On New Year’s Eve, I gathered with old friends as usual, surrounding a table, accompanied by a few drinks, to discuss the past year’s sorrows and joys, and reminisce about all sorts of older memories and amusing stories. However, unlike previous years, this time we seamlessly engaged in the same topic—using DeepSeek and our views on AI.

During the Spring Festival, DeepSeek’s momentary dominance of the trending searches once again sparked a wave of discussion about AI. For the automotive industry, which is currently the primary implementation landscape for AI, AI is particularly enchanting. It possesses both the realism of being implemented in intelligent driving and cabins and the fantastical possibility of one day transforming cars into wheeled robots. Amid this blend of reality and fantasy, the future influence of the automotive market seems intriguingly intertwined with AI, captivating the appetite of car enterprises.

At the end of December 2024, during the AI Talk, when asked what AI meant to Ideal, Ideal’s CEO Li Xiang replied resolutely:

It means the entirety of the future.

Apart from Ideal viewing AI as the complete future, Tesla has long vowed to become the world’s leading AI company with an “AI all-in” stance. Xpeng aims to become an AI-centric company with a global perspective in the next decade. NIO’s Chairman, William Li (Li Bin), stated that a successful smart electric vehicle company must be a successful AI company.

Furthermore, at the 2025 CES, Geely unveiled its “Universal AI for Smart Cars” technology system, while Great Wall Motors announced plans to invest over 100 billion yuan in AI by 2025 to become a global AI company.

Currently, AI has become the new “must-win battleground” in the automotive market.

However, AI technology is challenging, with high R&D costs, and requires a very long-term perspective to achieve commercial transformation. As of now, compared to potential grand future achievements, AI seems more capable of creating short-term brand value for car companies by building a space for imagination. Therefore, is it merely hype when car companies tell AI stories in 2025?

Musk’s Challenge Dashed, Yet End-to-End Ignited

In August 2023, under the watchful eyes of more than 12 million global netizens, Musk livestreamed himself driving a Model S equipped with end-to-end intelligent driving to Zuckerberg’s house. At that time, the global audience was keen on seeing whether the fight between Musk and Zuckerberg would actually happen.

In the end, Musk and Zuckerberg did not face off, nor did they even meet. Yet, Musk, being astute, successfully leveraged the buzz around the challenge to promote Tesla’s end-to-end intelligent driving, spurring a global conversation and gradual adoption of end-to-end intelligent driving.

The changes end-to-end brings to intelligent driving are revolutionary.

Under the end-to-end technology paradigm, intelligent driving no longer requires a massive workforce to write line after line of code to handle the innumerable corner cases. Instead, it uses vast amounts of real or simulated data to train car-like human neural networks, ultimately elevating the upper capability limit of intelligent driving, making it more human-like and even surpassing human abilities.In January 2024, Tesla’s FSD V12, developed using an end-to-end approach, began rolling out to regular users in the U.S. Its release notes mentioned that the end-to-end neural network was trained on millions of video clips, which replaced 300,000 lines of C++ code.

Since the launch of FSD V12, total FSD mileage quickly surged from under 800 million miles in December 2023 to over 1.2 billion miles by March 2024.

End-to-end intelligent driving is the largest application of AI in the automotive industry to date, and Tesla’s FSD V12 successfully demonstrated the significant appeal and value of end-to-end intelligent driving to users.

Subsequently, following Tesla’s lead, domestic car manufacturers have been revising their intelligent driving strategies, abandoning reliance on rule-based algorithms, and swiftly adopting end-to-end approaches to gain market share in intelligent driving.

Throughout 2024, Huawei’s ADS 3.0, Xpeng’s AI Tianji system, LI’s end-to-end + VLM, and Xiaomi’s end-to-end + VLM were successively released, while BYD, SAIC, Great Wall, Chery, and others also incorporated end-to-end intelligent driving in their DENZA, IM, Wey, and EXEED brand models.

Current results indicate that after years of groundwork and market cultivation, by 2024, under AI’s impetus, intelligent driving has become a key factor for car companies to create differentiated product strength, boost sales, and expand brand influence.

On January 15, LI revealed a statistic: with the push of its end-to-end + VLM intelligent driving solution, even though the AD Max model is nearly 30,000 more expensive than regular models, the delivery share of AD Max for models priced over 300,000 reached 75.4%, and over 400,000 models reached 84.6%, marking a prosperous scenario of increased sales volumes and prices for LI.

Notably, with the end-to-end + VLM, LI has gradually filled its brand’s technological image gap. Assertions like LI being only about big refrigerators, TVs, and sofas are becoming increasingly untenable at this stage.

Another representative phenomenon to mention is that an increasing number of car manufacturers are choosing to align closely with Huawei to enhance their models’ intelligent driving product strength and brand power, emphasizing Huawei’s presence in their promotional messaging.

It is well-known that Huawei, using intelligent driving as its entry point, has turned its AITO new M7 and AITO M9 into sensational hits and established itself as a benchmark of intelligent driving in consumers’ minds.In addition to the companies behind the Hongmeng Four Realms, such as SERES, Chery, BAIC, and JAC, others embracing Huawei include Changan’s Avatr and DEEPAL; DF’s VOYAH, MENGSHI, and YIPO; BYD’s FangChengBao; and GAC’s recent collaboration with Huawei to establish GH to create a new brand. Audi is also exploring the Huawei dual-laser radar intelligent driving solution to empower the Q6L e-tron in China.

Evidently, AI has significantly altered the application capabilities and commercial value of intelligent driving, as well as the competitive landscape of the automotive market. However, it is equally clear that numerous issues still persist in the development of intelligent driving.

For instance, while advanced intelligent driving in highways and cities has been deployed, it still requires human oversight to prevent unexpected dangers. Even in relatively fixed intelligent driving scenarios like automatic parking, incidents such as collisions with poles and trees occasionally occur. When they do, disputes between users and manufacturers often arise due to unclear responsibility allocation.

Despite the recurring issues, some automakers have indeed benefited commercially from intelligent driving. To secure greater returns in the future, some fast-moving car companies are already planning for a longer-term intelligent driving market.

L3 intelligent driving is relatively close to reality. According to official reports, both new forces and traditional enterprises have obtained L3 intelligent driving test licenses. However, even though L3 intelligent driving has been discussed and developed for many years, only a few have truly brought it to implementation.

The ZunJie S800 and NIO ET9 have incorporated L3 intelligent driving architectures, paving the way for future L3 intelligent driving approvals. Additionally, Xpeng aims to achieve “L3-level all-scenario intelligent driving” by 2025, while LI has announced plans for supervised L3 intelligent driving by 2025.

Robotaxi, on the other hand, requires more time for implementation and commercialization.

Currently, Tesla has launched the Cybercab; ZEEKR and Waymo are co-developing a Robotaxi, which is undergoing road testing in the U.S.; GAC’s subsidiary Ruqi Mobility has introduced a no-safety-driver Robotaxi service in Guangzhou; and Xpeng has announced plans to officially launch a Robotaxi in 2026. However, for these Robotaxis to become truly user-friendly and contribute positive profits to companies, they still face significant challenges such as regulatory approval, user trust, and cost reduction in manufacturing.

Overall, AI has already tangibly transformed intelligent driving and the entire market. With unwavering confidence in AI, the market is advancing rapidly toward L3, L4, and higher levels of intelligent driving, representing a bolder and grander market. Yet, the endpoint of this race remains rather ambiguous.

The Magic of OpenAI Brings a Revolution in Intelligent CabinsThe starting point for Tesla’s end-to-end intelligent driving can be traced back to December 2022, coinciding with the late November release of OpenAI’s ChatGPT 3.5 that year. ChatGPT 3.5 demonstrated remarkable semantic understanding and intelligent response capabilities, showcasing the power and allure of AI to the world.

Influenced by ChatGPT, during an interview in May 2023, Musk earnestly stated:

Tesla will also have a so-called ‘ChatGPT moment,’ if not this year, then certainly by next year. This means that suddenly there will be 3 million Teslas capable of autonomous driving, followed by 5 million, and then 10 million……

However, Musk’s prediction has not yet materialized, and Tesla has still not experienced its ‘ChatGPT moment.’ Nonetheless, as mentioned above, after Tesla verified end-to-end intelligent driving, China’s intelligent driving market has become increasingly vigorous and prosperous due to end-to-end solutions.

If in terms of intelligent driving, there is still a ‘Tesla’ between Chinese companies and OpenAI, then in the intelligent cockpit domain, OpenAI has acted as the ‘guide’ for Chinese enterprises.

A typical implementation of AI in the intelligent cockpit is the voice assistant. Li Xiang remarked in an AI Talk that after using ChatGPT, the most significant realization was that artificial intelligence should be like this… OpenAI clearly demonstrated the optimal experience for chatbots.

Following the release of ChatGPT by OpenAI, numerous automakers began releasing AI large models. For instance, in June 2023, LI released MindGPT; in July, Huawei launched its Pangu Model 3.0; and in October, Xpeng introduced the XGPT Lingxi model…

Simultaneously, traditional automakers accelerated their efforts to integrate AI. Great Wall established an AI Lab, Geely founded an AI Intelligence Research Department, and Chery recruited Gu Junli, who had been responsible for intelligent driving at Tesla and Xpeng, to establish Dazhuo Intelligence…

Objectively speaking, even without AI integration like today, voice assistants in cockpits could handle vehicle control or conversations. However, with AI, voice assistants can efficiently manage vehicle controls and user interactions, while also imbuing the cockpit with a layer of technological allure and mystery unique to AI, providing users with an imaginative space rich in emotional value.

Thus, even though the intelligent cockpit has not yet become as critical a factor as intelligent driving in influencing car buyers, every new model released by mainstream brands emphasizes, to some degree, the AI capabilities in the vehicle’s cockpit. Some brands, like LI, are no longer content with limiting AI applications solely to the car.In late December 2024, Ideal Mate, equipped with MindGPT, launched on smartphone app stores. Interestingly, Ideal Mate not only handles Q&A and object recognition but also showcases its reasoning process, making it appear more interpretable. Naturally, there’s an element of performance involved as well.

Nowadays, smartphones are hubs of connectivity, and Ideal Mate’s strong mobile presence not only helps expand Ideal’s intelligent IP but also strengthens the connection between Ideal and users’ lives, further enhancing the brand’s influence. This strategy closely mirrors that of Huawei’s Xiaoyi and Xiaomi’s Xiaoai, which integrate into users’ homes using smart home devices.

Intelligent driving and smart cabins are the two most important and representative applications of AI in the new energy vehicle industry. Additionally, the deployment of AI in humanoid robots is equally crucial.

In August 2021, during AI Day, Tesla unveiled the concept of Optimus, sparking global discussion and interest in humanoid robots. By now, Optimus has entered initial mass production, performing simple tasks at Tesla factories.

According to Elon Musk, Tesla plans to produce thousands of Optimus units by 2025. If all goes well, they aim to manufacture 50,000-100,000 units by 2026 and then increase production tenfold by 2027.

Musk is extremely optimistic about the future of the humanoid robot market, predicting 10-20 billion robots capable of performing general tasks, potentially creating a massive $25-30 trillion market.

Like Tesla, domestic companies are also optimistic about the humanoid robot industry, but actions haven’t progressed as quickly.

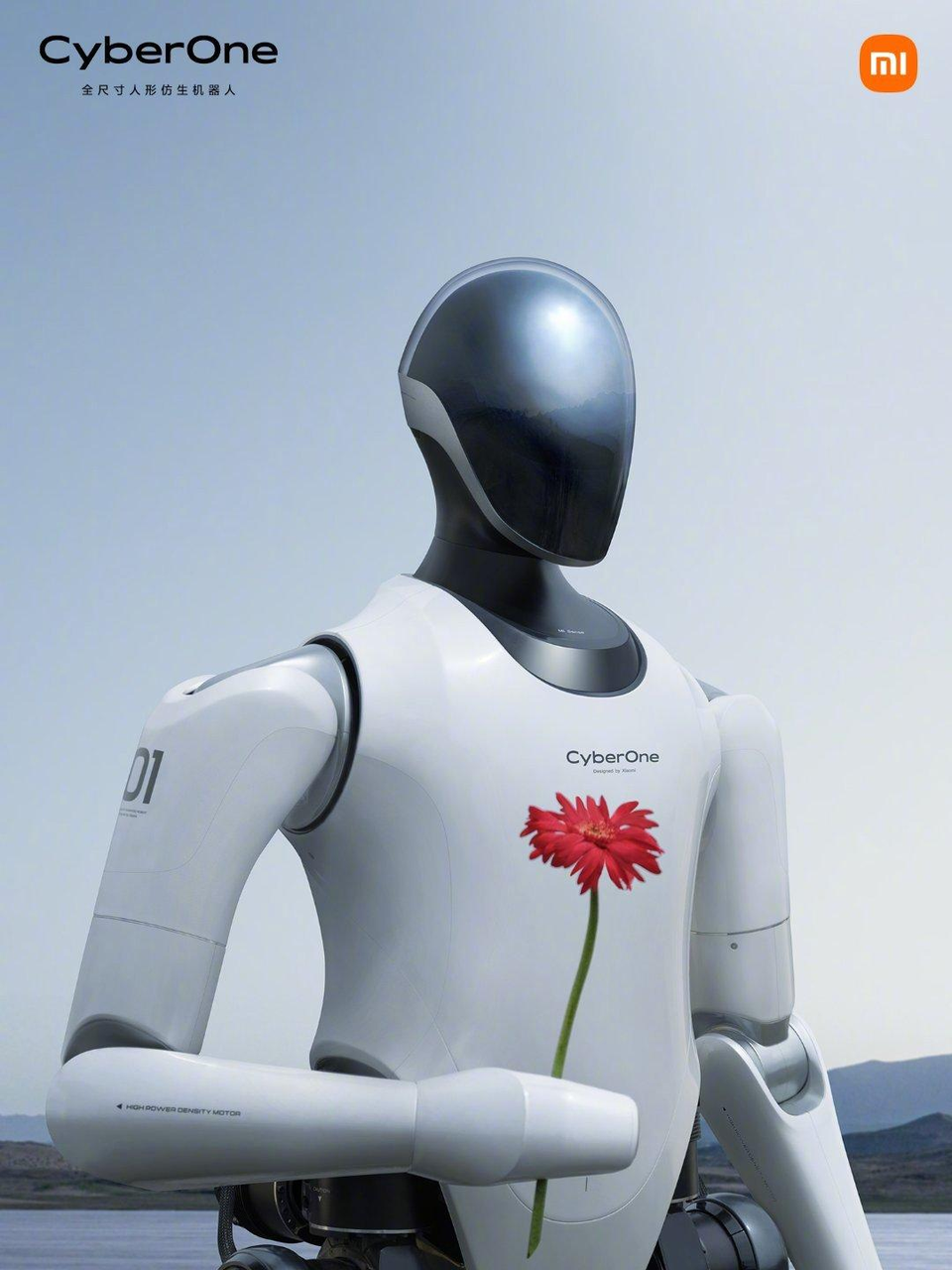

Xiaomi ventured into humanoid robots early, unveiling its first humanoid robot CyberOne (nicknamed Iron One) in August 2022, though there hasn’t been any successful mass production yet.

Currently, among domestic car manufacturers, Xpeng has pioneered the mass production of its self-developed humanoid robot Iron. Meanwhile, GAC recently released the Gomate robot with a variable wheel-leg design, which isn’t a complete humanoid robot. Its mass production is expected by 2026.

Additionally, Ideal has announced a definitive commitment to humanoid robots. Huawei has partnered with Leju Robot to explore humanoid robot R&D and applications. Companies like BYD, Geely, CCAG, and Chery are also entering the humanoid robot industry through independent R&D or investment, with a surge of humanoid robots on the horizon.It’s worth mentioning that although the aforementioned intelligent driving, voice assistants, and humanoid robots vary in form and application, a lot of their technology is actually shared. While they currently take different paths, they are highly likely to one day converge, supporting each other and advancing together, forming a broader societal and commercial landscape. Li Xiang once made a related analogy in AI Talk:

If a person only has language intelligence, he is smart enough but cannot act. If a person only has behavioral and spatial intelligence, he is like an ordinary worker. So what is a person? A combination of these aspects.

How far are we from the dreamed “ChatGPT Moment,” “Decades”?

The “ChatGPT Moment” is truly enticing. In 2023, Musk said Tesla would reach a “ChatGPT Moment,” and He Xiaopeng made a similar prediction for 2024, stating that full self-driving would experience its “ChatGPT Moment” in 2025.

Now, after implementation in smart driving, smart cabins, and humanoid robots, the value of AI is increasingly like a golden block dangling in front of companies, visible yet temporarily out of reach, continuously attracting them to muster their strength and overcome challenges.

A typical issue is cost.

Li Xiang’s VP of Smart Driving R&D, Lang Xianpeng, once discussed with us Li Xiang’s investment in computing power. Although end-to-end smart driving does not rely on manpower to write rule codes, saving some labor costs for car companies, the cloud computing power required for data training is extremely expensive.

Lang Xianpeng stated that with the continuous expansion of smart driving parameters and the future deepening towards L4 level, Li Xiang might spend around $1 billion (approximately 7.1 billion RMB) annually solely on computing power clusters.

Huawei’s investment is even more significant. At the 2023 China Electric Vehicle 100 Forum, Yu Chengdong mentioned that Huawei’s annual investment in smart cars exceeds 10 billion RMB. In the 2025 internal letter, he further indicated that the entire Harmony ecosystem would continue to heavily invest.

Of course, Tesla spends even more aggressively than Huawei. According to its official financial report, Tesla’s cumulative R&D investment in 2024 reached $4.54 billion (approximately 33.02 billion RMB).

It should be noted that AI is a vast systemic engineering project, requiring not only considerable cost in computing power for neural network training but also the construction and maintenance of supporting infrastructure, effective talent system, and organizational capability deployment.

During Huawei’s All-Connect Conference in 2024, Huawei’s Deputy Chairman Xu Zhijun pointed out that AI technology is still in its growth phase, with rapid technological changes and coexistence of multi-generational products, requiring high skill levels and posing maintenance challenges, which are significant hurdles for companies with only traditional IT maintenance capabilities.In addition, Mr. Lang Xianpeng discussed with us the changes in work patterns that AI brings to Li Auto, such as the evolving role of intelligent driving product managers. Previously, a product manager focused more on product functionality design, but now the emphasis shifts towards managing the relationship between AI and users, gradually earning users’ trust in AI.

Due to the current high costs and complexities of AI, its applicability and user acceptance remain relatively limited. For example, vehicles featuring advanced intelligent driving are generally priced above 200,000.

Of course, there is a trend for advanced intelligent driving to become more widespread. The top configuration version of the Xpeng MONA M03 includes features like “full-scene intelligent assisted driving” and “AI chauffeur.” Leapmotor is also making strides; its upcoming B10 model will feature LIDAR, and Leapmotor Chairman Zhu Jiangming has stated, “Even with thrift, we cannot reduce investment in intelligent driving.”

Nonetheless, considering the current state of intelligent driving, smart cockpits, and humanoid robots, some specific AI applications may soon experience a “ChatGPT moment,” similar to what He Xiaopeng said about full autonomous driving. However, for AI as a whole to reach a “ChatGPT moment” will likely be a long and challenging journey. He Xiaopeng has also remarked:

Firmly believe in the advent of the AI era, yet be prepared for slow and gradual maturity and large-scale implementation over several decades.

Talking AI in 2025: Mere Hype?

Currently, Tesla’s market capitalization stands at $1.26 trillion, while Toyota’s is $0.25 trillion. Although both companies primarily sell cars globally, Tesla’s market cap is more than five times that of Toyota, largely due to Tesla’s expansive imagination in AI.

Similarly, a comparable story unfolded with Li Auto. After Li Xiang announced plans for developing humanoid robots and L4 autonomous driving at AI Talk, Li Auto’s stock prices surged in both the Hong Kong and US markets, with Hong Kong stocks rising by over 6% intraday.

As with any emerging technology or trend, a wave of capital enthusiasm and market discourse ensues. Automakers involved in AI are not only keeping pace with technological trends but also captivating the capital markets and user interest. Achieving results is ideal; even without them, it positions them as pioneering brands at the forefront of innovation.

Particularly in China’s competitive landscape, both sales and attention are indispensable. Without telling new stories, the lack of novelty might lead to new mishaps.

Therefore, when automakers discuss AI in 2025, there may be some element of hype. However, the importance of AI is already a consensus both inside and outside the industry, and automakers have no reason to work behind closed doors.

Of course, as automakers forge ahead in AI, they must also make tangible progress along the way. If the focus is solely on the future without addressing the present, sometimes investors and users may lose patience. After Tesla’s “WE, Robot” event, its stock price dropped nearly 9%, wiping out $67 billion in market value.AI has developed extensively today. Despite high technical and financial barriers, and the challenges of commercial implementation, it has already borne substantial fruit; however, further time is required for gradual application and commercial transition.

For automobile companies, the pressure has intensified. While the bloody competition centered around “cars” in the new energy vehicle industry is ongoing, a new competitive race centered on AI is already looming on the horizon.

This article is a translation by AI of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.