*Author: Tianhui

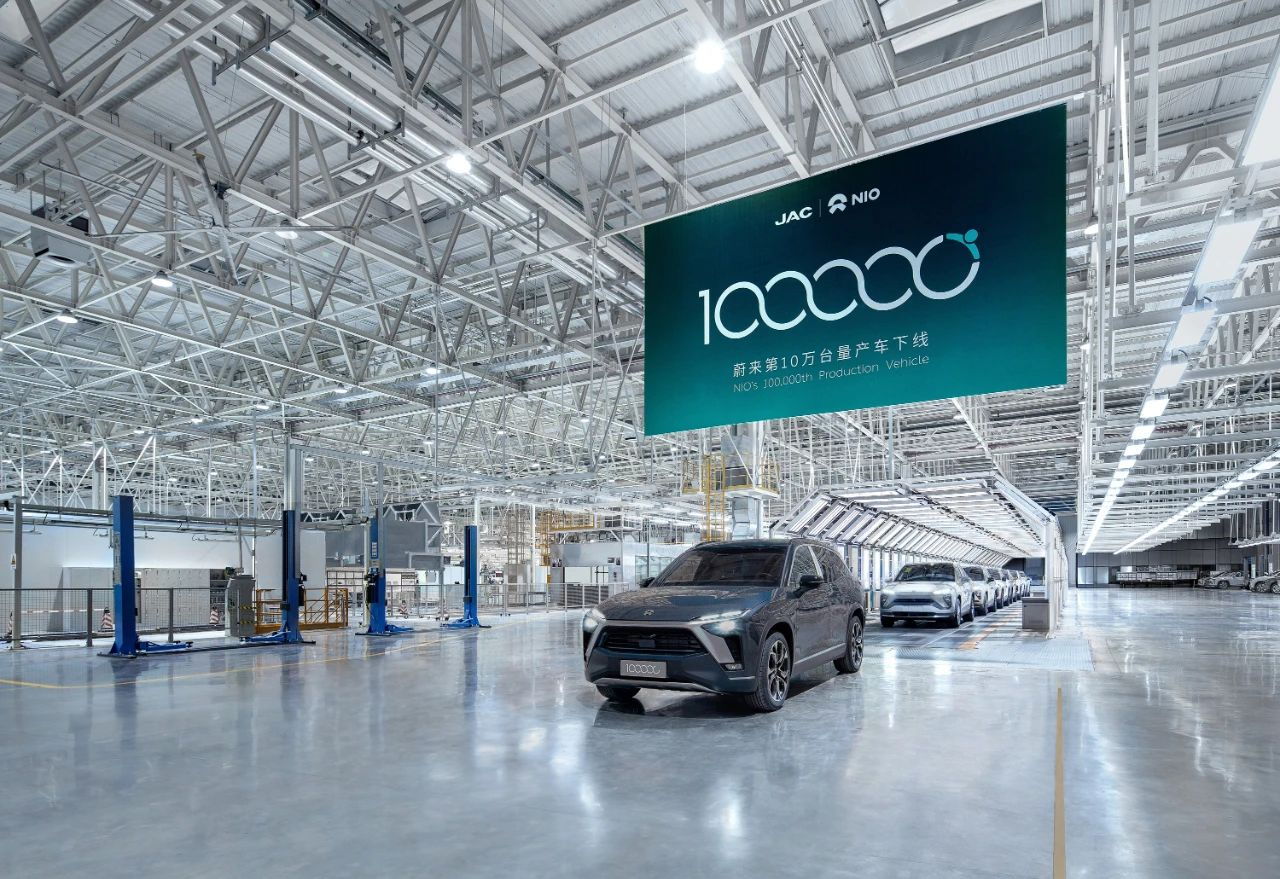

On April 7, 2021, a NIO ES8 in Antarctica Blue slowly rolled off the production line (pictured above) at the NIO Advanced Manufacturing Plant in Hefei, Anhui Province, and NIO’s production reached a new milestone of 100,000 vehicles.

Since starting mass production on May 27, 2018, NIO has achieved this milestone in 1,046 days, becoming the first Chinese new energy vehicle manufacturer to produce over 100,000 vehicles.

One interesting fact is that many car company bosses have competed with NIO on production volume, including two well-known figures: He XPeng, who bet that NIO would not be able to produce 10,000 cars in 2018, and Shen Hui, who pledged to be the first to achieve 100,000 cars. Time has proved that NIO is the ultimate winner.

NIO’s sales have maintained a monthly sales of over 5,000 vehicles for half a year, and the biggest problem that NIO currently faces is not questioning or sales, but supply and demand.

Therefore, NIO has revealed its preliminary plan for capacity expansion.

Capacity has always been a problem for NIO

If not for the chip supply issue, NIO’s 100,000th mass-produced vehicle would have arrived a few days earlier.

On March 29, NIO temporarily stopped production for 5 days due to chip supply problems.

In fact, NIO is not lacking in final assembly capacity, but there are still certain difficulties in the supply chain.

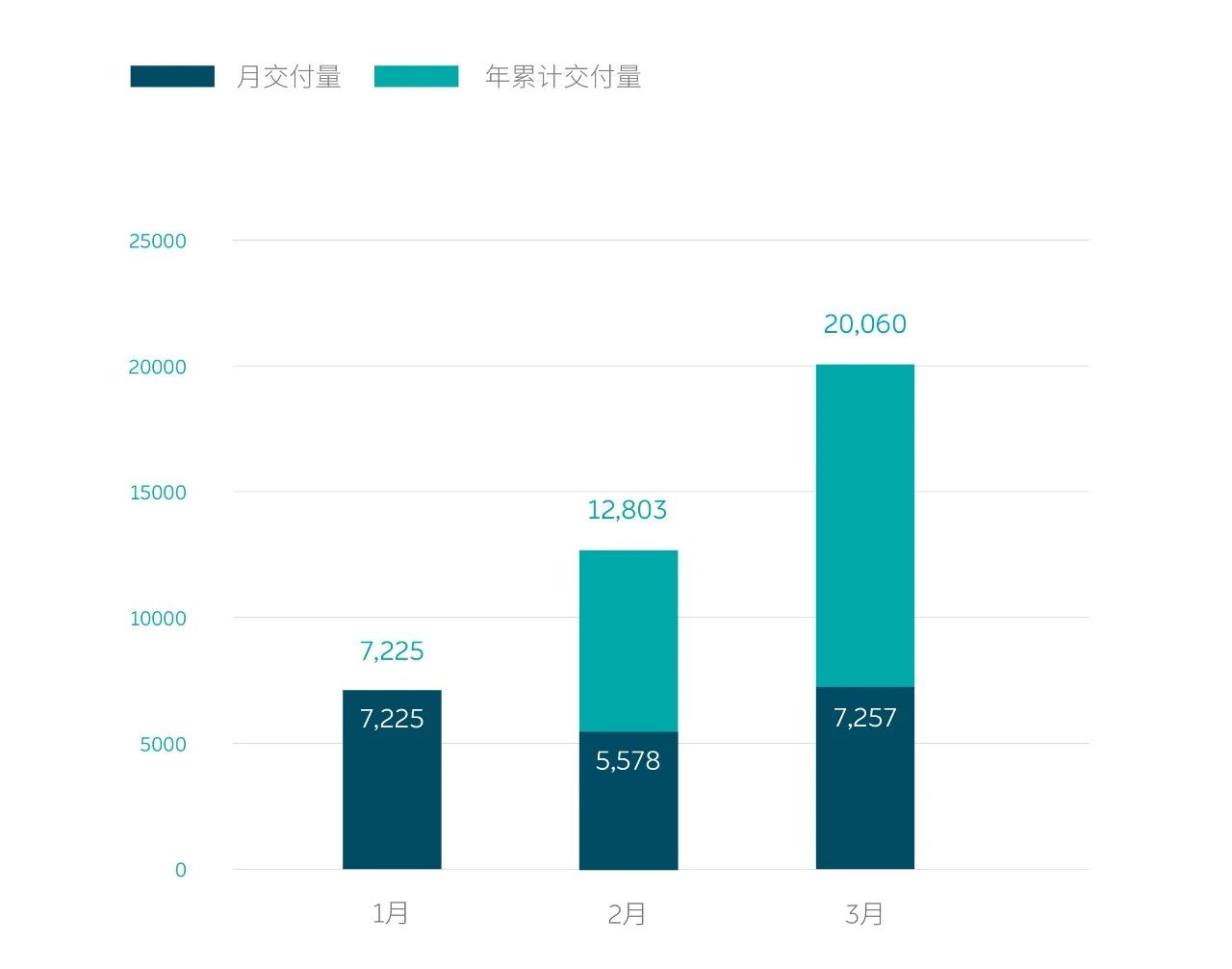

On the marketing side, since the fourth quarter of 2020, NIO has steadily maintained a monthly delivery volume of over 5,000 vehicles, reaching a maximum of 7,227 at one point. Pre-ordered consumers need to wait more than a month to pick up their vehicles, and the sales volume is indeed booming.

In the media interview after the celebratory event, Li Bin said that the manufacturing plant can achieve a production capacity of 400 units/day, producing 1,000 vehicles per month over 25 days.

The total assembly capacity is 10,000 units, the delivery volume is 7,227 units, and the shortfall is nearly 3,000 units, which is precisely the problem.

The current main difficulty lies in the supply chain, including certain pressure on the supply of chips and batteries. Therefore, NIO is currently producing at a rate of 7,500 units/month.

The temporary suspension of production due to a shortage of chips will undoubtedly worsen the problem of production capacity.

Li Bin stated that it is generally agreed within the industry that the second quarter will be more difficult, and the third quarter should see some improvement. NIO expects the biggest challenge to be in the second quarter, and it should improve somewhat in the third quarter.

At present, the entire semiconductor industry is adding capacity to the automotive industry. Not all automotive chips are high-precision chips. Many of them are basic chips. It may be that the semiconductor industry has been too cautious in predicting the demand for automotive chips, which has led to a shortage of supply. NIO believes that this is only a temporary pressure, and it should be relieved starting from the third quarter.Outside of its chip issues, NIO has also encountered a surprising constraint in its power battery supply. According to Li Bin, the demand for the 100 kWh power battery pack has exceeded expectations, and NIO is currently increasing production capacity. By the third quarter, they expect to ramp up their capacity.

The production constraints facing NIO and Li Bin are not only due to the short-term tightening of chip and power battery supply, but also due to the launch and planning of new models such as the ET7, which could further increase their production needs.

After Jianghuai NIO’s contract manufacturing model received market recognition, the status of NIO’s self-built factories has garnered considerable attention.

“Since we didn’t have enough funds, we had to delay construction of the Shanghai factory,” said Li Bin, chairman of NIO. During NIO’s most difficult times, the production equipment for the NIO Shanghai factory was sold to Tesla, generating funds that helped NIO to tide over the difficulties.

Fortunately, the delay provided an opportunity for NIO to deepen its cooperation with Anhui Provincial State Asset Management, making up for the shortfall of capital.

Based on NIO’s product roadmap, a number of new models will be launched in the next few years. On the Q3 2020 earnings call, Li Bin announced that, in addition to a sedan that was about to be released, another sedan was still in development. The sedan he referred to earlier was the ET7, which was launched at the NIO Day event in 2021.

Once the ET7 begins delivery, NIO will produce and sell a total of four models: ES8, ES6, EC6, and ET7, which could further strain the production capacity. NIO needs to have a plan in place for the production of sedans after the ET7.

Constructing new factories is one solution to this problem.

Li Bin gave a clear answer regarding NIO’s new factory in Hefei, saying that it will be located in Hefei near the airport. Rather than simply building a new factory, this will be a world-class intelligent electric vehicle industrial park that integrates research, development, manufacturing, and life services. This industrial park will be located in a prime location.

NIO’s collaboration with Anhui is a win-win situation. For NIO, they receive funding and land, while for Anhui Province, they have the opportunity to develop an intelligent electric vehicle industrial cluster as a development strategy. In addition to NIO, Hefei is home to Jianghuai, Chang’an, Guoxuan, and iFlytek, all of which are part of the intelligent electric vehicle industrial chain.

When questioned by the media, Li Bin stated that establishing the Chinese headquarters in Hefei is very appropriate and reasonable. “Otherwise, if we were to negotiate with any other place, we would need to quickly build a new factory on site. By the time we run out of capacity in Hefei, both sides’ production capacity will not be sufficient, and the efficiency will be low.”But Li Bin did not give a clear answer regarding the investment mode of the new factory. However, Qin Lihong, the CEO of NIO, said that the joint venture between NIO and JAC, called Jianglai, is an innovative cooperation mode in the automotive industry. Jianglai is the cooperation mode of the two factories, with great imagination in manufacturing services, supply chain management, and manufacturing upgrades.

Will Develop Independent Brands if the Market Demands It

As NIO’s sales soar and the new factory’s initial plans are announced, NIO’s product and brand sinking issues remain a concern for consumers.

NIO’s average per-vehicle price has reached 428,000 yuan, even surpassing traditional luxury German brands like BBA.

For consumers, NIO is a luxury brand known for its services, which has changed the traditional model of positioning luxury brands with products. However, the average per-vehicle price of 428,000 yuan also makes most car buyers feel intimidated.

At the beginning of 2021, Li Bin stated in an interview with CCTV that NIO aims to sell 500,000 vehicles annually.

However, with the current situation of high per-vehicle prices and a potential product gap after the release of the ET7, whether NIO should develop low-priced models or sub-brands with slightly lower brand tonality has attracted attention from the industry.

Regarding the development of sub-brands and low-priced models, Li Bin did not give a positive answer. “If everyone thinks we need to do it, we will do it,” he said. “The NIO brand won’t fall into a lower price range… If we do it, we need to create a very independent brand.”

Regarding NIO’s pursuit of sales volume, Li Bin believes that there is a great opportunity for NIO in the process of the oil-to-electric transformation in the automotive market.

Li Bin said that sales of high-end cars totaled nearly 3.5 million in 2020 and are still growing. Taking an optimistic view, the high-end market could develop to 4 million cars in the future. If NIO achieves 25% market share, it would be 1 million cars, and 30% market share would be nearly 1.2 million.

Currently, NIO cars, including the ES8, ES6, and EC6, have surpassed all gasoline cars in their respective price ranges and become the sales champions in first-tier cities like Shanghai. “In more than 20 markets, including Shanghai, the EC6 has already surpassed the same-priced gasoline cars. Therefore, I am still very confident, and we have more markets,” Li Bin said.

“As gasoline cars are converted to electric cars, if NIO can maintain its 40% to 50% market share in the high-end electric car market, the sales volume will be excellent,” Li Bin said.

It took NIO six months to produce 10,000 vehicles, and from the first 50,000th vehicle to the 100,000th vehicle, it took NIO only 263 days, indicating that their production and marketing pace is accelerating.With the further acceleration of the oil-to-electricity effect in the automotive market, the sales of NIO cars are expected to be further boosted.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.