By the time you clicked on this article, Waymo, a self-driving car fleet under Alphabet, had been running steadily in Phoenix, Arizona for at least 7 months.

During these 7 months, Waymo’s self-driving car fleet has stably met the daily commuting needs of the residents in Phoenix without triggering any accidents. A few days ago, an accident finally occurred, and after the preliminary investigation by the police, it was concluded that the vehicle involved was in manual mode rather than autonomous driving mode, and both the system and the tester did not make any mistakes.

At the previous financial report meeting, Alphabet CFO Ruth Porat stated that Waymo will launch a transportation app later this year to provide travel services driven by self-driving car fleets. Waymo CEO John Krafcik also claims that “Waymo’s focus has shifted from research and development to operation and promotion”.

Apple, Google, BAT, Toyota, GM, BBA, and other internet and automobile industry giants have all entered the field of self-driving cars, and capital and talents have accelerated the evolution of technology. No matter which angle you look at it from, self-driving cars should have landed earlier.

Do not be deceived by Krafcik. Today, let’s clarify to everyone that progress in the field of self-driving cars is far behind expectations.

Waymo

Let’s start with Waymo.

First, it must be acknowledged that the completeness of Waymo’s software and hardware technology is unparalleled. Yesterday at the Google I/O conference, John Krafcik mentioned some advantages of Waymo that are backed by Google.

For example, Waymo has established a simulated environment with road details that are comparable to the real world to run data. There are 25,000 Waymo self-driving cars “driving” 8 million miles in the simulator every day, and the cumulative mileage has reached 5 billion miles.

In addition, AI experts from Google Brain team regularly collaborate with Waymo’s technology team led by Waymo CTO Dmitri Dolgov to explore the possibility of using AI to improve the technology. Krafcik mentioned an example yesterday: Waymo’s self-driving cars can already predict potential pedestrian crossing or red light violations through AI, thereby avoiding accidents.

In terms of hardware, Waymo has independently developed a set of sensor solutions that include lidar, millimeter wave radar, ultrasound sensors, and cameras. The overall performance is better. Waymo has undergone brutal testing of this hardware in extreme environments around the world (including extreme high/low temperatures, heavy rain/snow, hurricanes, etc.) to verify its reliability and durability.# Waymo conducts road tests in 20 cities with a total test distance of 6 million miles. In algorithm training, Waymo uses Google’s dedicated processor TPU to improve training efficiency by 15 times. In fact, Waymo is also the first autonomous vehicle company to use dedicated processors to train algorithms in the industry.

However, the more comprehensive Waymo’s work towards commercializing autonomous vehicles is, the more severe the challenges the company faces.

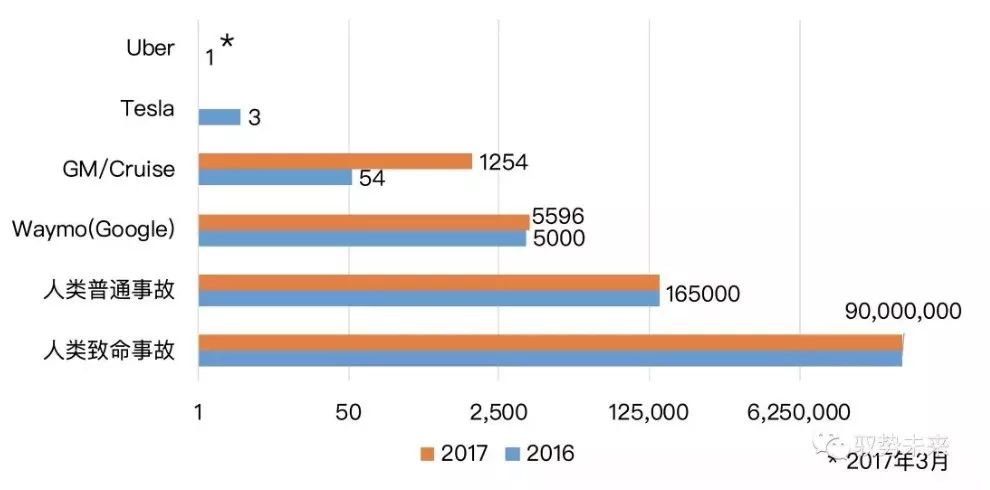

Take a closer look at the chart below:

Uber requires intervention once per mile (an accident will occur without intervention); Waymo requires intervention once per 5,596 miles; humans experience one commonplace accident per 165,000 miles and one fatal accident per 90,000,000 miles.

Therefore, don’t be misled by the x-axis, the conclusion is: Waymo is far ahead of its competitors, but humans are still far ahead of Waymo.

This is the problem. Waymo has been continuously increasing its R&D investment. It took a full 6 years for Waymo to complete the first 1 million miles, but only 4 months to complete the fifth million miles. At the same time, virtual mileage has rapidly increased from 1 billion miles in October last year to 5 billion miles.

But from a technical perspective, the improvement from once every 1,300 miles (in 2015) to once every 5,000 miles (in 2016) to once every 5,596 miles (in 2017) is getting smaller.

The investment keeps increasing, but the improvement is getting smaller. Waymo’s current situation is like an early race car driver who has worked hard to buy the best-performing car and compress his time to 3 minutes, but the passing line is 50 seconds.

More importantly, this strategy of self-funding, collecting data and training algorithms is not sustainable. As mentioned above, Alphabet CFO Ruth Porat has been tightening spending on Alphabet’s emerging businesses, and as an unrevenue generating business, Waymo is unlikely to receive more significant financial support.

You might say that Waymo’s upcoming travel services to be launched later this year will relieve the pressure, but these services are only available in Phoenix. For autonomous vehicles with full sensor hardware and the ongoing R&D investment in testing personnel, it is insignificant.If even Alphabet can’t afford it, other competitors on the same route should give up.

Tesla

Tesla did not directly develop L4 technology in one step. It has taken a crowdsourcing and iterative approach to develop autonomous driving technology through OTA updates and necessary sensors and computer hardware as standard equipment. For example, since the start of the production of the Autopilot 2.0 model in October 2016, Tesla has delivered approximately 100,000 Autopilot 2.0 cars worldwide, which all can be considered Tesla’s autonomous driving fleet. Hence, Tesla has the world’s largest autonomous driving road test fleet. To give a simple comparison, Waymo’s autonomous driving fleet consists of only 600 cars.

After running 5 million miles and collecting data on various road conditions, Waymo has achieved a leading level of technology. However, as of April 23rd, Tesla’s models have already run 7.2 billion miles. In other words, even if Waymo adds simulation data, its data-accumulation speed cannot match that of Tesla’s global car owners.

Moreover, Waymo’s road testing takes place only in 25 specific cities, while Tesla collects data in various weather and road conditions across the world, making its data more valuable than Waymo’s. Therefore, Tesla’s crowdsourcing and iterative approach have solved Waymo’s bugs perfectly.

This is why a former Waymo employee admits in an interview that although Waymo is the only company with a fully automated driving fleet, Tesla has a unique advantage in data collection, which is crucial for improving machine learning algorithms. At least in terms of data, Tesla may be ahead.

With a large amount of real-world data input and OTA updates, Tesla’s AP 2.0 models went from being “almost unusable” at launch to “functionally and smoothly beyond AP 1.0.”

Starting from $35,000, the Tesla Model 3 is equipped with Autopilot 2.0 as standard. It’s noteworthy that the cost of AP 2.0 hardware is about $2000-3000. If Tesla wants to achieve a 25% gross margin, it’s like dancing in shackles. However, if we look at it from another perspective, Tesla’s R&D costs for autonomous driving technology are much lower than its competitors because it doesn’t have a huge road test fleet and related energy and labor costs.

The Tesla route’s bug is simply put: Elon Musk himself.Since the end of 2015, Elon Musk has personally interviewed and directly led the Autopilot team, and said “This is a super high priority”.

Under Elon’s strong intervention, Tesla’s AP 2.0 sensor still does not include lidar. Tesla’s official website describes it as follows:

The upgraded suite of cameras uses a new hardware platform with 8 cameras, providing 360-degree visibility around the car at up to 250 meters of range, which enhances the vehicle’s software and computing capabilities to respond to threats with lightning-fast speed and accuracy.

In other words, Tesla believes that L4-level autonomous driving technology can be achieved without lidar.

At the same time, all manufacturers around the world who are dedicated to developing L4 level autonomous driving technology have chosen to use multi-sensor fusion of cameras, lidar, and mmWave radar for perception redundancy. Most professionals do not deny that the camera + computer vision + deep learning technology has enormous potential. The evolution of AP 2.0 over the past year is a testament to this.

However, there are obvious limitations to this technology route, such as limitations in environment lighting and extreme difficulties in resolving three-dimensional information. With the improvement of technology, Tesla AP 2.0 achieves the relatively achievable goal of L3-level autonomous driving.

As of now, Elon Musk is the only person in the industry who strongly opposes the use of lidar. Initially, we thought this was his promotional rhetoric- that is, once the cost is available, Tesla cars are likely to come standard with lidar. However, Elon really dislikes lidar. He explained his reasons at a Tesla earnings conference:

In my opinion, it’s (lidar) like a cane, it will cause companies to get stuck in a very difficult-to-get-out-of situation.

It is incomprehensible that some companies use incorrect wavelengths for active proton generation systems (lidar). They arm the car with expensive equipment, making the car expensive, ugly and unnecessary. I think they will eventually find themselves at a disadvantage in competition.

Even if the technology meets the standard of L4 level autonomous driving technology, Tesla still has one problem: the lack of redundancy mechanisms. Take Waymo as an example, Waymo’s self-driving cars have a series of backup mechanisms, including brake backups, steering backups (including independent power and controllers), power backups, and redundant inertial measurement systems. The backup system can take over in time when the executing system fails to prevent accidents from happening. However, we believe that Tesla will gradually improve this problem in later mass-produced models.Although Tesla has the unique advantage of having a fleet of hundreds of thousands of vehicles collecting data (and still increasing), it is almost certain that Tesla cannot reach the finish line if its technology roadmap is wrong.

Didi

Is there any company that can support a self-driving fleet of over 100,000 vehicles, and also equipped with expensive lidars?

As early as May 2014, Uber founder Travis Kalanick said: “People think Uber is expensive because you are not only paying for your own ride, you are also paying for the other guy (the driver) in the car.”

Foreign media Rocode exposed Uber’s data model: For each earned $1 by Uber, 65%-80% of the fare is paid to the drivers, leaving only 20 to 35 cents for Uber.

Considering that Uber only recently caused the first fatal accident involving self-driving cars in history, and has suspended its road testing, it is more reasonable to shift our focus to Didi, a competitor with comparable scale in China.

In China, Didi’s commission rate is about 20%. Previous media reports showed that Didi’s GMV in 2017 was between USD 25 billion to USD 27 billion. Didi’s daily orders last year remained around 25 million. Therefore, Didi has sufficient motivation to develop self-driving cars to replace drivers.

It is not that Didi has stronger financial resources than Alphabet. With the declining cost of lidar, the comprehensive cost of self-driving cars has already decreased, and there will be a certain point at which it will not attract ordinary consumers. Then Didi will have a bigger role to play.

Ola Kaellenius, Daimler’s head of market and sales, recently told Bloomberg that early Mercedes self-driving cars will be used for shared rides to spread the hardware costs by replacing the drivers. This is a logical business model.

Considering Didi’s low-key approach to its self-driving business, let’s take a look at Cheng Wei’s attitude. Last year, in an interview with “Caijing”, Cheng Wei said:

(Didi raised $4 billion) There will be a huge global battle soon. Didi and Uber will have fierce competition globally, but this competition is not the endpoint. The winner will then compete and cooperate fully with car manufacturers, then compete with Google and Tesla in the field of self-driving, and the champion will build the future transportation and automotive systems.

About self-driving views:> The advantage of Didi lies in two aspects. First, commercialization. It is difficult for self-driving cars to be sold to ordinary consumers within ten years because self-driving requires specific roads and environments. Before dispatching a car to pick up a passenger, Didi already knows the starting point, destination and whether the route is suitable for self-driving. If it is suitable, they dispatch a self-driving car; if not, they dispatch a human driver’s car. This hybrid mode will last for a long time. Second, data. Didi has a fleet of 21 million cars, and neither Baidu nor Tesla have such a large fleet to gather data for them, which is why Google is investing in Lyft.

We have the opportunity to win. In my mind, the importance of this is ten times higher than local competition.

Recently, in an interview with BBC, Cheng Wei once again mentioned artificial intelligence and self-driving cars as Didi’s current focus and the main direction of their future investment.

Their ambition is large; they want to compete with Google and Tesla, but they have not mentioned when they will mass-produce and commercialize. Considering that Didi has already formed the world’s largest travel platform and their car fleet is gradually expanding, we can temporarily list Didi as a contestant in the China region.

Waymo, Tesla, and Didi are all New Money, and there are no opportunities left for traditional car giants in the future field of transportation. At least for now, this is the case for the top spot.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.