Introduction

Recently, General Motors participated in several conference calls on Wall Street (before that, David Einhorn’s Greenlight Capital had withdrawn from General Motors and reduced its stake by 6.15 million shares before March 31, 2020). These calls mainly focused on electric vehicles, batteries, and autonomous driving. Let’s take a look at what the future holds.

Dhivya Suryadevara, CFO at “Goldman Sachs Industrials & Materials Conference“

Mary Barra & Dhivya Suryadevara at “Bank of America’s 2020 Auto Summit“

Doug Parks at “Citi’s 2020 Car of the Future Symposium“

Adam Kwiatkowski at “Evercore’s EV Mobility Virtual Conference“

Note: the first two calls focused more on the overall strategy and operation of the company, while the latter two focused more on technological strategies. More information can be found on General Motors’ website.

Electric Vehicles and Batteries

Adam Kwiatkowski, Executive Chief Engineer, Global Electric Propulsion Systems, emphasized the following points mainly in the webcast:

1) The modular configuration of Ultium batteries is compatible with soft-pack and hard-shell batteries in terms of battery modules. The entire platform’s capabilities can be configured in terms of the drivetrain system, highlighting the overall platform’s capabilities.

Confidence in battery vertical integration (two strategies for battery companies: competitors in the automotive industry directly purchase from battery companies) discussed by online investors.

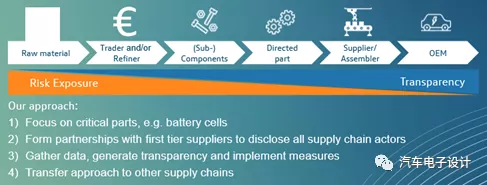

2) General Motors’ joint venture with LG Chem, Ultium Cells LLC, is an important lever for General Motors to reduce costs at the cell level, mainly targeting the 80% of the cost of the battery pack. The main focus is on the supply side of battery materials, including the procurement of the four main materials and upstream raw materials (investing in mines that produce raw materials for battery production and hedging against major metal prices).

Doug Parks talked about broader topics during his meeting at Citigroup.

1) General Motors has multiple battery teams on investment. After deciding to enter the field of battery production, multiple teams are dedicated to developing technologies such as cobalt-free electrodes, solid-state electrolytes, and ultra-fast charging.

2) In comparison to Tesla’s million-mile battery, they are “almost there” with product design.

Ultra Cruise Autonomous Driving

This section is based on Doug Parks’s keynote address at the Citigroup meeting. The evolution of General Motors’ autonomous driving system included L4 autonomous driving and L2+ autonomous driving:

1) Cruise Automation develops L4 Robot Taxi operations to compete with Waymo. However, the overall development speed is much slower than before. The original plan was to invest in 2019. Cruise has laid off 150 people, discontinuing the development of lidar and downsizing teams. The deployment time of RoboTaxi service has been postponed for at least 2 years.

2) Super Cruise competes with Audi’s L3 and gradually penetrates into other models of Cadillac high-end cars, addressing mass-produced cars. Parks talked about General Motors developing the next-generation mass-produced autonomous driving system, “Ultra Cruise,” based on the benchmark of Tesla’s Autopilot.

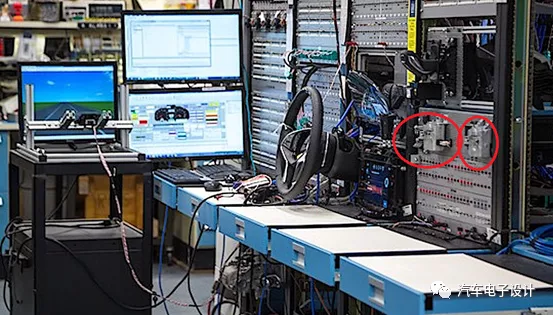

The differentiation of Ultra Cruise lies in achieving autonomous driving on city streets. Since Super Cruise requires the support of high-precision maps and is limited to already mapped highways in North America, the design of the overall algorithm is fixed. This product is based on the foundation of Super Cruise, which is a relatively conservative strategy that allows for continuous OTA improvement of ECU.

It can be predicted that Ultra Cruise will adopt a similar calculation host operation mode as Cruise Automation on the latest architecture, balance the design of an upgradable system at a reasonable price, and provide drivers with the ability of autonomous driving on city streets outside highways, which will greatly improve the customer experience.

It can be predicted that Ultra Cruise will adopt a similar calculation host operation mode as Cruise Automation on the latest architecture, balance the design of an upgradable system at a reasonable price, and provide drivers with the ability of autonomous driving on city streets outside highways, which will greatly improve the customer experience.

Summary

I feel that General Motors is the second major automaker to vigorously reduce Powertrain (further adjust Global Powertrain organization) and enter the layout of battery manufacturing and pure electric vehicles. You can see that both Volkswagen and GM do not want to be constrained by battery suppliers, including Toyota, which follows suit.

In this continuously iterative field, Tesla also appears to be vertically integrated, which is closer to their own scale and willingness and can more directly understand the bottom cost of batteries.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.