Data Intelligence Bureau

This column is jointly launched by Garage 42 and SoCar Product Strategic Consulting, updated monthly. Special guest writer: Hu Jiahe, co-founder of SoCar, editor: Garage 42.

At first glance, the sales of new energy vehicles in the first half of the year compared to the same period last year seem to be dismal. Recently, various analyses have been discussing that the new energy market will have a significant decrease after the subsidy decline in 2020.

Data analysis is always subjective.

For example, there was once such a sentence in sales analysis: “The XX brand only achieved 23% of its annual sales target in the first quarter of XXXX year!” At first glance, it seems that this XX brand is about to fall apart. However, after careful consideration, it may not be the case.

The conclusion that “the first half of the year is dismal” in the beginning is a subjective conclusion observed from the perspective of data observation, and in fact, the performance of new energy in the first half of the year is very encouraging to me.

Model 3 continues to be in the forefront, and in June, as predicted last month, it broke the threshold of 15,000 units released from accumulated orders. With such achievements, it is ranked 27th among all models and only behind Accord, Camry, and Mercedes-Benz C in the B-class sedan category.

The above chart summarizes the market share of about 850 cars sold in the first half of 2020. Each dot represents a car, and the bright yellow is Model 3, which is ranked 47th.

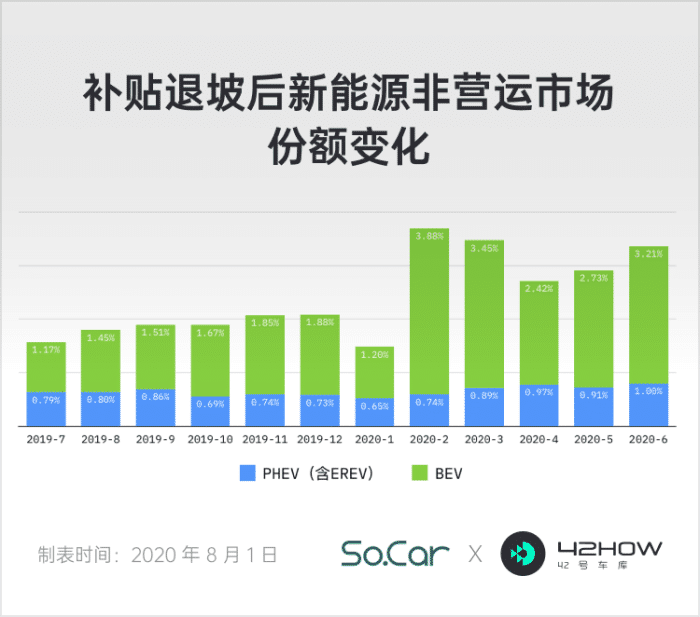

As a pioneer of pure electric vehicles or new energy vehicles impacting the traditional fuel vehicle market, since building a factory in Shanghai, Tesla has taken on the task of opening up the Chinese market. Under its driving force, the market share of the new energy personal demand part in the post-subsidy era has increased by nearly double: it has already exceeded 4%.

The growth of market share will inevitably attract more attention and interest in new energy vehicles, and this attention and interest will create more fertile ground for the products to take root and grow. New energy is getting closer and closer to the Early Majority in China as the national confidence continues to rise.

In this gradually accumulating market sentiment, many people (ordinary users, industry professionals, investors, and even well-wishers) are waiting for the “Tesla of China.”

The seed players gave a good answer in the first half of 2020. Various milestones were constantly achieved, and the market heat continued to rise.Like pioneers, several leading new forces brands have been racing to deploy their projects in important areas such as electrification, intelligentization, autonomous driving, and energy replenishment convenience, and the competition is fierce and brilliant.

On the other hand, traditional automakers have not fallen behind, and several products have been launched this year, specifically targeting Tesla.

On the day when the June sales data was received, President Xi Jinping inspected Red Flag vehicles and said, “We must get our national car brands up there.”

In this largest market, for Chinese brands and new forces, they should shoulder the historical mission of pushing national car brands forward, despite the many challenges. Although it’s a difficult mission, there are also abundant opportunities. This topic has been raised a bit high, and it’s a good time to observe half a year later.

Tearing Open the To C Channel, More Meat and Fewer Wolves Can be Found

The huge decline in new energy in the first half of the year mainly came from the B-side.

The best-selling cars of the new forces are almost 100% To C. How much bigger is the To C market than the To B market? In the fuel vehicle market, their ratio is 99:1.

In order to meet policies, especially carbon credits, the seemingly ridiculous and mysterious To B market, which exists for policies, has returned to its original form this year.

New forces are the only ones who did not choose this path according to the data.

Before the Model 3, ES6, and Ideal ONE, traditional brands stayed put and waited, relying on the B-side market to meet policies. In the past six months, the products of new forces for “expensive and good” have seen that there is still a market for new energy. The best time to plant a tree is ten years ago, but the second best time is now.

Did license plate restrictions help them? Nearly half of the sales of the three cars were in non-restricted cities, which means that even without license plate restrictions, their sales performance would be just as good.

The entry point is not new energy but product value. Energy is just a technical means to achieve value, and in the eyes of the market and users, the Model 3 is just a four-wheeled vehicle.

Chinese brands must tear open the To C channel in new energy.

For a price around 300,000 yuan, the Model 3 has become the consensus focal point: the cost disadvantage is not obvious, the product power is less limited, and it can pick up Tesla’s defeated users from the closest distance.

-

Different cards, different playing styles.

-

XiaoPeng and BYD chose to fight it hard, focusing on user’s “cost-effectiveness” experience.- NIO and Xpeng have chosen differentiated positioning while inheriting the core trend;

-

Traditional brands including WM Motor have adopted the most conservative and familiar approach of “low price” + “differentiation”.

Xpeng, BYD, and most traditional brands have not started selling yet. The market will vote with their feet. Now let’s talk about my opinion on ES6 and Xpeng ONE. It should be noted that we are not evaluating the product itself but only the positioning strategy.

Strong benchmarking cost-effectiveness – P7 and Han have a monthly capacity of 2,500 units with limited total capacity:

The advantage of this strategy is that it quickly gains exposure and can quickly enter the user’s circle of initial comparison. However, there are few new energy products, and coupled with the hard standard of cruising range, the user’s initial selection logic cannot be the same as that of traditional cars.

The bigger problem is that the overall capacity is too limited, and the growth rate cannot match the increase in the number of products. In other words, the entry of P7 and Han will not directly triple the demand for pure electric mid-size cars.

Strong benchmarking logic is only applicable in relatively large blank markets. Before 2015, a compact SUV could sell 5,000 units per month by blindly creating a strong benchmarking car like Haval H6 and Changan CS75.

New energy is limited by policies and strongly suppressed by traditional cars. Divided into a separate pure electric segment, the upper limit of growth rate is foreseeable but not a blank market. The products of this strategy correspond to an average market volume of no more than 2,500 units per month in the second half of the year. This P7 and Han need to share.

Ps. Calculation method: Model 3 is sold at 10,000 units per month, the growth rate of demand for segmentation is about 15% (considering history, license plate number, and the impact of new subsidy policies), and some users indeed feel that Model 3 has various shortcomings. Without considering the channel problem, it is roughly estimated.

Inherit core + differentiation – With the new subsidy policy, there is still a lack of an SUV under 300,000 yuan, and the expected monthly sales are over 5,000 units.

The differentiation strategy always faces a problem in the market: whether the visible market blank effectively exists.

This problem does not exist in the new energy market at all. Model 3 is surrounded by effective blank spaces, and any dimension can be segmented into a new market. A new segmentation market can effectively avoid sharing market space with Model 3, so a larger demand base can be seen.

The first thing that was noticed was SUVs. In the traditional market, the market share of SUVs and sedan two-box types has reached a balance. However, in the new energy market, it is still relatively skewed.From a positioning perspective, the Ideal ONE is most effective, with differences in powertrain (range extension vs pure electric), applicable scenario (family vs personal), size/type (mid-size SUV vs mid-size sedan), and style (conservative traditional vs dynamic technological) achieving a positioning that Model 3 cannot match.

Looking at it this way, can’t gasoline cars also compete with Model 3 because of enough differentiation?

Yes, but not entirely. Don’t forget the “core inheritance” as a premise, the core is intelligence and electrification.

It can be anticipated that Ideal ONE will successfully pass the transition period from the completion of orders in the first two months of the previous period to the impact on this year’s target of 30,000 units.

The success of ES6 is not only due to differences in size and styling, but also more importantly, the brand positioning, which is no less popular or likable in China than Tesla.

Brand positioning is higher than product positioning, all products under Huize, coupled with a rapidly expanding network, NIO has already established a path of its own.

To judge whether the differentiated positioning is good or not, just imagine when your family needs two cars, whether the combination of ONE + 3 or ES6 + 3 is harmonious, and you can get the answer. Therefore, the arrival of Model Y is not so scary.

So why don’t ONE and ES6 sell as well as the domestically produced Model 3?

I think the main reason for the strategy is still price, now with the influence of the 300,000 subsidy threshold. Tesla used the space opened up by low prices, coupled with the policy boost of 300,000, imagine if Ideal ONE introduced a low-end/5-seat/small-size version, or ES6, EC6 appropriately reduced configuration, it would be easy to double sales.

The low-price strategy – the cost of Model 3 is already low enough, where is it lower?

So if we adopt a low-price strategy, it will be very difficult to allocate costs, and positioning must be supported by a feasible and reasonable product plan.

This strategy also has a major weakness, that is, once Model 3 lowers its price, it will be in a state of panic, of course, Tesla will not lower the price in the short term as previously analyzed.

I also look forward to an excellent new energy vehicle with a price far lower than that of Model 3, but based on now, whether it is technology or supply chain, this “excellence” is too difficult.

In fact, there is a fourth type – “low-price but not exactly the same in shape”.

Low-price but not exactly the same in shape – Tesla will do it themselves

Low-price but not exactly the same in shape is a very mystical positioning. Many low-price but similar-looking products exist, such as Zotye. To think that Zhongtai is bankrupt, I can’t help but feel that I will never drive a Lamborghini again in this life.

The previous Geometry A had some of this meaning, but due to price limitations, the overall user experience of the product was not quite satisfactory.

So who is more suitable for this strategy?Tesla has finally announced its plan to produce compact cars, as Elon revealed during the Q2 earnings call after our previous analysis suggesting that Tesla was likely to follow this logic.

Interestingly, Tesla’s product line resembles that of Apple, with Mac, MacBook, iPhone, iTouch, and iPod.

In conclusion, the space next to the Model 3 is perfect for a new model that can meet high demand with little competition. Chinese brands are beginning to make their mark in the capital market before launching their products, signaling their intent to compete with global giants.

However, the upcoming Chinese brands face a challenge as they don’t fit the lifestyle of Chinese users. With declining sales over the past two years, the internal restructuring of the market is unavoidable, and the short-term conflict between foreign and Chinese brands is looming.

President Xi Jinping’s call to “build up national auto brands” is timely. The pandemic has refreshed our understanding of national strength and ushered in a wave of Chinese brand pride.

Over the past decade, Chinese auto brands have made significant progress, from producing the lowest-priced models to competing fiercely with joint ventures. In the past two years, new entrants like NIO, Lynk & Co, and WEY have gained increasing confidence in product design and branding, which is exciting.

For instance, Haval H6 has consistently topped the annual sales chart, thanks to its agility in detecting market trends and executing quick iterations. Recently, Great Wall’s brand showcase also demonstrated this advantage, which plays into the hands of local brands targeting the world’s largest auto market.

Therefore, Tesla might not be the main rival, but those “giants” who lack understanding of the internet and Chinese lifestyle. Their meaty pies are at stake. Joint ventures in China have accomplished their historic mission of “exchanging market share for technology,” so the room for dependence is limited.

More and more brands are studying domestic EV models such as NIO ES8, Li Xiang ONE, and XPeng P7, which have surpassed foreign counterparts in many respects for the same price range. In the aftermath of successes in appliances, computers, phones, and televisions, it is a matter of time before Chinese brands win over the foreign giants in the auto market.I still remember a year and a half ago, when a European expert excitedly praised the HMI of a German flagship, while the majority of Chinese attendees showed embarrassed but polite smiles.

Recently, it was reported that NIO is ready to launch its overseas strategy, and Great Wall has put forward the global strategy of “dying outside”. The leaders have already had the courage to “challenge the door”.

Recognize these opponents and make efforts.

Bend is New Energy and Intelligence

The voice of “new energy vehicles are overtaking on the bend” is still echoing in my mind, but intelligence around intelligent cabins and autonomous driving has quietly become the biggest advantage of Chinese brands relative to foreign brands.

Even Tesla has to sit down and learn from Chinese brands on how to provide navigation, speech, APP, and user experience for Chinese users. If the new energy bend is yet to be decided, Chinese brands have already taken a half-body lead in intelligence.

Intelligence is now relatively superficial and slogan-like. From architecture to software to product functionality, the transformation has just begun. A common and optimized product solution is still far from us. The layout of front-engine front-wheel-drive for fuel-powered cars has also been gradually confirmed in the automotive industry over decades.

As the most important trend in intelligence, autonomous driving has long been a battleground for strategists. Fortunately, Tesla is the only one to catch up on this track.

I won’t try to subjectively evaluate and judge the pros and cons of different technological paths. In the end, I sincerely hope that Chinese brands can run out on these two “tracks”.

In Conclusion

This article has already departed from data analysis, even from new energy. This is not only because there hasn’t been significant fluctuations in data in the first half of the year, but also because that inspiring sentence has stirred up fighting spirit in the hearts of every practitioner in the Chinese automotive industry.

As for this column, we still believe that oil-powered cars will eventually be replaced by new energy sources, and now we have added another belief, that Chinese national automotive brands will definitely win over traditional European and American “giants”.

This topic is getting big.

Next month, let’s continue to chat about sales and data honestly.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.