Author: Wu Xianzhi

There are many differences between the new and old forces of car manufacturing, not only in terms of philosophy, but also in the finer details. For example, the luxurious cuisine and drinking games of the old forces have been replaced by coffee and blues music in the new forces.

When NIO was first formed, Li Bin often met with different people at the Kerry Hotel coffee shop in Beijing. The Nordic decor and quiet background music created a relaxed and comfortable environment, which may be more conducive to attracting talent.

In 2017, Li Bin met with Zhu Jiang here on more than one occasion.

A few months ago, when NIO released the EP9, Zhu Jiang took notice of the new company for the first time. Having worked in foreign enterprises for a long time, he began to feel that he should try something different, such as a private startup, especially after seeing that the only thing he could achieve in the role of China Regional Manager was to stare at the ceiling during meetings.

Zhu Jiang signed a three-year contract with NIO, responsible for user development. When the contract expired three years later, he officially resigned on May 7, 2020, and then appeared at Ford China less than a month later. After only a year, he changed jobs again. Yang Jun, vice president of Didi and general manager of Xiaoju Car Service, mentioned earlier that Zhu Jiang might join Didi, but Zhu Jiang himself denied it.

Today, it was confirmed by the official account of Jidu Auto, the car-making company under Baidu, that Zhu Jiang has joined Jidu as Vice President responsible for user development and operations.

With no financial worries for the three forces of car manufacturing after surviving 2019, frequent talent turnover was the major concern.

In this battle for talent, many people joined “Wei Xiaoli,” while these three companies have also output a large number of talents for the industry. For example, between 2019 and 2020, Zhu Jiang, Huang Chendong, Zhao Yuhui, Zhuang Li, Xie Dongying, and others left NIO one after the other, along with a certain number of technical personnel and mid-level employees.

From 2015 to 2017, car manufacturing was still in its infancy. At that time, many people saw the industry’s opportunities, and the three companies, “Wei Xiaoli,” relied on the industry’s momentum and entrepreneurial spirit to create a powerful force. Today, the old forces that are dispirited and eager to make a comeback, as well as the internet giants that are restless to seize the entry point in order to escape the second half of the game, and even capital players such as Evergrande and Baoneng have shifted from PPT car-making to video car-making.

They wave their hoes, offer high salaries, give equity incentives, and paint blueprints, doing everything possible to recruit key personnel to their sides, who knows they may soon have their own car manufacturing company.

Talent Doesn’t Fall from the Sky

Talent doesn’t fall from the sky, nor does it crawl out of cracks in the stones. Before discussing how big companies poach talent, how these talents joined “Wei Xiaoli” is an interesting preliminary topic.### 2015-2017 Are Three Years of Intensive Talent Flow in the Car Manufacturing Industry

During these years, traditional automakers lost their attractiveness and experienced talent outflows. In contrast, new forces in the industry saw an inflow of talented individuals. Examples of this include Ding Lei, a former Vice President at SAIC, who joined LeEco’s automotive division, as well as Huang Chendong, the former Chief Engineer of Dongfeng Motor’s electric vehicle development and former President of Volvo China R&D, and Shen Feng, who joined NIO.

The movement of these high-ranking executives from traditional automakers to new forces further drives home the trend in the industry. Li Xiang once publicly spoke of the high level of security for the Ideal ONE at an autumn communication conference last year, stating, “We also have a lot of colleagues who came from traditional automotive companies, including luxury brands.”

People also have fresh memories of He XPeng’s internal email from 2019, in which he encouraged his employees to help recommend 2-3 friends, classmates, or experts to work at Xpeng Motors via their friend circle or during friend gatherings.

This marks the beginning of the confluence of two major camps in the automotive industry.

In 2015, Shen Hui returned from Vietnam and founded WM Motor after leaving Volvo. During an interview, he used his smartphone to compare the intelligent cars of the future and explained his departure from traditional car manufacturers as feeling limited by the “old model.”

Shen Hui’s experience represents a large number of engineers from traditional car companies who have joined new forces.

For example, Shen Feng, who was the President of Volvo China R&D at the time, saw the trend and decided to leave Volvo two years later. He told Li Shufu in no uncertain terms about his thoughts. Li Shufu didn’t want him to leave as he had just successfully helped Volvo achieve a breakthrough. However, he agreed that there was an opportunity behind new energy. Seeing that Shen Feng was determined to go out and explore, Li Shufu did not force him to stay, and he agreed to his resignation.

After leaving Geely, Shen Feng did not immediately switch to new forces. He spent the whole summer asking people around him about the situation of the new energy industry and NIO. “BBA’s top manufacturer doesn’t communicate with its users, but NIO can,” Shen Feng observed. The words of his wife, who said, “Go to NIO, you can use all your accumulated experience there,” were decisive, and the balance of his mind began to lean.

Huang Chendong had contact with NIO slightly earlier than Shen Feng did. On November 18, 2014, in a hotel in Hongkou District, Shanghai, he chatted with Qin Lihong from 8 pm until midnight. The charging and swapping modes of NIO’s future electric vehicles were already in their nascent stage during that conversation.

A week later, Huang Chendong flew to Beijing to further understand the company’s business model and future plans from Li Bin’s mouth. “Li Bin was particularly sincere, and many of his ideas were interesting,” Huang Chendong said. After no bargaining, he decided to join the company after the trip to Beijing.# A transition between offense and defense

Since 2015, talents from various industries have been joining NIO with a large proportion coming from traditional automakers.

Nowadays, these employees have already adapted to NIO’s flat management structure while facing increasing temptation as the company becomes a leader in the industry.

In Shanghai and Beijing, resignation has become a norm, especially with Internet giants entering the car-making race and imitating NIO’s success. Some longstanding employees used to deeply believe in the company’s culture and values; however, the loyalty of new hires has lately dwindled.

For instance, a NIO employee recounted receiving headhunting calls multiple times. She stayed with the company, predominantly for two reasons: “I trust (Li Bin and Li Hongqiang) very much,” and NIO’s flat management structure that allows for equality. Nevertheless, not everyone shares the same level of loyalty.

To prevent large-scale departures, some automakers have implemented certain strategies.

On April 8, 2021, following Didi’s car-making announcement, engineers at Ideanomics received emails requiring them to sign non-compete agreements. Meanwhile, Xiaomi posted many car-making job vacancies, marked as “Urgent.”

One industry insider stated that non-compete agreements often turn out to be hollow in reality, primarily because companies don’t want to pay the costs. The usual practice is to compensate employees with a sum equivalent to 50% of their annual salary. For high-ranking executives whose salaries are in the millions, this cost would skyrocket, causing an overall increase in manpower costs.

A NIO employee revealed that NIO has an employee stock ownership plan, but its current price is relatively high — not everyone is willing to bear the cost.

In 2021, Xiaomi announced its foray into car-making, poaching industry talents. However, they chose not to target NIO but instead focused on traditional automakers’ personnel.

Recently, a Xiaomi car team member informed Guangzi Xingqiu that the former director of Geely Research Institute, Hu Zhengnan, who had joined Shunwei Capital, has begun working for Xiaomi and may eventually become a full-fledged member of the team.

We searched Shunwei Capital’s website and found that Hu Zhengnan’s official title is investment partner. Formerly, this position has been held by Xiaomi co-founder Lei Jun and founder of Eido Yongche, Zhou Hang. Both held the position as part-timers or consultants and did not participate in Shunwei’s daily operations. Hu’s appointment is similar in nature to those of the two.顺为资本有意将「投资合伙人」与「合伙人」的职务进行了区分。目前在顺为资本出任合伙人的程天、李锐、李威等人均为全职,参与日常投资工作。

上述人士认为,胡峥楠没有直接加盟小米而是加盟了顺为,或许就是由于竞业协议方面的原因,才采取这种迂回路线。一旦正式加盟小米汽车,其有望与小米汽车目前唯一一位副总裁李肖爽同级,直接向雷军汇报,成为后者的左膀右臂。

一位汽车行业猎头告诉光子星球,目前来看大家挖人的规律基本是,互联网背景出身的人造车喜欢挖传统主机厂的人,而传统主机厂推出的新品牌又喜欢从蔚小理这些新势力挖人,各家车企其实都已经形成了新旧交融的情况。

新老势力互换血液

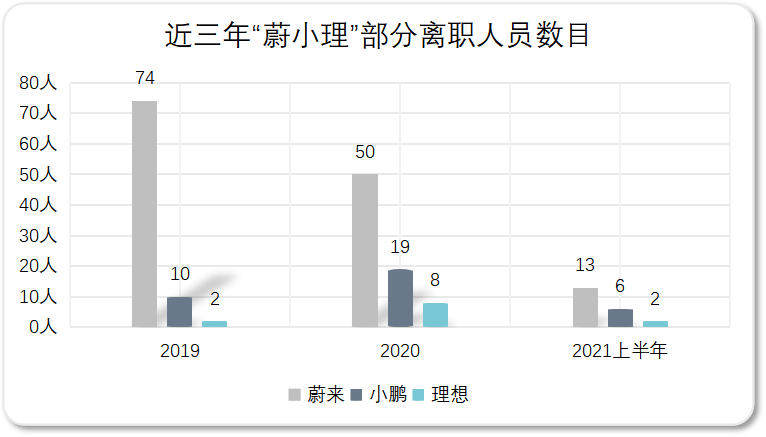

为了研究造车行业人才流向变化,光子星球从公开信息、职场软件与社交平台等多个渠道梳理了一份「蔚小理」最近三年部分离职高管与员工的名单,为了保证样本有效性,仅筛选出入职在12个月(1年)以上的人,共计185位。

这里需要指出,高管流动情况往往有公开新闻报道,可信度高,但样本总量有限。数目更大、更能反映变化的其实是技术、销售与运维、财务与其他管理人员的流动情况大多依赖职场软件与社交平台。

职场软件接受度高,大部分用户个人公开的职业履历相对可靠度高,唯一缺陷是用户的姓名可能不是真实姓名。社交平台信息的价值偏低,在缺乏双重证据论证的情况下,暂不采纳。

根据我们统计的样本,蔚小理在2019年流失87人,2020年流失77人,2021上半年流失仅为21人,数据基本上与行业发展脉络吻合。2019年,三家九死一生,人才流失最为严重。一年后,因为互联网巨头入局挖角与旧势力反戈,人才市场热闹非凡。到了今年,三家基本盘稳固,头部格局初现,流动才变得不那么剧烈。

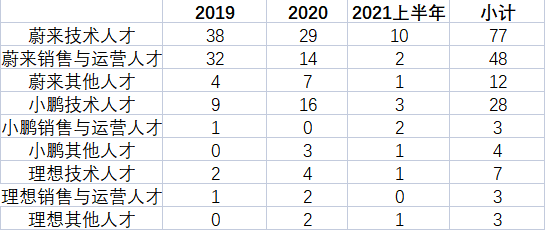

大致可以将上述名单中的人物分为三类,一类为技术管理者与职员,第二类为运营与销售管理者、职员,第三类为HR、PR、财务等其他人员。

根据目前所搜集、整理的部分信息看,造车三势力流出的人才主要为技术人才,在蔚来、小鹏、理想流出人才中的比例分别为56.2%、80.0%、53.8%。

Sales and user operations capability are NIO’s strengths, so talent mobility in this area is also quite significant.

On August 22, 2019, Li Bin sent an internal email requesting a reduction in staff to 7,500 by the end of September. A mid-level employee who left during that period told Guanzhi Xingqiu that the situation was not as severe as reported by the outside world. With the company growing, it was normal for people to come and go, “I left at that point purely because I wanted to challenge other avenues.”

This statement can indeed be confirmed from the sample we have collected. A total of 34 people left within two months after the email was sent, which is not very prominent in the entire personnel flow-intensive 2019. The overall turnover situation in 2019 is roughly the same as in 2020.

Another issue worth noting is where these talents who left “Nio Xiaoli” went.

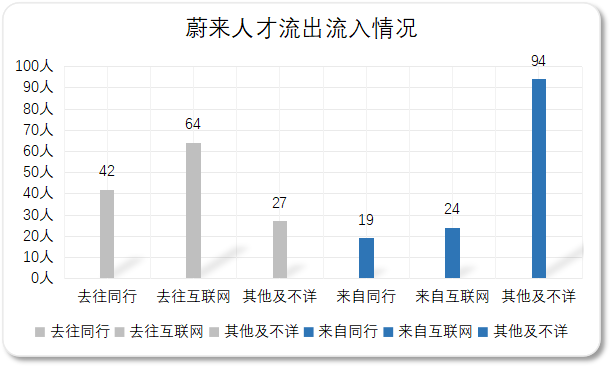

Taking NIO as an example, among the total of 137 samples, the destinations of those who left NIO are relatively clear. Although there are more people in the internet industry, most of them are in operation and marketing sales. Those technical and software talents mainly still flow to peers.

Specifically, among the sample, 42 people joined peers after leaving NIO, accounting for 30.7%. They include both traditional carmakers and some of the new car-making forces are small or ideal, and more joined in upstream segments of various sub-sectors, such as Magna Technology and Xynerbotics.

On the one hand, old talents flowed back to traditional car-makers such as SAIC, BAIC, and Geely, where talents used to flow out. Today, they have become places for many new car-makers. This kind of talent mobility reflects that the old and new forces have actually blended with each other.

On the other hand, intelligent vehicles are a broad track, and the successful experience of NIO has brought prosperity to the entire industry with the mobility of talents.

Both Magna Technology and Xynerbotics have two former NIO executives, one is the aforementioned Zhuang Li, and the other is Chen Yingrui, former deputy director of NIO’s AI product design department. After leaving NIO, these two persons were deeply involved in the business of the new company. Zhou Li is currently the CEO of Magna Technology, while Chen Yingrui is the Vice President of Xynerbotics.

The departure of technical personnel from NIO has greatly promoted the development of the industry. Some companies more or less carry the shadow of NIO, such as everyone thinking issues from the user’s perspective.

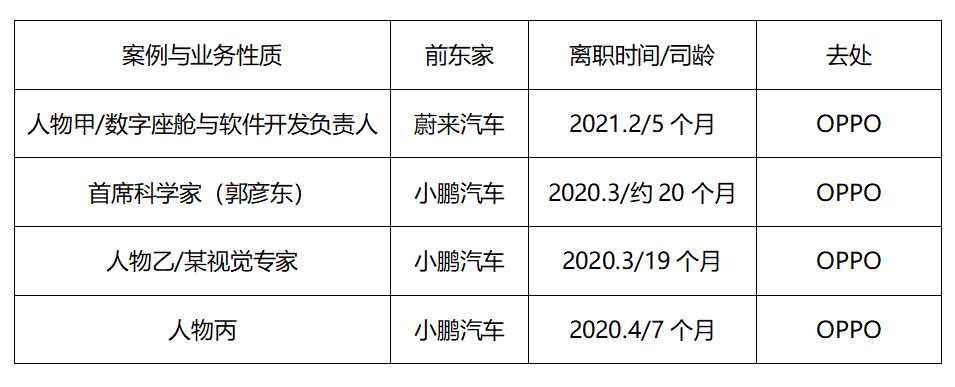

In addition, a large number of former NIO employees appear in the core team of Jidu Auto, including Zhu Jiang mentioned earlier, as well as Ji Hongmin, senior manager of chassis architecture, Hamm, director of automotive R&D, and senior product manager of the interconnect Zhao Bowen, etc.One, some companies that deny making cars are actually working hard to develop them, such as OPPO. In March and April of last year, they poached the chief scientist Guo Yandong, as well as visual experts Tao Xunqiang and Feng Tianpeng, from Xpeng Motors. In May of this year, a digital cockpit and software developer from NIO also joined OPPO.

Two, talents are gathering in the new car-making forces in the second-tier cities. This year, Alibaba and SAIC’s joint venture company Zhi Ji Auto just introduced two key staff members from NIO: a purchasing director who had been working at NIO for 42 months, and a senior UI designer who had been with the company for 46 months.

Three, even if they don’t make cars, product managers, user operations staff, and software developers in new car-making forces are also entering internet companies. Among 185 people, nine went to ByteDance, eight went to Didi and Meituan, and five went to Tencent and Alibaba. “Nio Xiao Li” has also become a stepping stone for many people to enter the internet giants to some extent.

However, more and more talents are still pouring into Nio. Recently, chip technology expert Hu Chengchen, and She Xiaoli from Huawei’s automotive business unit, have also chosen to join NIO.

The industry’s salary levels are also being pushed up by the constant flow of personnel.

On the one hand, talent mobility may make car-making the next high-paying field after the internet. On the other hand, we need to pay attention to whether the mobility of core executives will lead to management, operational and even technological homogenization and insularity among various car companies, which cannot be determined at present.

At least in terms of traditional car companies and new car-making ventures, the distinct cultural barriers, business concepts, and organizational forms of the past seem insignificant now.