The balance of this year leaves only 2 months, yet in these 2 months, LI Auto needs to establish 1,000 supercharging stations—this number exceeds the total number of supercharging stations established by LI Auto in the past 8 months.

On October 31st, taking 561 days, LI Auto officially announced the establishment of its 1,000th supercharging station. According to official data, these 1,000 charging stations have already covered 175 cities across 31 provinces in China, connecting 9 national highways.

However, it should be noted that on February 26th of this year, LI Auto announced an annual goal to establish 2,000 charging stations by the end of the year. At that time, LI Auto had only 344 operational stations, meaning it needed to launch an additional 1,656 charging stations within 10 months.

Now, 8 months have passed since February 26th, and LI Auto’s charging stations have rapidly increased to 1,000. Despite this, LI Auto still has 1,000 more charging stations to establish, with only 2 months remaining—can LI Auto achieve the goal of 2,000 charging stations this year?

Recently, we interviewed Sun Guangmin, Vice President of LI Auto’s charging network, and Tang Huayin, Head of LI Auto’s electric vehicle product. Sun Guangmin told us that LI Auto currently has confirmed supercharging station projects exceeding 2,000, with numerous sites preparing for entry and construction. From the end of October until the end of this year, LI Auto’s supercharging stations are expected to see a peak in online activity.

It is worth mentioning that the location of LI Auto’s 1,000th supercharging station is significant—Mount Everest station. This is a 5C supercharging station located on a plateau over 4,200 meters above sea level. The environment is extremely harsh, presenting a major challenge for early-stage construction and later maintenance and operation. By choosing this challenging location for the 1,000th station, and being a 5C supercharging station, LI Auto undoubtedly aims to showcase its strong recharging technology and commitment to accelerating the development of pure electric vehicles.

This year, due to the setback of the MEGA launch, LI Auto faced significant challenges in its initial entry into the pure electric market. However, it also made LI Auto realize that despite the L series’ success in the range-extended market providing a solid resource foundation for pure electric products, LI Auto needs to start anew with a beginner’s mindset to penetrate the pure electric market.

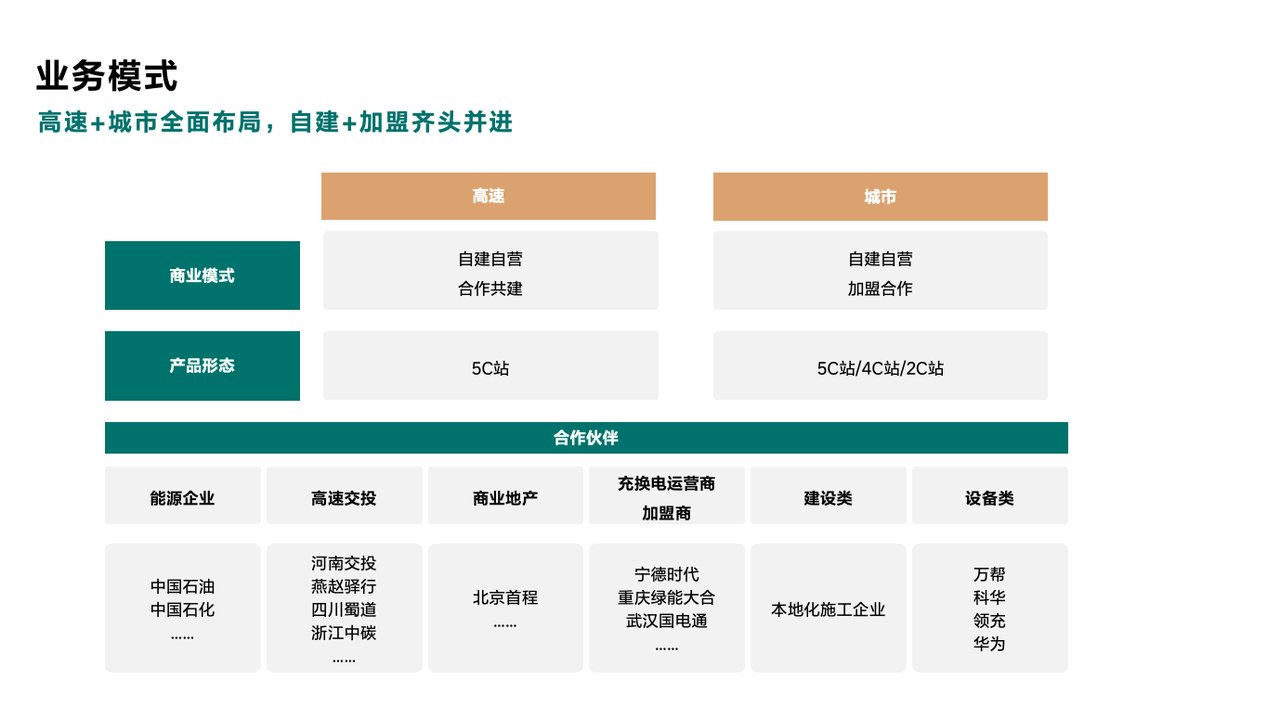

During the 0 to 1 phase, LI Auto believes establishing a recharging system is a critical component. Sun Guangmin stated that supercharging is an essential part of LI Auto’s pure electric product strength; it is meaningless to sell a car with supercharging capability to users without providing a matching supercharging network. Additionally, in April’s Beijing Auto Show, LI Auto’s chairman, Li Xiang, mentioned to NIO’s chairman, William Li Bin, that “if the charging network doesn’t thrive, (high-end pure electric vehicles) really can’t sell.”To quickly scale up its network, LI Auto takes a dual approach in both highway and urban settings. On the one hand, the company is advancing its self-operated supercharging stations to ensure efficiency and quality; on the other hand, it is seeking partners to jointly build supercharging stations, aiming to secure more sites, electricity, and other resources more efficiently.

According to Sun Guangmin, establishing a supercharging station by LI Auto generally involves four steps: site selection, contract signing, on-site work commencement, and going live. Though the path is clear, the actual execution is not easy.

Sun Guangmin indicates that LI Auto faces many challenges in this process, including enhancing team capabilities, standardizing construction with partners, and aligning supplier resources. Increasing the number of supercharging stations from 344 to 2,000 in approximately 10 months is undoubtedly a daunting challenge.

In the interview, Sun Guangmin and Tang Huayin discussed many of the difficulties faced by LI Auto in building supercharging stations, the operation of the energy replenishment system, and their overall perspective on the energy replenishment industry. The main content of the interview follows, edited without altering the original meaning:

Achieving 2,000 Supercharging Stations is Not Yet Meeting KPI

42 Garage: Recently, LI Auto’s promotional materials and posters have not mentioned the year-end target of 2,000 stations. Will LI Auto still be able to achieve 2,000 supercharging stations this year?

Sun Guangmin: The goal for this year remains 2,000 stations. Although it seems that only 1,000 stations have been completed in the past nearly 10 months, the basic construction and electrical engineering cycles for LI Auto supercharging stations are all prioritized.

Building a station requires four steps: site determination, contract signing, construction commencement, and acceptance and line commissioning. Currently, LI Auto has already determined supercharging station projects exceeding 2,000 stations, with many preparing for site entry and construction. From the end of October to the end of the year, there will be a peak period for LI Auto supercharging stations going live.

Our target is 700 stations on highways and 1,300 in cities. Among these, we are very confident in completing the 700 highway stations, but city stations are more challenging.

City stations are a new business. For us, the advancement of this new business is akin to a leap from a standing start. However, given the current overall commencement situation, we are still confident. There are challenges, such as management requirements for construction after urban heating in northern cities, particularly in the arrangement of power grid transmission.

42 Garage: What was the most difficult thing LI Auto faced in the process of advancing 2,000 stations?

Sun Guangmin: For the first half of this year, it can be divided into three stages. In the first stage, the challenge was to persuade partners to invest in a project that would not be profitable within two years.

The second stage was to rapidly improve the team’s capabilities and capacity in order to accelerate the national layout.“`markdown

In the third phase, our challenge primarily lies in the acceptance of engineering projects. Sometimes, while our partner’s work meets industry standards, we believe it is not yet ready for acceptance, requiring rectification item by item. This process took a long time.

In the second half of this year, our challenge is to rapidly increase station construction speed. Building 50 stations a month and 200 stations a month are entirely different in difficulty, requiring a complete coordination of backend supplier resources after capacity enhancement.

Moreover, in terms of the charging business, simply launching 2,000 supercharging stations does not fulfill the KPI. We also need to select appropriate locations, construct the sites properly, and manage later-stage operations and maintenance effectively.

Garage No. 42: What are LI Auto’s plans for site construction next year?

Sun Guangmin: The specific number of site constructions for next year is still under discussion, but we have some thoughts for next year.

Firstly, before LI’s pure electric products are launched next year, we must preemptively complete the supercharge replenishment facilities. The standard of completion is that users will experience no replenishment anxiety when purchasing and using LI’s pure electric products.

Secondly, we will work even harder next year than this year. On one hand, we have recognized the replenishment needs of users, and on the other hand, we are influenced by the current macroeconomic environment of “making large-scale investments in advance during short cycles.”

Not Pursuing Short-Term Victories and Small Profits

Garage No. 42: When does LI Auto’s supercharging network expect to break even?

Sun Guangmin: This is a long-term, large-scale campaign. We do not aim for quick small victories to make some minor profits, but rather to win the entire campaign.

We measure the victory of this long-term campaign with two standards: the large-scale replacement of fuel vehicles by electric vehicles, and providing a replenishment experience for users akin to refueling.

Garage No. 42: What is the current cost per LI supercharging station?

Sun Guangmin: The construction cost of an LI supercharging station mainly includes equipment costs, low-voltage engineering construction costs, and high-voltage costs for expanding and upgrading capacity. If high-voltage sites are required, our cost will be controlled at around 1 million RMB.

However, over the entire lifecycle, the more significant cost of a supercharging station lies in the systematic operation and maintenance afterward.

Garage No. 42: What is the current profitability situation of LI supercharging stations?

Sun Guangmin: The profitability of supercharging stations mainly hinges on their capacity limit and efficiency limit. In terms of capacity, we have already conducted some closed-loop verification. The capacity limit of supercharging stations is relatively high, for example, our recent update to the 4C product can increase capacity efficiency by about 60% compared to the 2C.

In terms of efficiency, it is primarily our ability to serve users, which is also a source of profitability for supercharging stations as basic infrastructure.

Currently, the failure rate of a single charge at LI Auto’s supercharging stations is less than 0.5%, whereas the failure rate of leading industry companies is generally around 1% to 2%. Additionally, we will continue to enhance user experience using intelligent car piers and cloud deployment operations, while improving overall maintenance efficiency with remote systems and proactive defensive measures.

“`In the long term, supercharging stations are a promising profitable project. After all, the trend of new energy in China is irreversible, and the technical route of high-voltage supercharging for pure electric vehicles is certain. Therefore, there will be tens of millions, even hundreds of millions, of electric vehicles in need of energy replenishment.

In the short term, however, supercharging stations are still in the investment phase. Currently, we need to focus more on the fundamentals, such as site deployment and vehicle-pile-cloud system deployment.

Garage 42: When will the balance of supply and demand for charging and energy replenishment be achieved?

Sun Guangmin: The current charging experience demanded by users, especially a high-quality and fast charging experience, is constraining the growth of pure electric vehicle demand. Upon identifying this constraint, there will be an accelerated deployment of the supercharging network, which will, in turn, accelerate the sales growth of new energy vehicles. Thus, it is a double-helix evolutionary state.

Garage 42: What are the criteria for an LI Auto supercharging station to be considered successful?

Sun Guangmin: Our core focus is whether the average daily charging volume at each site can reach the corresponding break-even point. We have found that some high-traffic sites and peak traffic periods have already exceeded expectations in achieving validation targets.

Creating a Productive Feedback Loop Between LI Auto Pure Electric Vehicles and Supercharging Stations

Garage 42: Li Xiang mentioned that LI Auto would operate supercharging piles as a product or service. At what stage will LI Auto supercharging piles primarily provide services, and at what stage will they truly become a product?

Sun Guangmin: Supercharging is a key part of the product strength of LI Auto pure electric vehicles. It is integrated with the vehicle to form a product strength loop.

From a user perspective, simply selling a vehicle with the ability to supercharge is meaningless without a matching supercharging network. Internally, we consider the vehicle and supercharging pile as an integrated product. Currently, the energy replenishment network is relatively weak within the pure electric product strength, and we need to strive to make it complete.

Tang Huayin: At the initial design and development stage of charging stations, we envisioned the supercharging station as a product. The subsequent enhancement of service levels is a process. This is also why we were determined from the outset to develop the lightest supercharging cable, achieving plug-and-charge functionality, and refining the overall user experience to perfection.

Garage 42: What are the quantitative definitions and criteria for a charging site, viewed as a product or service?

Sun Guangmin: “Service” can be understood as a cost center, with the amount of work and the level of operations determined by the budget.

Regarding products, we consider them more comprehensively, including profitability requirements and the closed-loop logic from users to commerce, which is the biggest difference between the two.

Garage 42: What is the mode of cooperation between LI Auto and supercharging station franchisees?

Sun Guangmin: Franchising is a means, but not the goal. Our goal is to rapidly deploy high-quality site resources on a large scale. From the perspective of acquiring land and electricity resources, we need to cooperate with partners.

In our communication with partners, we use specific data to clarify that although, in the short term, supercharging stations are in the investment phase, in reality, they are a long-term business with long-term profitability. Additionally, we aim for long-term strategic intertwining with our partners.加盟场站 encompass products, engineering, and operations adhering to the same standards as LI Auto’s self-built stations. Ultimately, users won’t distinguish which stations are self-constructed and which are franchised, much like staying in a hotel where, despite different owners across brands, the service quality remains consistent. This consistency is what we aim to control, and our team is collaborating with partners to refine the experience.

Garage 42: What’s the ratio of LI Auto owners to other brand owners using the LI Auto supercharging stations?

Sun Guangmin: In highway locations, the typical ratio of other brands to LI Auto is about 8:2. During peak periods such as National Day, the ratio shifts to roughly 7:3 in favor of LI Auto users. In urban locations, the ratio stands at 1:1.

Garage 42: How do you balance the relationship between LI Auto owners and other brand owners during the charging process?

Tang Huayin: We plan to introduce operational measures and strategies for special times like holidays, with constant iterations.

Moreover, we’ll continue to improve and optimize the issue of space occupation at daily charging stations, focusing on the following aspects:

- Facility Functionality: Increase the proportion of wheel locks and install limit bars between some parking spaces to prevent occupation. In the future, only LI Auto owners will be able to lower the wheel locks at 5C supercharging spots.

- Operations: Arrange on-site attendants at key stations, especially intensifying during holidays and special time periods.

- Mechanisms: Introduce potential fees for occupying spaces and implement a blacklist system for recurring instances of unlocking wheel locks without charging.

- Intelligent Systems: Install cameras at each location for smart identification and alerting, including automated phone calls to relocate vehicles.

Garage 42: What are the roles of LI’s 2C, 4C, and 5C charging stations?

Tang Huayin: 2C corresponds to the national standard current capacity of 250 A, and 4C corresponds to 400 A, representing the current national standard’s peak level. Next year, after verification, we plan to OTA upgrade the 4C stations to around 450 A.

5C equates to implementing a proprietary communication protocol between LI Auto’s vehicles and stations, surpassing the current national standard limits. This addresses the disparity between industry-average charging facilities and leading vehicle models’ supercharging capabilities, representing our added value.

Garage 42: If sales of LI’s pure electric products surpass extended-range products, will the 5C supercharging stations still suffice?

Sun Guangmin: They will certainly suffice. Currently, it takes 12 minutes for a 5C station to complete one charge, and if demand rises fiftyfold from current levels, a single station would be in use for about 5-6 hours daily, indicating low pressure on charging infrastructure.

However, if users converge at the same time, leading to queues, we have corresponding measures in place.First, on one hand, we have already begun to establish 8-stall, 12-stall, and even 16-stall stations in several expressway service areas. Our site expansion capability is unrestricted. Additionally, we can deploy a single host with multiple gun lines and have reserved sufficient power resources for future expansion. On the other hand, we’ve increased station density in Beijing, Shanghai, Guangzhou, and Shenzhen, so users may have more than one station within a radius of three kilometers. If users experience queues, we might increase density further to five stations or continue to establish 8-stall and 12-stall stations, among others.

Secondly, we will further regulate the order of the charging sites. Our order management not only involves the management of the site itself but also guides user charging habits.

Tang Huayin: Some sites already have two 5C stalls, which will subsequently support more flexible power distribution. For instance, when two MEGA vehicles charge simultaneously on two 5C stalls, power will be distributed more flexibly.

Moreover, the combination of charging stalls in our sites will also change. Currently, the most common combinations at LI Supercharging Stations are 5C + 2C, as well as pure 2C stalls. However, by the end of this year, we will not install any more pure 2C stations and will only add pure 4C stations. By mid-next year, all new 5C stations will no longer include 2C stalls but will feature a 5C + 4C combination.

Garage 42: What is the site selection strategy for LI Supercharging Stations?

Sun Guangmin: The site selection logic in cities is based on user demand coverage, while on highways, it is based on user traffic coverage.

In terms of urban site selection, we first focus on the city’s economic volume, new energy penetration rate, and the existing stock of LI vehicle owners, roughly ranking cities in the order of first-tier, new first-tier, second-tier, and better third-tier cities.

Next, we deploy within the city according to the logic of having a station within a three-kilometer radius of users. The specific location considers various spots like malls and parking lots within this radius.

Finally, we look at the specific placement of stations in malls or parking lots. For instance, in parking lots, the station should be at a certain distance from the exit but not too far and should have an independent area. We also consider the parking flow line and parking space width for users.

Garage 42: How does LI secure power resources?

Sun Guangmin: In highway scenarios, since power resources at highway stations are relatively scarce, we self-build high-voltage networks at a ratio of 80-85%.

In urban scenarios, we acquire power resources more through partnerships. Additionally, we have discovered that some other operators’ charging stations built five years ago require upgrades. This is due to their previous operational inefficiency, necessitating refurbishment or adjustments to release some corresponding resources. We see this as an opportunity to capture.

LI’s Replenishment System as an Improvement Factor

Garage 42: Is LI’s replenishment system an improvement factor rather than a rigid necessity factor?

Sun Guangmin: In our replenishment system, we have self-built supercharging stations and premium supercharging stations, as well as more official three-party interconnections, which precisely meet the different needs of “necessity” and “improvement”.In today’s cities, particularly in first-tier cities, regardless of the intermediate process, users can find a charging station to recharge, so the “just-needed” issue has been solved. However, the increasing demand for energy replenishment experience from electric vehicle users and potential electric vehicle users cannot be met.

At the same charging station, users would certainly want faster energy replenishment speeds, as well as certainty in charging and planning charging navigation times. We find that users with higher-priced vehicles value their time more. Thus, there is a significant unmet user demand. This is also why we deploy ultra-fast charging stations.

From a commercial perspective, the improvement side incurs higher costs than the just-needed side. Ultimately, the production capacity and user-facing service capability of ultra-fast charging are robust. With more demand, greater capacity can accommodate more needs, while greater demand can bring better profitability by distributing costs.

Garage 42: What will the future structure of China’s energy replenishment network look like? Will state-owned charging piles dominate, or will private charging piles like those of LI Auto have a larger share?

Sun Guangmin: Ultimately, the characteristic of this industry is that the energy replenishment infrastructure can support the sales and use of new energy vehicles. Based on this, there are two thresholds in the energy replenishment industry:

- The ability to deploy large-scale infrastructure

- The efficient operation of large-scale infrastructure

These two thresholds are essential to be crossed, one on the supply side and the other on the management demand side.

From the perspective of the ability to deploy large-scale infrastructure, state-owned enterprises have more advantages in terms of land resources, electricity resources, and investment capacity. In this respect, LI Auto chooses to cooperate, such as with large state-owned enterprises like Sinopec, CNPC, Shougang, and Shoucheng.

LI Auto’s strength lies in the efficient operation of large-scale infrastructure. As an auto company, our user-facing services are not only reflected in charging stations but also in comprehensive charging navigation and energy management planning starting from the vehicle’s onboard system. We have a natural advantage in closed-loop thinking and can think holistically.

Garage 42: Is LI Auto considering the integration layout of photovoltaics, storage, and charging?

Tang Huayin: There are some pilot projects, but this is not something we can promote single-handedly. It definitely requires industry co-creation.

Sun Guangmin: We have been accumulating technologies in energy storage, photovoltaics, and other areas. Energy storage is a good product for enhancing station efficiency and profitability when charging demand rises. We will also partner with the best energy storage professionals in the industry to serve users well.

Garage 42: The voice for battery swapping is getting louder. What is LI Auto’s perspective on battery swapping?

Sun Guangmin: The path to success is not necessarily singular. Different paths may have varying technological development cycles. For example, ultra-fast charging technology has developed rapidly in recent years, alongside vehicle, pile, and platform technologies. Ultimately, both charging and battery swapping need to be viewed from two perspectives.One focuses on user experience, and the other on operational efficiency.

This article is a translation by AI of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.