Introduction

The biggest technological highlight of 2021 is whether the two 800V models that modern Kia is pushing can stand firm in Europe and South Korea. There are two points here, whether the fast charging in terms of battery can withstand the challenge, and whether the 800V SiC inverter of the drive system can be successfully mass-produced.

Yesterday, Vitesco, a power system company spun off from Continental Group in mainland China, announced that it will provide an 800-volt inverter (worth a “triple-digit million Euro amount” for modern new E-GMP modular electric platform, which is worth several hundred million euros. Calculated based on a single unit price of 600 Euros, it is estimated to have a scale of around 800,000 units).

Note: It is estimated that modern Kia will have secondary supply for vehicle models, just like previous battery batch 1, batch 2, and batch 3.

Vitesco and Rohm

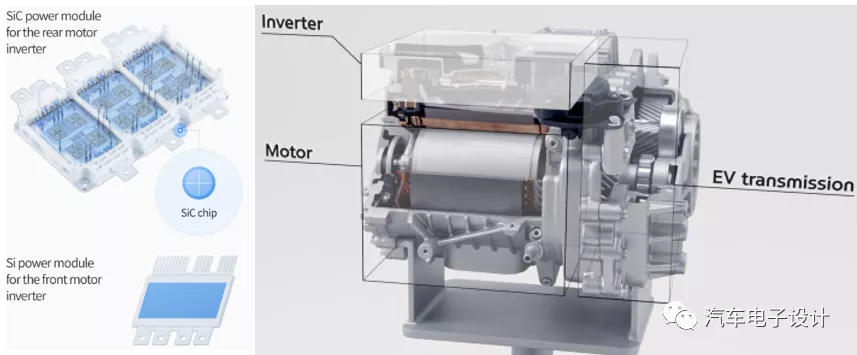

In modern E-GMP system, traditional modules are used in the front drive. In the inverter power module of the rear motor system, 800V silicon carbide (SiC) modules are used, which can improve the system efficiency by 2-3% and extend the cruising range by about 5% through the introduction of emerging modules.

The supplier has always been unknown. The main thing is that it is unclear whether modern has the ability to quickly push this platform up.

From the perspective of its suppliers, Vitesco is the powertrain department spun off from Continental AG in mainland China. In the entire business layout, the electric vehicle business is a small business.

Previously, it mainly supplied integrated electric axles to PSA e-CMP, and supplied Encino and Lafesta to modern cars.

In the high-voltage platform of the 800V system this time, according to the mass production time of modern Ioniq 5 and Kia EV6, it is actually earlier than the subsequent BorgWarner (Delphi) mass production time.

In mid-2020, Vitesco Technologies signed an agreement with Rohm to develop silicon carbide electric vehicle drives. Rohm has been investing in silicon carbide for a long time, having acquired German wafer factory SiCrystal in 2009, mainly producing silicon carbide columns and substrates.

In mid-2020, Vitesco Technologies signed an agreement with Rohm to develop silicon carbide electric vehicle drives. Rohm has been investing in silicon carbide for a long time, having acquired German wafer factory SiCrystal in 2009, mainly producing silicon carbide columns and substrates.

In 2010, Rohm began mass production of silicon carbide Schottky diodes and silicon carbide MOS, and two years later, began mass producing silicon carbide modules. Rohm’s characteristic in silicon carbide manufacturing process is that it completes everything through its own company, from raw materials to final packaging and assembly.

In the process of electrification, IGBT modules play a very important role. In the field of IGBT modules, Infineon has previously dominated the absolute supply center. Switching from 400V IGBT for cars to 800V SiC requires solving the core problem of the supply side.

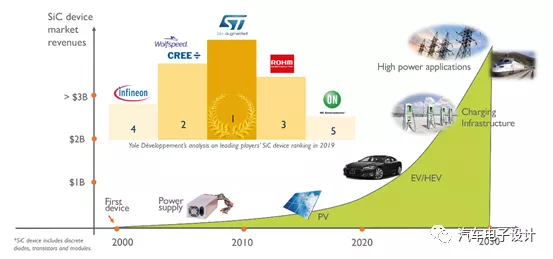

According to Yole’s evaluation, major SiC device suppliers include ST, Cree, Rohm, Infineon and On Semiconductor. ST is based on Tesla’s extensive use of 400V discrete devices. This time, the production of modern Kia will also use 800V SiC devices.

Previously we saw the market share of silicon carbide materials, where Cree occupies a large proportion (supplying Infineon, ST, ABB and ZF). The overall expansion pace mainly follows the expansion of Cree’s material capacity (investing US$720 million to expand SiC material and wafer capacity 30 times), which is expected to be fully pulled up by 2024.With Rohm’s investment in SiC wafers, they are expanding direct customer base and subsidiary SiCrystal is also expanding its user base. In 2020, STMicroelectronics signed a long-term supply agreement with SiCrystal, a subsidiary of the Rohm Group, which provides advanced 150 mm SiC chips worth more than $120 million.

Therefore, as the upstream gradually expands, the timeline for SiC that we previously thought will be slightly advanced. In large quantities, it is indeed necessary to wait until Cree is fully ready by 2024, but before this, modern Kia’s strategy will still cause a wave of differentiation.

Summary

There is currently no big data to support the specific market rhythm of 800 V or how consumers feel about this system. With the gradual increase in investment in semiconductors, it still has strategic value due to the reduction of system power consumption and rapid charging speed improvement.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.