In the past year, “chip” is definitely a word with a high exposure rate. Firstly, due to the news that Huawei’s chip supply disruption may lead to phone production stoppage, chip shortage eventually hit the automotive industry at the end of the year. In December 2020, Volkswagen announced that due to the shortage of semiconductor chips, it would adjust its car production in China, North America, and Europe. Subsequently, car companies such as Ford, Toyota, and Ford have also announced production cuts or even shutdowns due to chip shortages. In early January, the production of 15 key auto companies decreased by 27.4% compared with the same period last year. It is expected that by June, the global auto manufacturers’ production reduction will reach 1.5 million vehicles.

At the same time, automotive chip suppliers NXP, Infineon, and others have also reported price hikes, with increases of up to 10-20%.

This inevitably raises the question: how important are chips to cars? Why are they so scarce?

Automotive-Grade Chips, The Neurons of Modern Cars

Although this highly integrated circuit board, the chip, is only the size of a fingernail, its role in cars is crucial. The chips used in cars are called “automotive-grade chips,” which almost drive the technological changes of modern cars. In 2019 CES, Bosch described that the automotive industry’s demand for chips is “billions,” and in 2020, the number of chips installed in global cars had reached 2.5 billion.

Today, every vehicle requires 50-150 chips and sensors for only ADAS and navigation systems. Chips for various functions almost cover the entire vehicle, controlling the car’s functions like a nervous system. In the processors and controllers of systems such as autonomous driving systems, chassis and body control systems (such as ESP and ECU), there are MCUs (microcontrollers) responsible for computational power. In the power and motor systems of the car, there are IGBTs (Insulated Gate Bipolar Transistors) and MOSFETs (Metal-Oxide-Semiconductor Field-Effect Transistors) responsible for power conversion. The chips on sensors are responsible for airbags, tire pressure detection systems, and the radar of the car’s body…

The protagonist of this car chip shortage is precisely the chip (MCU) used for calculation in the ESP and ECU systems.

Why Are Not “High-Precision” Automotive Chips Scarce?

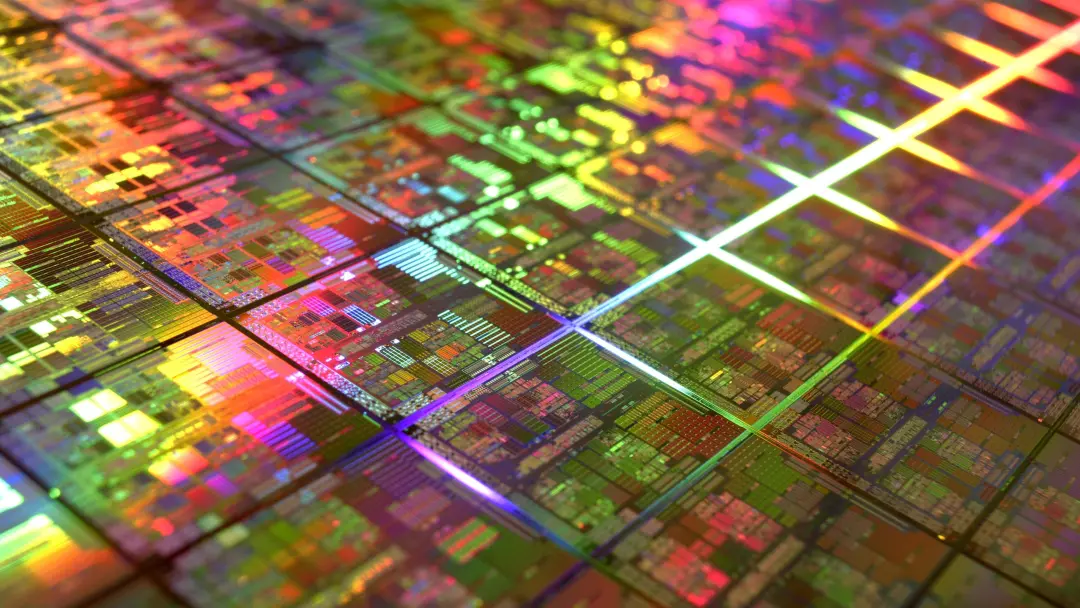

In this chip shortage, Volkswagen was the first to stand up because of the lack of chips from suppliers Continental and Bosch, which could not provide ECU and ESP modules. So, what are the chips in the ECU and ESP, and where do they come from?Compared to the frequent breakthroughs in the use of 5nm chips in the mobile phone field, the MCU chip shortage this time seems not so “high-precision” with a chip process of 90nm-0.13um and mature 8-inch wafers as raw materials.

Obviously, the shortage of automotive chips is not a technical problem. What is the reason behind it?

Insufficient early orders, car companies and suppliers caught off guard

Faced with the sudden outbreak of the epidemic at the beginning of last year, many companies chose to reduce production capacity or shut down factories in order to deal with the threat of the epidemic by “recuperating.” The automotive and chip industries were no exception. Automakers, who were accustomed to the “just-in-time” model, also reduced their orders for parts. According to data from TSMC, the demand for chip orders from automotive customers was decreasing in the first three quarters of 2020 and suddenly recovered in the fourth quarter. The fourth quarter happened to be the time when the automotive industry started to recover.

The long manufacturing process of chips cannot meet the sudden surge in demand for automobiles. Moreover, it was not only the automotive industry that had a high demand for chips at that time.

As 2020 was the first year of commercialization of 5G, it was also the time for many electronic products to be updated. The “online culture” brought about by the epidemic also led to an increase in sales of electronic products. When the demand for chips for automobiles collided with the earlier demand for chips for mobile phones and computers, the only solution was to “wait.” No wonder the delivery time of chips has increased from 8-10 weeks before the epidemic to 6 months, more than doubled.

Behind the chip shortage, there is a shortage of raw materials

The raw material for MCU chips, the automotive chip that is currently in shortage, is an 8-inch wafer. The 8-inch wafer has been in existence for nearly 30 years. It is technically mature and has a good quality-price ratio, but it is relatively “outdated” and is being replaced by the 12-inch wafer, which has lower manufacturing costs and higher performance.

Therefore, since the global production line of 8-inch wafers reached its peak in 2007, there have been few increases in 8-inch wafer production lines, and existing production lines are at risk of being discontinued due to aging. This means that contract manufacturers have no spare production lines available even if they want to increase production capacity. As Risto Puhakka, President of industry analysis firm VLSlresearch, said, “There is almost no spare capacity in the entire semiconductor industry.”

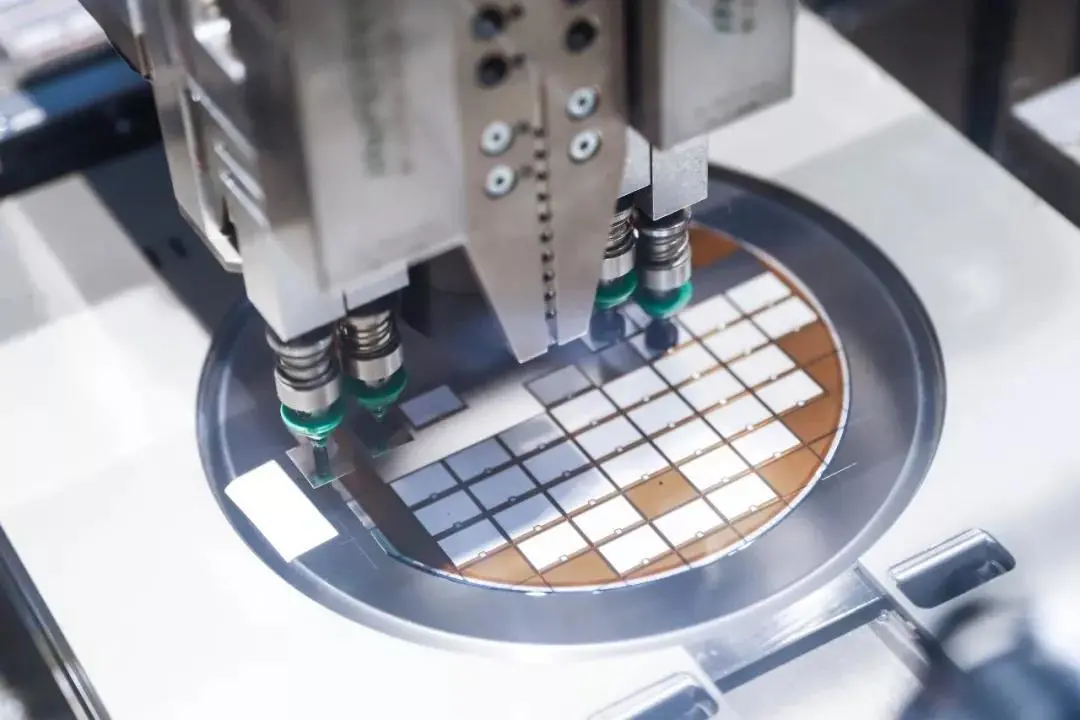

Temporary construction of factories, long cycles, and high difficulty

In order to deal with the shortage of automotive chips, many semiconductor companies have recently announced plans to expand production lines.According to the prediction report of the International Semiconductor Industry Association, the production line of 8-inch wafers that has been stagnant for many years will increase to 202 by the end of 2021, exceeding the historical high; Infineon is expanding investment in chip production lines; TSMC has built a 5nm chip production line in the United States; Samsung is also considering expanding chip factories in South Korea or Austin, Texas…

But it takes a long time to expand from plant construction, equipment procurement, process debugging to the real production of wafers and chips, whether it is a wafer fab or a chip fab. After all, the requirements for integration and accuracy of chips are extremely high. Even for the same batch of equipment, the chips produced by different production lines are not exactly the same, and it is impossible to “produce semiconductors as long as you buy equipment, arrange them, and press the button, and everyone can do it.”

Therefore, many people think that the “chip shortage” will continue until 2022.

Shortage of chips triggers hoarding sentiment

Faced with the current shortage of chips, many customers choose to stock up heavily and increase their chip inventory to resist future bottlenecks. For example, General Motors requested suppliers to reserve one year of chips at the end of last December; some domestic automakers also specifically sent people to chip factories to explore the bottom of chip inventory; American automakers even pressured TSMC and other chip companies through official channels. , To give priority to the supply of important chips. Under this hoarding sentiment, not only are chip orders full, but “cutting in line” also frequently occurs. It is not surprising that the imbalance between supply and demand has caused automotive chip prices to rise.

Chip shortage is a crisis and an opportunity

In 2019, the global automotive chip market was approximately US$47.5 billion, of which NXP and Infineon accounted for one-quarter of the market share. In contrast, domestically produced chips accounted for less than 5% of global capacity. The protagonist of this automotive chip shortage-MCU, It is imported by 80%~90%. Although this shortage of chips is global, it also brings warnings and opportunities to domestic semiconductor companies.

At present, more and more domestic companies are laying out the automotive chip field. BYD’s IGBT module seized 18% of the domestic electric vehicle market in 2019, and there are rumors that it will separately spin off the semiconductor business for listing; the production of CRU grade IGBT chips at CRRC Times Electric has reached 20,000 pieces/month; Siwei World’s CRU grade chips have accumulated shipments of 60 million units; Huatian Technology acquired Anshi Semiconductor, and the 12-inch CRU grade wafer factory is under construction; Beijing Junzheng acquired ISSI chip company, targeting CRU grade storage chips…

Although there is still a significant gap between domestic companies and semiconductor giants, the enormous market potential of automotive electronic components and the booming development prospects of domestic electric vehicles are driving the development of domestic semiconductor companies.

Conclusion

How long the current shortage of automotive chips will last is uncertain. However, the changes brought by the chip shortage, such as the expansion of production lines, cost increases, and profit growth, will inevitably affect the development of the semiconductor industry in the long term.

Perhaps this is the opportunity for domestic semiconductor companies to catch up?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.