Introduction

SNE has released some data on global power battery, and I have summarized it through a report from a Korean security company.

In the first two months of 2021, the global installation of power batteries reached 25.2 GWh, more than double compared with the same period last year. The installed capacity in February was 11.2 GWh.

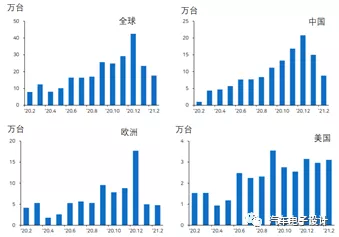

Note: SNE also analyzed the global demand for BEVs. In February, the global sales volume of pure electric vehicles (BEV) was 176,000 units, an increase of 123% compared with the same period last year. Among them, Europe sold 48,000 units (up 15% year-on-year), China sold 88,000 units (up 759% year-on-year), and the United States sold 31,000 units (up 102% year-on-year).

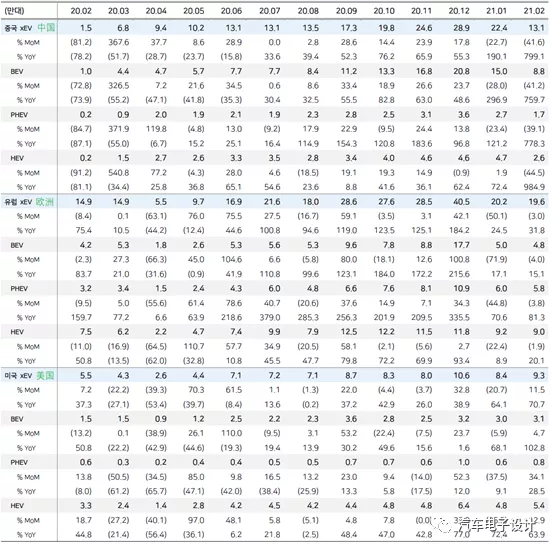

Breakdown data of Global Demand

SNE has produced a detailed table of HEV, PHEV, and BEV global data on a monthly basis last year. The monthly output of electrified vehicles reached a peak of 920,000 units in December last year.

Since June last year, the volume of all HEV models has been over 500,000. Currently, the HEV volume is relatively stable, accounting for 33% to 50% of xEV, PHEV accounts for about 15%, and the volume of BEV fluctuates between 30% and 40%.

Looking at the three regional markets, we can see the following characteristics:

1) Europe: Due to stringent carbon emission requirements, the penetration rates of PHEV, HEV, and BEV have been rising. PHEV and HEV are still the focus of European automakers’ promotion in the short term. After experiencing the peak in December last year, the demand for BEV is not that sustainable in the short term.

2) The United States: Due to subsidy policies and BEV merger policy, PHEV has been abandoned by all automakers and sells less than 10,000 units per month. At the same time, the volume of HEV is not low, which is what the Japanese have been promoting. The demand for BEV has stabilized at around 30,000 units.3) China: No need to say much about this. We have been tracking this table on a monthly basis, so we won’t go into detail.

This is an overview of the corresponding electric vehicle battery installation and shipping volumes. SNE has made a beautiful table, from which we can clearly see the magnitude of global xEV demand each month. Starting from June last year, it has remained stable at over 11 GWh, with a peak installation volume of 28.3 GWh in December. The difference between pure electric and non-pure electric vehicles is ten times.

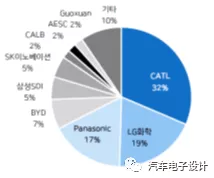

Global power battery installation rankings

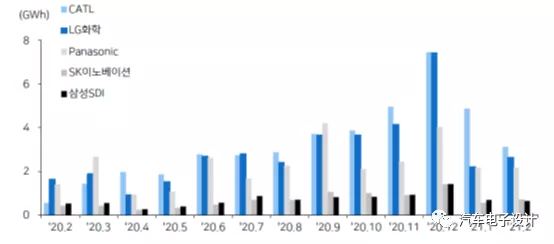

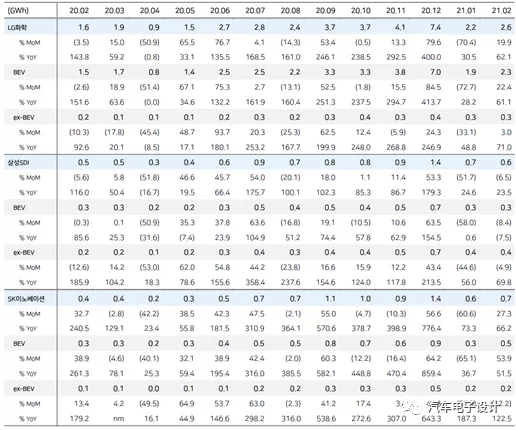

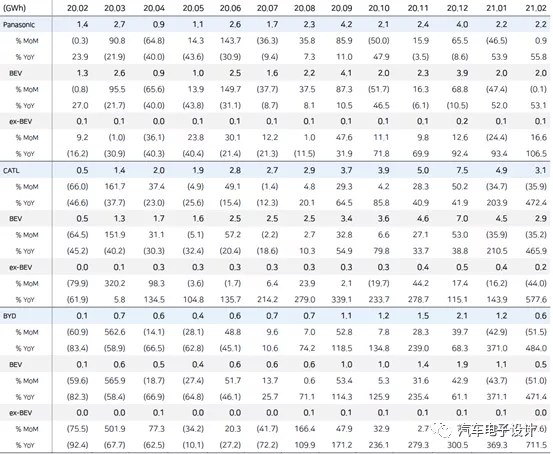

Here we have the data charts for the top five companies in the world. Their installation volumes in February were as follows: CATL with 3.1 GWh, LG with 2.6 GWh, Panasonic with 2.2 GWh, SK with 0.7 GWh, and SDI with 0.6 GWh.

SNE has made a detailed table, from which we can compare the actual installation volumes of several major battery companies in PHEV and BEV.

LG, a South Korean battery company, invested more resources in BEVs than others, which is why it completely pulled away from the other two companies since June last year. Especially for the concentrated demand in Europe last year, the single-month BEV battery increased to 7 GWh.

Samsung SDI is a very interesting company. It is currently the world’s largest seller of PHEV batteries, and in terms of PHEV scale, the volume is still quite large. However, the mystery remains as to why they have encountered consecutive issues with Ford and BMW.

Ningde’s BEV volume has been increasing in recent years, and is expected to continue to increase monthly power battery installation volumes after opening up Tesla and the European market.

Summary

I think it’s worth sharing the detailed data breakdown of SNE for everyone’s reference.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.