Introduction

Recently, a series of movements by Tesla (Tesla and Panasonic’s three-year pricing agreement, expansion of production capacity in the US, and an agreement with Glencore to purchase 6,000 tons of cobalt per year) have truly shown us the meaning of “明修栈道,暗渡陈仓” in Chinese. Regarding the battery day, it may just be an improved version of the current technology.

Panasonic Cooperation and Cobalt Resources

1) Relationship with Panasonic

Previously, the relationship between Tesla and Panasonic was not pleasant, but this time Tesla modified the battery supply agreement with Panasonic. It locked in the price and production capacity for the next three years, and Panasonic increased its investment to ensure the supply capacity, while Tesla guaranteed a certain purchase volume.

From this point of view, Tesla will continue to maintain its Pack design and use a combination of purchasing and self-production at the module and cell levels. Therefore, overall, this strategy of pressuring prices and determining demand has once again achieved its goal.

From a logical perspective, Tesla’s control of suppliers covers all aspects, and behind the dual adjustments of price and production capacity is its confidence in converting production capacity into sales.

2) Cobalt Usage

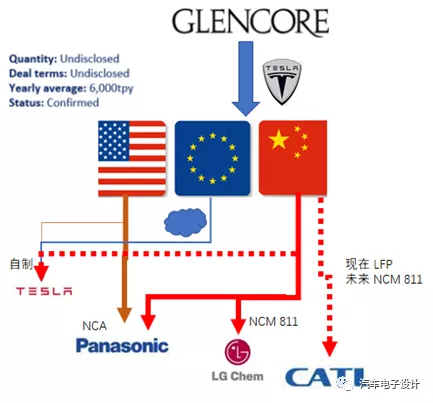

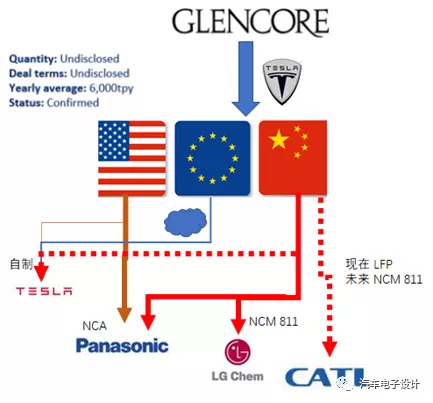

With this added factor, according to media reports, Tesla has reached a cobalt supply agreement with mining giant Glencore, which will supply cobalt materials for the production of lithium-ion batteries in its new factory.

In other words, what we see in Tesla’s asset plan in the United States may be used for the self-production of batteries at the “super factories” in Shanghai and Berlin, with a maximum of 6,000 tons of cobalt based on scale.

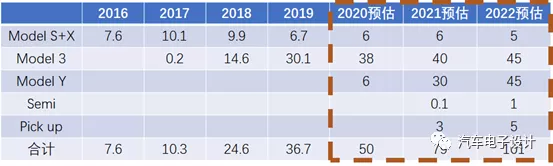

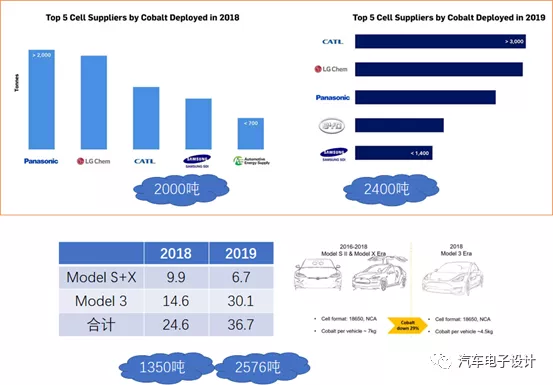

If we take 2,000 tons of cobalt, which was used for 246,000 cars in 2018 and 2,400 tons of cobalt for the corresponding usage in 2019 under NCA (these data are calculated according to Adamas Intelligence), and assume that each car has a battery capacity of 90 kWh (7 kg) or 78 kWh (4.5 kg), we can estimate that there may be some differences in energy usage. Roughly, we can estimate that 6,000 tons of cobalt may be used for about 900,000 cars.

LFP Battery Solution for Model 3

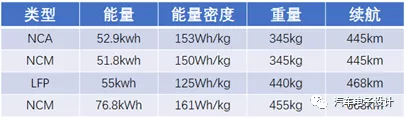

After the announcement of the 333rd batch, Tesla officially announced the models using LFP batteries. As we enter the catalog, we also learn more information, as shown in the table below:

After adopting the long module design, the energy density of the LFP battery cell is fixed at 170 Wh/kg, while the energy density of NCA and NCM 811 battery cells is 255.5 Wh/kg and 256.8 Wh/kg, respectively.

In terms of the pure cell weight, the weight difference between LFP and NCA and NCM is 121.7 kg and 116.36 kg, respectively:

1) LFP 106 battery cells, the total weight is 323.2 kg,

2) NCM 811 has a total of 2,976 battery cells and a weight of 201.5 kg,

3) NCA has a total of 2,976 battery cells and a weight of 206.8 kg.

The final result has a difference of 95 kg. Therefore, in the design of the module, under the same size, the difference between the four modules is recovered by 26.7 kg with the LFP battery solution. In principle, under the design of a large module, the weight difference of LFP as a long module is not particularly significant.

Note: Tesla Model 3 cylindrical batteries use a combination of (31P25S) and (31P23S) with a capacity of 148.8 Ah and 52.85 kWh.

In terms of size, the width and height are identical: the width is 323 mm, and the height is 81 mm. The length has differences: the longer one is 1.95 m, and the shorter one is 1.85 m. For this size, some fake battery cells may be maintained to support the entire structure.

On the other hand, CATL’s battery solution utilizes 220 mm wide 234 Ah battery cells and elongates the cells while reducing the height to achieve the final solution.

ConclusionIt’s almost the end of June. It is estimated that Tesla will release all the news about the Battery Day soon. Currently, LFP can achieve over 50 kWh with an increase in weight of about 100 kg. Going higher would result in even more weight and less cost-effectiveness.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.