“We won’t hype BaaS to the skies, it’s just an option for users, but it’s a big innovation and change for the industry’s rules. ” This is Qin Lihong, NIO’s CEO’s view on BaaS.

On August 20th, NIO unveiled the specific plan for BaaS: Vehicle down payment is reduced by 70,000 RMB, monthly fee for 70kWh power battery rental is 980 RMB, and with an additional battery insurance fee of 80 RMB, users will need to spend 1,060 RMB per month to rent NIO’s battery. If you choose the Service without Worry package, then the battery insurance fee of 80 RMB/month does not need to be paid.

So here comes the question, is NIO’s BaaS plan worth choosing? How much benefit can BaaS bring to users? And what are the innovations and changes BaaS brings to the industry? That’s what we’re going to talk about today.

The six-year itch for BaaS

To answer these questions, we first need to understand what BaaS is.

BaaS stands for Battery as a Service, originally known as a battery rental financing scheme. Now it’s officially called “NIO battery rental service”, which is an integrated solution that includes services instead of just a financial model, completing NIO’s final commercial closed-loop.

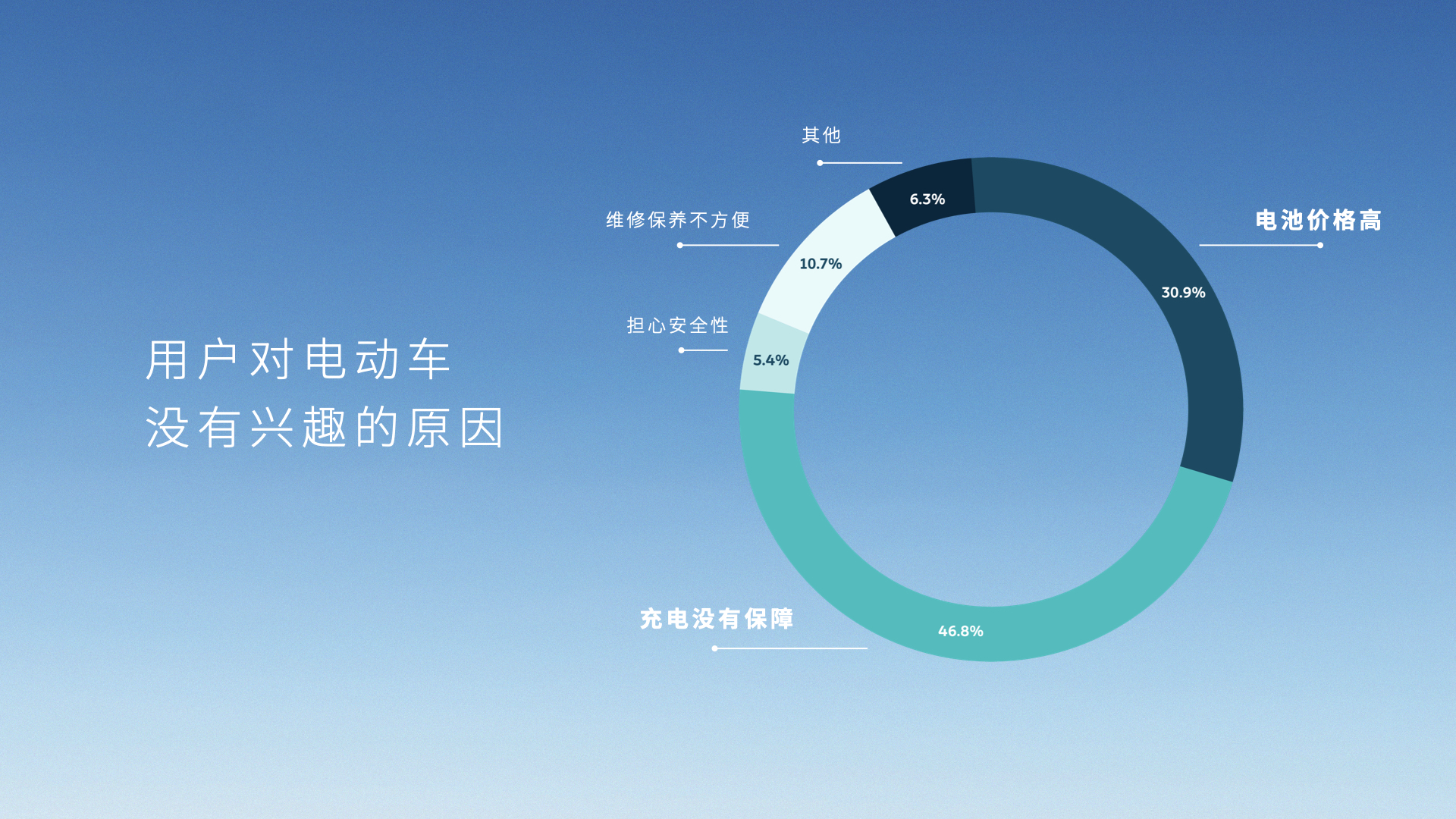

At today’s BaaS launch event, Li Bin quoted a survey from Yiche in 2012. The survey collected more than 60,000 user samples, and its core question was: Why don’t you buy an electric car if you don’t have one?

The final survey result showed that nearly 80% of users had two reasons for not buying, one was the high price of the battery, the other was the lack of charging guarantee.

In an interview with Garage 42, Qin Lihong said, “From this survey, we see two deadlocks. One is that because the battery is expensive, everyone doesn’t buy electric cars, because electric cars sell less, so the volume of batteries is small, and because the volume of batteries is small, electric cars are more expensive. The second deadlock is that charging is inconvenient, so sales are low, whoever invests is losing money, and because whoever invests is losing money, there are fewer charging piles, so people don’t buy. At the time, Li Bin, Lei Jun, Liu Qiangdong, and others discussed and exchanged that distributed fast battery swapping is the only way we can think of. And today, it seems that this is also the only way.”After eight years, Li Bin stood on the second floor of the first NIO House in China and announced the details of the NIO BaaS plan to all users through live broadcast.

Lower Down Payment and Installment Fees

First, let’s take a look at this chart which shows the prices of ES8, ES6, and EC6 under the BaaS policy.

Due to the separation of the vehicle and the battery, users only need to be responsible for the cost of the vehicle itself. Therefore, under the same down payment ratio, the purchase price of a vehicle using the BaaS policy is always cheaper.

However, users who choose the BaaS policy need to spend an additional RMB 980 per month for battery rental. Here we take the performance version of ES6 as an example.

Under the same down payment ratio of 30%, an interest rate of 2.99%, and a loan term of 36 months, the down payment for the model that did not choose the BaaS policy is RMB 115,080, with a monthly payment of RMB 8130.

For the vehicle that chooses the BaaS policy, the down payment is RMB 94,080, reducing RMB 21,000. The monthly payment is RMB 6645, even if the monthly battery rental fee of RMB 1060 and battery insurance fee are added, the monthly payment is only RMB 7705.

The advantage of low down payment and low monthly payment is obvious.

Next, let’s do some calculations. How long is it cost-effective to rent for RMB 70,000?

Calculated based on the monthly rental fee of RMB 980, RMB 70,000 can rent a 70-degree battery for about 71 months, which is about 6 years. If adding RMB 80 for battery insurance, it is about 66 months, which is about 5 and a half years.

Based on the 6-year rental time, if the user sells the vehicle after using it for 4 years, there is only residual value issue except the battery, and there is no battery residual value issue. In addition, the user can save about RMB 11,000 in the remaining two years. On the contrary, if the user continues to use the vehicle after 6 years, he/she needs to continue paying the rent.

Although the rental expenses will gradually increase over a single buyout after 6 years, the advantage is that when selling the vehicle, the user is not selling a 6-year life battery, so there will be a great advantage in residual value. Meanwhile, if the owner wants to upgrade to a larger capacity battery after 6 years, only the rental fee will change slightly, while the owner who bought out the battery needs to spend more money to upgrade to the larger capacity battery at once. Now it costs RMB 58,000 to upgrade from 70 kWh to 100 kWh.

In this aspect, NIO’s vehicle models have the same competitiveness in residual value rate as the same level of gasoline vehicles.Therefore, without affecting user usability, BaaS’s vehicle-electricity separation solves users’ concerns about buying pure electric vehicles from two aspects: used car residual value and battery upgrades. This is a milestone achievement for NIO and even for the industry.

Battery ownership transfer

On August 18th, NIO’s battery asset company “Wuhan NIO Energy Battery Asset Co., Ltd.” was registered and established. There are a total of four shareholders, including NIO, CATL, Hubei Science and Technology Investment, and Guotai Junan International, with each shareholder investing 200 million yuan, to complete the last piece of NIO’s commercial closed-loop.

After the establishment of the new company, the car and battery were separated. For vehicles that choose the BaaS policy, NIO only needs to manage the vehicle part, and the battery part is managed by the battery asset company. After purchasing the car from NIO, the user rents the battery from the battery asset company.

As a result, after stripping off the battery, NIO’s whole vehicle BOM cost can be reduced, and the battery asset company can also obtain revenue through battery leasing.

It should be noted that in the future, users will need to sign four contracts when buying a car, which are the NIO’s vehicle sales contract with users, NIO’s battery sales contract with the battery asset company, the battery asset company’s battery rental contract with users, and the battery asset company’s commission service contract with NIO.

The role played by the battery asset company is similar to that of a telecom operator. The battery asset company launches corresponding leasing packages for batteries with different capacities, and users only need to choose the packages they need according to their own needs.

No need to worry about residual value

In the past, users of the battery rental scheme had to bear the problem of battery loss after 5 years, which directly led to a decrease in the residual value rate of the battery after 5 years, thereby reducing the residual value rate of the vehicle.

Here we can refer to a colleague’s Imported Long-Range Model 3, which has driven more than 35,000 kilometers after delivery, with a battery decay of about 4%. Although it is impossible to accurately calculate the specific loss in 5 years, this part of anxiety still exists.

BaaS solves this kind of problem. In Qin Lihong’s words, “Although you do not have the ownership of the battery, you also do not have the trouble of the battery. You can always rent the battery and let NIO’s battery asset company consider the residual value problem.”

Put it simply, you only need to bear the residual value rate of the battery. The problem of low residual value of second-hand pure electric vehicles, which has discouraged numerous potential buyers in the past, can now be solved in NIO BaaS.

According to the “GB/T 31484-2015 Requirements and Test Methods for the Cycle Life of Power Batteries for Electric Vehicles” released in 2015, when the tested samples are subjected to standard cycle life tests according to the relevant procedures, the discharge capacity is not less than 90% of the initial capacity when the cycle times reach 500 times, or the discharge capacity should not be less than 80% of the initial capacity when the cycle times reach 1000 times. Qin Lihong revealed that NIO will set this value between 80% and 85%.

In other words, if you want to sell an electric vehicle with a battery, the first thing to consider is not how the residual value of the vehicle will be in the next five years, but whether users will be more willing to buy a second-hand NIO with a 70 kWh degraded battery or a NIO that can directly rent a large battery in the BaaS mode when the time comes.

Free battery replacement policy upgrade

For users who place an order for NIO on October 11th, whether you choose to buy the battery all at once or choose the BaaS policy, you can enjoy lifetime free battery replacement, unlimited distance, unlimited times, and no limit on charging stations.

For users who place an order from October 12th, whether you choose to buy the battery all at once or choose the BaaS policy, if you give up the free home charging pile, you can enjoy free battery replacement for the first six times each month. For users who keep the free home charging pile, the first six battery replacements each month only charge the electricity fee and are free of service fee. Starting from the 7th time, the full battery replacement fee will be charged. The specific charging standard is: Battery Replacement Fee = Battery Degree x (Electricity Fee + Service Fee).

As for the question of whether the six free battery swaps per month are enough, let’s do a simple calculation. Taking the 70 kWh version of ES6 as an example, its NEDC range is 430 km, and six free battery swaps equals a range of 2580 km. Considering the discount between NEDC range and actual range, as well as minor discrepancies before and after battery swaps, these six battery swaps can meet users’ actual range of at least 1500-1800 km.

We also interviewed eight NIO car owners, among whom three swap batteries 4-6 times per month, two swap fewer than 4 times, and the other three have home chargers and basically do not need to swap batteries. Although the sample size is not large enough, it does show to some extent that for users with a lower frequency of battery swaps, six free swaps per month are sufficient.

What other concerns are there?

Although the rental process has been explained clearly, there are still concerns among some members of the 42HOW community about “renting.” Qin Lihong also mentioned that “the biggest problem actually comes from users’ subjective feelings. Most Chinese people still have a strong attachment to owning things.“

NIO regards batteries as energy, and Qin Lihong believes that “in the civilian field, paying for coal and electricity is based on usage. In the automotive industry, owning a battery is like paying tens of thousands of yuan in advance to purchase a fuel tank and future fuel costs. I believe that some people will accept this concept first, enabling the essence of using energy to truly return to the usage of vehicles.”

NIO expects that 20-30% of users will accept this consumption model first, and in a few years, if 80-90% of users are willing to accept the BaaS model, NIO may stop traditional sales services.

They even thought ahead that if a car is not used for a long time, the user only needs to pay a fee for disassembly and removal at home, and can temporarily suspend rental payments.

The Industry Impact of Battery Swapping

Why Battery Swapping?

Some of the advantages of battery swapping have been mentioned above, most of which are considered from the user’s perspective. However, there needs to be more profound reasons for why battery swapping is necessary, answers on an industry level.

Firstly, let’s understand the pain points of electric vehicles.

The problems of electric vehicles are nothing more than long charging time, endurance, battery degradation, and resale value.

The problems of electric vehicles are nothing more than long charging time, endurance, battery degradation, and resale value.

What is the significance of solving these problems for the electric vehicle industry?

From the problems themselves, if you think carefully, you will find that the relative reference object for these four problems is gasoline vehicles.

In other words, if these problems are solved, the biggest shortcomings of electric vehicles compared to gasoline vehicles will be solved. This will be an important turning point for electric vehicles to replace gasoline vehicles, which is very meaningful.

And the battery swap system brings possibilities for solving these four problems. If the degree of completion is high enough, the battery swap system will be a “direct train” for this turning point.

Problems with battery swap system

However, this “direct train” faces many thorny issues.

Firstly, on the technical level, the battery swap system requires standardized batteries, which require matching vehicle models. From this perspective, the compatibility of battery swapping is not as good as charging, and once the compatibility is poor, the battery swapping station will lack universality.

Secondly, under the battery swap system, the battery asset cannot be fixed on one vehicle, and the lifespan of different batteries is different. This issue needs to be resolved by enterprises.

In addition, for the battery swap system to form a business model, it must be profitable. The most important issue among them is how to form a profitable closed loop.

Why was the BaaS model only launched today?

As a battery charging mode that is closest to the gasoline vehicle experience, the battery swap system is not the creation of NIO. Many companies have made relevant attempts in the past, and it is necessary to review the pioneer of the battery swap mode, Better Place.

Founded in Israel in 2007, this company mainly focuses on the battery swap of electric vehicles and related service system. It purchases batteries from battery suppliers, has battery property rights, and provides consumers with battery replacement and maintenance services. It hopes to use independent battery swap services to solve the pain points of electric vehicle range anxiety and high prices.

Opposing charging stations, Better Place wanted to be the “gas station” for electric vehicles, which was too big of a goal. But a critical issue is that Better Place’s battery swap mode requires the vehicle to be matched with the battery, and Better Place, which is not a host automaker, is very passive in this regard, and its growth depends on whether electric vehicle manufacturers are willing to comply with it.The fact is that Better Place’s radical approach did not appeal to people at the time. Throughout its six-year history, Renault was the only automaker involved, and even worse, only the Fluence ZE model was offered. During the partnership, only just over 1,000 of these cars were sold. This amount was not enough for Better Place, which hoped to create a global industry for battery swapping. In the end, this pioneering company became “a lonely old man” and declared bankruptcy in 2013.

Although Better Place failed to expand the battery swapping industry, its visionary and disruptive ideas still offer many valuable lessons and insights. Better Place was a precursor and an ancestor in the industry.

As the only automaker cooperating with Better Place, Renault subsequently developed a new sales model based on battery leasing. Users only buy the car, while the battery is leased, and users pay monthly rent for the battery.

Renault, as the automaker, was in charge of battery swapping, acting as both the battery supplier and operator. As for whether to swap the battery or to charge it, it was up to the vehicle owner. The battery leasing model lowered the threshold for purchasing a car, and this method was effective in promoting sales. The sales of the Zoe, a battery swapping model, steadily increased over the following years, becoming the top-selling electric car in Europe in 2017.

In the exploration of battery swapping, Better Place and Renault made many innovations, becoming the pioneers in the history of battery swapping. Today, NIO has also joined in.

NIO takes up the baton, innovating BaaS

The core of BaaS is the separation of car and battery, freeing electric vehicles from a series of problems related to the battery. To achieve this, NIO made a lot of efforts in promoting BaaS, which are often overlooked by people.

First, NIO made it technically feasible to swap batteries at the design stage. As the main manufacturer, NIO considered battery swapping from the beginning and also addressed compatibility issues, allowing multiple models to complete battery swapping under the same standard. This “self-production and self-sales” approach has avoided the dilemma faced by Better Place.

Once the technology was implemented, the compliance of vehicle and battery separation in the law was a crucial issue.

NIO has been communicating with relevant national departments on this matter for years, and through NIO’s efforts, experts and leaders have also recognized that this issue can solve the root problems of electric vehicles.In June of this year, the battery-free car model listed in the MIIT announcement and marked with “battery separation” on the vehicle’s certificate has been recognized as legal.

The third prerequisite: the entire transaction chain of vehicle sales must recognize battery separation.

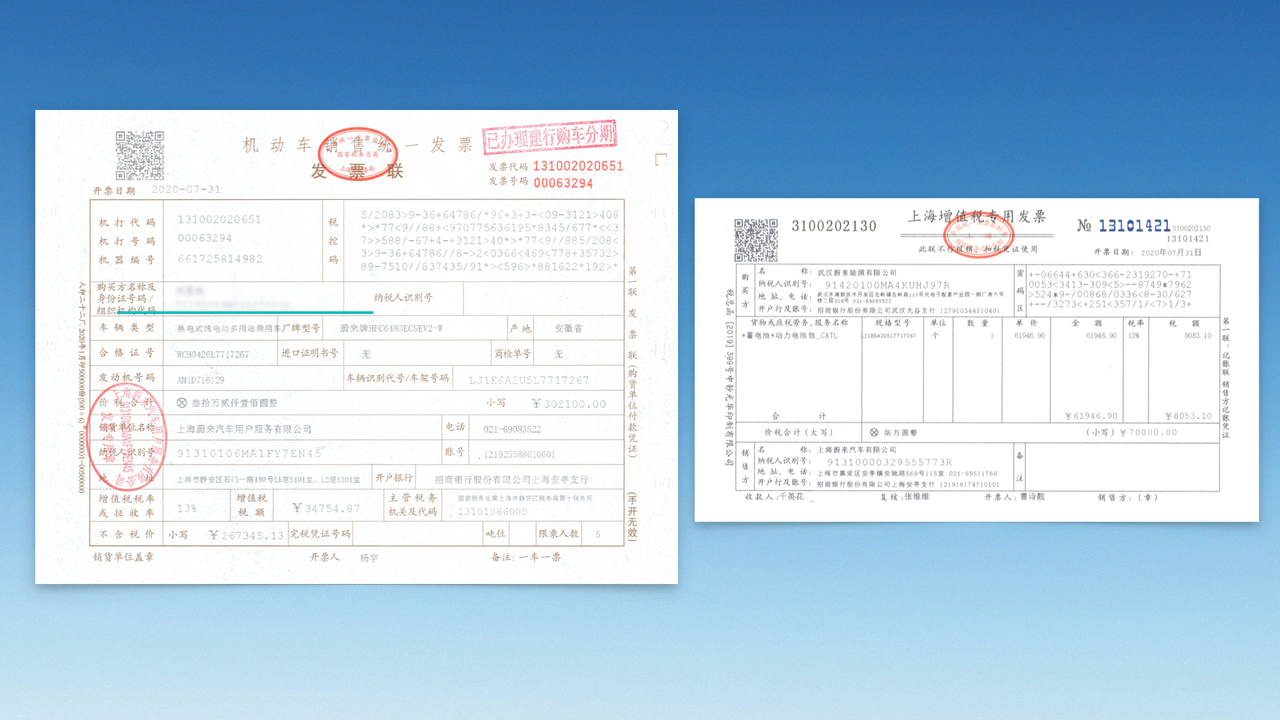

Although MIIT allows battery separation, recognition is required throughout the transaction process. Of course, NIO has also taken care of this, and in the afternoon, it also displayed the invoice for both the ES6 and the battery.

There is another issue, which is the asset of the battery. If there are 10,000 cars in one year, the resulting battery assets will be more than one billion yuan. If NIO bears this part of the asset, the pressure will be tremendous. Therefore, NIO has taken the lead and organized a third-party battery asset management company.

Under these four conditions, NIO’s BaaS has finally completed the commercial closed loop. In addition, NIO has learned a lot from predecessors.

For example, Better Place’s method of large-scale deployment from the beginning was too aggressive, and this was also the key reason why it failed. Growth of electric vehicles needs a process, and battery swapping and charging should not be mutually exclusive. NIO uses a more cautious, distributed approach in the construction of charging stations, which is more efficient.

From Renault, NIO referred to its leasing model and further localized it in NIO’s current products. About the recycling of old batteries, NIO also hopes to refer to Renault for centralized recycling in the future, but this will be handled by the asset company.

Regarding some questions from the outside world about BaaS, NIO’s co-founder and president Qin Lihong also gave some answers in a pre-release interview, and here are a few simple ones.

Question: Can BaaS support the closed ecological system?

Answer: No problem at all. NIO has invested more than 2 billion yuan in energy, and after normal operation, the battery rental service can maintain a break-even state without losing money. However, NIO does not want to make money from it, and its services do not make money, only breaking even is fine. But NIO hopes that the asset company can make reasonable profits from it.

CATL actively participates in this matter and also sees the value in secondary use of batteries after the attenuation node. In this way, CATL has also transformed from a battery manufacturing company to a battery lifecycle management company, which is very valuable for it.

Question: Currently, several battery swapping companies are doing their own thing. Is it possible for NIO to cooperate with them?The NIO does not object to cooperation, but no one is willing to cooperate with NIO in the short term, because this is not simply a matter of money. If collaboration is to be achieved, the chassis must be redesigned. Discussions in the short term are possible, and it is more suitable for mid-to-high-end models. However, for cars under 300,000 yuan, the chance of collaboration is not great.

For mid-to-low-end cars, NIO invests in ODMO, which is a platform that can be widely used in mid-to-low-end models. Now, Great Wall, SAIC, and Geely are all researching battery swapping, and third-party companies like ODMO will provide facilities to everyone, just like Sinopec. Soon there will be a shared platform for mid-to-low-end electric vehicles, and NIO is the initiator of this concept.

Conclusion

At the Tesla shareholder meeting in 2013, Musk discussed battery swapping, and the conclusion was that “there is not much future value in promoting it, unless there is an unexpected turn of events.”

Since then, many people have habitually criticized and belittled battery swapping for this reason – Tesla gave up on it.

Tesla’s statement is indeed influential, but they ignored the reason why Tesla gave up the battery swapping: when Tesla provided two supplementary energy (SE) modes, the Supercharger mode was free, while the battery-swapping mode needed to pay additional service charges, which ranged between 60 to 80 US dollars per transaction. Under this circumstance, it is not difficult to understand why Tesla’s users chose the Supercharger mode.

While the industry was following Tesla’s path to increase charging power, NIO introduced BaaS, which not only provides users with another choice but also brings greater imagination to the prospects of the electric vehicle industry. As Li Bin said, battery swapping and charging should not be mutually exclusive.

The fundamental reason Tesla abandoned the battery swapping back then was that it was not suitable for Tesla in terms of profitability and efficiency. However, NIO persisted in battery swapping since the EP9, and now, with BaaS, because it can address the core pain points of slow charging speeds, fast battery iteration, and low resale value for electric vehicles.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.