Introduction

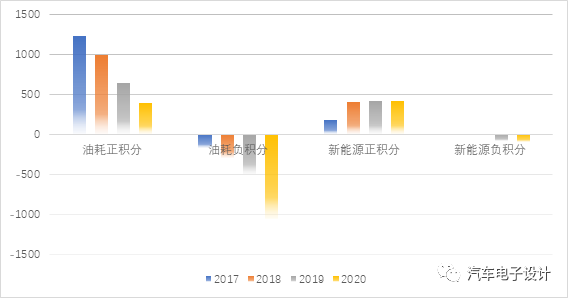

Recently, the Ministry of Industry and Information Technology (MIIT) of China released a notification on the average fuel consumption and new energy vehicle credit scores for passenger car companies in 2020, and there are several noteworthy things in it. In 2020, the industry generated 4.2 million new energy positive credits and 0.92 million new energy negative credits. In terms of fuel consumption credits, the industry generated 10.57 million negative fuel consumption credits and 3.91 million positive fuel consumption credits, with negative fuel consumption credits far exceeding positive credits.

Note: Currently, new energy credits are not actually important. The most intuitive thing is how traditional companies deal with negative fuel consumption credits, and the new energy credits themselves are oversupplied.

From the current situation, companies with positive credits are all those producing new energy vehicles, and I personally think that this is due to higher requirements for fuel consumption reduction. Looking at 2021, it is indeed necessary to fully promote hybrid power in order to make the automobile industry develop stably.

US Transportation Data

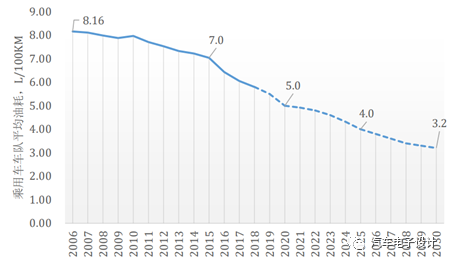

Below are the Chinese-defined goals for the next five years, which have made the passenger car industry plummet from 10.7 million fuel consumption credits in 2017 and 6.98 million in 2018, down to the tipping point of 1.33 million in 2019 and -6.66 million in 2020. Actually, it is easy to understand that the automobile industry itself has basically blocked the roads planned for traditional cars. On the one hand, the effort of reducing the number of cylinders at the engine level by enterprises has failed, and on the other hand, Chinese consumers essentially do not consider choosing engines below A0 level and choose larger models (more powerful ones), which makes positive fuel consumption credits generated by fuel consumption even more difficult.

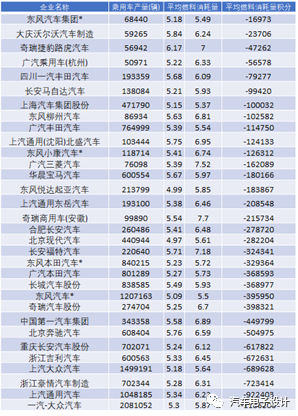

BYD generated the most positive fuel consumption credits, with 0.95 million credits, followed by Tesla with 0.8 million credits. The most effective among them is Wuling, which relies on the development of A00-class BEVs and has also produced 0.49 million credits. This part is very precious for SAIC Group and GM. As for positive credits, Toyota’s HEV strategy needs to be further strengthened, otherwise going from the current limit to negative credit is just around the corner. I think this is still a very interesting thing to see from this table.1. BEVs provide significant assistance in generating positive fuel consumption integration, such as when Wuling Motors relied on 170,000 BEVs to achieve the complete transition to positive integration for 930,000 vehicles. The most direct drive behind Wuling’s approach is that SAIC Motor Group requires a considerable amount of positive integration to be transferred internally in the short term.

- The impact of PHEVs on positive fuel consumption integration is not significant: the ideal EREV of 35,800 units corresponds to 230,000 positive integrations, while WM Motor’s 26,000 units correspond to 150,000 integrations. This means that relying on PHEVs to generate positive integration does not have a significant effect when the PHEV market as a whole has not yet broken through.

The situation becomes awkward for companies with negative fuel consumption integration. Joint ventures are almost completely wiped out, with varying degrees of severity. Volkswagen and GM have more severe problems, with more negative integration for a greater volume. Japanese automakers Nissan and Honda are both at a scale of -300,000, while Toyota’s early start in promoting hybrid electric vehicles was relatively better. Among luxury brands, BMW’s PHEV sales generated a slightly better level of negative integration. Among domestic brands, the negative fuel consumption integration of Geely, Great Wall, Changan, and Chery is more prominent. In fact, it is now very clear that the Ministry of Industry and Information Technology needs to compensate for some of the benefits outside the recycling loop. Following this trend and with a goal of 4L by 2025, the negative integration gap is increasingly unbridgeable, as evidenced by the premise that each BEV is equivalent to 5-6 fuel consumption integrations. Volkswagen will need 200,000 BEVs to meet its requirements.

To date, SAIC-GM-Wuling has successfully transitioned from a player with negative fuel consumption integration to one that can sell positive integration for 500,000 fuel consumption integrations and 440,000 new energy source integrations after selling 170,000 A00-level BEVs in 2020. If sold at a 20% discount of 3,000 RMB per integration, SAIC-GM-Wuling could earn 2.256 billion RMB from GM.

Conclusion:

The changes in China’s auto industry in 2020 may have been just a rehearsal for what’s to come. In fact, in 2022, with or without subsidy reductions, the automotive industry will begin to change due to the constraint of fuel consumption integration. The introduction of EREV is not designed to allow for a dramatic shift. A00 BEVs will continue to sell well this year, which is itself a way to satisfy the industry’s demand for fuel consumption integration.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.