*Author: Chris Zheng

On April 29, 2020, Tesla released its first-quarter (Q1) financial report for 2020. Despite the epidemic, Tesla had the best quarter ever in terms of key indicators such as sales, revenue, gross margin, and cash flow.

However, during the earnings conference call, Elon Musk became very angry when facing analysts’ comments on the California shelter-in-place order. He stated that the expansion of shelter-in-place, which forcibly imprisons people in their homes, violates their constitutional rights and breaks people’s freedom in horrible and wrong ways. This is not why people came to America and built this country. What the fuck!

The conference call was then cut off…

Due to California’s strict shelter-in-place order, Tesla’s US factory must remain closed. Two years after the last one, Elon Musk once again went into a mode of losing control during the earnings call, which was very embarrassing.

Let’s start with the financial report.

The hardest ever best quarter

Q1 revenue was $5.985 billion, an increase of 32% compared to Q1 2019, and a decrease of 19% compared to Q4 2019.

Q1 automotive revenue was $5.132 billion, an increase of 38% compared to Q1 2019, and a decrease of 19% compared to Q4 2019.

15390 Model S/X vehicles were produced and 87282 Model 3/Y vehicles were produced in Q1.

12230 Model S/X vehicles were delivered and 76266 Model 3/Y vehicles were delivered in Q1.

The gross margin in Q1 was 20.6%, with an automotive gross margin of 25.5% and cash reserves of $8.08 billion.

Why was it said that it was not easy to achieve such results?

The devil is in the details. Let’s start with the production and sales data.Due to the global shutdown and stay-at-home orders caused by the pandemic, Tesla produced over 14,000 more cars than it sold in Q1, which directly led to the demise of Tesla’s two consecutive quarters of meticulous operation results.

In Q3 and Q4 2019, Tesla’s global inventory turnover days decreased to 17 and 11, respectively. Compared with the average inventory turnover cycle of 68 days for the US auto industry reported by Cox Automotive, Tesla’s inventory operational capability has approached that of the electronic consumer electronics leader and real inventory killer, Apple.

However, the pandemic dealt an indiscriminate blow to the auto industry. Prior to Tesla, predecessors in the auto industry had already successively “collapsed”:

On March 20, Ford announced the withdrawal of its 2020 annual target.

On March 25, General Motors announced the withdrawal of its 2020 annual target.

On April 17, Volkswagen announced the withdrawal of its 2020 performance outlook.

Tesla was also not spared. Due to the operational interruption caused by the epidemic at the end of Q1, the turnover days of Tesla inventory deteriorated to 20 days, an 82% increase from Q4 2019, which directly pushed Tesla to pay 981 million dollars in operating costs for inventory growth.

If there had not been an operational interruption caused by the pandemic, this would have been Tesla’s first $1 billion profitable quarter. But reality is not hypothetical. Compared with the Q1 financial reports of the vast majority of multinational car companies with sales declines ranging from 6% to 30%, and huge losses, it is already difficult for Tesla to maintain profitability.

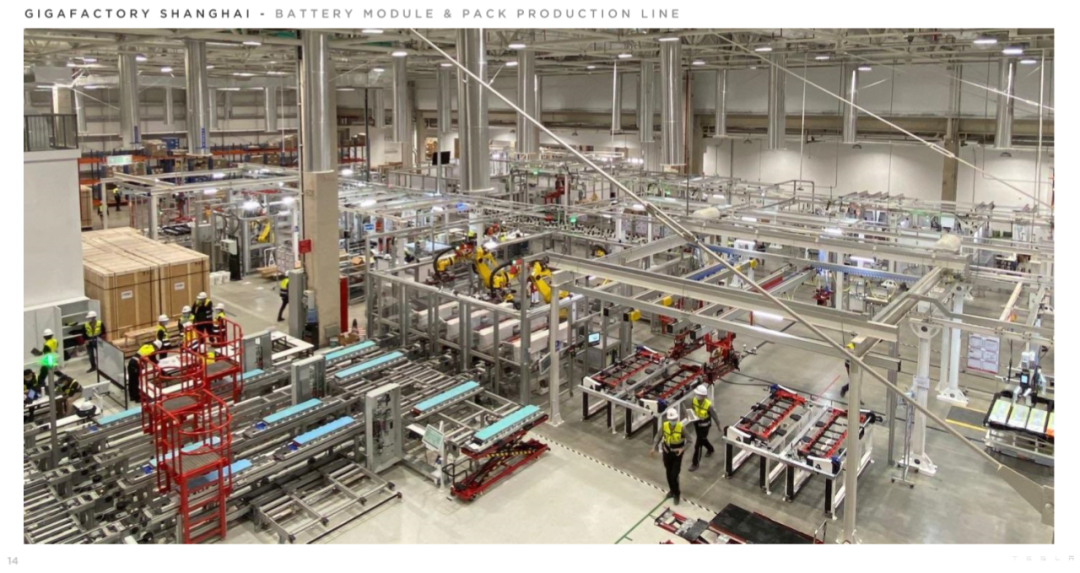

Gigafactory Shanghai

For Chinese consumers, the progress of the Shanghai factory is of utmost importance.

Due to the uncertainty of the Fremont factory’s resumption of work caused by the pandemic, Gigafactory Shanghai has become Tesla’s only regularly-operating factory worldwide. This has further highlighted the importance of the Shanghai factory.

Tesla disclosed in its financial report that after improvements to the production line, the Model 3 production line in Shanghai will increase from 3,000 cars/week to 4,000 cars/week, and the annual production capacity will increase from 150,000 cars/year to 200,000 cars/year.

In addition, the Shanghai battery module/pack factory matching it has also been basically completed.

After making cars, the next step is to sell them.

Elon announced at the earnings conference that Tesla China will announce the price adjustment of the domestic Model 3 standard upgrade version tomorrow, and the price of the standard version of Model 3 after the price reduction will be reduced to within the subsidy red line (300,000 yuan).

Then the Tesla China management team revealed in an interview that after the price cut, the standard version of Model 3 “has no change in configuration, and the price of the long-endurance version has not been adjusted.”

Combined with the current official website price information, this means that the price difference between the Model 3 standard upgrade version (comprehensive working condition endurance 445 km) and the long-endurance version (comprehensive working condition endurance 668 km) after the price reduction will increase to more than 60,000 yuan. This is not common in Tesla’s history.

Therefore, if you are a potential owner of the domestic Model 3 long-endurance version, you can pay attention to the price trend of the long-endurance version in the next two months.

The question investors are concerned about is: Will such sustained price reductions have a negative impact on gross margins?

Tesla CFO Zachary Kirkhorn revealed that the production cost of the Shanghai factory in Q1 has been lower than that of the Fremont factory in California. In addition, from Q2 to the end of the year, the production capacity growth will further amortize fixed investment costs. Considering that the supply chain has not yet been localized (the localization rate of the supply chain of the Shanghai factory is still lower than 50%), Tesla will further increase its gross margin while reducing the price (costs down and expand margin even with this reduction in price).

Finally, according to the financial report, the second phase of the Shanghai factory, which is the progress of the Model Y plant construction, has already passed halfway. Combining with the uncertainty of the resumption of work in North American factories mentioned earlier, the progress of the domestic Model Y will be further accelerated, and under the premise that the epidemic does not recur, the Model Y is highly likely to be produced domestically in Q4 2020.According to previous production capacity planning, the production capacity of the Shanghai factory will increase from 200,000 vehicles per year to 450,000 vehicles per year, becoming a core component of Tesla’s global production capacity of 1 million vehicles in 2021, as Elon mentioned.

The Money-Maker Model Y

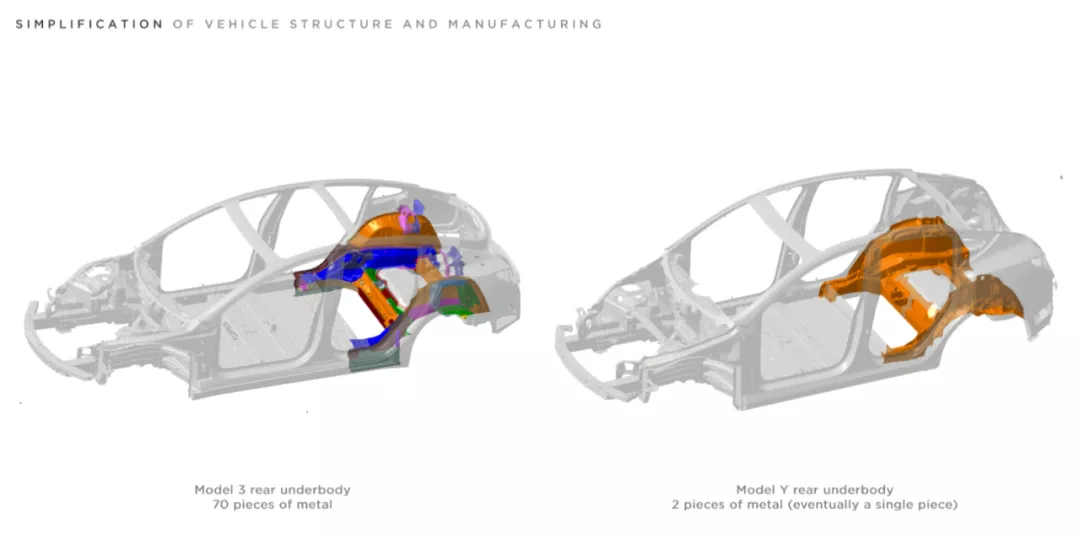

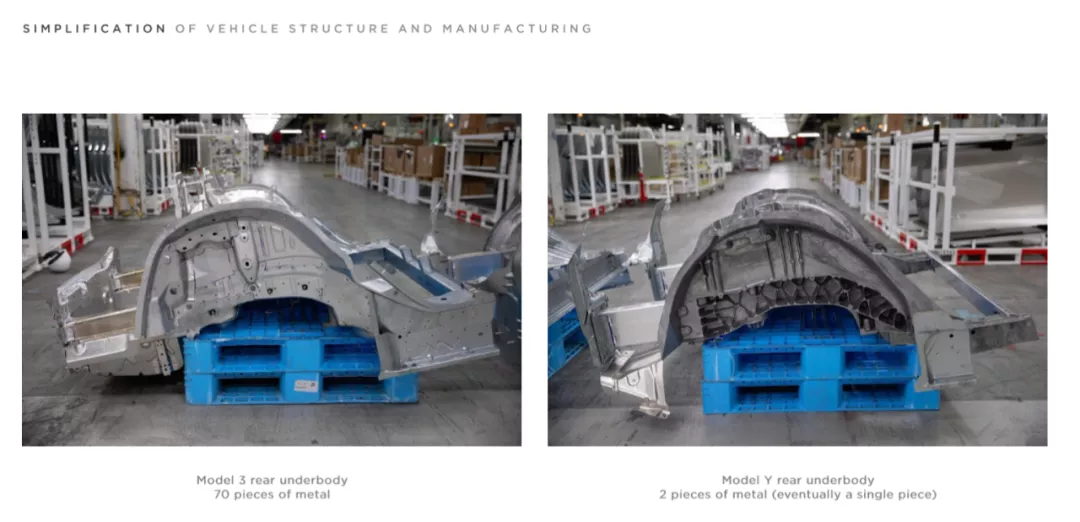

Compared to Model 3, one major iteration of Tesla Model Y is integrating up to 70 parts in the rear body into one component, greatly improving manufacturing efficiency, reducing manufacturing time, and costs by die-casting machines.

In the Q1 quarterly report, Tesla officials for the first time visually showed the differences between the 70 parts, combined in various ways, and the two large components, cast by the large die-caster.

If you look closely, you will notice that the iteration target of “integrating 70 parts into one component” has become two large parts again.

Tesla is indeed continuously adjusting the body evolution plan of Model Y. In June 2019, Tesla planned to reduce the rear body parts from 70 to 4 (2 castings + 2 connectors) with two die-casting machines.

Today, the Fremont factory in California has evolved into a version with two large components for the Model Y production line.

Supply chain information shows that Tesla China has purchased a 6000-ton die-casting machine from Li Jing Group, and the Model Y production line at the Shanghai factory will be the world’s first large-scale cast rear body production line that integrates rear wheel packages, towers, longitudinal beams and others.

Tesla has high hopes for this, in addition to reducing manufacturing costs and improving manufacturing efficiency, the integrated rear body will also reduce body weight and improve NVH performance.

Elon himself gave high praise to the integrated rear body:

“The rear body has never been so large and complex as it is now, so we’re really pushing the development of automotive structural engineering and manufacturing fields. Essentially, it is getting better in every way.”The comprehensive improvement in every aspect has been fully reflected in the Model Y production line that has been put into operation. According to Tesla’s financial report, the production ramp-up speed of the Fremont factory’s Model Y production line is faster than the domestically produced Model 3 in the Shanghai factory.

In addition, due to a significant reduction in cost, the Model Y completed its transition from negative to positive gross margin within one quarter of its production in Q1. Moreover, Tesla estimated that when Model Y sales reach a range of 10,000-20,000 units, the marginal cost of the five-seater Model Y will be comparable to that of the Model 3.

Given that the average selling price (ASP) of the Model Y is $5,000 higher than that of the same level Model 3, and that Tesla’s automotive business gross margin reached 25.5% in Q1, the company’s annual automotive business gross margin for 2020 will remain in the range of 25%-30% without significant price adjustments.

It is clear that with the resumption of work and production after the COVID-19 pandemic, the Model Y will replace the Model 3 as Tesla’s new, profitable machine.

FSD Fully Autonomous Driving

On March 30th, Tesla pushed the Traffic Light and Stop Sign Control feature to the users who have purchased FSD Fully Autonomous Driving package. This allows vehicles to recognize and respond to traffic signals and stop signs.

Specifically, when the beta version is activated, as long as the vehicle encounters a traffic light or stop sign, regardless of whether it’s green or not, the vehicle will slow down and stop at the intersection. The driver needs to move the lever or lightly press the accelerator pedal to continue through the intersection.

Elon explained the advantage that this function gives Tesla during the financial report conference by using Google search as an example.It’s hard to imagine any search engine that can compete with Google.

Each Google user trains the algorithm by using the search engine. When you search for something and click the right link, you train the Google algorithm every time. Any new search engine would have a difficult time competing on this, as Google has a significant advantage in this area. Furthermore, based on (road test) data, we are several orders of magnitude better than all our competitors combined.

As of now, Tesla’s Autopilot has driven over 5.3 billion kilometers. Elon Musk stated that Tesla is collecting data at a rate of 1 million intersections per month, and with the help of the above-mentioned annotations, Tesla cars will soon be able to pass through intersections and turn without human intervention.

Elon Musk revealed that “FSD Full Self Driving” will be released by the end of the year, and Tesla may launch a paid subscription service for “FSD Full Self Driving” by the end of the year.

Regarding the release of Autopilot/FSD, Tesla has a global quality control team, and Elon is a member of the quality inspection team.

Specifically, each new version of the algorithm is first tested in a simulator, followed by an internal beta testing team at Tesla, then the audience is expanded to include external Tesla owners, and finally, it is widely released.

In the Alpha version of FSD (currently widely released as a Beta version), vehicles have achieved driving from home to work without any intervention in most cases.

Finally, let’s take a look at the revenue data for the FSD Full Self Driving upgrade package.

In Q2 2019, Tesla first revealed the concept of “deferred revenue” for software, with cumulative deferred revenue reaching $1.3 billion and revenue covering supercharging network, internet connection, OTA update feature packages, Autopilot autonomous driving assistance, and FSD Full Self Driving.

During the Q1 earnings conference, Zach introduced the deferred revenue rules for FSD Full Self Driving sales. Tesla will count half of FSD revenue in the financial report and the other half as deferred revenue, which will be included in the current quarter’s financial report as time goes on and features are released.

As of now, Tesla’s deferred revenue is slightly over $600 million, and it is still growing.Sorry. But this is outrageous – it’s outrageous. So – but it will not only cause harm to Tesla, but to many companies. Although Tesla will survive the difficult times, many small companies will not. Everything that people have worked for their whole lives – will be destroyed in real-time.

Moreover, we will have many suppliers – or many suppliers that are going through super hard times, especially small enterprises, which will cause a lot of harm to many people. Yes.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.