Abstract:

This article explores the investment logic behind Geely’s investment in the field of power batteries by reviewing its investment trajectory in power battery, as well as the current situation of capacity construction and matching, and attempts to predict its future investment direction.

——Main Text——

On February 20th, Li Shufu, Chairman of Geely Holding Group, updated the Blue Geely Action Plan content in his internal speech to the group.

Li Shufu divided the plan into two parts, with Blue Geely Action Plan One focusing on energy-saving and new energy vehicles, including hybrid vehicles, plug-in hybrid vehicles, extended-range plug-in hybrid vehicles, and small-displacement energy-saving vehicles; and Blue Geely Action Plan Two focusing on pure electric intelligent vehicles, establishing a new pure electric vehicle company, and actively participating in the competition in the market of intelligent pure electric vehicles.

No matter Plan One or Plan Two, power battery is an important part of Geely’s strategic plan.

Furthermore, Geely’s layout in the field of power batteries can be described as far-reaching. According to media reports, Geely’s investment in the battery field has exceeded RMB 10 billion.

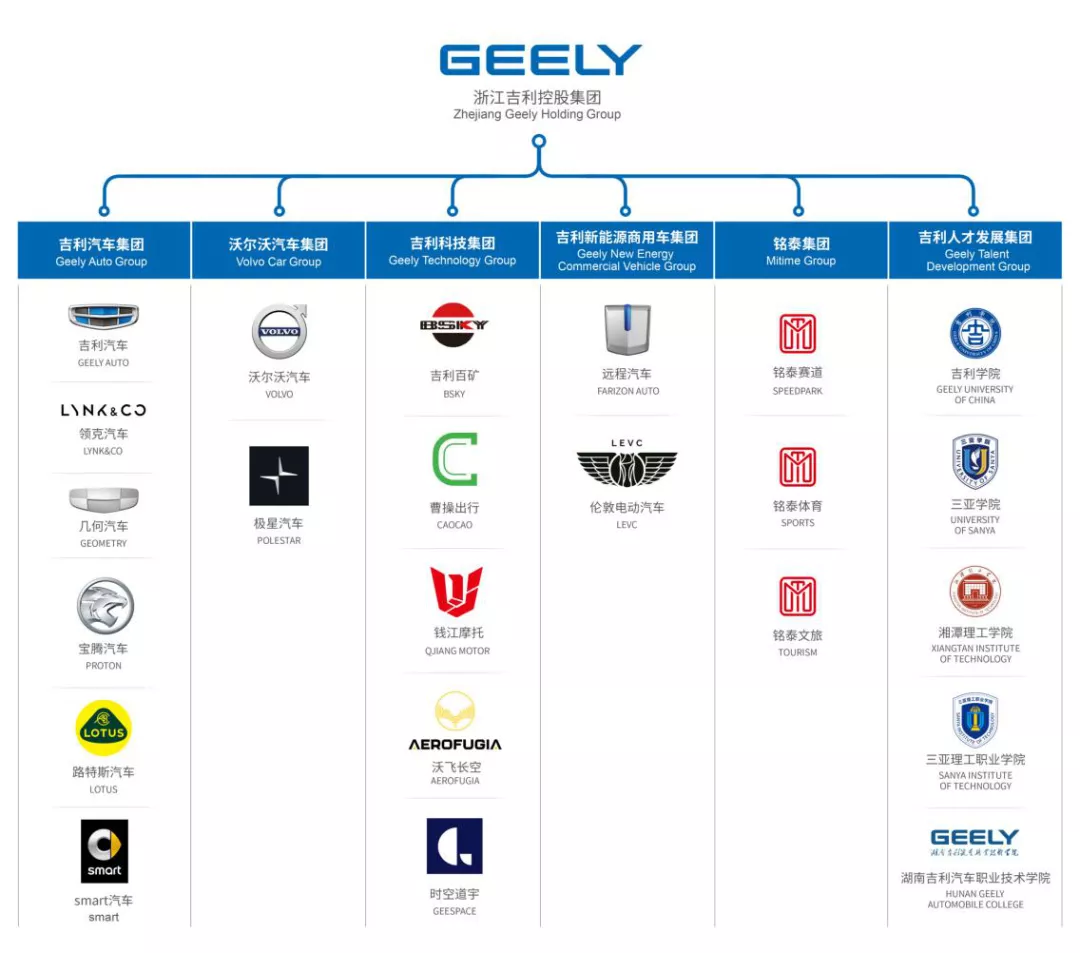

Geely’s battery layout already includes raw materials, battery cells, modules, battery packs, battery recycling and utilization, and even battery leasing.

Undeniably, as a car company, Geely is one of the very few enterprises that has built a complete industry chain for batteries.

After sorting out numerous data, it was found out that “Electric Vehicle Observer” believed that there were not many effective companies among the billions of investment by Geely in the battery field.

However, this does not mean that Geely’s investment has failed. Perhaps the application of solid-state batteries is another opportunity for Geely to show its ambition in the field of power batteries.

An Attempt to Master Battery Technology

The battery, which has the highest cost in pure electric vehicles, has always been the focus of vehicle companies. But given the complexity of battery electrochemical technology, most vehicle companies enter from the battery system integration field, which is also the most influential part for vehicle companies in the battery.

Geely also took the lead in the field of battery system.

(1) Established WeiRui, mastered battery pack integration technology

In June 2013, Weirui Electric Vehicle Technology (Suzhou) Co., Ltd. was established, mainly engaged in the manufacturing, research and development, and sales of electric vehicle drive system power battery system, electric control, motor and system integration.

In 2017, Geely set up Weirui Electric Vehicle Technology (Ningbo) Co., Ltd.

These two companies are Geely’s wholly-owned subsidiaries, specializing in supplying battery pack products for Geely’s own brands.

(2) Holding shares of Shandong Hengyuan

Of course, Geely is not satisfied with only limiting itself in the field of battery packs, but also battery cells.

As can be seen from the subsequent layout, Geely wants to cover the entire battery industry chain.But unlike the battery pack, the manufacture of battery cells involves electrochemistry, requiring a knowledge system and resources completely different from automobile manufacturing. In order to succeed, cooperation is necessary to draw on the experiences of others, which is where Li Shufu’s old partner, He Xuechu, controlling shareholder of the Hongqiao Group, just happens to have an interest in entering the electric vehicle field.

On September 26, 2014, Hongqiao Group purchased 90.68% of Kairong Investment’s shares, totaling 635 million yuan, along with the shareholder loan. Kairong Investment’s main asset is all of the issued share capital of Shandong Hengyuan New Energy Technology Co., Ltd.

Shandong Hengyuan mainly engages in the research and development, production, and sales of lithium-ion power batteries, with their products mainly being lithium iron phosphate batteries.

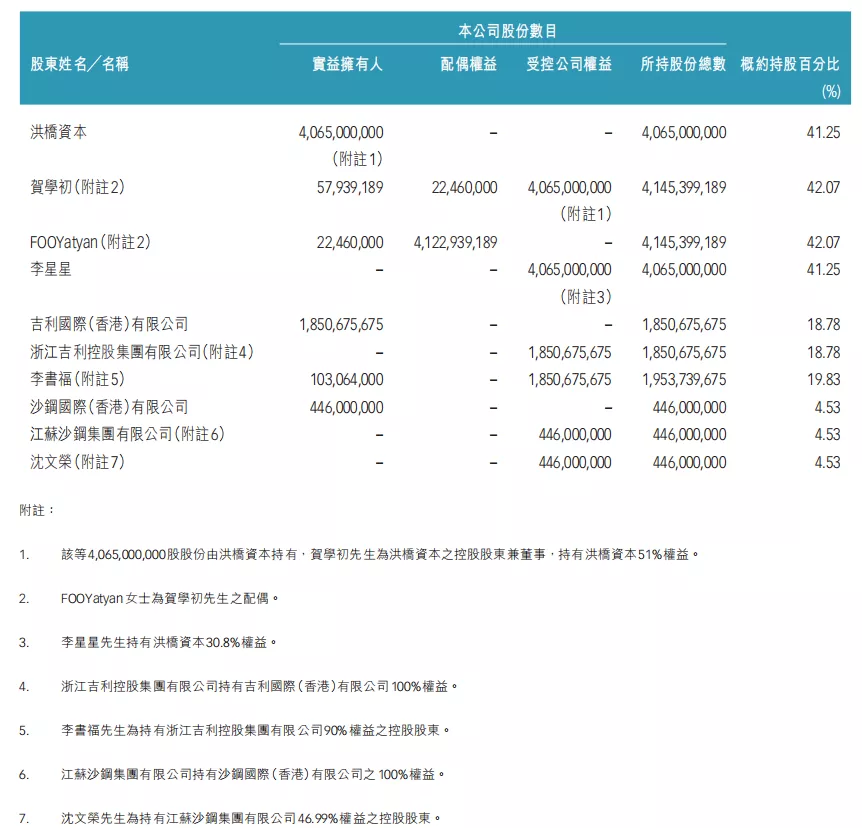

This is not He Xuechu and Li Shufu’s first collaboration.

In 2003, He Xuechu helped Li Shufu’s Geely list in Hong Kong, as the “key man” for Geely’s listing. Li Shufu found He Xuechu, who held the shell resources. The two sides gradually put Geely Automobile into this listed company through the establishment of a joint venture, with Li Shufu becoming the major shareholder.

Unlike “backdoor listing,” this approach carried a great deal of risk; if the joint venture went wrong, it was likely an exercise in futility. Fortunately, the mutual trust between the two sides allowed them to complete this capital shuffle with ease, becoming a classic case in the textbook.

Of course, it may be precisely this relationship of mutual trust that has led to many collaborations between the two sides in other areas.

For example, both Geely and Li Shufu’s father and son hold shares in Hongqiao Group. As of June 2020, Geely holds 18.78% of Hongqiao Group’s shares, and Li Shufu personally holds 19.83% of indirect holdings in Hongqiao Group; Li Shufu’s son, Li Xingxing, also holds 41.25% of indirect holdings.

This is how Geely indirectly holds shares in Shandong Hengyuan.

It should be noted that the main customers of Shandong Hengyuan are Kandi and Zhidou. Kandi Electric was originally held by Shanghai Maple Guorun, a subsidiary of Hong Kong-listed Geely Automobile; Zhidou is also held by Geely Holding, New Ocean Electromechanical, and Jinsha River Venture Capital Fund.

In other words, Shandong Hengyuan is also a supplier of some Geely A-level and A0-level products.

(3) Formation of Zhejiang Hengyuan New Energy

Starting in 2016-2017, as electrification deepens, passenger vehicles gradually became the main force in promoting new energy vehicles.

The subsidy policy for new energy passenger vehicles made the energy density of battery packs and the range the main indicators.

New energy vehicle companies, in pursuit of high subsidies, gradually abandoned lithium iron phosphate power batteries and turned to ternary batteries.## Geely and Hongqiao Group Recognized the Potential of Ternary Batteries

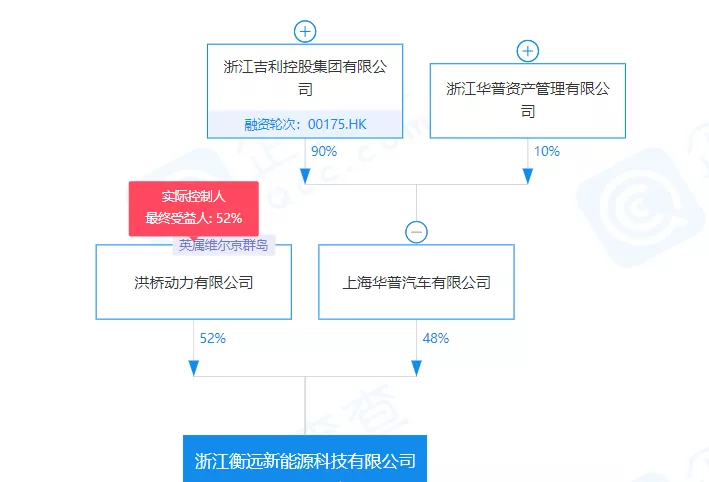

Geely and Hongqiao Group apparently recognized the potential of ternary batteries. In 2015, Hongqiao Group and HuaPu Auto formed a joint venture to establish Zhejiang Hengyuan New Energy.

On April 14, 2016, Hongqiao Group officially announced the commencement of the Zhejiang Hengyuan New Energy Power Battery Assembly Project in Jinhua. The purpose of this base was to design an annual production capacity of 1.5 million kWh of new energy power batteries. After completion, it could meet the needs of 80,000 pure electric cars every year.

Although the establishment of a battery enterprise was important, Geely and Hongqiao Group did not possess any experience with ternary batteries, so their ability to produce high-quality batteries was uncertain.

Fortunately, Geely had great timing. The rapid growth of foreign-funded battery enterprises had set off alarm bells for the Chinese government: the achievements of the new energy automobile industry had to be kept within the country.

Starting on May 1, 2016, China’s policy required that new energy vehicles eligible for subsidies must use battery enterprises listed in the “Automotive Power Battery Industry Standard Conditions” enterprise catalog as suppliers. However, Korean battery companies such as LG Chemicals and Samsung, were not included in the catalog. This meant that new energy products using these batteries required switching suppliers.

Many companies, including Volvo and SAIC, were affected. How could the negative impact be minimized by changing battery suppliers, which would require at least 1 to 2 years?

The solution: purchasing the production capacity and technology of foreign battery enterprises.

And that’s exactly what Geely did. In April 2017, Geely acquired all production equipment and technology intellectual property rights for LG Chemicals’ Nanjing factory. LG Chemicals will also help Geely Group’s high-end brands (including Volvo) to continue to upgrade battery technology.

According to reports, at its peak, more than 100 LG Chemicals engineers helped Hengyuan debug the production line to achieve LG’s quality standards. By the end of 2017, debugging was completed and the project entered the production stage.

This way, not only did Geely acquire LG Chemicals’ equipment and technology, but it also solved Volvo’s battery supply problem.

Of course, this was also the best solution for LG Chemicals. The factory was idle, but equipment depreciation and maintenance were still significant costs.

In order to gain more experience in the battery industry, Geely planned to establish another battery enterprise.

In September 2018, Geely established another Hengyuan New Energy, Hubei Geely Hengyuan New Energy, in Wuhan. This new company was 100% controlled by Geely MJ Investment Co., Ltd., and had a registered capital of 50 million. According to the Jingzhou Daily, Geely planned to establish a power battery production plant and R&D center in Wuhan, with a total investment of 8 billion yuan for two phases of construction.In March 2019, this company was renamed Hubei Yichixinnengyuan Technology Co., Ltd. In August of the same year, Hubei Yichi’s first-phase project, which produces 10 GWh of high-performance automotive power battery and module annually, was granted with a construction land planning permit.

At this stage, Geely had already had three battery companies. It can be seen that whether through indirect equity participation, acquisition of companies or obtaining intellectual property rights, Geely’s main strategy was to have the ability and technology to produce battery cells.

Return to Cooperation Mode

After realizing that technology in the battery field was costly and difficult to master in the early stage of massive investment in the battery industry, Geely has once again started the pattern of joint venture and sharing in battery enterprises.

In December 2018, Geely Auto announced that its subsidiary, Zhejiang Geely Run and CATL, would establish a joint venture with the registered capital of CNY 1 billion, or USD 144 million. CATL would contribute CNY 510 million with a 51% stake, while Zhejiang Geely Run would contribute CNY 490 million with a 49% stake, establishing the joint venture named Contemporary Amperex Technology (CATL) and Geely Technology Co., Ltd., which engages in the research and development, manufacturing, and sales of battery cells, battery module and battery pack, and provides core power battery for Geely’s new energy vehicles.

On June 12, 2019, Geely Auto announced that its wholly-owned subsidiary, Shanghai Maple Guorun Automobile Co., Ltd, would form a joint venture with LG Chem to develop, produce, sell, and offer after-sale service for power batteries. The registered capital of the joint venture with LG Chem is USD 188 million, with each party contributing 50%.

While everyone was waiting for the latest progress of Geely’s joint venture with LG Chem, it became a shareholder of Funeng.

On January 28, 2021, it was reported that Chongqing Jianghe Equity Investment Fund Partnership Enterprise, which holds a 13.33% stake in Funeng Technology, has been added to the company registration information instead of Shenzhen Anyan Investment Partnership Enterprise, the second-largest shareholder with a 19.1% stake.

Xu Zhihao, the legal representative of Chongqing Jianghe Equity Investment Fund Partnership Enterprise, is the current CEO of Geely Group. His holding company, Geely MJ Holding Company, is wholly owned by Geely, and the shareholders behind Geely MJ Holding Company are all related to Geely. Geely has indirectly held Funeng Technology’s shares and become its important shareholder.

Before Geely’s indirect acquisition of Funeng, the two parties had established a joint venture in December 2019 to jointly build a power battery factory project, with an annual production capacity of 120 GWh. Geely Technology and its controlling subsidiaries, Geely Commercial Vehicle Group, promised to purchase power batteries from Funeng or the joint venture. The annual purchase volume will not be less than 80% of the demand, and they have signed an exclusive agreement on power battery production capacity cooperation.

However, it is worth noting that brands such as Geometry, Lynk & Co, Proton, Lotus, and Volvo are not included under the umbrella of Geely Technology. The brands under Geely Technology are still being adjusted, and it is uncertain how large the future market scale will be.

In addition to building their own power battery factory, Geely Automobile has also extended into the field of power battery material production and manufacturing.

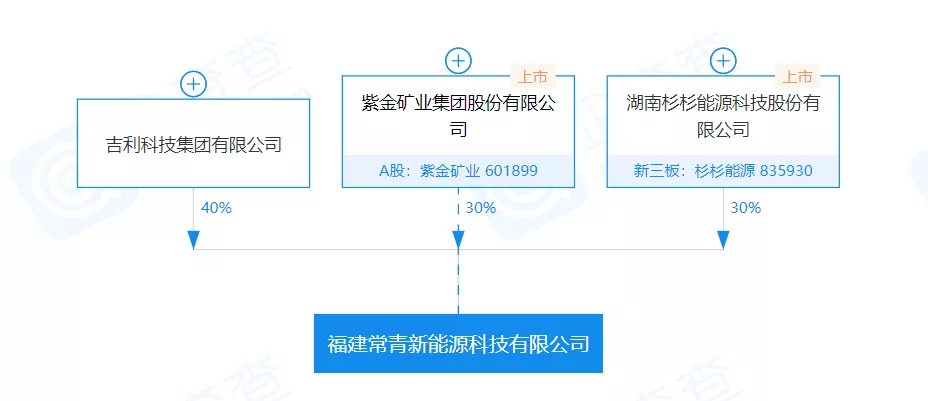

In October 2018, Geely Group, Shanshan Co., Ltd. and Zijin Mining jointly established Fujian Changqing New Energy Technology Co., Ltd. According to the official website of Fujian Changqing, the company is a joint venture integrating battery recycling and precursor manufacturing. Fujian Changqing is located in Shanghang County, Longyan City, Fujian Province, with a registered capital of 200 million yuan. According to the information on the Shanghang County government website, the total investment in this project is 5.6 billion yuan.

On August 10, 2020, the first phase of the Fujian Changqing project jointly established by Geely Group, Shanshan Co., Ltd. and Zijin Mining was completed and officially launched.

Before it was completed, customers had already come to the door.

In March 2020, Shanshan Co., Ltd. announced that its subsidiary Shanshan Energy planned to purchase raw materials for lithium battery from related party Fujian Changqing New Energy before April 30, with a transaction amount expected to be within 200 million yuan.

If it is thought that Geely’s battery layout only extends to raw materials, then Geely is underestimated.

In terms of business sales, Geely also has plans and arrangements for battery leasing.

According to QCC, on December 1, 2020, Sunshine Mingdao Energy Technology Co., Ltd. was established with a registered capital of 100 million yuan. Its business scope includes energy recovery system research and development, electric vehicle charging infrastructure operation, power transmission and control equipment manufacturing, energy-saving management services, battery leasing, etc.

Through the equity penetration diagram on QCC, it can be found that this company is indirectly 100% owned by Geely Technology Group Co., Ltd.

So far, from raw materials to battery recycling, and then to battery leasing, Geely has completed the layout of the entire battery industry chain.

The Battery Support Relies Heavily on External Procurement

Generally speaking, enterprises that have laid out in the battery field rely more on their own enterprises, such as BYD, which fully uses self-produced batteries; Great Wall Motors, if not for the fact that the capacity of its bee nest energy is in the climbing stage, would also use bee nest energy’s batteries to the greatest extent.

Obviously, Geely’s approach is not like this. From the perspective of installations in 2020, Geely has 9 large battery companies to support, among which Ningde Times accounts for more than 70%; Guoxuan High-tech ranks second in installation volume, accounting for 15%; Geely’s own Hengrui New Energy accounts for only 3.4%.

It should be noted that Zhejiang Hengrui’s design capacity is 1.5 GWh, but only 68.56 MWh was actually used in 2020. If the planned capacity is fully built, its capacity utilization rate is extremely low.# 2020 Power Battery Installations

Regarding the battery system, Geely mainly uses batteries from CATL. According to the data from the Vehicle Production Certificate, Geely produced a total of 25,285 new energy vehicles in 2020, of which only 5,470 used batteries from Weirui Electric. This accounts for only 21.63% of the total, while the supply of batteries from CATL accounted for 59.38%, with a total of 15,013 vehicles produced.

Geely doesn’t seem to rely heavily on Hengrui New Energy and Weirui Electric, but mainly relies on external procurement. This also indicates that Geely seems not to want to expand its battery industry, but just wants an extra layer of insurance.

Low Return on Battery Investment

Of course, the reason Geely doesn’t rely heavily on its own batteries may be because the return on investment is not high.

“Electric Vehicle Observer” found in the process of sorting out that although Geely has made many investment layouts, the actual utilization rate is not high, and many investments are still pending or have been abandoned.

(1) Shandong Hengrui restructuring failed

As Geely’s earliest battery company, Shandong Hengrui mainly produces A-level and A0-level vehicle battery products. After losing large customers such as Kandi and ZhiDou, Shandong Hengrui declined rapidly, and Hongqiao Group sought to sell the company.

On January 20th, 2020, Hongqiao Group announced that it had signed a restructuring agreement with Kairong Investment, Geely Automobile, and Jiangsu Tiankai Energy Technology Co., Ltd. in which Jiangsu Tiankai agreed to indirectly invest 20.4081 million US dollars in Shandong Hengrui New Energy.

Of course, Geely was not the only bidder.

After the completion of the capital increase matter, Jiangsu Tiankai will hold 50% of Shandong Hengrui New Energy’s equity, while Kairong Investment’s share will be diluted from 49% to 24.5%; Geely Automobile will directly hold 24.5% of Shandong Hengrui.

However, news in mid-2020 showed that Jiangsu Tiankai failed to pay the capital contribution to Shandong Hengrui, and Hongqiao Group is seeking a solution.

Geely’s capital contribution to Shandong Hengrui also has to be paid up by October 31, 2022.

At present, from the current situation, the restructuring plan for Shandong Hengrui has not been successful.

(2) Zhejiang Hengrui New Energy only supplies a few brands

After obtaining LG Chemical technology, Geely seems not to have transformed its technology into its own capability. From the current situation, it still only supplies batteries to Volvo, Lynk & Co, and Polestar.

Looking at the installation situation in 2020, Hengrui New Energy only supplied 68.56 MWh to Geely, ranking fourth in the installed capacity of battery companies that supplied batteries to Geely.From a product perspective, Hengyuan New Energy mainly supports Geely’s plug-in hybrid models, and relies on external procurement, mainly from Ningde Era, for pure electric models with large energy storage capacities.

(3) Joint ventures with LG Chemical may have been suspended.

In 2019, Geely’s joint venture with LG Chemical was a major industry event, but there have been no updates in 2020. According to insiders, Geely and LG Chemical’s project has been put on hold.

(4) Hubei Geely Hengyuan New Energy has no production information to date.

Hubei Geely Hengyuan New Energy, which was renamed, should have been completed and put into production in 2020, but there is currently no news of completion or production, and may be a stalled project.

It is clear that from an industrial perspective, Geely’s series of investments in the battery sector cannot be considered successful, as battery technology is still not in their hands, nor have they developed their own technology brand.

A New Opportunity for Solid-State Batteries

Li Shufu summarized the reasons for the failure of the “Blue Geely Plan” as “not a strategic direction error, nor a strategic execution failure, but an immature historical opportunity.”

Perhaps this opportunity includes batteries.

Currently, there are still many problems with battery products, such as safety, energy density, low-temperature performance, and cost, which have not reached the standards of mature vehicle power batteries.

As a main manufacturer, Geely has no accumulation in the electrochemical field, thus it cannot support the upgrading and replacement of cell technology. This may be the fundamental reason why Geely has not become a leader in early-stage involvement in cell manufacturing, and still relies on external procurement.

However, as the most expensive parts and components of electric vehicles, vehicle manufacturers will not simply hand over this part of the business. This can be inferred from the attitude of vehicle manufacturers towards engines.

The time point for vehicle manufacturers to enter the cell field is when there are more mature products and technologies that can meet the needs of the entire vehicle, and products enter a stable period. At this time, the vehicle manufacturer only needs to improve the local performance of the product, and the requirements for research and development capabilities are low.

Currently, solid-state batteries are most likely to meet energy density, safety, and other performance requirements.

The industrialization time of solid-state batteries is generally believed to be around 2030.

Therefore, “Electric Vehicle Observer” boldly predicts that until the large-scale production of solid-state batteries, Geely will probably still need to rely on external procurement of batteries.

When large-scale production of solid-state batteries becomes a reality, it may be time for vehicle manufacturers, represented by Geely, to start a new round of investment or acquisition in power battery enterprises.

——END——

To communicate with the author of this article, please add WeChat:

skilawang

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.