Introduction

A few days ago, a friend of mine gave me an essay question, which was why car companies need to enter the construction of fast charging networks in their respective fields. There are several points of doubt here:

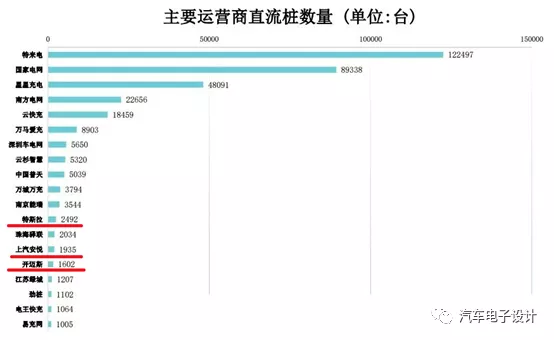

1) Among the self-financed DC fast charging piles of car companies, the top three are Tesla’s 2492 (cumulative power of 310,000 kW), SAIC Anyue’s 1935 (cumulative power of 210,000 kW), and Volkswagen’s Kaimi’s 1602 (cumulative power of 200,000 kW). The differences with State Grid Corporation and TELD charging piles, which are close to the level of 100,000, are huge. In addition, due to the difference in the number of network points, the efficiency of the operation network is also different.

2) DC charging piles require good land (parking spaces) in the area, and a series of factors on the power load of the grid end. To go through these factors again, the investment-output ratio of car companies’ short-term expenditures is not cost-effective; if they rent with the top three operators, the long-term value is doubtful.

What is the use of DC fast charging network?

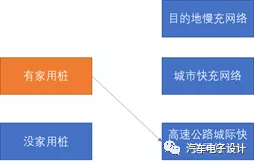

From many previous concepts, the basis for buying pure electric vehicles is to have a home charging pile. According to the current actual situation, the actual power consumption is above 65 kWh and the cruising range is around 500 kilometers. Once consumers have a home charging pile, they actually do not need a DC fast charging network in urban areas.

From a logical point of view, home charging is the most convenient. All pure electric vehicle owners can currently get rid of the problem of energy replenishment in the daily commuting process. They can charge at home for 8 hours and calculate it based on the average power of 6 kW, which is about 48 kWh.

Therefore, for consumers with home charging piles, the demand for fast charging is only the fast charging network on the highway and in other places, and the frequency of use is relatively low. For a long time in the past, the country has made great efforts to promote this matter, and the current bottleneck is also very clear.

Before 2005, if all the communities were on the ground, it was difficult to promote the installation of property management; from 2005 to 2015, within a certain range, it was estimated based on the power consumption capacity that about 30 could be installed (3-6 kW, with an average of 5 kW, 150 kW in total). This has reached the limit.Therefore, I believe that Volkswagen and Tesla’s core mission in China is to expand their customer base. We can see a few core characteristics of these two automakers:

1) They have very high production capacity in the future, starting from 500,000 units and aiming for 1-2 million units.

2) The EV deployment plan is not related to the government’s push for home charging infrastructure. The scale and speed of capacity expansion cannot be changed.

Under these two constraints, these companies will inevitably choose to build a fast charging network on a large scale, deploying fast charging facilities at intervals of 1-2 kilometers in EV-use areas.

We can see that the fast charging network of these two automakers can be equipped with temporary energy storage systems, which can be decoupled from power load in low-frequency charging conditions. As long as suitable locations can be found, fast charging facilities can be deployed. Both companies can’t wait for home charging infrastructure to be ready.

Compatible Development of Battery Swapping and Charging

1) Charging: We all know about slow charging, and the core is still letting consumers take care of it at home. In the community, we can promote sharing, but the biggest challenge is how to park. In the city, security guards are coordinating and it is very troublesome to come and go for charging.

If we want a good experience, for those of us who don’t have charging stations in our community, automakers’ charging networks are the best solution. They can provide reserved parking spaces, free parking, and even provide vehicle locks. This is the most rigid means of capturing the largest potential users. If you don’t do it, others will.

2) Battery Swapping: The battery swapping story is attractive to automakers. Building a large pool of batteries can equalize battery usage and support a vehicle-battery separation and upgradeable model with an investment in fast swapping stations equal to that of fast charging.But for many car companies, these are not matched. We can see the potential of fast charging in the future, where car companies’ networks can be merged and integrated, as these are mostly universal. However, it is difficult to unify swappable batteries considering the current situation of multiple car companies. In other words, all assets of the losers will be cleared if swappable batteries are implemented.

The worst-case scenario for charging is that all inputs can be extended and integrated. Even Tesla’s strange plug can be unified using a converter. Other companies’ networks can be acquired and integrated if the operating department goes down.

Conclusion

I think building a fast charging network is a long-term consideration for car companies’ production capacity planning. If it stays around 100,000, it doesn’t matter whether to build it or not. But when various companies plan for 300,000 to 500,000, or even higher, if they do not build their own networks in the core areas, they will be at a disadvantage in acquiring customers.

Especially when Volkswagen and Tesla continue to subdivide the scale and grid of fast charging networks, there will be a process of quantitative change to qualitative change in the consumers’ psychology.

Starting in 2021, the competition for A-level and above BEV accelerated, and there seems to be a king who is pulling away in the terminal. Most likely, the top 3 will occupy 50% of the core area market and form a very strong Matthew effect.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.