Author: Director

No more pretense, it’s been revealed that FaradayFuture, the Silicon Valley-based electric vehicle maker founded by Jia Yueting, plans to raise over $1 billion in an initial public offering (IPO) on the Nasdaq Stock Market, turning the company into a billionaire.

Regarding FF’s future direction, on January 28th, FF announced that it has reached a merger agreement with Property Solutions Acquisition Corp (PSAC) and will be listed on the Nasdaq Stock Exchange after the completion of the merger. The stock code will be FFIE.

The cornerstone investors of FFIE’s PIPE include China’s top three private car manufacturers and the government of first-tier Chinese cities, most likely Geely and Zhuhai State-Owned Assets, and it is rumored that Evergrande will also participate in the IPO.

FF will raise a total of $1 billion in this IPO, including $230 million in trust for PSAC (assuming it does not redeem) and $775 million through PIPE at $10 per share.

On January 29th, Geely and FF signed a framework cooperation agreement, planning to cooperate in the fields of technical support and engineering services.

FF’s IPO has become a reality, but still leaves many questions: Why can FF, which is on the verge of bankruptcy and yet to produce a single car, still go public?

A Look at FF’s Background

It is probably not possible to explain FF’s story in one article. Let’s start with a brief introduction to FF and Jia Yueting.

A Discussion of Jia Yueting’s “Con Man” Title

Let’s suffocate for our dreams together!

At the 2015 release event of LeEco Automobile, Jia Yueting, chairman of the LeEco Group, shed tears as he spoke these words. Ironically, Jia Yueting, during his subsequent years in the auto industry, not only suffocated his own dreams, but also repeatedly sent his companies into the “intensive care unit”.

LeEco Automobile is a smart electric car company owned by the LeEco Group and led by Jia Yueting, whereas FF is a smart electric car company founded by Jia Yueting in Silicon Valley and is under his control. The two companies are independent, and can be simply understood as Jia Yueting’s dual headquarters strategy for his car companies.

LeEco is the first Internet company in China to announce that it will produce cars. With its influence in the industry, LeEco’s automotive division raised 1.2 billion U.S. dollars in its first round of investment. Having ample funding, the company’s aggressive approach reflects its style.

With R&D centers and factories established in both China and the United States, and high salaries attracting top talents, the start-up company has quickly built a team of over 2000. In 2017, Jia Yueting launched the first luxury pure electric SUV, the FF91, under the FF brand in the United States. Everything was going smoothly, but that same year, Jia’s personal financial crisis began to unfold, and LeEco Group also exposed financial problems. As a result, FF’s funds became short, and production of the product stagnated.

As the saying goes, “overstepping one’s bounds leads to trouble.” Although FF’s predicament was caused by multiple factors, it was also related to Jia’s underestimation of the difficulty of producing cars, combined with the rapid expansion of the company, its financial needs soon outstripped Jia’s own financing capabilities.

Industry insiders speculate that it is precisely because of this that “Jia Yueting was eager to use a large amount of funding from LeEco to subsidize FF. In the end, he failed to push for the production of FF and dragged down the entire LeEco Group’s business.”

During this process, Jia did not stop seeking external funding.

In January 2017, there was the most famous “Sunac China’s 15 billion yuan investment in LeEco” event. As a result, the money not only filled the holes in LeEco’s financial chain but also a large part of it was injected by Jia into the overseas FF company. On the other hand, with LeEco Group’s debt problems becoming increasingly serious, Jia was no longer able to seek other external funding inside China. In June 2017, he chose to go to the United States to produce cars. Meanwhile, LeEco and its affiliated companies were taken over by Sun Hongbin, the chairman of Sunac China.”

In October 2017, LeEco’s problems erupted, and most people became aware of its financial shortfall.

At this time, domestic creditors called on Jia Yueting to return to China to repay the debt, and Jia responded with another famous saying: “I will return next week.” During this period, Jia Yueting was also listed as a serious credit defaulter by related state departments seven times.

Since then, Jia Yueting has been characterized as a “runaway cheat” in China.

FF and Evergrande

Throughout 2018, the biggest problem facing Jia Yueting was still a lack of funds. Without new capital injection, it would be difficult for FF91 to achieve mass production. That’s when Evergrande stepped in.

Throughout 2018, the biggest problem facing Jia Yueting was still a lack of funds. Without new capital injection, it would be difficult for FF91 to achieve mass production. That’s when Evergrande stepped in.

In June 2018, Evergrande officially invested $2 billion in FF, becoming its largest institutional shareholder. The funds were injected in two installments with $800 million paid in early 2018 and the remaining $1.2 billion to be paid later.

This set the stage for the power struggle between Evergrande and FF over control, with both sides having their own agenda. Evergrande invested in FF under the guise of financial investment, but had the intention to take control; FF, which was previously in dire need of funds, thought that Evergrande only wanted to make a financial investment and signed a supplementary agreement.

The result was that in June 2019, the $800 million was quickly depleted, and FF hoped that Evergrande would pay $500 million of the remaining $1.2 billion ahead of schedule. At this point, Evergrande requested that Jia Yueting sign a supplementary agreement with several key conditions: First, Evergrande Health would obtain the operational rights to FF’s Chinese business/team and send out executives; Second, Jia Yueting would resign from his position as global chairman of FF.

According to later media reports, FF had met the conditions at the time but Evergrande still refused to pay, which can be easily understood as everything was for the sake of control over FF. As we know, FF and Evergrande engaged in a more than one-year-long power struggle.

In the end, Evergrande and FF reached a settlement.

Why do we spend time explaining this background? Because it can explain two questions:

- Why were industry professionals so surprised by the investment of Zhuhai National Assets in FF?

Because FF still doesn’t have a mass-produced car up to now; the complexity of FF’s corporate level has been heightened after a series of battles; and Jia Yueting is still the “untrustworthy person” who refuses to return to China.

Any one of these reasons could make an investor refuse to invest, but FF is an exception.

- Why would a luxury combination of national assets + Geely + Evergrande still choose FF?

The answer to this question needs to be seen further below.

National assets + Geely + Evergrande, giving life to FF

Four forces are interwoven here, so let’s start with the possible goals of these four companies for investing in FF.

Take a Look at the Three Investors

Before discussing Zhuhai National Assets’ investment in FF, one must first understand the relationship between Jia Yueting and FF. Before this, Jia Yueting was deeply involved as the founder of FF, so he was equated with FF, just as we equate Jack Ma with Alibaba or Liu Qiangdong with JD.com. The founder is the enterprise.The difference now is that Jia Yueting, due to personal debt issues in October 2019, implemented the “personal bankruptcy reorganization” plan, formally transferring all FF shares and related income rights to the creditor trust, and Jia Yueting officially gave up all FF equity.

In other words, FF now operates as an independent new energy vehicle company, and has only an employment relationship with Jia Yueting. This further explains why state-owned assets are confident to invest in FF because it has completed the de-Jia Yueting process.

Firstly, Zhuhai State-owned Assets.

The ambiguity between FF and Zhuhai can be traced back. In December 2020, FF established a new company “Fafa Auto (Zhuhai) Co., Ltd.” in Zhuhai. The registered capital of the company is USD 250 million, with Jia Chentao as the legal representative.

Fafa Auto is wholly-owned by FF’s Hong Kong entity (FF Hong Kong Holding Limited), and its business scope includes the sales of new energy vehicles.

What does Zhuhai want to do?

“Zhuhai aims to build a new energy industry cluster with new energy vehicles as its core,” according to Guangdong Province’s emerging industry strategic plan, which will make Jinwan District of Zhuhai a top new energy vehicle industrial base.

The competition of local governments for the new energy vehicle industry has entered a white-hot stage. Hefei has strategically introduced NIO, Volkswagen, and invested in Leading Ideal. Shanghai has introduced Tesla, established IM Auto, and retained WM Motor. Guangzhou has GAC New Energy, and introduced XPeng, etc. The industrial chain covering key components such as vehicle manufacturing, batteries, motors, and electronic controls as well as charging equipment production in the Pearl River Delta cannot be ignored.

Zhuhai’s layout in the field of new energy commercial vehicles includes: Gree’s acquisition of Zhuhai Yinlong’s entry into new energy buses, and ZTE’s intelligent car production base.

However, it has not yet entered the important passenger car field, and FF could be the first step for Zhuhai to enter the new energy passenger car industry.

Secondly, Evergrande Health.

Evergrande’s ambition in new energy vehicles has been revealed. Although there has been a dispute over control between Evergrande and FF in the past, Evergrande is still an important major shareholder of FF. If FF succeeds, Evergrande can still get a rich return.

If it is confirmed that Zhuhai will invest in FF, it also means that FF’s return to the Chinese market is just a matter of time. Evergrande can still help FF in factory construction, but more importantly, Evergrande can find a business model between FF and Evergrande Real Estate, such as developing supporting commercial areas for FF factories.And FF can complement with Evergrande in corresponding sub-markets.

Thirdly, Geely Automobile.

Prior to this, Geely Automobile did not have much interaction with FF, then why did Geely choose FF?

There is a view on the Internet that Geely is seeking to expand overseas markets. The view itself is not wrong, but the explanation will be somewhat far-fetched, because FF is definitely not the best choice for Geely to expand overseas.

The question needs to be addressed to FF.

In Jia Yueting’s era, FF was positioned as a super luxury brand with products priced above 2 million yuan. After Jia’s departure, FF’s brand positioning should be adjusted. In an interview with FF CEO, Bi Fukang, in the previous issue of “Jianyue Auto Review,” there was a question: “Why did you join FF and what considerations did you have at the time, including FF’s condition?”

Bi Fukang answered, “In the future, the car will become a part of the mobile travel mode and the ecosystem. The car will be shared and automated, so the focus of attention on the car will no longer be the driver, but other passengers and all users.

From this perspective, there will be many changes in the business model. Selling cars will no longer be the main business model. The automotive industry will regard the car as a smart device, and profit by selling the ecosystem and content loaded by the smart device. “

There are two very important pieces of information here, “profit is no longer from selling cars” and “importance of intelligence.”

This also means that high unit prices are no longer the best business model for FF. Obtaining profits through outstanding intelligence capabilities is the focus of the next step for FF. In the profit-making model of intelligence, car companies need a very large user base. Therefore, high unit prices are obviously not conducive to sales. Therefore, the pricing of products under the FF brand will definitely drop, even to the level of 300,000 yuan.

Currently, FF has the FF91, which is a quasi-mass-produced model and the flagship model of the FF brand. Its price will certainly increase, and the next model FF81 is the true mass-produced vehicle of FF. With different product positioning, different platforms are needed. Currently, FF has a platform that can build FF91, but what about FF81 and lower-level models?

At this point, Geely’s role comes in, and that is the SEA platform, which covers A to D+ grade models and is very suitable for FF’s future product needs. In addition to sharing SEA, Geely can also build a bridge of technical exchange with FF.The advantages of Geely are as follows: Firstly, selling the usage right of SEA platform; secondly, collaborating with FF on technology; thirdly, Geely will be the best and top priority acquirer if FF fails.

FF’s 880 patents

According to data from the U.S. Patent and Trademark Office, as of January 1, 2021, FF has a total of 880 patents worldwide, 530 of which involve various components, technologies, and processes.

Randolph Square IP (RSIP), a U.S. patent data analysis company, believes that FF’s diversified patent portfolio is more advanced than that of many OEMs, including Toyota, Ford, and Honda in terms of technical comparability. FF’s diversified patent portfolio for electric vehicles is on par with Tesla’s key technology patent portfolio.

These technologies involve engineering development, autonomous driving, intelligent entertainment, vehicle control, power batteries, and so on.

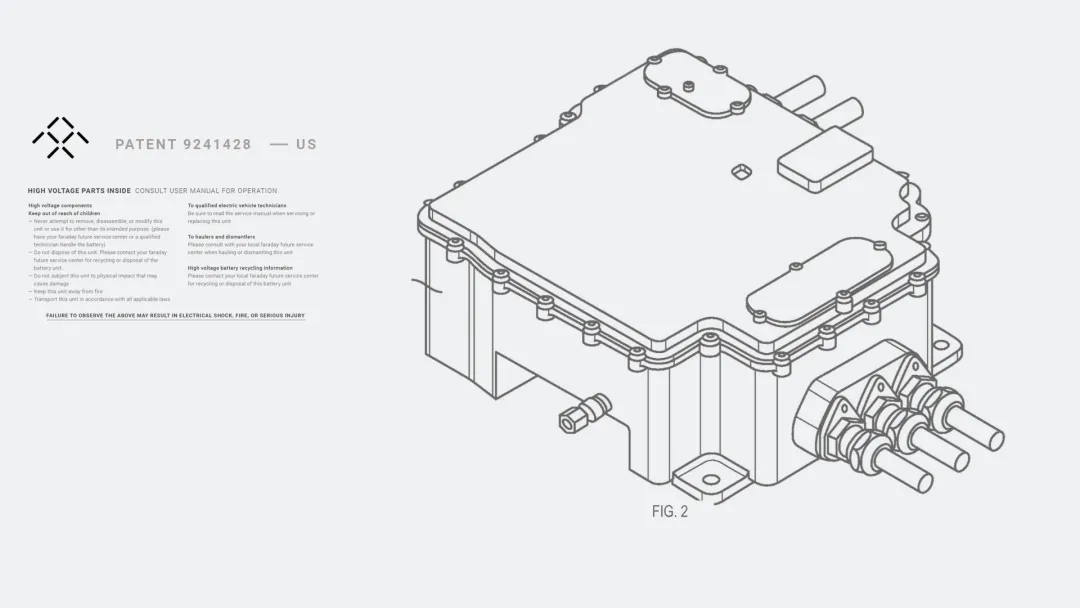

Patents are a crucial part of product development and are the result of attempting to solve specific challenges without an appropriate solution. In April 2014, FF released its first approved patents by the U.S. Patent and Trademark Office, including the latest power inverter technology with patent number #9241428 B1.

Taking the inverter technology as an example, FF’s new generation of inverter structures are compact and lightweight, and can be directly mounted on motors with a power of 261 kW, providing 850 amps rms of AC current. According to the patent, the volume is only 8 liters, and the weight is 8 kg.

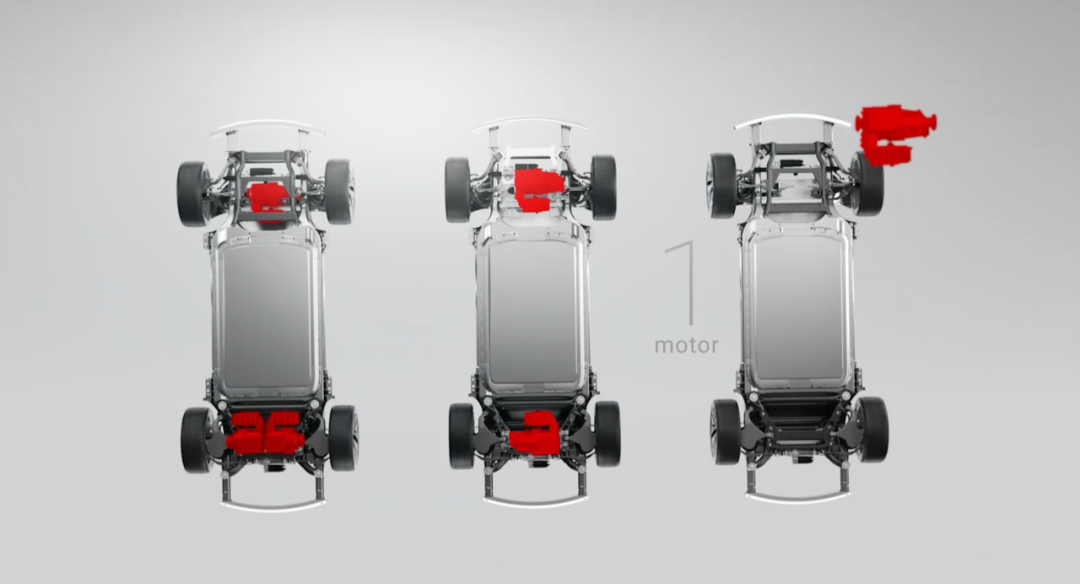

FF’s single-drive unit contains a motor, gearbox, and parking pawl system, weighing 93 kg, with a power-to-weight ratio of 2.8 kW/kg. The dual-drive unit weighs 145 kg, providing 522 kW of power, and the power-to-weight ratio is 3.6 kW/kg.

FF’s inverter uses two parallel high-power 6-package IGBT battery modules, with on-chip temperature and current sensing, allowing the IGBT to work at peak power and eliminating premature reduction of phase currents. To ensure reliability at these high power levels, the IGBT power module uses a sturdy high-current connection without wire bonding and has a built-in intelligent fault monitoring function.

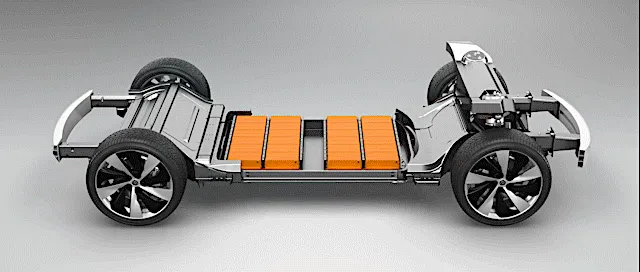

FF91 can have up to 3 motor inverter units, providing drivers with up to 1050 horsepower.FF has developed a variable powertrain architecture, VPA, which is a highly flexible pure electric platform. According to FF’s disclosed technical roadmap, VPA can change the wheelbase with only a few components that vary in length according to the width of the battery module. For example, if VPA needs to increase vehicle wheelbase, the additional space can accommodate more battery modules.

The goal of VPA is to “provide a powertrain architecture that can be modified and installed in different vehicle applications.”

Typical patents:

- “System and method for intelligent battery core charging”

Patent number: 10320207;

Abstract: Battery management system;

Patent date: June 11, 2019.

- “Power battery pack solution”

Patent number: 10283752;

Abstract: Solutions for battery modules to packs;

Patent date: May 7, 2019.

- “Electric vehicle battery charge-discharge management system”

Patent number: 10259337;

Abstract: Power management system;

Patent date: April 16, 2019.

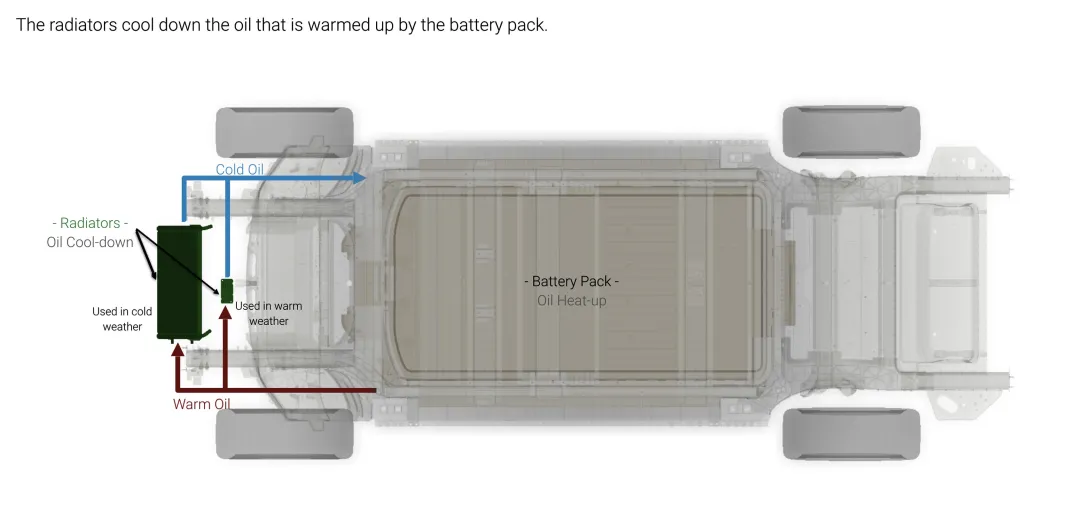

- “Battery cooling system”

Patent number: 102180043

Abstract: Cooling scheme for battery cells;

Patent date: February 26, 2019.

There are many similar patents. According to the US Patent Analysis Company RSIP, “FF has a patent library of 330 patents related to core smart electric vehicle technologies. These patents are not general technology patents, but involve core technologies related to whole vehicle engineering and autonomous driving.”

Regarding FF’s technology, at the Evergrande investment conference, a reporter asked why Evergrande decided to invest in Faraday Future.

Li Yongzhuo (President of Evergrande Auto): “Faraday Future has world-leading new energy vehicle technology with more than 1,000 scientific research experts and hundreds of patents globally. The performance and technical indicators of the FF91 are world-leading.

Investment in and acquisition of Faraday Future by Evergrande means bringing the world’s top new energy vehicle technology into China, contributing to the transformation and upgrading of China’s automobile industry, and promoting China’s progress from a country with a large automobile industry to an automobile power.“From an overall perspective, all problems have been easily solved. FF91 is a product that can be mass-produced with just one chance. As a company, FF has its own technical reserves. What can truly assist FF’s further development is its planned second car model, FF81. Jia Yueting stated that this car will continue FF91’s design style and some of its performance, and is expected to be priced as low as 300,000 yuan.

According to official plans, FF’s B2C passenger cars in the next five years will include the FF91 Series, FF81 Series and FF71 Series. FF81 is expected to be mass-produced and marketed in 2023, and FF71 is expected to be mass-produced and marketed by the end of 2024.

Having reserves in electric vehicle technology, near-production models, and Jia Yueting no longer owning shares, these are the main reasons why FF can survive.

Overall, going public cannot represent FF’s success. Going public is to solve FF’s funding problem and realize mass production of its products. However, in the electric vehicle market, the final word is from the products themselves. At present, Tesla’s worldwide deliveries have exceeded 500,000 vehicles, and NIO, XPeng, and Li Auto have all received varying degrees of market recognition. For FF, it won’t be easy to make a major breakthrough.

Let the bullet fly for a little longer.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.