index

Weekly News

Sales figures of new forces in the past month

On February 1st, the first day of the Chinese New Year, various new forces in China greeted the public by announcing their sales figures. In January, the first tier had declined compared to December of last year, while the second tier showed a clear catching up trend.

XPeng Motors (XPeng)

In January, XPeng Motors delivered 12,922 vehicles, an increase of 115% year-on-year, but a decrease compared to the delivery volume of 16,000 in December of last year.

The delivery performance of specific models is as follows:

-

XPeng P7 delivery: 6,707 units;

-

XPeng P5 delivery: 4,029 units;

-

XPeng G3 series delivery: 2,186 units.

As of the end of January 2022, the cumulative delivery volume of XPeng P7 had exceeded 80,000 units, and the cumulative delivery volume of XPeng Motors had exceeded 150,000 units. In addition, XPeng plans to carry out technical transformation of its Zhaoqing base during the Spring Festival production suspension period from the end of January to early February 2022. After the transformation, the backlog of orders is expected to accelerate the delivery process.

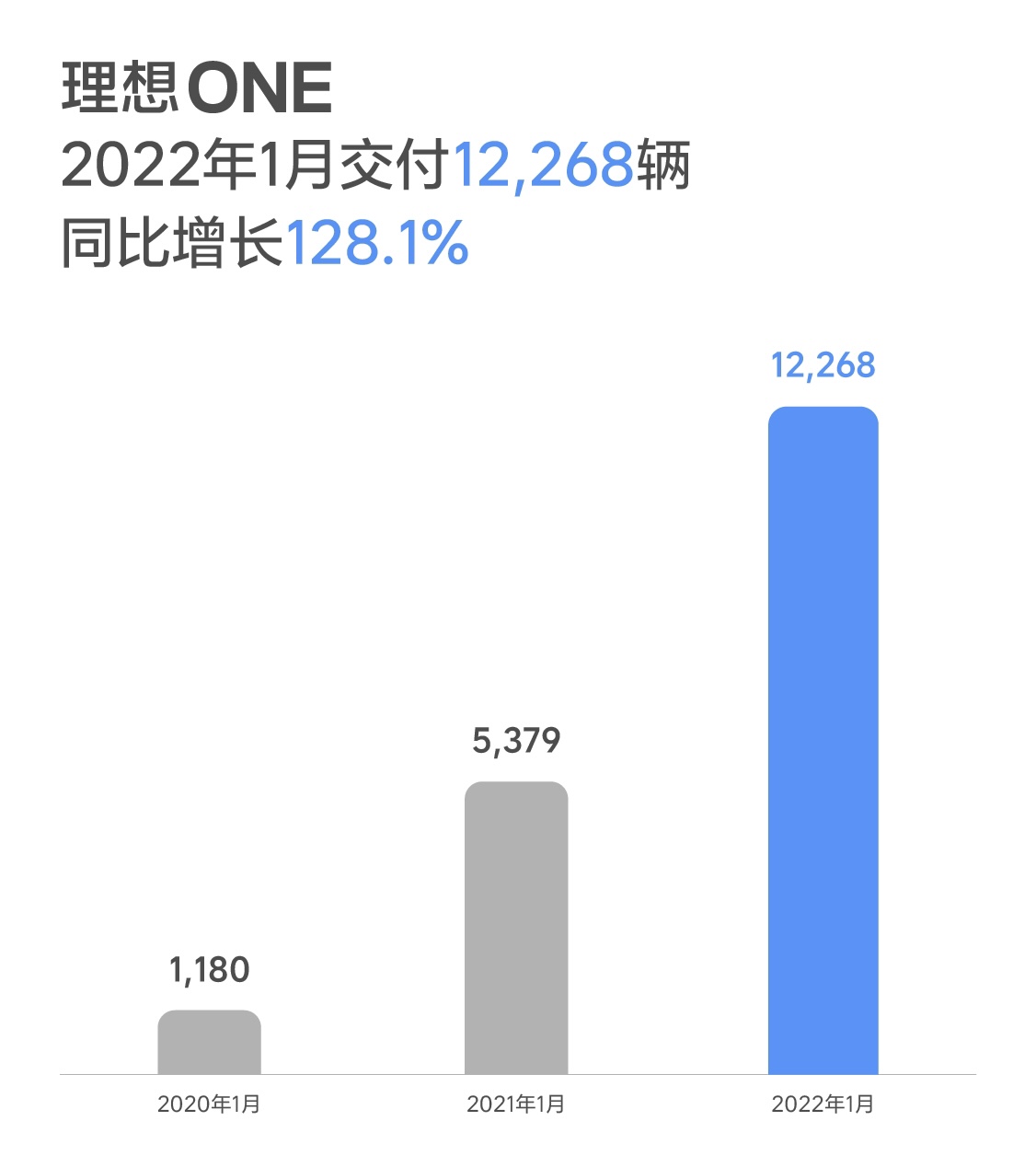

Li Auto (Li)

In January 2022, Li Auto delivered 12,268 vehicles, a year-on-year increase of 128.1%, but a slight decrease compared to December.

Li ONE has achieved over 10,000 deliveries for three consecutive months since November 2021, and the cumulative number of deliveries has reached 136,356 as of now.Regarding new products, in Q2 this year, Ideanomics will release a brand new flagship model codenamed X01. The estimated delivery volume in 2022 is expected to increase by more than 50% year-on-year.

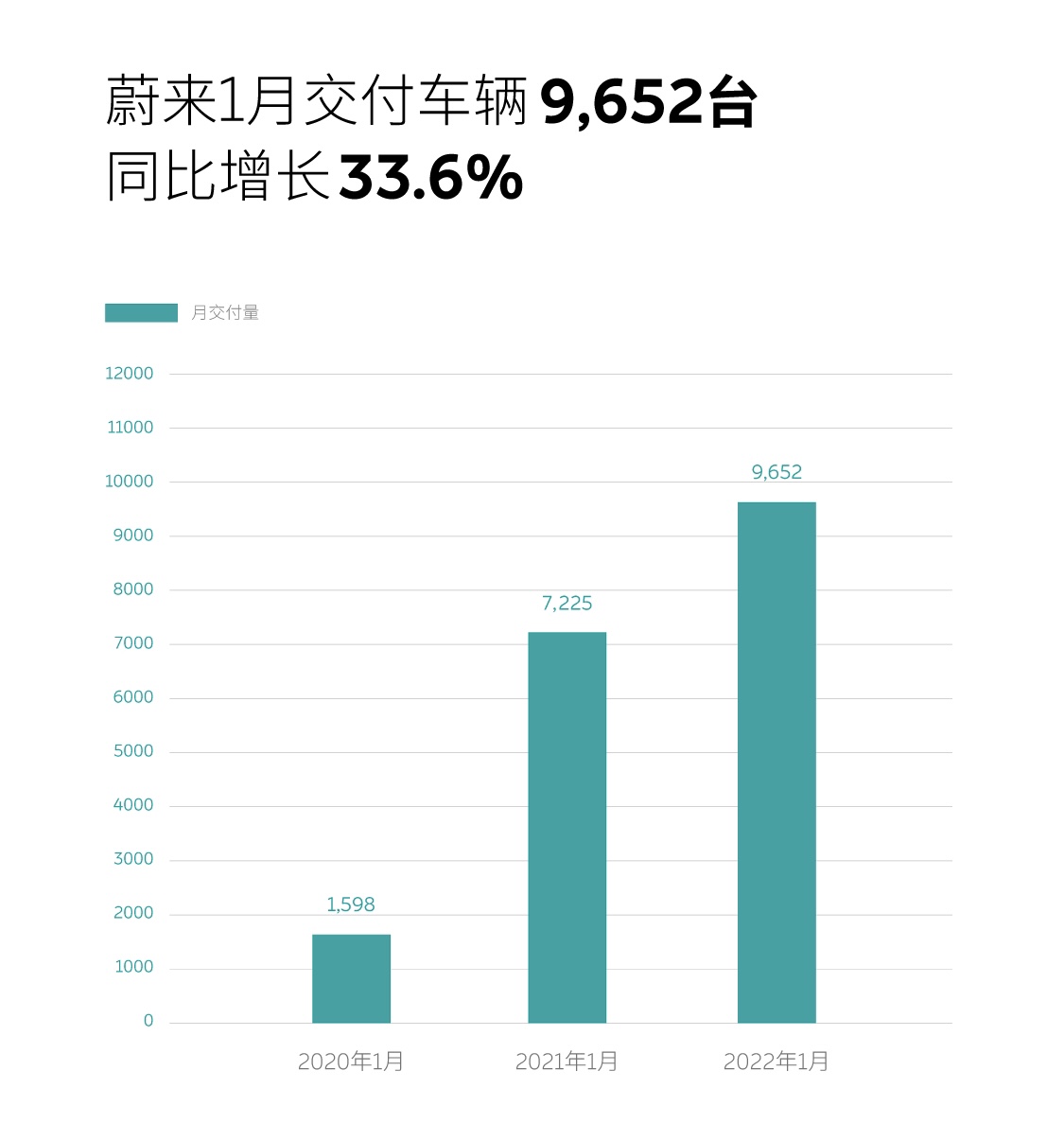

NIO

In January, NIO delivered 9,652 vehicles, a year-on-year increase of 33.6%, but a slight decrease from the delivery volume of 10,489 vehicles in December last year. The delivery volumes of each model are:

- ES8: 1,531 vehicles

- ES6: 5,247 vehicles

- EC6: 2,874 vehicles

As of the end of January 2022, NIO has delivered a total of 176,722 new vehicles.

This year, NIO has three new models, including the already revealed ET7 and ET5, and the ES7, which is still in the confidential stage. The ET7 will be delivered at the end of March, and the ET5 will be delivered in the third quarter, with the ES7 likely to be delivered around the same time as the ET5. After the launch of the three new models, NIO’s sales performance in 2022 is expected to reach new heights.

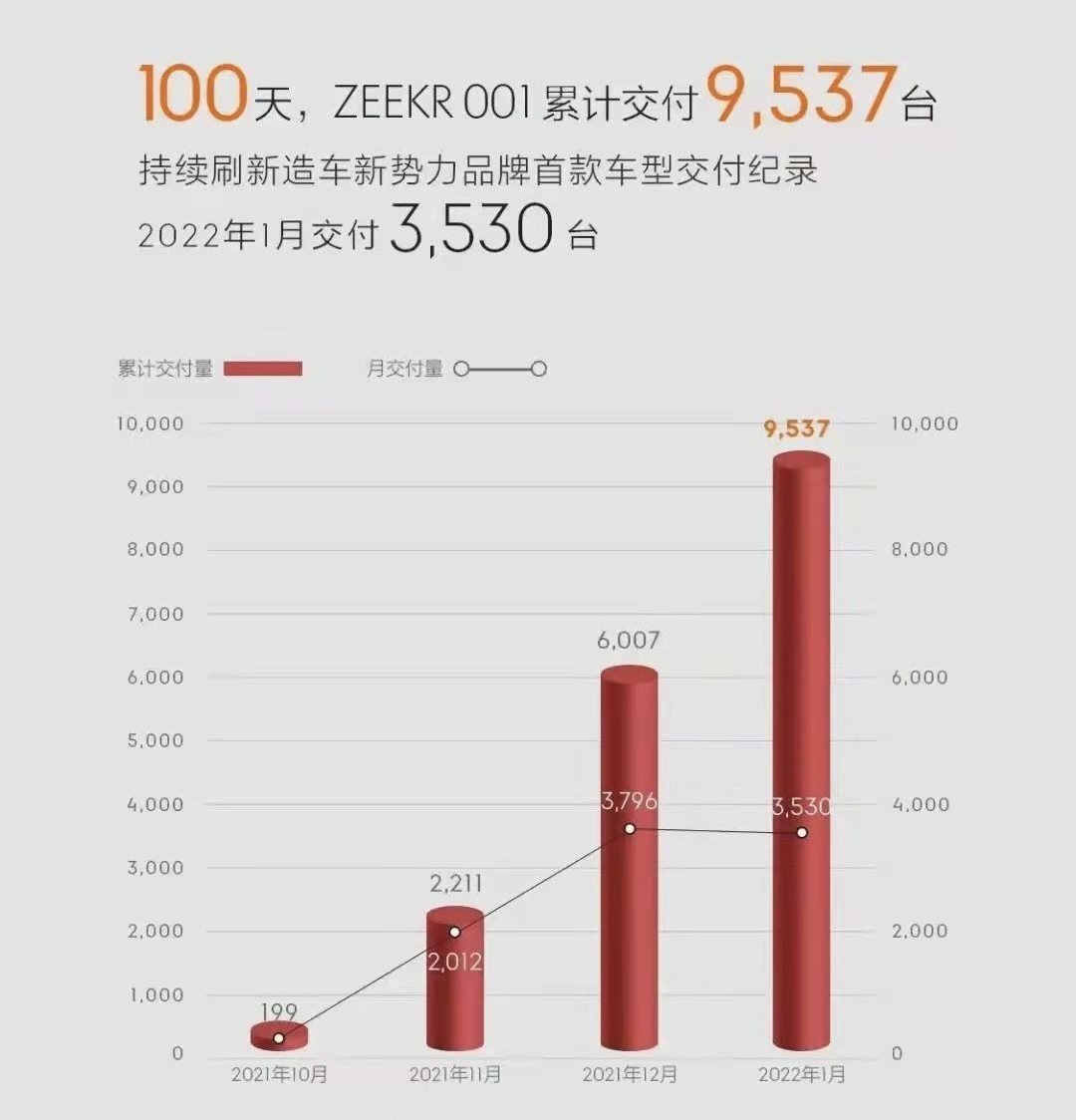

Jidu Auto

In January, Jidu Auto delivered 3,530 Jidu 001 vehicles, a slight decrease from the 3,796 in December 2021.

Since the start of deliveries in October last year, Jidu Auto has delivered a total of 9,537 Jidu 001 vehicles, and is about to break the ten-thousand mark.

Leapmotor

In January, Leapmotor delivered 8,085 vehicles, surpassing the 7,807 of December last year, with a year-on-year increase of 434%.

As of January, Leapmotor has achieved continuous year-on-year growth of more than 200% for 10 consecutive months, showing strong performance.

In 2021, the T03 model from Leapmotor saw a total delivery of 38,463 vehicles, while the C11 model began deliveries in October last year, with a total delivery of 4,021 vehicles in 2021.

NIOA (NIO+)

In January, NIOA delivered 11,009 vehicles, a year-on-year increase of 402%, with sales exceeding ten thousand units for three consecutive months, showing an encouraging trend.

From January to December last year, NIOA delivered a total of 69,674 vehicles.## Translation

The NETA cars currently on sale are priced at around 200,000 yuan or below. We are looking forward to seeing the performance of NETA S, which will be launched this year.

Summary:

Overall, the disclosed delivery volume of several companies is not bad. The January timeframe is unique, affected by the subsidy reduction of new energy in 2022, and the approaching Spring Festival vacation. Many automobile companies have seen a year-on-year growth but a month-on-month decline, with delivery volumes lower than in December last year. It is expected that the Spring Festival holiday will also have a significant impact on the delivery volume in February.

From the perspective of brand delivery, the competition in sales of the top few brands has become increasingly fierce. XPeng and Ideal’s delivery volume is neck-and-neck and exceeded 12,000. NETA surpassed the 11,000 mark as a dark horse. NIO dropped slightly compared with December and barely surpassed the 10,000 mark. ZeroRun’s January delivery volume exceeded 8,000, and its future is promising. With the launch of new car models for delivery, we believe that these five brands will maintain or have the ability to deliver more than 10 thousand vehicles per month in the coming months.

Tesla FSD Beta 10.10 released, “Rolling Stop” feature ordered to be removed

On February 2nd, the update log of Tesla FSD Beta 10.10 was exposed, with a software version number of 2021.44.30.15. This update still focuses on improving stability, but the “Rolling Stop” feature has been removed.

The “Rolling Stop” feature allows the vehicle to slowly pass through a crossroad with a “STOP” sign when there are no other vehicles or pedestrians passing by. This feature has been deemed by the National Highway Traffic Safety Administration (NHTSA) as a potential safety hazard, and a recall has been requested. The recall involves a total of 53,822 Model S/3/X/Y vehicles equipped with this feature. Therefore, Tesla removed this feature in the latest software version following NHTSA’s request.

Summary:

The remaining feature updates of FSD Beta 10.10 are regular upgrades in stability and user experience. It is worth mentioning that according to the exposure of Twitter users, FSD Beta may be pushed to Canadian users this month. With the opening of FSD Beta except in the United States, when will the FSD in China be pushed to the Beta version?

Volvo and battery manufacturer Northvolt will build a battery factory in Gothenburg

According to foreign media on February 4th, Volvo and battery manufacturer Northvolt will build their joint battery factory in Gothenburg, western Sweden.Volvo announced that the new 50 GWh plant will create up to 3,000 job opportunities and produce batteries specifically developed for pure electric Volvo and Polestar cars. Production is set to begin in 2025.

The two companies’ total investment is about SEK 30 billion (USD 3.3 billion), including the establishment of a giant production plant and a research and development center. Adrian Clarke, a former senior executive of Tesla, has been appointed to lead the battery production company.

Quick comment:

According to Peter Carlsson, CEO of Northvolt, they have gained rich experience from Tesla, including how to build such battery plants. However, they also stated that the construction of the new plant remains difficult due to global supply chain issues, semiconductor shortages, and the COVID-19 pandemic. Northvolt’s largest shareholder is Volkswagen. So far, it has received contracts worth more than USD 30 billion from clients such as BMW, Fluence, Scania, Volkswagen, Volvo Car, and Polestar.

Volvo’s goal is to achieve sales of 50% pure electric vehicles by 2025 and only sell fully electric vehicles by 2030. In order to achieve this goal, Volvo has invested SEK 30 billion to build a battery plant and an additional SEK 10 billion to establish a new vehicle plant, which will play a crucial role in Volvo’s transformation.

JAC Volkswagen’s support will help it achieve an annual output of one million electric cars in China.

The CEO of Volkswagen Passenger Cars said that, along with FAW, SAIC and JAC’s joint venture factories, it will achieve the goal of producing one million electric vehicles annually in China by 2023.

In 2019, Volkswagen announced for the first time the establishment of a joint venture with Anhui Jianghuai Automobile and invest more than CNY 20 billion to build a new MEB factory. It is expected to start production from 2023, with an annual output of about 350,000-400,000 vehicles.

Quick comment:Affected by issues such as the supply chain, chip shortage, and the pandemic, Volkswagen sold 70,625 electric vehicles in China last year, failing to reach its target of selling 80,000 to 100,000 cars. Stephan Woellenstein, head of Volkswagen’s China subsidiary, stated in a report in Beijing in January that Volkswagen hopes to double the sales of its ID. series vehicles in 2022, but a shortage of semiconductor supply may hinder this plan.

With the support of JAC Volkswagen and the signing of an agreement with Guoxuan High-tech, Volkswagen continues to pour resources into the Chinese market, hoping to maintain its leading position in the era of electric vehicles. However, to achieve its goal of selling one million electric vehicles, Volkswagen needs to make more effort in many areas.

Ford will follow Tesla’s footsteps and upgrade the Mustang Mach-E intermittently.

Recently, Ford clarified that it will adjust the product strategy of its electric vehicle Mustang Mach-E based on its own needs. This adjustment will focus on further increasing profits and intermittently upgrading the vehicle’s software and hardware.

Previously, Ford CEO Jim Farley stated to analysts that Ford does not plan to update software and hardware in annual vehicle models in the traditional way in the future. Instead, Ford will push software upgrades irregularly and constantly redesign vehicle hardware to reduce costs. These new iterations of software and hardware will not wait for the annual model and will be directly installed and sold when appropriate. At the same time, accumulated experience will also be used in the F-150 Lightning.

Quick Comment:

Although this is very different from the practices of most traditional car companies at present, it will be Ford’s future business model. Jim Farley stated that Tesla has always operated in this way, and both software updates and hardware changes have led them to discover more opportunities for profitability.

Jim Farley found that Ford still has problems with vehicle integration when comparing his own Mustang Mach-E with Tesla’s products. The Mach-E has made some progress in integrated design for cooling systems and motors compared to previous electric products, but there is still room for improvement. Farley recognizes that fewer parts will bring higher profits, and Ford will also change its traditional iterative approach to further increase profits. As a result, Ford’s future vehicle iteration mode will become more interesting.

Jim Farley found that Ford still has problems with vehicle integration when comparing his own Mustang Mach-E with Tesla’s products. The Mach-E has made some progress in integrated design for cooling systems and motors compared to previous electric products, but there is still room for improvement. Farley recognizes that fewer parts will bring higher profits, and Ford will also change its traditional iterative approach to further increase profits. As a result, Ford’s future vehicle iteration mode will become more interesting.