After tasting the sweet success of “1+1>2” from the merger of Lynk & Co with ZEEKR, Geely is evidently more determined.

Yesterday afternoon, Geely and ZEEKR released their Q1 2025 financial reports, followed by Geely’s “Q1 Performance Release and ‘One Geely’ Strategic Integration Plan Briefing.” In the evening, ZEEKR Intelligent Technology also held a performance briefing regarding their Q1 report.

At the afternoon meeting, Geely Holding Group CEO and Geely Automobile Holdings Limited Vice Chairman and Executive Director, Li Donghui, ZEEKR Technology Group CEO, An Conghui, Geely Automobile Holdings Limited President and Executive Director, Gui Shengyue, and Geely Automobile Group CEO and Geely Automobile Holdings Limited Executive Director, Gan Jiayue, unveiled significant information on Geely’s personnel and structural adjustments, as well as the merger progress and new product plans of Geely and ZEEKR.

Behind the dazzling financial data, the more crucial signal is that Geely’s pace towards deep integration is accelerating.

From integrating Lynk & Co into ZEEKR, coordinating the brands to currently pushing for ZEEKR’s privatization and integrating the listed platform, Li Shufu and his management team are compressing redundancies and tightening focus to tackle the fierce global market competition with “One Geely.”

Yesterday afternoon, Gui Shengyue admitted at the meeting that the integration process was not smooth, experiencing internal inefficiencies and conflicts of interest. Yet, they see huge dividends from synergy through the process.

Geely’s swift market response and frequent actions make each step a critical turning point. If the last integration led ZEEKR out of loss, how will this more thorough merger propel Geely and ZEEKR towards a new destination?

Fists Clenching

During the nearly two-hour performance release and strategic integration plan briefing yesterday afternoon, the “One Geely” strategy was materialized into a clear organizational framework and substantial capital movements.

On May 7, Geely Automobile Holdings Limited (hereinafter referred to as Geely Automobile) announced its plan to acquire all issued shares of ZEEKR Intelligent Technology Co., Ltd. If completed, ZEEKR will fully merge with Geely Automobile.

This not only means that two of Geely’s internally independent subsidiaries will come under unified operation, but it also signifies a more comprehensive phase: brands, organization, and capital are being fully consolidated, the “fist” is clenching.

The organizational structure and personnel adjustments announced by Geely Automobile yesterday are as follows, to adapt to business development needs upon transaction completion:

-

Li Donghui will become Vice Chairman of Geely Holding Group, overseeing the daily management of the Board and the Group’s investment and financing management, playing an important role in capital operations and major external cooperation projects.

-

An Conghui will assume the role of CEO of Geely Holding Group, fully responsible for the operational management of Geely Holding Group. Before the merger is completed, An Conghui will continue to serve as CEO of ZEEKR Technology Group.

-

Gui Shengyue will remain CEO and Executive Director of Geely Automobile.

-

Gan Jiayue will continue as Executive Director of Geely Automobile and will become CEO of the merged Geely Automobile Group, which will include the GEELY business group and ZEEKR Technology business group.- Additionally, to cultivate young, multi-skilled senior management talent, Dai Qing has been appointed as the rotating president of Geely Holding Group as of March 29, 2025, reporting to the CEO of Geely Holding Group.

More importantly, there is a capital merger between Geely and ZEEKR. According to the disclosed plan, Geely Automobile will acquire all the outstanding shares of ZEEKR Technology through privatization, leading to the latter’s delisting from the NYSE and a complete integration from business to listing platform.

At Geely’s performance conference, Gui Shengyue, CEO and Executive Director of Geely Automobile Holdings Limited, emphasized the strategic significance of this integration: “The merger of 175 (Geely Automobile) and ZEEKR is strategically significant for promoting deep internal resource integration and efficient coordination, eliminating redundant investments, reducing costs, enhancing corporate competitiveness, and creating long-term corporate value. This is the core logic of our merger. During the shareholders’ meeting, 99.99% approval of the merger was achieved, reflecting the high recognition of deep integration by the shareholders.”

Gan Jiayue also stated that the future must avoid redundant investments.

However, the integration of two independently listed companies is not simple. Gui Shengyue candidly discussed several issues in the merger of Geely and ZEEKR Technology Group.

One is the efficiency of integration. Although it is an internal merger, Geely and ZEEKR are two independent listed companies, making it a complex process, with many aspects needing confirmation by the respective boards of listed companies, leading to inefficiency and slow progress.

Another is the problem of misaligned interests. Gui Shengyue said, “Geely and ZEEKR Technology Group each have their own employee incentive mechanisms, which create misaligned interests, and during actual operations, different teams will inevitably strive for preferential benefits for their respective companies, substantially diminishing the effectiveness of the integration.”

However, Gui Shengyue indicated that the cash involved in this merger might not be substantial.

Compared to a declarative statement and a plan, the integration must genuinely happen by acting from the organizational roots. This is also the reason why, just after completing the merger of Lynk & Co and ZEEKR, Geely decided to accelerate again, integrating ZEEKR into a unified platform. In the eyes of the leadership, the pace of change cannot stop, nor can it be afforded to stop.

“In fact, from the merger of ZEEKR and Lynk & Co, we have already perceived a very significant benefit.” Gan Jiayue stated at the conference. After the integration with Geely, ZEEKR’s efficiency target will be even greater, with an initial goal of exceeding 5% in future integration, and improvements in R&D, management, and marketing efficiency are expected to reach 15%-20%.”

An Conghui added, according to internal estimates, the cost savings from the synergy between Geely and ZEEKR on the R&D level alone is expected to reach tens of billions annually. The consolidation of joint financial, legal, and human resources systems has already yielded substantial cost reductions last year.These data have become crucial support for the continued progress of the merger plan, and they have elicited a positive response from the capital market in the short term.

On May 7, after Geely announced plans to privatize ZEEKR at $25.66 per share, ZEEKR’s stock price on the US market surged over 11% pre-market and closed up 11.51%, at $25.19, nearing the privatization offer, indicating a positive market sentiment towards the merger plan. As of the time of writing, ZEEKR’s stock price stands at $28.3, surpassing the privatization offer.

Regarding whether other brands will be further integrated, Geely Holding Group’s CEO and Deputy Chairman and Executive Director of Geely Automobile Holdings Limited, Li Donghui, clearly stated that there are no plans to integrate Polestar, smart, or LOTUS into a unified platform at the moment. “Geely Holding Group currently has no privatization plans for any listed companies other than ZEEKR, and there are no discussions on privatization issues within the entire Geely Holding Group or regarding other individually listed related companies.”

The boundaries of “One Geely” have been delineated at this stage, but the depth of integration continues to extend inwards.

Guisheng Yue said integration is a necessity. “Why so quickly? Time waits for no one.”

Can Growth Continue Amidst the Merger?

The merger of Geely and ZEEKR isn’t a spur-of-the-moment decision. Since the “Taizhou Declaration” was issued last September, integration has been ongoing. With the release of the first quarterly report after ZEEKR’s consolidation with the Lynk & Co brand, it is time to evaluate the effects. How much has ZEEKR Technology Group saved after merging with Lynk & Co?

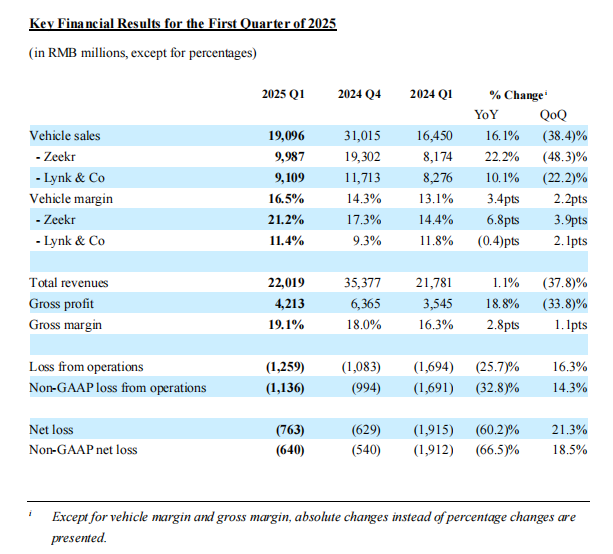

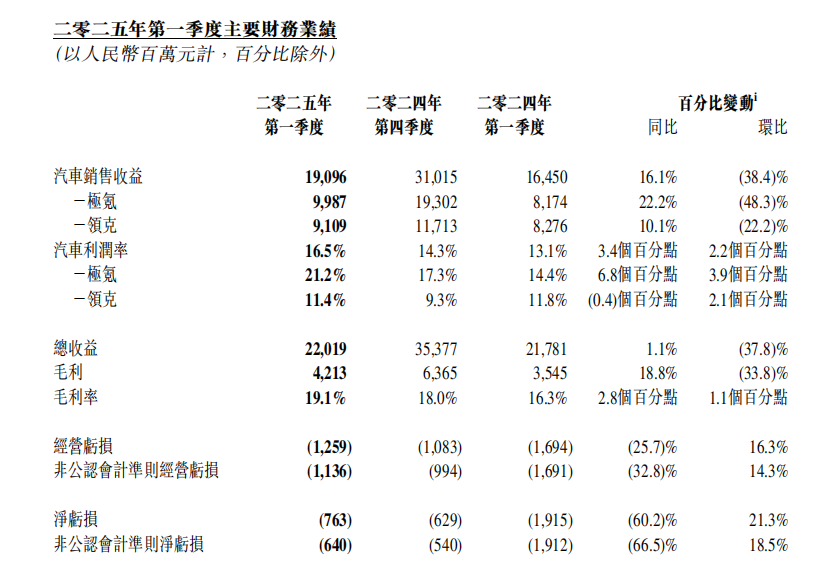

At Geely’s first-quarter performance communication meeting yesterday, An Conghui interpreted the achievements of the ZEEKR and Lynk & Co merger with some financial data:

-

ZEEKR Technology Group achieved a comprehensive gross profit margin of 19.1% in the first quarter, with the ZEEKR brand reaching 21.2%, demonstrating the financial performance of a luxury brand. According to Hong Kong accounting standards, ZEEKR has achieved profitability;

-

In terms of marketing investment and management expenses, last year’s first-quarter sales expenses were 2.17 billion, this year’s first quarter is 2 billion, and last year’s fourth quarter was 3.14 billion, showing a substantial decline year-on-year and quarter-on-quarter; management expenses have also significantly decreased;

-

In R&D, last year’s first quarter for ZEEKR and Lynk & Co combined was 2.33 billion, last year’s fourth quarter was 3.91 billion, and this year’s first quarter is 2.91 billion;

-

R&D expense ratio decreased from 13.2% in the first quarter of last year to 11.9% in the first quarter of this year.

Although ZEEKR’s net loss in the first quarter of this year is still 763 million, it has decreased by 60.2% year-on-year, restoring some market confidence. After all, a year ago, ZEEKR was deeply mired in losses, with its IPO pace repeatedly delayed, and the path to profitability seemed distant. From 2021 to 2024, ZEEKR’s net losses were 4.514 billion, 7.655 billion, 8.264 billion, and 5.79 billion respectively, with cumulative losses exceeding 26 billion.

However, cost reduction is not everything. For ZEEKR, the key lies in regaining market momentum after a preliminary recovery in profitability.

After yesterday’s afternoon meeting, ZEEKR Intelligent Technology held its first-quarter earnings call in the evening. During the meeting, for compliance reasons, the management did not disclose information about Geely’s privatization offer for ZEEKR, focusing instead on sales and the super electric hybrid technology.

Management, including An Cong Hui, stated: ZEEKR’s sales in the first four months of the year were not satisfactory, but within the expectations of the company and management. Despite the lack of new product launches affecting sales in the first quarter, the annual sales target remains unchanged: ZEEKR targets 320,000 units, Lynk & Co 390,000 units, totaling 710,000 units.

ZEEKR is confident about increasing sales and gross profits in the second half of the year: “The ZEEKR 007 GT achieved 10,000 offline deliveries from April 15 to May 15, the orders for the 009 Glorious Collectible Edition exceeded expectations after its launch, and the Lynk & Co 09 has received over 40,000 substantial orders since its release last December.”

Expanding Outward, Intensifying Inward

If organizational restructuring and halting financial losses have allowed Geely to regain its footing, ultimately determining its long-term success are the dual strategies of globalization and intelligentization. Neither path is easy at present.

According to the financial report, in the first quarter of 2025, Geely’s total auto sales reached 704,000 units, a year-on-year increase of 48%, setting a new historical record; operating revenue was 72.5 billion RMB, up 25% year-on-year; net profit attributable to the parent company was 5.67 billion RMB, a rise of 264%; and among these, new energy vehicle sales were 339,000 units, up 135% year-over-year.

Regarding Geely’s first-quarter performance, Guisheng Yue highlighted five key points in the meeting yesterday:

- First, the industry trend of first-quarter sales being lower than the previous quarter was broken, achieving sequential growth;

- Second, the combined efforts of ZEEKR, Lynk & Co, and GEELY, the three major new energy brands, have propelled the new energy boom;

- Third, several models have led in their respective segments, with Geely’s Xingyuan selling over 35,000 units for two consecutive months, becoming the cumulative all-category sales champion from January to April with 117,000 units sold;

- Fourth, Geely has become the only car enterprise worldwide to complete a full-fledged AI intelligentization layout, transitioning towards a tech company focused on intelligent technologies;- Fifthly, the sales return on sales (ROS) has risen from 2.7% at the same time last year to 4.8%, entering the top tier of the industry.

Gui Shengyue said, “Our ROS level should represent the profitability of China’s leading automakers. I believe this figure significantly reflects the results of Geely’s comprehensive capabilities, showcasing the success of our deep integration efforts that began last year.”

In acknowledging these achievements, the management did not shy away from issues. “Exports have not declined, but they also haven’t shown strong growth.” Gui Shengyue admitted there are still shortcomings in the overseas market strategy: insufficient company resources for supporting overseas markets, lack of localized product configurations, limited variety of popular new energy vehicle models, slow organizational response, and inadequate research mechanisms. These factors combined resulted in Geely exporting 90,000 units in the first quarter, achieving only a 2.2% year-on-year increase, which is below the overall car export growth rate.

To reverse the overseas situation, Geely plans to establish a fast response mechanism, changing the fragmented approach of different brands operating independently in international markets. Export volumes are expected to increase starting next month.

According to Gan Jiayue, future overseas plans include developing four key regional markets: aiming for the top sales position among Chinese brands in the Middle East with an annual target of over 50,000 units; targeting 150,000 to 200,000 units in Eastern Europe and pan-European markets; expecting over 100,000 units annually in the Asia-Pacific market and striving to exceed 50,000 units in the Latin American market. The Asia-Pacific region has already achieved about 28,000 units in the first quarter, and confidence is high for surpassing 100,000 units for the year. Gan Jiayue stated that after May, Geely’s international sales will return to over 30,000 units monthly, aiming for continuous month-over-month growth.

Another issue lies in marketing and after-sales services. Gui Shengyue said that the automotive competition in the Chinese market is complex, and Geely has many shortcomings in marketing and after-sales. He predicts that Geely may continue to reach historic highs in sales each quarter and is very confident in exceeding this year’s annual target.

In terms of products for export, there is coordination in the rhythm. Gan Jiayue said, “By the end of the second quarter, we will launch an A+ class and mid-range, A+/B- sedan. This model will aim to become a benchmark in the mainstream segment. Additionally, at the beginning of the fourth quarter, we will release two more products, and next week, GEELY will debut a large flagship 6-seater SUV in Milan, Italy. In the fourth quarter, we plan to introduce 1 to 2 additional products to the market as opportunities arise.”

This clarifies the “going global” route, leaving the rhythm and execution to be addressed.

For Geely, the focus on “internal development” is an all-in commitment to the field of intelligence.

In yesterday afternoon’s meeting, Gui Shengyue announced that Geely has completed the “comprehensive AI intelligent layout,” becoming the world’s first car company to cover the three dimensions of computing power, algorithms, and data. Technologies including end-to-end voice large models, AI Digital Chassis, AI Cockpit, and the Qianli Haohan Driver Assistance System are gradually being integrated into multiple product lines within the group.All future products of GEELY Galaxy will be equipped with the Qianli Haohan Intelligent Safety Assisted Driving System, truly popularizing intelligent safety assisted driving. Currently, the Qianli Haohan H1 solution has been first equipped on the GEELY Galaxy Shine 8 and the all-new GEELY Galaxy E8. In the second half of this year, both new and facelifted products of the GEELY Galaxy brand will feature different levels of the Qianli Haohan Intelligent Safety Assisted Driving solutions.

However, intelligence is not a technology breakthrough at a single point. How to truly “get these technologies on board” and form a mass-producible, deliverable, and iterative product experience is a test from research and development capacity to product strength.

On one hand, there’s the ambition for globalization; on the other, there’s the internal upgrade of the technological system. Geely is undergoing a structural transformation, grappling with a transition from “having many babies to win battles” to clenching its fist to meet challenges head-on. Short-term financial improvements are certain, but how to navigate the uncertainties of the next phase still requires time to prove.

Hopefully, Geely’s trajectory will be as Guisheng Yue concluded at the end of Geely’s performance conference: “I think we are currently in a state where Geely has a very clear strategy, and everyone is unprecedentedly united. We have seen the results of the past few years of effort in terms of intelligence, new energy, and corporate governance gradually emerge. So, I believe, the current Geely is very much worth everyone’s anticipation.”

This article is a translation by AI of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.