On June 3, NIO released its financial report for the first quarter of 2025. The report shows a revenue of 12 billion yuan, with a year-over-year increase of over 21%; new vehicle deliveries totaled 42,000 units, increasing more than 40% year-over-year. However, the loss remains at 6.75 billion yuan, with only two quarters left to achieve William Li’s target of “profitability in the fourth quarter of this year.”

During the conference call following the release of the financial report, William Li presented NIO’s profitability formula: a combined monthly sales volume of 50,000 vehicles across three brands, with a gross profit margin controlled at 17%-18%, sales management expense ratio around 10%, and R&D expense ratio of 6% to 7%.

Looking solely at the loss figures, one can’t help but wonder if NIO is returning to the “ICU” situation of 2019. Comparing William Li’s target of 50,000 monthly sales against the record-high delivery of 31,000 units in December 2024, how will 50,000 units be achieved?

These two questions are the biggest concerns from the outside world.

This morning, several media outlets, including 42 Garage, conducted joint interviews with NIO’s founder, chairman, and CEO William Li, and co-founder, director, and president Lihong Qin. They disclosed significant information about business adjustments, technology pace, and operational strategies behind the financial report.

With only two quarters left until the profitability promise, how close is NIO to this target?

Losses Persist, Structure in Motion

Similar to previous quarters, the keyword in NIO’s Q1 financial report this year is “loss,” although slightly less than the last quarter. However, William Li expressed confidence in Q4 profitability during last night’s conference call: “The past few years were periods of high investment, this year’s Q2 marks the beginning of the harvest period, and we are very confident of achieving profitability in Q4.”

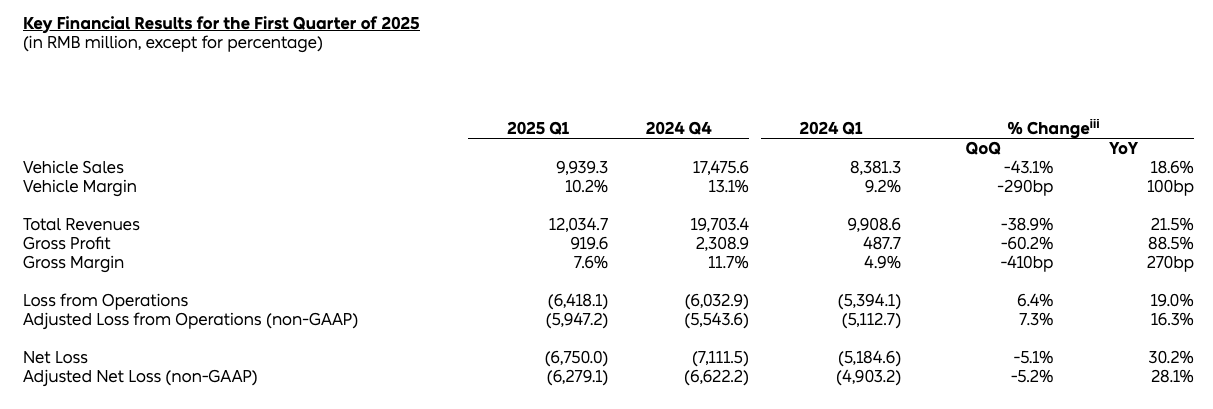

- Total revenue was 12.035 billion yuan, up 21.5% year-over-year, but down 38.9% quarter-over-quarter.

- Automotive sales revenue was 9.94 billion yuan, up 18.6% year-over-year, but down 43.1% quarter-over-quarter.

- Gross profit was 920 million yuan, up 88.5% year-over-year, but down 60.2% quarter-over-quarter; the gross profit margin was 7.6%, compared to 4.9% in the same period last year and 11.7% in the previous quarter; the automotive gross profit margin was 10.2%, compared to 9.2% in the same period last year and 13.1% in the previous quarter.

- The net loss was 6.75 billion yuan, increasing 30.2% year-over-year but decreasing 5.1% quarter-over-quarter.

- As of March 31, 2025, cash reserves (including cash, cash equivalents, restricted funds, short-term investments, and long-term fixed deposits) were 26.01 billion yuan, a decrease of 15.89 billion yuan quarter-over-quarter.

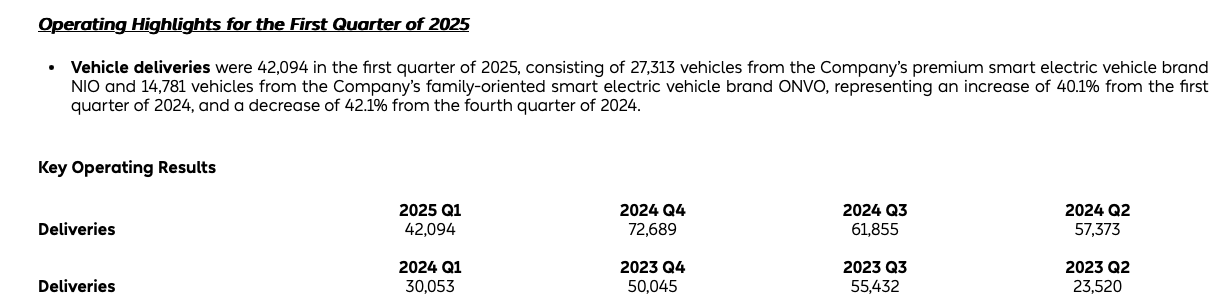

The pressure on the revenue side partly stems from changes in sales rhythm and price structure. In the first quarter of this year, NIO delivered a total of 42,094 new vehicles (NIO 27,313 units, ONVO 14,781 units), marking a year-on-year increase of 40.1%. This figure, due to seasonal factors, was lower than the 72,689 units delivered in the fourth quarter of last year.

The pressure on the revenue side partly stems from changes in sales rhythm and price structure. In the first quarter of this year, NIO delivered a total of 42,094 new vehicles (NIO 27,313 units, ONVO 14,781 units), marking a year-on-year increase of 40.1%. This figure, due to seasonal factors, was lower than the 72,689 units delivered in the fourth quarter of last year.

Both William Li and Lihong Qin hold optimistic views regarding the sales growth. At today’s media communication session, William Li stated: “The lowest point in the first quarter has passed, and starting from the second quarter, we are on an upward trajectory, which is an accurate assessment.”

Speaking about future sales, William Li projected that total deliveries for the second quarter would reach between 72,000 to 75,000 units, a year-on-year increase of 25.5% to 30.7%, setting a new quarterly delivery record.

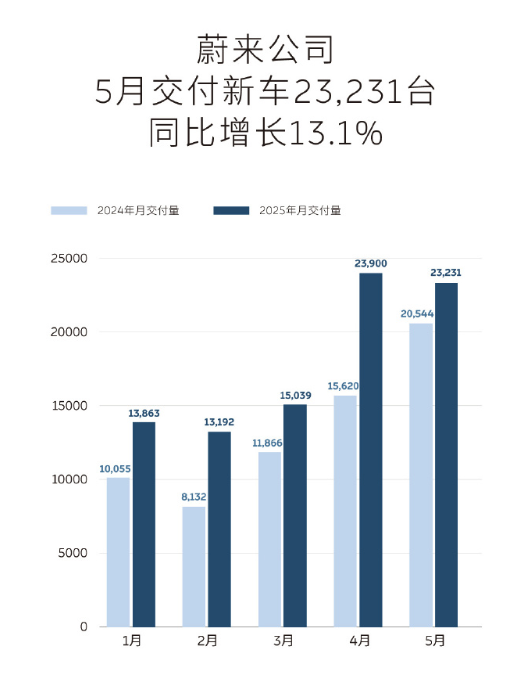

Based on the delivery data already announced for April and May, NIO’s June sales are expected to be between 25,000 to 28,000 units.

On the profitability front, due to promotional activities before the model update of the “5566” series in the first quarter, the average selling price fell by 15.3% year-on-year to 236,000 RMB, adversely affecting automotive gross margin performance.

In last night’s earnings call, William Li noted that with the launch of the 2025 model “5566” series, the average selling price of NIO’s new vehicles in the second quarter has already increased by over 10%, with gross margins also rising by close to 10 percentage points. CFO Steven Feng added that the gross margin per vehicle of the NIO brand is expected to recover to around 15% in the second quarter.

William Li places a greater emphasis on profit margins over sales volumes, indicating that there will not be any particularly aggressive sales targets set.

With the multi-faceted drivers of sales growth, price recovery, and cost optimization, NIO aims to steer its profitability trajectory onto the right path in the coming periods. However, this recovery still necessitates time and remains constrained by the rigid limitations of cash flow and resource allocation capabilities.

Regarding the significant reduction in cash reserves, Steven Feng mentioned that first-quarter sales decreased by nearly 30,000 units quarter-on-quarter, resulting in an outflow of approximately 10 billion RMB in operating cash flow. Yet, with reference to the sales guidance for the second quarter, NIO’s cash flow is expected to improve significantly and gradually realign.

William Li further stated that at the end of March, NIO completed a lightning share placement in the Hong Kong stock market, raising over HK$4 billion, with the proceeds arriving in April and not included in the first-quarter financials. “The increase in sales in April and May will directly lead to improved cash flow for NIO. From the current full-year perspective, NIO’s free cash flow should achieve a positive inflow.”

“Turning Tuition into Cash This Year”

During today’s two-plus hour media session, William Li rarely reflected on NIO’s ten-year development journey, recounting each experience of overcoming “life and death crises,” and candidly admitted that the company had failed to reach set targets on multiple levels.

Li Bin divided NIO’s journey of approximately a decade into three phases:

The first phase spans from the inception to 2021, marking the lifecycle of its first-generation products, establishing a business model as a “user enterprise,” and forming a “chargeable, swappable, and upgradable” battery system.

In this phase, the ES8, ES6, and EC6 claimed over 40% market share in the premium pure electric market (2021). NIO drove the “car-battery separation,” achieving a comprehensive system in August 2020. Furthermore, NIO House, NIO Day, and the innovative attempts with user communities and trusts essentially took shape in this initial stage.

This was the foundation NIO built.

Li Bin recounted that NIO faced critical challenges in 2019, emerging from its existential crisis post-2020. He highlighted NIO’s journey from global fundraising to bolstering China’s electric vehicle development.

The second phase, from 2022 to 2024, is characterized by two key aspects: not meeting operational targets and NIO engaging in significant countercyclical investments.

He attributes NIO’s inability to meet targets during 2022-2024 to changes in the external market and, more crucially, to internal strategic misalignments.

Li Bin pointed out that product issues, especially the misalignment between high-end product positioning and user needs, were notable. The 8 Series product, ES8, exhibited gaps in design, pricing, and user experience compared to expectations.

Moreover, during this period, the pure electric route also faced dual challenges from policy and market structure, especially amid a significant rise in lithium resource prices in 2022, where the pure electric path was pressured, while the pace for extended-range and plug-in hybrids surpassed pure electric vehicles.

Beyond product issues, Li Bin also reflected on the limitations of channel coverage. While NIO maintained solid performance in the Yangtze River Delta with a cumulative ownership exceeding 700,000 vehicles, representing more than half, it lagged behind traditional BBA internal combustion vehicles in broader regions such as Shandong, Hubei, Henan, and Jiangxi.

Channel issues aren’t new, yet in light of profitability becoming a key goal, expanding market reach has become increasingly pivotal.

“We have a ‘NIO-BMW Index’ (NBI) internally,” Li Bin explained. “In regions like Jiangsu, Zhejiang, and Shanghai, we might achieve 70%-80% of BMW’s sales, even surpassing 100% in specific areas, but in Jiangxi, it’s only 10%, and there are substantial gaps in the northeast and the north.”

In the second phase of NIO’s decade-long journey, even though business goals were not fully met, future infrastructural and R&D investments remain steadfast.

William Li noted that this raises a challenge: substantial quarterly losses over the past two years. Nevertheless, initial successes have been achieved: Firstly, the tri-brand layout is crucial for long-term delivery enhancements. Secondly, foundational technologies, with NIO’s 12 full-stack foundational technologies, covering chips, operating systems, smart chassis, AI, etc. Thirdly, the battery swap and charging network had an investment exceeding 100 billion last year, and has not slowed.

According to William Li, NIO entered its third phase this year, expressing hope that early investments and accumulations will enter a harvest period this year.

On the product side, William Li shared the latest delivery and car launch plans:

- In the first delivery month of ET9 (April), sales exceeded those of the BMW 7 Series and Audi A8 for the same period.

- The new four models of 5, 5, 6, 6 have begun delivery, completing the transition of main sales products.

- ONVO’s May delivery reached 6,281, setting a new delivery record for the year. ONVO’s sales service staff reduced by 40%, but sales increased by over 40%. Among ONVO users, 60% made battery swapping their first decision point. Currently, ROI calculations for battery swapping station planning indicate that more than half exceed 1. ONVO will retain independence in branding and stores but unify backend operations.

- In the first complete delivery month, Firefly tallied 3,680 units, surpassing the combined April sales of MINI (electric) + smart, with user satisfaction over 90%.

- L90 launches in Q3, “transforming the three-row SUV structure, becoming a key turning point.”

- ES8 launches in Q4, heralded by Li as “The King’s Return.”

However, compared to the 2019 crisis, which was mitigated by “external financial support,” NIO this time highlights an emphasis on internal self-sustaining growth to emerge from the past three years’ trough.

Starting last year, NIO streamlined organizational capabilities, progressing to product control and management efficiency improvements this year. Li provided the following timeline: effects are evident starting Q1, with 60% to 70% adjustments reaching completion by Q2, continuous acceleration (80%-90% completion) by Q3, and profitability targets achieved by Q4.

“This time it’s about managing our way out, a consensus reached throughout the company,” stated William Li.

Based on William Li’s remarks, NIO’s core efforts are focused on three directions: First, driving price recovery through product updates to restore the brand’s core strength; Second, continuous cost reduction via self-developed chips and organizational optimization; Third, advancing step-by-step against key indicators for the Q4 profitability target. Compared to last year, the overall pace is more pragmatic, with clearer strategies on where and how to make improvements.From the actual performance in the first quarter, this strategy is still in its early recovery phase: limited sales rebound, pressure on gross margin, rapid decline in cash reserves, and synergy and market differentiation among the three brands remain to be verified.

“**We believe that the lowest point was in the first quarter of this year, and the upward trajectory begins in the second quarter.” said Li Bin.**

“This time, we have to rely on ourselves.”

During the interview, Li Bin addressed various key issues related to the profitability model, organizational adjustments, product technology pace, and sales, attempting to explore the possibilities for NIO to transition from its current situation to anticipated goals through fundamental mechanisms. Below is the edited content of this interview with its original meaning preserved:

Q: To what extent will implementing the World Model improve sales?

Li Bin: NWM will indeed help boost sales. Over the past year, NIO has made significant efforts in active safety, but reputation has been slow to form and users haven’t fully experienced it. We previously placed urban navigation assistance further back, but we have now addressed this.

The new “5566” will be pushed by the end of June, resulting in a three-week gap, as migrating from Banyan to our own chip requires time for extensive testing. By mid-June, the test drive of our main models should allow everyone to have a better experience, which will surely aid sales conversion.

Q: There are rumors that NIO has lagged behind competitors in multiple smart driving milestones over the past year. I am curious about your perspective on this.

Li Bin: Many things are quickly forgotten. We were the first to introduce NIO Pilot in China and the first to implement navigation assistance on highways. In fact, if speaking of rule version, last year, we were the first to enable it across more than 700 cities, which was just a year ago. Our initial focus on safety in end-to-end solutions is aligned with NIO’s R&D priorities. In the urban sector, we were indeed about six months late compared to peers.

If we layer smart driving into levels, its value lies in accident reduction and reducing driver workload. We have always prioritized accident reduction, though it’s less perceptible to users. During NIO Day last year, four insurance companies verified a reduction of over 20% in accident rates, and it is undoubtedly higher now. We haven’t always lagged; we used to lead, and now we lead in safety scenarios. In urban areas, we’re now back in the industry’s leading ranks. One must view smart driving comprehensively.

Q: The entire new ES8 is greatly anticipated this year. What are its competitive advantages over peers? Where is the investment focused? What are the expectations for it?

Li Bin: The ES8 will be delivered in the fourth quarter, and it is certainly technologically advanced, superior in overall experience, excellent in service, and highly cost-competitive. During the second generation, we focused more on the global market, playing it a bit safe in size, but the third generation ES8 is definitely designed with more freedom in terms of space.Qin Lihong: The Ministry of Industry and Information Technology’s announcement for the third-generation ES8 is expected to be released in June. Soon, everyone will see some of its information.

Q: During the earnings call last night, it was mentioned that ONVO might reach a monthly sales of 25,000 for its three models in the fourth quarter this year. What are NIO’s expectations for the L60, L80, and L90?

Li Bin: We certainly hope for more L90s and L80s since their gross margins are somewhat better. However, the L60 has the potential to stabilize at a monthly sales of 10,000 units. With reasonable expectations, the goal for L80 and L90 combined is around 15,000 units per month.

Q: Is our planned monthly sales target of 50,000 based on actual calculations or just expectations? Could there be a shortfall like the previous situation with ONVO?

Li Bin: The quarterly report tends to lag behind; the most challenging quarter is now behind us, and our sales are continuously rising. With various improvements, we are confident in reaching 25,000 units for the ONVO brand and levels of 3,000 to 5,000 for the Firefly models in the fourth quarter. We reached 30,000 units last December; currently, we’re seeing approximately 25,000 units per month, with more groundbreaking models yet to be launched and strategic channel deployments showing effects progressively. All our cars are the latest models, and there is no reason for us to fall short.

Overall, we remain confident. Although initial expectations for the L60 were high, we’re now focusing on achievable goals. Last year saw around a 40% increase, with no new models apart from the L60. If executed well in the coming months, 50,000 units is not out of reach.

Qin Lihong: We have our targets and progress pace, but even if we slightly miss 50,000 units, it’s not a concern. Although June has just begun, the second quarter is likely to see a sales increase of over 70% compared to the first quarter, with an improved gross margin and further reduced expenses. As a listed company, we cannot make irresponsible profit forecasts or investment advice due to pressure, as it would be against legal compliance standards for public companies. However, the lowest point is behind us, making now an opportune time.

Q: Do we have any new plans for channel expansion if we’re looking to tap into lower-tier markets?

Qin Lihong: We’re engaging through two strategies, akin to a combination of “positional warfare” and “guerrilla warfare.” Some regions use a direct sales system with higher short-term investment but greater long-term stability, while others utilize a promotional approach through charging stations and teams interacting with potential local clients. This is actively being implemented on a large scale.

Q: What specific reform measures has NIO undertaken recently?**Li Bin: This adjustment aims to cultivate a bottom-up business mindset, where the entire company, not just Li Bin and Qin Lihong, takes responsibility for business outcomes. Every individual must be accountable for their tasks. Our goal is not simply to pursue sales but to focus on the final business result—profit or loss, P&L responsibilities should be borne by everyone.

Starting in May, each frontline fellow will clearly understand their costs and the revenue they’ve generated for the company. Every car is different, and we consider fellows as fundamental business units. Under this company-wide operational logic, several colleagues have indeed left, whether actively or passively.

Q: During the earnings call, management mentioned the intention to control R&D expenses within 2 to 2.5 billion RMB per quarter. Is this a strategic phase, or will NIO maintain this intensity in the long term?

Li Bin: Our R&D focus is on improving efficiency. Although current expenses are around 3 billion per quarter, we will reduce this to 2 to 2.5 billion RMB, reflecting a more than 20% efficiency gain. Essentially, striking this R&D spend will sustain our current R&D intensity, primarily by eliminating low-ROI projects and concentrating resources on high-output initiatives.

Spending 2 to 2.5 billion RMB on R&D ensures our competitive needs without compromising our R&D competitiveness under our current management direction.

Q: Is the current situation NIO faces more challenging than in 2019?

Li Bin: Overall, 2019 was definitely more difficult due to luck and strategic investors from Hefei and Anhui, which helped rescue us from an “ICU” status. We relied heavily on external help to navigate through 2019.

The situation is different now; our resilience has significantly increased since 2019. Moreover, our investments are beginning to yield returns this year.

However, today’s challenges differ; competition is more intense compared to 2019-2020. While this year requires comprehensive company improvement and strengthening, the main distinction is generating our own “blood” instead of depending on external resources, as was needed in 2019.

Q: Chinese car companies are entering a new round of price wars. How long do you expect this will last, and what impacts will it have on upstream and downstream industries? Will it affect NIO’s Q4 profits?

Li Bin: We have always opposed price wars and are pleased to see政府 (government) taking action.Industry chaos has prompted calls from industry associations. Behind the price war is still the mentality of “winner takes all.” I have always believed that this mindset does not align with the overall development pattern of the automotive industry. After all, the automotive industry is not platform-based, and such thinking will keep the entire industry in a state of low-level and vicious competition. We hope the industry can genuinely compete in technology, quality, and service. Only then can the industry achieve healthy and sustainable development, maintaining the hard-earned favorable position of China’s intelligent electric vehicle and new energy industries.

This article is a translation by AI of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.