Author: Chris Zheng

On the afternoon of September 22, 2020, at 2 pm Pacific Time, Tesla held its highly anticipated Battery Day, with the core introduction of Tesla’s self-developed batteries ending around 4 pm.

Unexpectedly, Tesla CEO Elon Musk saw his company’s stock prices drop after the well-prepared Battery Day presentation, reaching a low of $367 and expanding its decline to 17%.

It is evident that there is a serious division between Tesla’s management and the outside world regarding self-developed batteries.

What’s even more complicated is that if you compare the Chinese and overseas network’s reception, both have opposing bearish positions –

Based on feedback from the news coming from China, the industry’s general attitude toward Tesla’s self-developed battery program is “below expectations” and “nothing surprising.”

However, foreign media and related insiders’ general view is that the innovative, grand plans carried with a major challenge for future implementation.

So, how should we correctly view Tesla’s self-developed battery project?

“The Classic Problem Without a Best Solution”

Before discussing the Battery Day content, I must first talk about the event itself.

During Tesla’s 2019 shareholder meeting, Elon said this sentence (we will mention this sentence many times in the future because it is so important):

“If I were an outside shareholder, I would want to know: when do we think we can get the factories to 10 GWh-plus capacity? It’s not just a question of getting to 10 GWh-plus capacity, but, like, how fast can we scale that? That is the real limiting factor. It’s, like, not the cost per kilowatt hour of the battery pack!”

As an external investment person, the two things I would highly care about are the timeline for autonomous driving and battery capacity expansion, which reduces costs. Battery and self-driving technology are the two most important strategic focuses of Tesla.

In response, Tesla held its Autonomy Day in 2019, and Battery Day in 2020.

(P.S. In fact, the macro framework and layout logic of these two events are entirely consistent – two high-quality technical propaganda presentations. If you haven’t watched them yet, it’s recommended.)

At the start of the Battery Day, Elon directly directed the theme towards the basic strategy mentioned in the 2019 shareholder meeting: Battery capacity expansion and cost reduction plans.

Tesla’s answer is to start from five dimensions of cell design, cell production, cell cathode materials, cell anode materials, and cell vehicle engineering integration, with a focus on the following:

Battery Cell Design: 4680 large cylindrical cells with no tabs

Battery Cell Manufacturing Process: dry electrode manufacturing and automated production lines

Positive Electrode Material: high-nickel, cobalt-free

Negative Electrode Material: silicon-carbon anode with coating improvements

Engineering Integration: Tesla-designed cell-to-pack (CTP) integration into vehicle chassis

Compared with the 2170 cells, the new 4680 cells have improved chemical materials, grouping structure design, and automated manufacturing processes. Tesla believes that many elements in battery manufacturing are legacy issues from the early stages of the industry, and by redesigning the entire process, the cost and capacity expansion of batteries can be significantly improved.

In Elon’s words: “Based on the ‘first principles’ way of thinking,We’ve thought through almost every element of battery production.”

However, with the end of the conference comes a tidal wave of questions: from large cylindrical cells with no tabs, to high-nickel, cobalt-free materials, silicon-carbon anodes and CTP integration, all are directions that the whole industry has been working hard on, with many companies already investing in them long before Tesla’s Battery Day.

In summary, people’s expectations for Tesla are not for industry leadership, but for a unique, disruptive technology. Did Tesla bring out a battery black technology that will blow everyone away?

The reason for such expectations is that the market is not well-informed about Tesla’s research and development system over the past fifteen years.

Former Tesla Senior Battery Development Engineer Chris Burns summed up Battery Day accurately: “Most importantly, we won’t see a commercialized version of the ‘next-gen’ battery anytime soon.”

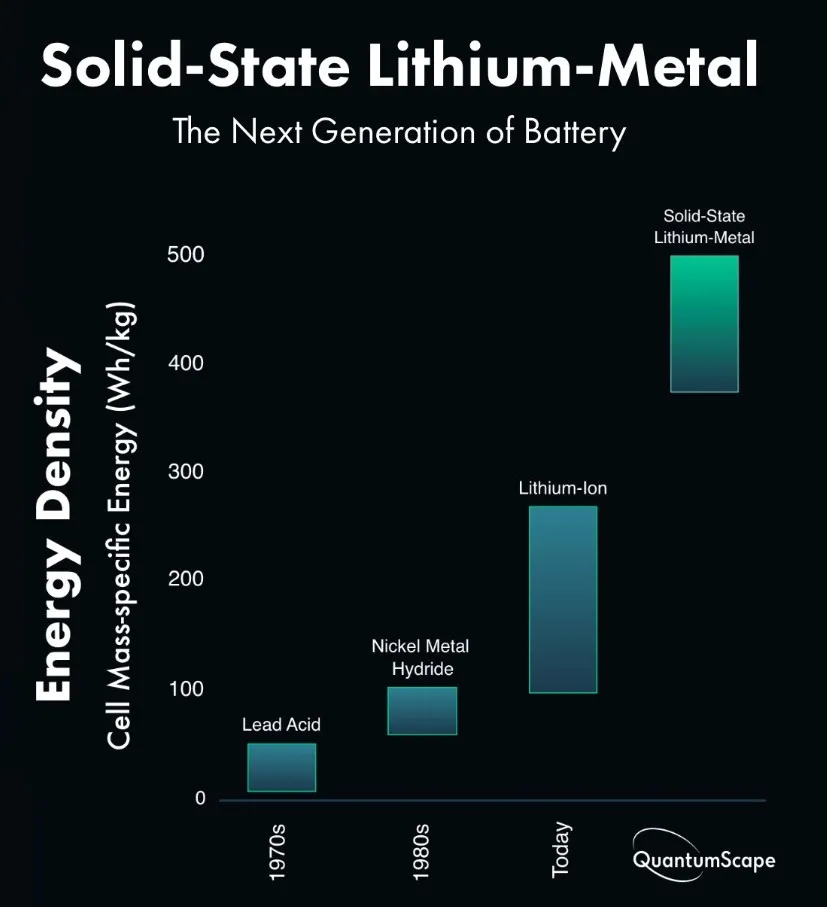

The entire industry believes that solid-state batteries or similar technologies have high energy density and low costs, and that the cost will decrease to a path of 50 US dollars/kWh.

Tesla’s answer is that they can achieve high energy density and low cost based on high-nickel positive electrode and silicon-carbon negative electrode.

The macro-level deduction of this paragraph is the style of Tesla’s research and development system: Tesla has been committed to what is called progressive innovation, making continuous improvements based on the existing research and development system, rather than a disruptive technological revolution.# Tesla’s Approach to Problem-Solving

According to J.B. Straubel, co-founder and former CTO of Tesla, when facing a classic problem with no optimal solution, Tesla always starts with the details and identifies 10 or 15 areas for improvement. This systemic approach leads to good results.

This statement was not made in reference to Battery Day, but rather in 2009 after the initial production of the Roadster. Ten years ago, Tesla made gradual improvements to the battery, motor, aerodynamics, tire rolling resistance, brake calipers, tire pressure, transmission, etc. This led them to achieve their original design goals: a range of 250 miles and acceleration from 0 to 96 km/h in under 4 seconds.

Ten years later, when faced with battery issues, Tesla employed the same approach. As Elon Musk said, they thought about every element of battery manufacturing and redesigned each process – a first-principle problem-solving approach that has proven successful.

Toyota is currently heavily focused on solid-state battery technology, which is a disruptive technology route different from Tesla’s. In July 2017, a Toyota spokesperson Kayo Doi stated that Toyota was developing solid-state batteries with a goal to mass-produce them by 2020.

During the Tesla Q2 earnings call a month later, Elon fired back at analysts’ frequent inquiries about solid-state batteries: “If someone has great solid-state batteries, then please send us a sample and we will see if it works. Because it’s the same as it always is: claims about batteries are meaningless until you have production cells that you can make in high volume.”

At that time, Tesla CTO J.B. Straubel also mentioned that Tesla had tested many solid-state battery prototypes from around the world, but had not found any product that would change their research and development strategy.

Three years later, in July 2020, Keiji Kaita, the executive vice president in charge of powertrain at Toyota, announced that the solid-state battery production would be delayed until 2025 due to technical difficulties.

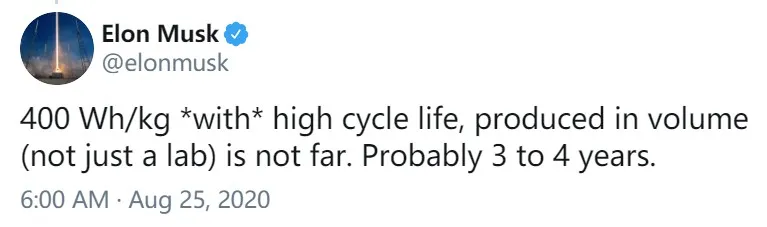

On September 3, QuantumScape, a solid-state battery start-up backed by Volkswagen Group, released its IPO prospectus. Elon subsequently commented on Twitter that the maximum energy-efficiency of the three-electrode cell was underestimated by about a third. (Note: The lithium-ion battery limit in the table is 300 Wh/kg.)

Combine with the previous statement of 400 Wh/kg, high cycle lithium battery is expected to be mass-produced in 3-4 years, which largely indicates that Tesla has established a pathway to achieve the theoretical limit of lithium batteries at 400 Wh/kg in the next 3-4 years.

Combine with the previous statement of 400 Wh/kg, high cycle lithium battery is expected to be mass-produced in 3-4 years, which largely indicates that Tesla has established a pathway to achieve the theoretical limit of lithium batteries at 400 Wh/kg in the next 3-4 years.

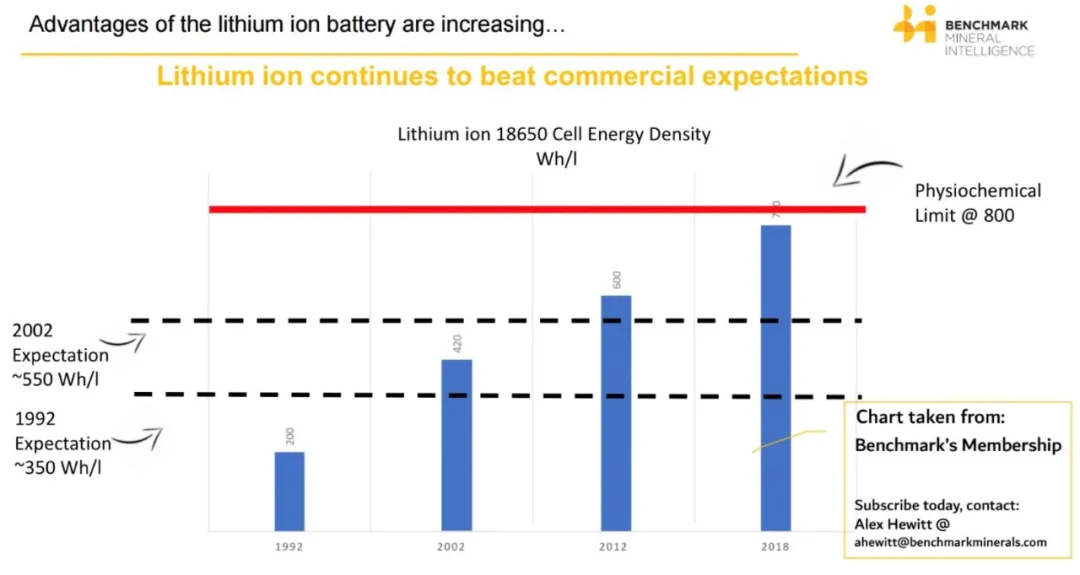

In fact, this is not the first time that lithium batteries have “exceeded” the theoretical limit. There have been four theoretical limits for lithium batteries in 1992, 2002, 2012 and 2018. With the continuous improvement of materials, the so-called solidified theoretical limit is actually a false proposition.

There is no difference between incremental innovation or disruptive innovation. It’s just that at present, the incremental innovation represented by Tesla has temporarily been smooth, and the disruptive innovation represented by Volkswagen Toyota still needs to work hard.

An insider at a large Korean power battery company said, “If Tesla announced something like a solid-state battery, we wouldn’t be too nervous; but what they announced looks like something that will be executed tomorrow, which is scary.”

For those skeptics who complain that there is no black technology in Battery Day, their biggest mistake is to classify the king of incremental innovation camp as a skilled player in disruptive innovation.

“Iterate every 3-4 months”

In the past five years, Tesla has been the company with the strongest will and most aggressive action to “remove cobalt” among all battery-consuming companies. So far, Tesla has reduced the cobalt content in NCA nickel-cobalt-aluminum batteries to an unprecedented low level (less than 3%).

However, from Battery Day, it can be seen that in the next five years, removing cobalt will no longer be the focus of Tesla’s battery “cost reduction and performance enhancement”.

Tesla has achieved a leading low-cobalt ratio in the industry, and further removing cobalt from ultra-high nickel batteries will greatly reduce the thermal stability and bring serious thermal runaway risks. For Tesla, completely “removing cobalt” is not cost-effective.

This is also why Elon has neither specified a specific material formula system nor given a definite timetable, which infinitely weakens the presence of “high nickel, cobalt-free”.

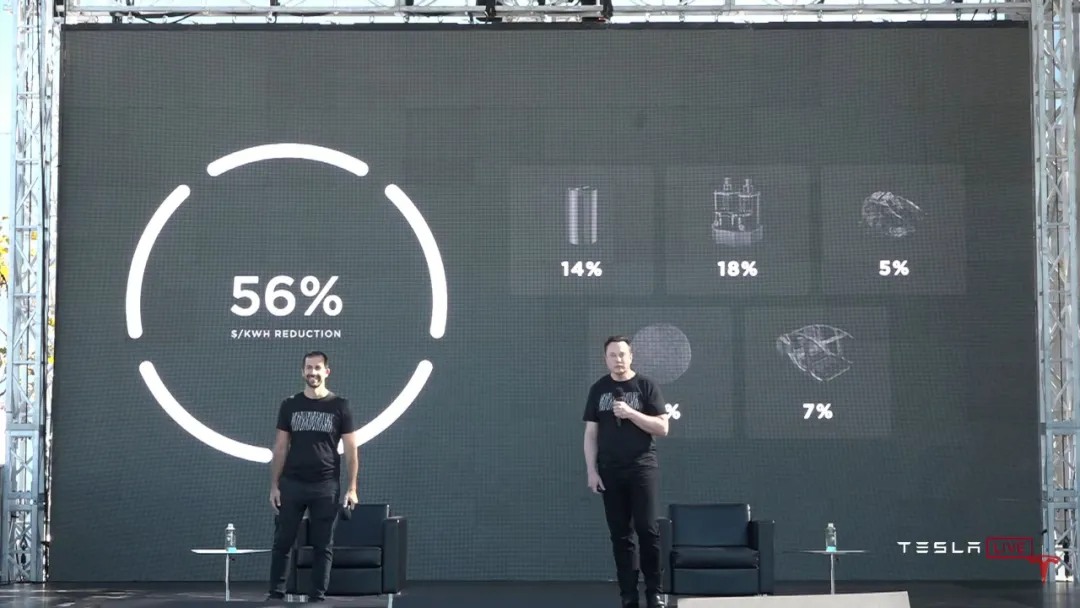

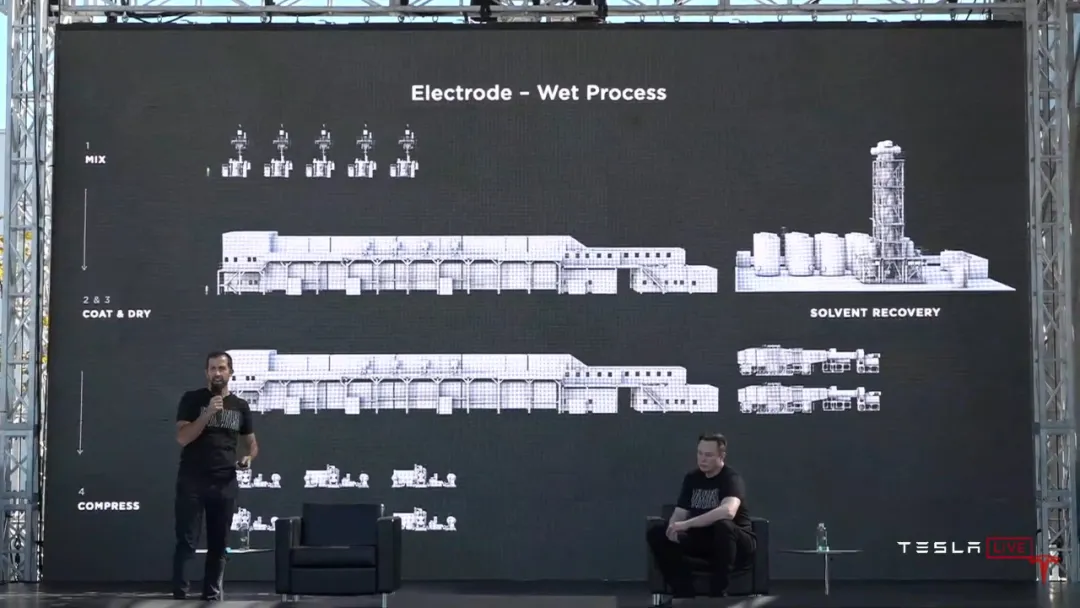

From this PPT, it can be seen that achieving a 56% cost reduction, the improvement of the negative electrode only accounts for 5%, and the manufacturing process accounts for 18%. Obviously, Tesla has placed the manufacturing process, including dry electrode preparation, at the most important position for automation.Translate the Chinese Markdown text below into English Markdown text in a professional manner, preserving HTML tags inside the Markdown and outputting only the result.

On the day before Battery Day, Elon tweeted “short”:

People don’t yet understand the extreme challenge of scaling up new technology production, which is 1000%-10000% more difficult than making a product prototype. Making machines that make machines is much more difficult than making the machines themselves.

Dr. Jake Whitehead, a Tritium e-mobility electric vehicle researcher at the University of Queensland, has said that Tesla’s biggest challenge with in-house battery production is that it has only achieved trial production, with many uncertainties in the transition to mass production.

Tesla’s most groundbreaking innovation is the use of a dry coating process to prepare electrodes, which greatly simplifies production complexity, increases automation levels, and significantly reduces investment in production equipment.

In the traditional wet electrode preparation process, the biggest challenge is to achieve a perfect and balanced distribution of the slurry coating, a task that is even more difficult in a dry environment. This is crucial for the mass production of batteries.

Dry electrode preparation is so difficult that Elon and another speaker, Drew Baglino, senior vice president of Tesla’s powertrain and energy engineering, described it as “insanely difficult” and “super demanding,” respectively.

How did Tesla solve this problem? This problem is somewhat similar to the question raised at the beginning of the article: how did Tesla solve the huge challenge of engineering implementation?

Dry electrode preparation originated from the acquisition and integration of the electrochemical company Maxwell by Tesla in February 2018.

Drew said that since the official acquisition of Maxwell on May 15, 2019, Tesla’s in-house battery production line has undergone four generations of equipment iteration regarding dry electrode preparation technology. It is expected that after two to three more iterations, the problem will be truly solved.

In my opinion, this is the most important sentence in the entire press conference. It perfectly presents Tesla’s research and development philosophy, which goes beyond just batteries and covers all components: “Fast Action, Fast Failure, Fast Correction, and Fast Breakthrough.”

In my opinion, this is the most important sentence in the entire press conference. It perfectly presents Tesla’s research and development philosophy, which goes beyond just batteries and covers all components: “Fast Action, Fast Failure, Fast Correction, and Fast Breakthrough.”

This is reflected in every detail of Tesla’s products. The Tesla Model Y will begin production in California, Shanghai, and Berlin in January 2020, January 2021, and May 2021, respectively. In less than a year and a half, the Model Y’s body has undergone three major engineering changes.

According to CEO Sandy Munro of a US engineering consulting firm that dismantled two Model Ys, Tesla made 13 design changes to the eight-way valve thermal management assembly of the Model Y in just two months.

Jerome Guillen, President of Tesla’s Automotive Business, revealed that Elon hopes that production line engineers will make at least two improvements per week to increase production speed and reduce costs.

Rapid iteration has brought Tesla into great controversy, but it is also the fundamental reason why Tesla continues to lead. Elon Musk has repeatedly emphasized on various occasions to “make the super factory the biggest product of Tesla.” The product itself can be constantly iterated.

Returning to the self-developed battery production line, according to Elon, after four versions of iteration, the self-developed battery production line has not yet been fully operational, but it is close to working.

Tesla’s goal is to achieve an annual production capacity of 20 GWh/year with one self-developed battery production line within one year. For comparison, Tesla’s super battery factory, Giga 1, has 13 traditional production lines and an annual production capacity of only 35 GWh/year.

When Tesla starts mining

For you, what is the most shocking PPT in the entire press conference?

For me, it is this page.

Elon stood on the stage and said that we own more than 10,000 acres of lithium mines in Nevada. Drew followed up and said that we will build our own cathode factory in North America and use existing nickel and lithium resources in North America. By simply localizing the cathode supply chain and manufacturing, we can reduce the cost of cathode materials by 80% compared to before.

Tesla has finally entered the mining industry.

In 2008, Tesla began manufacturing electric motors. In 2012, Tesla began manufacturing cars. In 2015, Tesla acquired Riviera Tool and began manufacturing car parts.In 2016, Tesla acquired Grohmann Automation and began manufacturing automotive production lines.

In 2020, Tesla started manufacturing battery raw materials and entered the mining industry.

When it comes to manufacturing, Elon Musk has famously stated that the only limit is the raw materials, and every step of the manufacturing process can be reinvented.

In January 2017, Tesla held an Investor Day at the Giga 1 super battery factory. Elon told investors that the ideal scenario for vertical integration would be to build a factory over a mine where one end is connected to the mine and the other produces cars.

Today, Tesla has really entered the mining industry, touching the raw materials – the only limitation in manufacturing.

Tesla’s vertical integration seems to have no limits – they keep pushing upstream until they can’t go any further. This makes us rethink the motivation behind Tesla’s vertical integration.

When it comes to batteries, this means that you can make large cylinders, you can make pole-less ears, you can make high-nickel, cobalt-free, silicon-carbon negative electrodes, CTC integration, but only Tesla can integrate all these micro-innovations and engineer them to be implemented.

In 2014, UBS analyst Colin Langan questioned Tesla’s continued focus on vertical integration, and Elon gave an unconventional explanation:

At any given level of technology, how far do molecules move? It would be expensive if a molecule traveled back and forth around the world several times. If it just moved from one place to another, the cost would obviously be lower. Therefore, vertical integration means that these molecules don’t move too far.For any given technology level, how far did that molecule move? And if the molecule is taking several round trips around the world, that’s expensive. If it’s just moving from one station to the next, then that’s obviously lower cost. And so the vertical integration just means that the molecule doesn’t move as much.

Tesla has entered every link of the manufacturing process. What next? “Reinvent every link.”

Tesla vertically integrated Grohmann, Hibar (automated manufacturing equipment manufacturers for Tesla’s automotive and battery production lines, respectively), and other mechanical design teams within the company.

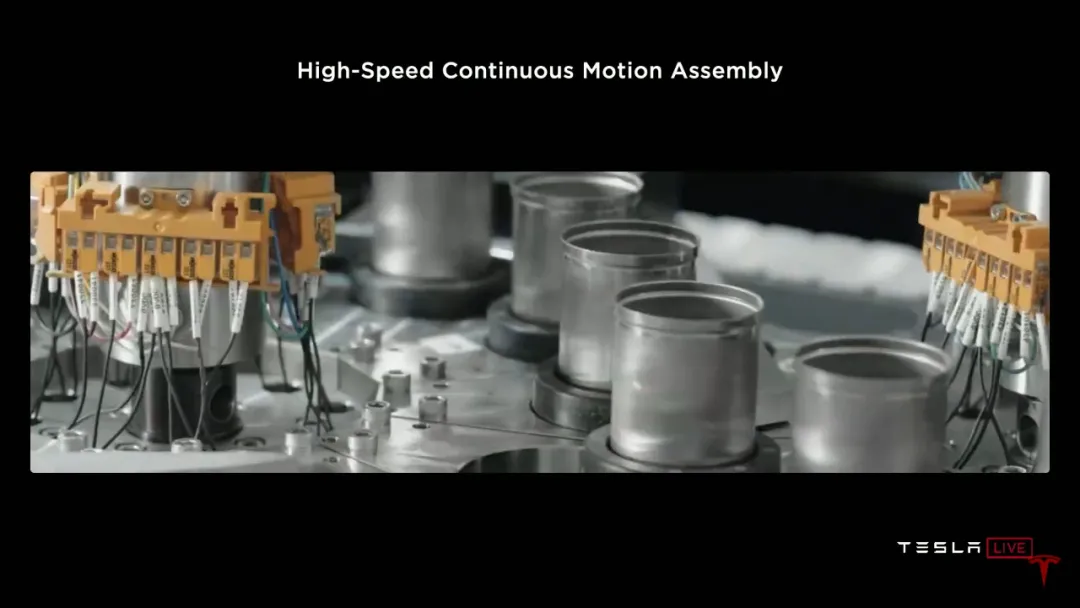

Drew said, “There are no intermediate steps between one machine and another on our production line, which allows us to design the entire line as a single machine and eliminate all unnecessary steps.”

Elon continued, “We eliminated the traditional ‘start’ and ‘stop’ and finally achieved high-speed continuous operation assembly of the production line.”

One month before Battery Day, Elon mentioned the tactical execution after completing the vertical integration of the closed loop:

Today, Tesla’s factory system has more software than cars, and in the long run, there may be an order of magnitude increase.

We bypass all contractors and suppliers and build the factory into a giant machine designed and continuously improved by us.

We can integrate and design cars and factories based on first principles.

Integrated design?

We have experienced independent battery pack design, independent car design, independent production lines, and independent factories, which are classic patterns in the traditional automotive industry.

By integrating the battery pack, car, production line, and factory design, we have seen this:

Through a 6,500-ton diecasting machine, the one-piece front and rear bodies are diecast; the battery pack and chassis are jointly designed, integrating the front seat frame. Through the integration of the battery pack and car design, manufacturing steps are reduced, and production line design is simplified.

Finally, based on the highly vertical integration of all products, Tesla will gradually achieve “integrated design” for all products.In 2019, Elon Musk said, “Batteries and autonomous driving are the two strategic focuses that are most important for Tesla.”

In 2020, Elon Musk said, “Ultimately, every car company will have long-range electric cars and autonomous driving technology, but not every company is good at manufacturing. Tesla will be far ahead of everyone else in manufacturing. That is our goal.”

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.