Last year at this time, MEGA’s release plunged LI Auto into its darkest moment, causing plans for launching pure electric products to be temporarily shelved. After a year of twists and turns past a sales nadir, has LI fully emerged?

Today, the fourth quarter and annual earnings report released by LI Auto gives a definite answer: with the additional volume brought by the L6, LI has escaped the sales quagmire, but has suffered the side effects of “price for volume.”

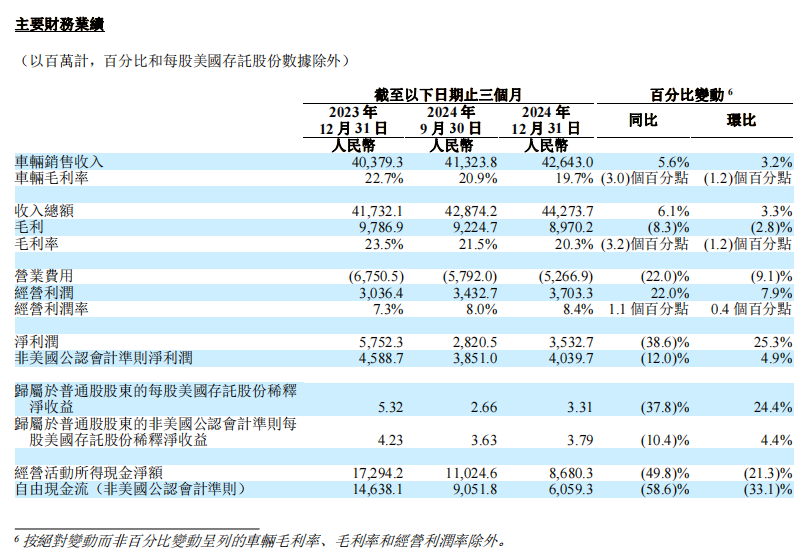

Both the fourth quarter and the annual financial data for 2024 show a trend of significant sales increase, but with varying degrees of decline in profitability. The overall gross margin for the fourth quarter was 20.3%, down 3.2 percentage points year-on-year, and down 1.2 percentage points quarter-on-quarter. The gross profit was 9 billion yuan, down 8.3% year-on-year, and down 2.8% quarter-on-quarter.

The annual gross margin was 20.5%, a decrease of 1.7 percentage points year-on-year, with a net profit of 8 billion yuan, down 31.9% year-on-year; however, gross profit increased by 7.9% year-on-year.

In the earnings call following the report, LI Auto management, including Li Xiang, Ma Donghui, Li Tie, and Zou Liangjun, addressed questions around products, market, intelligent driving, charging network, and overseas planning.

This year, LI Auto will release two pure electric SUVs, with the i8 expected to be released in July, followed by the i6 in the second half of the year.

Regarding the construction of the supercharging network, LI’s goal is to establish over 2,500 self-operated supercharging stations nationwide before the i8 hits the market, with the milestone of launching the 2,000th station to be completed in the first quarter.

In terms of intelligent development, LI Auto plans a significant increase in investment related to AI, positioning the company as a terminal enterprise in the AGI era. Li Xiang further explained the AI strategy planning.

Moving forward, LI as an automaker needs to rely on new and high-end products to balance sales and profitability; as an AI enterprise, LI needs to gradually realize the repeatedly depicted blueprint of intelligence.

Earnings Report Lacking Surprises

In the third quarter of 2024, LI Auto’s report card exceeded expectations, with both delivery and revenue reaching record highs. However, in the fourth quarter, during the key season for boosting sales, LI’s performance was not outstanding, with revenue growth slowing considerably and profitability slightly regressing.

Following the earnings report, LI Auto’s stock price in the U.S. pre-market trading took a short dive, dropping nearly 6% at one point. At the time of writing, U.S. stocks were down 2.12%.

Let’s take a look at the key financial indicators for the fourth quarter:

- Total revenue was 44.3 billion yuan, up 6.1% year-on-year, and up 3.3% quarter-on-quarter, with growth slowing significantly; vehicle sales revenue was 42.6 billion yuan, up 5.6% year-on-year, and up 3.2% quarter-on-quarter.

- The company’s overall gross margin was 20.3%, compared to 23.5% in the same period last year and 21.5% in the previous quarter, down 3.2 percentage points year-on-year and 1.2 percentage points quarter-on-quarter; gross profit was 9 billion yuan, down 8.3% year-on-year and down 2.8% quarter-on-quarter. Among them, the vehicle gross margin was 19.7%, compared to 22.7% in the same period last year and 20.9% in the previous quarter, with declines both year-on-year and quarter-on-quarter.- Net profit was 3.5 billion yuan, down 38.6% year-on-year, up 25.3% quarter-on-quarter.

- Free cash flow was 6.1 billion yuan, down 58.6% year-on-year, down 33.1% quarter-on-quarter.

- Cash reserves stood at 112.8 billion yuan, showing a slight increase from the third quarter’s 106.5 billion yuan.

In the fourth quarter of 2024, the growth of

When extending the timeline to the whole of 2024, one can observe that the trends of

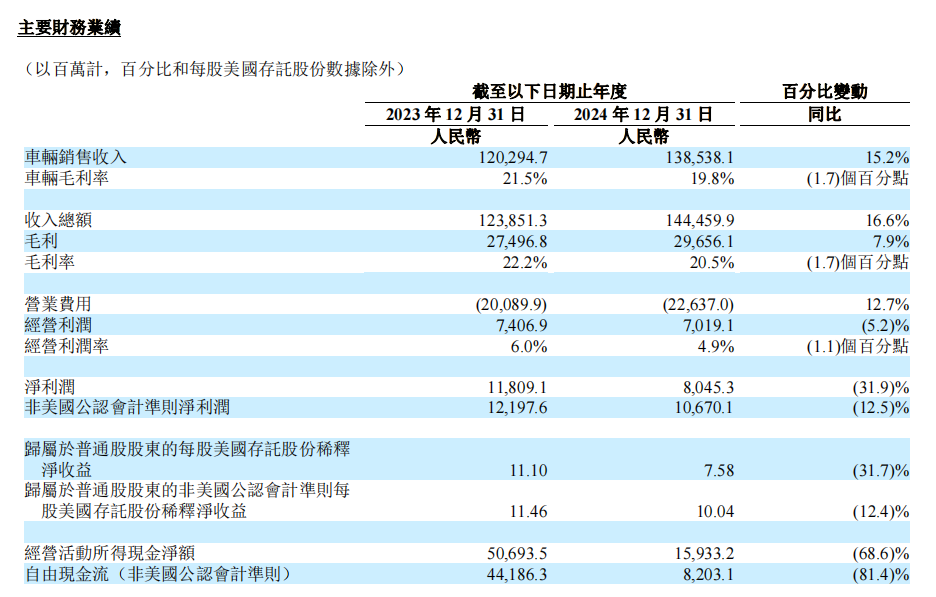

- The total annual revenue was 144.5 billion yuan, up 16.6% year-on-year; vehicle sales income was 138.5 billion yuan, up 15.2%.

- The annual gross margin was 20.5%, compared to 22.2% in 2023, a year-on-year decrease of 1.7 points; gross profit was 29.7 billion yuan, up 7.9% year-on-year. Specifically, vehicle gross margin was 19.8%, compared to 21.5% in 2023.

- Net profit was 8 billion yuan, down 31.9% year-on-year.

- Free cash flow was 8.2 billion yuan, down 81.4% year-on-year.

- Cash reserves increased by 8.8% year-on-year, reaching 112.8 billion yuan.

However,

Conversely,

Overall,

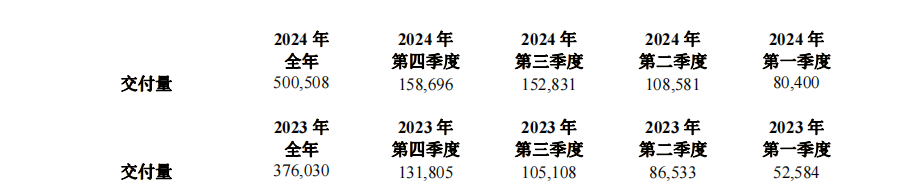

LI Auto experienced a significant highlight in sales during 2024.

As of December 31, 2024, LI Auto’s annual deliveries grew by 33.1% year-on-year, reaching 500,508 units, setting a record as the fastest luxury car brand to surpass 500,000 annual deliveries in the Chinese market; cumulative deliveries reached 1,133,872 units, becoming the first Chinese new force automobile brand to achieve the milestone of 1 million cumulative deliveries. The cumulative deliveries of each product in the L series exceeded 200,000 units.

In the fourth quarter of 2024, LI Auto’s deliveries totaled 158,696 units, a year-on-year increase of 20.4%, once again setting a historical high.

Furthermore, in the 200,000 RMB and above new energy vehicle market, LI Auto’s cumulative annual market share rose to 15.3%, ranking first among Chinese brands.

After MEGA’s setback, the LI L6 emerged as a remarkable contender, helping LI Auto overcome a sales slump.

The LI L6, in less than 9 months since launch, achieved cumulative deliveries of 192,000 units in 2024. On February 27, LI Auto announced that cumulative deliveries of the LI L6 had surpassed 220,000 units, maintaining the top position in mid-to-large SUV sales for 9 consecutive months and leading the range-extended electric vehicle sales for 8 consecutive months. Since starting deliveries last April, the LI L6 surpassed a monthly sales figure of 20,000 units in 7 out of the 9 months.

The LI L6 success effectively addressed LI Auto’s growth impasse, with February deliveries amounting to 26,263 units, half of which were L6. This “dark horse product,” born out of crisis, shows no signs of a lifecycle decline.

However, alongside rapid sales growth, LI Auto’s revenue may face a decline in the first quarter this year.

LI Auto’s 2025 Q1 performance guidance indicates expected delivery growth with a revenue decrease, reflecting a lack of confidence in current profitability:

- Q1 2025, vehicle deliveries are estimated to be between 88,000 and 93,000 units, representing a 9.5% to 15.7% year-on-year increase.

- Total revenue is projected at 23.4 billion to 24.7 billion RMB, a year-on-year decline of 8.7% to 3.5%.

In tonight’s earnings call, LI Auto’s CFO, Li Tie, stated in response to investor inquiries that due to year-end and Spring Festival promotional activities, the Q1 gross margin guidance is around 19%, further dropping compared to Q4 2024.According to the latest financial report data, LI Auto’s deliveries in January and February 2025 were 29,927 and 26,263 units, respectively. This implies that LI Auto’s sales expectation for March is above 31,810 units. Compared to past sales targets, LI Auto now aims for stability in achieving its goals.

The “price for volume” strategy not only affects LI Auto’s profitability but also impacts the premium brand image it has been striving to build. Investors showed their response with their capital, as LI Auto’s stock price experienced varying degrees of decline following the semi-annual, third-quarter, and annual reports released last year.

Exiting the sales predicament, LI Auto urgently needs high-margin products and new growth drivers to instill confidence among investors and potential customers.

In 2024, besides launching the hit model L6, LI Auto has made several efforts and preparations to consolidate its brand image, enhance product competitiveness, and welcome the arrival of its pure electric series.

Firstly, a series of actions in intelligent driving and smart development have placed LI Auto at the forefront of intelligent driving and smart development.

In July 2024, LI Auto fully rolled out map-free NOA, which is usable nationwide, to all LI AD Max users without relying on prior information. Following this, in October 2024, after three months, LI Auto once again realized a tech stack update for LI AD Max and fully deployed a new dual-system intelligent driving solution featuring end-to-end (E2E) and Vision Language Model (VLM) to LI AD Max users.

Subsequently, in November, LI Auto launched “parking-to-parking” one-click intelligent driving and nationwide highway toll station ETC autonomous passage functions based on the above technology, achieving 100% coverage of daily driving scenarios.

On February 27 of this year, the LI Auto OTA 7.1 version was fully released, with AD Max V13 training data reaching 10 million clips. Since the initial internal test with 1,000 personnel starting in late July 2024, AD Max completed a tenfold increase in training data from 1 million clips for the initial model to 10 million clips within seven months.

The intense and preemptive cadence of intelligent driving updates left competitors behind and earned users’ trust.

As of mid-December 2024, the sales share of AD Max grew from about 20% in February to over 50%, with a sales share of AD Max for models priced over 300,000 exceeding 75%.

Additionally, in terms of the ultra-charging network layout, by the end of 2024, there were 1,727 LI ultra-charging stations and 9,100 charging piles in operation; as of the end of February this year, 1,874 LI ultra-charging stations were in operation, equipped with 10,008 charging piles. During the Spring Festival holiday, the online rate of highway charging equipment maintained a level of 99.9%.

In terms of channel development, LI Auto’s strategy can be summed up as penetrating deeper, being flexible, and targeting precisely.

By the end of 2024, LI Auto will have 502 retail centers in 150 cities across China, and will operate 478 after-sales service centers and LI Auto authorized body and paint centers in 225 cities.

During tonight’s earnings call, LI’s Senior Vice President of Sales and Service, Zou Liangjun, mentioned that based on the after-sales centers, LI has also launched the “Star Plan”, which involves enhancing LI’s coverage in fourth and fifth-tier cities by partnering with after-sales service collaborators.

The flexibility is shown by, in addition to official stores, LI has opened more than 200 retail showrooms and 60 pop-up stores, and increased dedicated online streaming teams for a broader customer reach.

Additionally, Li Xiang mentioned in the call that both the quality of store openings and sales efficiency for LI Auto in 2024 have significantly improved. By gradually converting stores in lesser malls to key centers in automotive city hubs, the proportion of central stores increased from 24% at the end of 2023 to 42% by the end of 2024. The total number of exhibition spaces nationwide increased from over 2,600 to more than 3,700.

Thus, LI’s cost structure in channel development has been optimized, reducing unnecessary operating expenses and making its channel strategy more precise.

Moreover, LI is quickening its pace in building its overseas R&D, dealership channels, and after-sales service networks. In January 2025, LI Auto’s first overseas R&D center will officially open in Munich, Germany. LI has also established direct-service centers in Kazakhstan, Dubai, and Uzbekistan, with plans to enhance overseas expansion this year.

Zou Liangjun stated that internationalization and overseas markets are core strategies of the company, and an independent overseas market expansion department was established at the beginning of this year. LI is confident about gaining significant market increment overseas, thanks to product competitiveness from technological iteration, along with flexible and precise market strategies and channel expansion, instilling overall confidence in sales growth this year.

Supercharging stations, channels, and intelligent driving capabilities are all well-prepared. As for the core product line, can the upcoming i8, LI’s second pure electric product after MEGA, fulfill the role of redeeming the reputation of LI’s electric line and persuading the market?

The i8: An Indispensable Success?

During tonight’s earnings call, Li Xiang clearly laid out the release schedule for this year’s electric products: Two new electric SUVs will be launched this year, with the i8 expected in July and the i6 also set to launch in the second half of the year, following a rhythm similar to the 2022 releases of L9 and L8.For this arrangement, Li Xiang remarked, “Such a rhythm not only allows the brand to have better sales in the second half of the year but also helps store more orders for the first quarter of next year.” However, he also indicated he wouldn’t disclose too much product information before the launch, “hoping to closely link the product’s highlights with users’ real experiences.”

After MEGA, LI Auto needs to present sufficiently convincing products to demonstrate that its core competitiveness isn’t the fuel tank. In this context, the i8 is bearing considerable expectations both internally and externally.

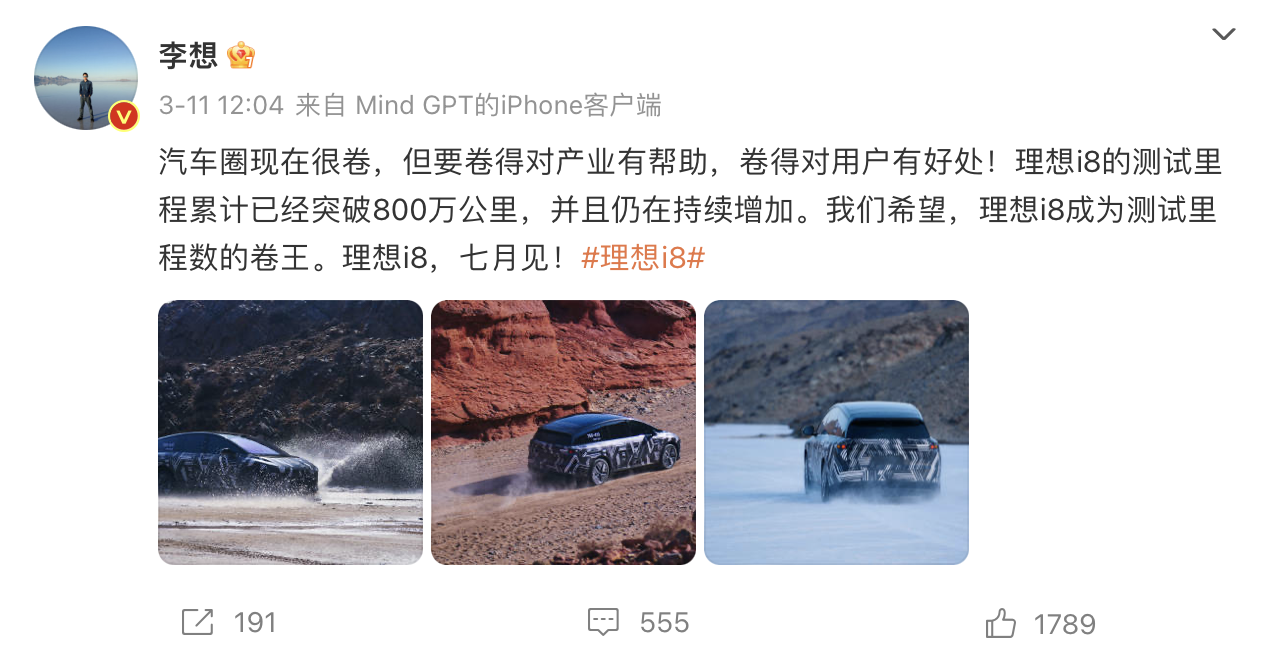

Formerly known as the “King of Weibo,” Li Xiang began sharing updates on LI Auto’s product developments on his personal Weibo account at the end of February, nearly a year after stopping regular posts. In a Weibo post made three days ago, Li Xiang stated that the LI Auto i8 has already accumulated over 8 million kilometers in testing mileage, and this continues to grow. We hope the LI Auto i8 becomes the king of test mileage. See you in July, LI Auto i8!

Pressure has mounted on the i8; it seems this product has no option but to succeed. But is this the only way to move out from under MEGA’s shadow?

In reality, even if the initial launch faces setbacks, MEGA can leverage its inherent product strengths to navigate through difficulties. According to Zou Liangjun, this luxury pure electric MPV, priced above 500,000 RMB, has maintained the second position in sales for several months in this segment, second only to Toyota’s Alphard.

Zou Liangjun expressed confidence in the sales of LI Auto MEGA, due to the continued improvement of the supercharging network this year, as well as the introduction of i8 and other pure electric models to the market, which will lead to scale effects.

Moreover, LI Auto’s pure electric focus isn’t just a single product but an entire system. The arrival of i8 and i6 not only signifies the official launch of LI Auto’s pure electric series product line, entering the fiercely competitive and challenging pure electric SUV battlefield but also promises the implementation of a more comprehensive charging and after-sales service system, benefitting existing products including MEGA. Additionally, over 100 billion in cash reserves provide LI Auto with the confidence to experiment and learn.

In 2025, LI Auto’s goal is to construct over 2,500 self-operated supercharging stations and more than 15,000 supercharging piles nationwide before the i8’s launch, eliminating charging anxiety for pure electric users.

Specifically, Zou Liangjun mentioned that over 2,000 supercharging stations should be completed in the first quarter, connecting the nine vertical and nine horizontal national highways. “By April of this year, we will complete the construction of the 5C supercharging network along the G318 highway. This year, we will also gradually open over 50 tourist routes. By the end of the year, we will cover national-level expressways exceeding 67,000 kilometers and provincial-level high traffic expressways spanning 10,000 kilometers, totaling over 77,000 kilometers of coverage.”With the support of the supercharging system, the competitive edge and persuasiveness of the pure electric series are bound to reach a new level. However, LI set a target last year to have 2,000 supercharging stations by 2024, but unfortunately, this goal was not met. It wasn’t until March 11 this year that LI announced the launch of the 1,900th supercharging station.

As a leading emerging brand, LI’s strategy in intelligent development has always pursued independent research and rapid iteration. Ma Donghui also stated that investment in AI technologies, such as smart driving, will be increased to maintain a leading edge in product strength.

Following Li Xiang’s bold declaration at the end of last year to become an AI enterprise, he further clarified the rationale for LI’s AI strategy during today’s conference call.

Li Xiang said, “We believe that our role is to be the terminal enterprise of the AGI era, with abilities of perception, decision-making, execution, and feedback.” He believes that such companies will face the challenge of operating APIs and managing silicon-based life forms.

Regarding the future form of robots, Li Xiang stated that from LI’s users’ scenarios, there will actually be three kinds of robots over time: one is the L4-level autonomous driving spatial robot, the second will be robots that merge with humans to enhance human capabilities, and the third, which is more challenging, is humanoid robots within spaces. “These three types of terminals or AGI robots will enhance users’ lives significantly.”

“Similar to how we use Apple today and have terminals such as Macs, iPhones, iPads, and Apple Watches,” Li Xiang used the example of the terminal forms in the mobile internet era, “this is our positioning for 3 to 5 years or even longer-term.”

In simple terms, LI aims to be the Apple of the AGI era.

As for the current development of smart driving or intelligence, Ma Donghui addressed more practical questions – how will LI’s smart driving be monetized?

He stated, “We believe current smart driving tools, including L2 and L3, are still tools that assist humans in driving. Although there might be a difference in technical solutions, the essence of the relationship between humans and cars hasn’t fundamentally changed.”

Ma Donghui believes that if autonomous driving evolves to the L4 stage, it will create a qualitative leap; by then, the smart driving system will transform from a tool to an assistant that can genuinely replace humans in driving. “It’s equivalent to hiring a dedicated driver, and in such cases, we believe users will be willing to pay for this, and then cars will upgrade to spatial robots of the AI era. At this point, in-car software services will be endowed with greater value, expected to create new business models and a bigger imagination space for software monetization.”

The question arises, selling cars and pursuing an AI strategy essentially do not conflict, but as a manager with limited focus, how will Li Xiang balance between selling cars well and telling a compelling AI story?In February, according to the exclusive report by “21Auto”, LI Auto decided to appoint LI Auto President Ma Donghui as the head of the intelligent vehicle strategy, responsible for setting strategic objectives related to the intelligent vehicle business and ensuring their effective execution. There is external speculation that Li Xiang has stepped away from overseeing the enterprise’s vehicle business to focus on AI.

This evening, Li Xiang responded: “First of all, I am still the company CEO, managing the teams related to automotive business product lines, product department, and brand strategy, consistent with 2024. We have indeed made new divisions in terms of strategic leadership, but it remains achieved through company-wide collaboration.”

In 2025, LI’s “dual-core drive” needs to instill market confidence through sales and profitability, while everyone is also awaiting a new chapter as an “AI enterprise.”

This article is a translation by AI of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.