Author: A Green Leaf

As pure electric vehicles become increasingly popular, more and more people are choosing to use them for transportation, especially as the conversion from traditional fuel vehicles to pure electric vehicles has been happening quickly. Despite this, the “new users” who have converted from traditional fuel vehicles still have large doubts about the charging capabilities of electric cars.

Currently, there are two main solutions for charging electric vehicles: the first involves an 800V supercharging mode, while the second is NIO’s insistence on battery swapping and supercharging.

From the perspective of charging infrastructure, charging stations are currently mostly located in cities, with few companies discussing the construction of charging infrastructure between cities except for NIO.

This brings up several questions:

- Why is it difficult to increase both the range of electric vehicles and the construction of charging infrastructure between cities?

- Why is fast charging always so difficult?

- What problems have been solved by NIO’s high-speed battery swapping station?

- Why is swapping batteries convenient for users but a moat for automakers?

The Background That Needs to be Discussed

Have you noticed that since the second half of 2021, carmakers have hardly mentioned “range anxiety” anymore? In fact, it is because the focus has shifted to charging anxiety.

As the CEO of TELD stated publicly, there is still a long way to go before electric vehicle owners have a good charging experience in terms of range and charging capabilities.

The two underlying issues are:

- Improving the range of electric vehicles;

- Addressing the issues with charging infrastructure.

Improving range and building more supercharging stations are the two main ways car manufacturers are addressing charging anxiety, and these two strategies have been developed in parallel.

Talking About Range First

Since 2015, the primary approach to providing a better experience for electric vehicle owners has been to improve the range of the vehicle itself, but the fact remains that there has been no significant breakthrough in the technology of battery materials.

From a technical perspective, improving the battery’s power and lowering the cost by integrating it into the chassis is limited. In reality, the current range of electric vehicles, including models with dual motors that can last over 600 km and models with single motors that can last 660-700 km, are achieved by simply adding more batteries.Why has adding “battery cells” become a dead end for the automotive industry?

The answer is cost.

According to data, due to the continuous spike in lithium material prices, the purchasing cost of ternary batteries reached 1200-1300 yuan per kWh (Pack kWh) for car companies in Q3 this year, and this price may rise to 1300-1400 yuan in Q4, which is enough to make many car companies hesitate.

As a result, we can see that the battery pack is generally capped at around 100 kWh, because this degree can maximize the benefits between cost and range.

The reason why users currently feel like they no longer have range anxiety is due to the perfect construction of the urban charging system, which allows for a chargless perception and less of a deep sense of range anxiety.

Note that there are two necessary conditions to achieve this perception, one is that the single-vehicle range is long enough, and the other is that the city’s energy supplement system is perfect.

As mentioned above, increasing battery cells to improve range is a dead cycle. Some car companies’ approach is to reduce motor power. The Cadillac Ruijie model of around 400,000 yuan can only be delivered with a single motor, the Gleagle 001 uses an additional clutch to decouple the front and rear permanent magnet motors, and car companies are working on reducing wind resistance.

All of these efforts are aimed at increasing range by optimizing the system without increasing battery cells.

Energy supplement issues

No one doubts the intention of car companies to construct an energy supplement system:

- As of December 7, 2022, NIO has built 1,250 battery swap stations nationwide, of which 332 are high-speed battery swap stations;

- As of September 24, XPeng Motors has launched a total of 1,011 self-operated charging stations, including 205 self-operated destination charging stations, 799 self-operated supercharging stations, and 7 self-operated ultra-fast charging stations, covering all prefecture-level administrative regions and municipalities directly under the Central Government.

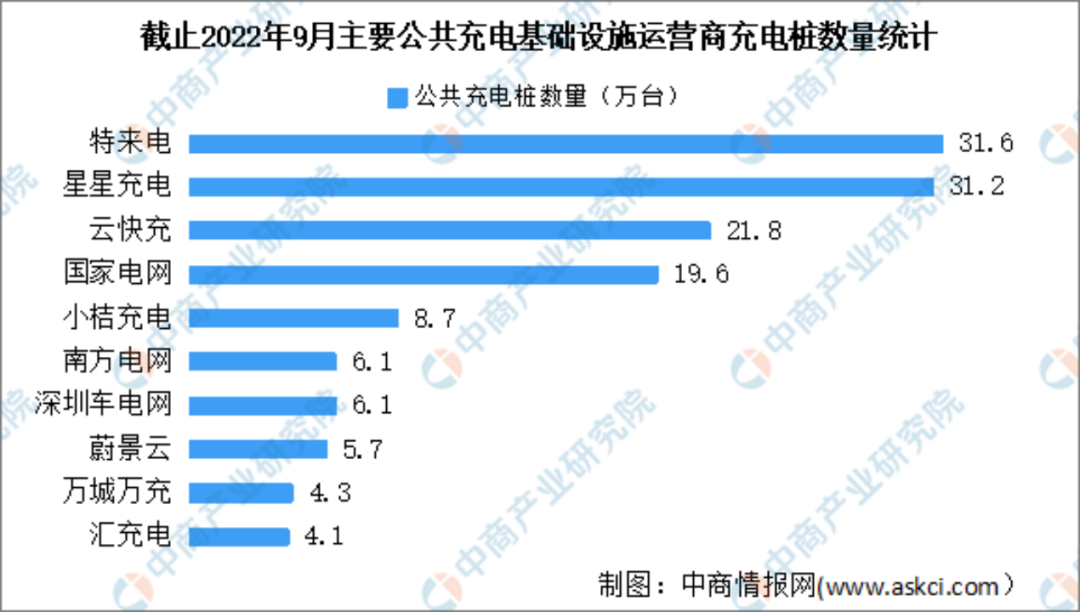

This picture shows a total of 1.392 million charging piles, but according to the data of the National Energy Administration, currently only State Grid and Southern Grid are deployed in the intercity expressway service area.

This picture shows a total of 1.392 million charging piles, but according to the data of the National Energy Administration, currently only State Grid and Southern Grid are deployed in the intercity expressway service area.

That is to say, among the 257,000 stations deployed by the State Grid and the Southern Grid, a considerable part of them are in the city, and there are few stations for commuting on highways.

What does all this mean?

Taking Shanghai as an example, with over 100 battery swap stations and a coverage rate of nearly 90% of the electricity distribution room, long-term NIO car owners may have a feeling that even if there is no standard electricity distribution room within a few kilometers, as long as there is a battery swap station, the owner’s first choice is still to go there to swap the battery. NIO car owners can even proudly say that they can charge their vehicles with just one click.

In short, until now, the charging stations built by most private enterprises and vehicle manufacturers are located in the city. Even car manufacturers like NIO layout both battery swap stations and charging points in the city, so the commuting range anxiety in the city has been basically eliminated.

The urban commuting energy supply, both in scale and depth, has become mature. But the high-speed energy supply seems to be in a completely disconnected stage. Except for state-owned companies like State Grid and Southern Grid, there are almost no third-party charging piles in the service area.

But here’s the point, except NIO.

Because NIO has already deployed battery swap stations in the service area, and battery swap stations will be established within 3 km of the highway exit in even the service areas where they cannot be accessed.

This raises a question: why don’t vehicle manufacturers deploy charging stations in service areas, given the importance of intercity commuting?

Let’s take a look at this.

Why is high-speed charging always difficult?

On December 12, 2022, at a media event held by NIO, Qin Lihong, the CEO of NIO, said:

Establishing a systemic ability is a difficult thing, and it is even harder to let outsiders understand the “system” itself.

For example, even now, 70% of electric vehicle users still think that battery swap will bring down NIO.

From the latter half of the sentence, even if NIO’s battery swap has become one of the best energy replenishment solutions for EVs, it may have become the best energy supplementation solution for NIO car owners, regardless of where they are located or how densely the stations are set up.However, many people still question the “battery swap” itself.

Here’s a question: why does only the State Grid have charging stations in high-speed scenarios, which are the most anxious situations for pure electric vehicle users?

To answer this question, let’s first understand how many charging stations currently exist on China’s highways. According to information released by the Ministry of Transportation at the end of October, there are currently 16,721 charging stations built in 3,974 public service areas across the country.

In other words, there are an average of 4.2 charging stations per service area, which is in line with users’ perceptions. Usually, there are four charging stations at each highway service area, most of which are from the State Grid.

Why is it rare to see charging stations from other brands except for the State Grid?

The answer is “losing money”!

Currently, charging stations can only make a profit from service fees, so they place great emphasis on “utilization rate.”

According to the estimation of Guotai Junan Securities in 2021, if we take a 60 kW charging station as an example, it needs to achieve an 8.29% utilization rate to break even.

What is the general utilization rate now?

Let’s take Shanghai, the first-tier city with the highest proportion of electric vehicles, as an example.

According to the public data collection platform for charging and swapping facilities in Shanghai, despite the rapid increase in the number of electric vehicles in 2022, the utilization rate of public charging stations has not been rising. Setting aside April and May for special reasons, the utilization rate increased from 4% at the beginning of the year to around 6% at the end of the year.

To achieve a high utilization rate for charging stations, there needs to be a stable customer base. Similarly, taking Shanghai as an example, charging stations specifically designed for electric buses generally have a 2% higher utilization rate than public charging stations.

Do not underestimate this 2%, as it may be the key to turning losses into gains.

Many charging stations prefer to be located near Didi or Huochebang stations for this reason, as stable customer sources help improve utilization rates.

From the perspective of utilization rate, it is evident that even in Shanghai, charging stations are not so easy to profit from, as they need to find the right location.# Shanghai is already difficult enough, not to mention making a profit at highway service area charging stations.

Moreover, service area charging stations have obvious tidal effects, with a scarcity of supply during the Spring Festival or long national holidays and no attention on regular days. The utilization distribution is severely uneven, as if crowded up during the rising tide, and scattered during the ebbing tide.

Teld, the electric vehicle charging infrastructure provider, once said, “If we relied solely on trips during the Spring Festival, May Day, and the National Day golden weeks, normal operations could not be sustained. The higher the investment in charging pile projects, the higher the utilization rate requirement.”

Most industries only focus on the difficult charging during the Spring Festival, but no one pays attention to the day-to-day lack of demand, which results in it being difficult to attract charging service providers to join in.

Only the State Grid will respond to the policy of promoting the popularization of electric vehicles by setting up charging stations at highway service areas. However, due to the difficulty in profitability and promotion, it has become common for chargers to be faulty and phones to go unanswered.

There is now a new question: since the State Grid actively responds to policies, why only build an average of four sets of charging piles? Why not build eight, ten, twenty or fifty sets of charging piles?

Highway service areas are products of the age of gasoline-fueled cars. At the beginning of the planning, the distribution capacity was relatively limited. Coupled with many areas of highway service areas being far from the market, the cost of building a dedicated large-capacity line for the power grid is high.

Therefore, the distribution capacity of service areas is inherently insufficient and has been poorly adjusted afterwards. Many areas can only meet a capacity of 630 kVA or less, and four sets of charging piles are the most cost-effective solution.

Some service area charging piles are clearly 120 kW, but the power is limited to 60 kW or less due to insufficient local power capacity. It is necessary to wait until the charging power is expanded before it can be increased.

These difficulties are not the only ones. The management models of various highway service areas differ, and finding the appropriate unit for coordination is also different:

- There are provincial state-owned enterprises such as Hebei Highway and Shandong Expressway Group;

- There are national energy companies such as China National Petroleum Corporation and China Petroleum and Chemical Corporation;

- And there are private companies such as Jiaxing Kaitong Investment and Tianfu Group.

Each company’s managed highway service area has different scopes and restrictions, which require time and effort to overcome.

In response to this, the Ministry of Transport, together with the National Energy Administration, the State Grid, and the Southern Power Grid, released the “Action Plan for Accelerating the Construction of Charging Infrastructure along Highways” in August of this year, to accelerate the construction of charging infrastructure at highway service areas.Translated Markdown Text:

NIO’s Highway Charging and Battery Swap Network

It’s notable that the state has acknowledged that the charging problem at service areas is a pain point for electric vehicles on long trips. However, government policies only guarantee availability rather than ensuring the charge points are plentiful and user-friendly.

In conclusion, there are three main reasons why charging operators don’t invest in highway service areas:

- There is a crowding-out effect at highway charging stations, with overall utilization rate insufficient to support private companies’ business models.

- Most service areas on highways have insufficient electricity capacity, and third-party companies cannot use them after State Grid’s distribution.

- Service areas management and unit designations vary from one another, necessitating large energy operators to provide site support.

Does this mean that only State Grid offers highway energy supplements?

This is where NIO comes in.

NIO’s Highway Charging and Battery Swap Network

During this year’s NIO Power Day event, NIO co-founder and CEO Qin Lihong announced the high-speed battery swap target for 2025, which is to build a network of 9 verticals, 9 horizontals, and 19 city clusters.

- On November 14, 2018, NIO successfully set up the first G4 high-speed battery swap network.

- By June 22, 2022, NIO had basically completed the high-speed battery swap network of 5 verticals, 3 horizontals, and 4 city clusters.

According to Qin Lihong:

“What do we mean by the ‘basic completion’?

It could be a one-way or two-way route, but there will be a battery swap station within approximately 200 kilometers.”

The 2025 target of 9 verticals, 9 horizontals, and 19 city clusters represents total coverage, meaning that “within any highway planned route section, there will be a battery swap station within approximately 150 kilometers in any direction.”

Therefore, on NIO’s app, we can see that car owners attending this year’s NIO Day spontaneously chose self-driving for routes like Guangzhou to Hefei, Beijing to Hefei, and Hangzhou to Hefei, which is an interesting route, as it happens to have several optimal locations for NIO’s high-speed battery swap stations, such as the entire Shenhai Highway, Jinghu Expressway, etc.The highest standard for high-speed travel is not how many kilometers you travel or how many routes you take, but the ability to hit the road whenever you want.

Based on current battery swapping times, NIO has yet to reach the user’s expected time of 3 minutes per swap, but for existing NIO owners who have completed battery swaps, their experience of an average of 5 to 6 minutes per swap can be easily ignored.

Hitting the road whenever you want is not determined by battery swapping time, but rather by the knowledge that as long as a battery swapping station is available, NIO users can enjoy the best supplementary energy experience without worrying about a faulty charger.

Therefore, NIO’s high-speed highway battery swapping stations are prioritized for construction within service areas, and if not feasible, are located as close to the entrance and exit ramps as possible.

Below are two details worth noting:

Firstly, NIO not only provides battery swapping, but also has a total of 2,170 charging stations and 12,689 charging piles, which places NIO among the top 15 charging service providers in terms of quantity.

Secondly, despite having a relatively small number of charging piles, NIO’s charging rank is among the top five, and it could take years for NIO vehicle owners alone to consume all this electricity.

This means that NIO has achieved the most charging volume with fewer charging piles, and many external car brands also use NIO’s charging piles. Each high-speed battery swapping station is equipped with two charging piles, which not only does not occupy much power capacity but also provides the charging and battery swapping experience.

Most importantly, NIO’s charging piles are fully open, and any vehicle with a standard interface can use them by simply downloading the “Add Electricity” app. Users can access all NIO charging piles and 600,000 third-party charging piles through the app.

NIO is not only constructing stations along the east coast, but also deeply penetrating the central and western regions, and even attempting to tap into the deserts and plateaus of the western regions. The once-mocked “charging is more convenient than refueling” statement by Li Bin is gradually coming true.

As mentioned above, constructing service areas requires connecting counterparts in other units, so why does NIO build some of its high-speed battery swapping stations outside of service areas?Due to the corresponding units not allowing it, there is a joke online called “All-Electric Cars Can’t Get Over the Shanhaiguan Pass.” In Northeast China, where temperatures are low for six months out of the year, the performance of the batteries is greatly affected, which results in a sharp decline in the all-electric driving range. As a result, the sales of all-electric vehicles in Northeast China are very poor. Additionally, the construction of high-speed charging stations in Northeast China is notoriously poor, so it is very difficult for people in other provinces to drive all-electric cars to Northeast China.

This year, charging stations are only being rapidly built along the G1 Jingha Expressway in the second half of the year. Before that, it was difficult to find a single charging station at service areas.

After the Liaoning Provincial Expressway Industrial Development Company completed the planning of charging stations at service areas along the entire provincial expressway system in the “Action Plan to Accelerate the Construction of Charging Infrastructure Along the Highway,” the construction of charging stations could not keep up. As a result, NIO’s battery swapping station in Liaoning is located some distance away from highway service areas, not because NIO doesn’t want to build within the service areas, but because they cannot persuade the Liaoning Provincial Expressway Industrial Development Company to do so. NIO must spend a lot of time negotiating with the management companies of various highway service areas.

On the homepage, you can often see strategic cooperation, such as working with Yan Zhao Yi Xing to build Hebei Expressway, working with Zhejiang Commercial Group to build Zhejiang Expressway, and working with Anhui Yi Da to build Anhui Expressway, etc. These are the partnerships NIO has made with some of the companies to build battery swapping stations. The red circle is where the management companies of the highway service areas are located. Building stations in service areas is not something that can be done easily. Behind the scenes, time and effort must be invested. For places where a deal was not made, NIO makes an effort to find nearby location for the stations.

Some people may argue that NIO’s battery swapping station can only serve its own car owners and is not compatible with other all-electric models, which actually captures electric capacity that might be used by other manufacturers’ charging stations. Obviously, this is not something NIO wants. Take the Lotus Mountain Service Area on the G1523 Yongguan Expressway as an example. This location is an important relay station from Chaoshan to the Greater Bay Area, but it has been plagued by insufficient electric capacity, especially during holidays. During last year’s National Day holiday, to cope with the local electric capacity problem, NIO specifically brought a mobile charging vehicle on standby to ensure fast charging. They also parked an ES8 next to the charging station to be charged. After it was fully charged, they would swap the battery into the battery swapping station and continue charging the empty battery.Maximizing the Use of Local Capacities with the Time Difference Utilizing Tidal Effects – Only Battery Swapping Can Achieve the Assurance of Owners’ Mobility under this.

“Rechargeable, Swappable, Upgradeable” has always been NIO’s insistence. As long as the local capacity allows, there are NIO charging piles next to the battery swapping stations, and the service areas on the highways are no exception. NIO charging piles are open to all electric vehicles.

To comprehensively enhance the pure electric experience of Northern users, NIO has launched the Power North program aimed at eight northern provinces, hoping to achieve an average of one mega charging station for every 100 kilometers on highways in the provinces.

Like Liaoning, Geelyn is also far behind in terms of high-speed charging construction. After receiving the Action Plan for Accelerating the Construction of Charging Infrastructure Along Highways, Geelyn chose to cooperate with NIO in building high-speed charging stations.

- On September 30th, NIO signed a cooperation agreement with Geelyn Jigao Service Area Management Company, with the first batch of 12 high-speed mega charging stations launched.

- On November 28th, Geelyn’s high-speed mega-charging network was officially connected, with a total of 35 mega charging stations deployed, connecting nine prefecture-level cities in the province and providing an efficient transportation experience in Geelyn.

NIO spares no effort in constructing high-speed charging and swapping stations, only to provide better user experience for pure electric vehicle owners and to solve the pain points in long-distance travel.

NIO’s Unique Moat

Inter-city energy supplementation is a very important scenario, and the development of pure electric vehicles will also penetrate from first- and second-tier cities to smaller cities and broader population. Users’ travel scenarios will also become more complex, and the demand for inter-city travel will be magnified.

Whoever can solve this scenario experience well will have a first-mover advantage in the minds of “new users”.

Many automakers have only realized the actual demand for the high-speed scene after the fact, just like only 30% of people are optimistic about NIO’s battery swapping stations until now. Many people said that the cost of urban battery swapping stations was high, but when they saw that the cost of a large-scale deployment of 800V was higher than that of battery swapping stations, many people were slow to catch on.

Why is the energy supplementation system NIO’s moat?

Note that this river cannot be founded by anyone. The urban battery swapping stations + home charging + mega chargers to solve the energy supplementation of urban users, coupled with NIO’s own 800V scheme, NIO battery swapping stations can achieve true 800V in coordination with mega chargers without the need for additional capacitors.I have always had a point of view: the automaker that can achieve large-scale implementation of 800V is not XPeng, not Guangzhou Auto, not SAIC, and not the one that will go all-electric in the future. It is NIO.

Many people may say, isn’t it just about cost? Even if it costs more than a battery swap station, as long as the automaker is willing, is there no chance?

I can only say that there is a chance, but not much.

There is a chance because it is possible as long as you can ensure the relevant department will modify the power grid infrastructure for you.

Not much, because I believe you cannot make it happen.

Infrastructure transformation must be a major policy, and the country has a rhythm of promotion. Furthermore, the charging pile’s locations have basically been taken over by Tesla and NIO. It is like winning a lottery ticket, difficult to attain.

Inter-city expressway stations combine battery swap stations and supercharging, solving the commuting efficiency of users. I believe there are not many people who want to see the scenery along the highway when commuting inter-city. Most of them just want to reach their destination quickly. The energy supplement efficiency of the battery swap station has an absolute advantage compared to charging.

As mentioned above, whether car manufacturers build their own or rely on third-party operators, the layout of charging piles between cities is not just one problem, but also includes the capacities and utilization rates of service areas that cannot support business models, and the problem of different government units managing the service areas.

As Qin Lihong, the co-founder and president of NIO, said: We are not worried about our competitors imitating us. We have already deployed 1,250 battery swap stations. From imitation to exceeding, there are still over 1,000 stations yet for our competitors to catch up.

Qin Lihong’s words are very cutting-edge but very realistic. This is the first-mover advantage, and this first-mover advantage cannot be bought only with “money.”

NIO car owners may be the happiest electric vehicle owners. They have the opportunity to experience true 800V charging, the best inter-city energy replenishment efficiency, and the most convenient battery swapping experience in the city.

These things, it is difficult for other car manufacturers to achieve at present. Not to mention replicating such an energy supplement system, let’s first deploy 1,250 800V supercharging stations.

Conclusion

First of all, we must be clear that although the battery swap station still needs an average of 5-6 minutes to swap, it is still the best way to supplement the energy of pure electric vehicles.

The problem with the battery swap stations mainly stems from the density of the layout and the high-speed swap stations. The former can be compensated for with time. As for the latter, if it were not for brands like NIO that treat swapping as infrastructure, it would be difficult to make significant progress.## Profit Difficulties of High-speed Charging Piles and Solution of Capacity Problem

Apart from state-owned enterprises like State Grid which have the capability to promote changes in infrastructure for all government departments and operating companies, private enterprises cannot achieve this. “Battery swapping + charging” can achieve charging and swapping with only part of the capacity.

In terms of establishing stations, NIO has not only cooperated with the High-speed Group, but also with energy giants such as Sinopec, PetroChina, CNOOC, and Shell. NIO is actively expanding integrated high-speed charging and swapping stations overseas.

Qin Lihong, co-founder and president of NIO, said at this year’s NIO DAY that there will be a change in NOP+. NOP+ will be able to achieve autonomous navigation and battery swapping. In simple terms, the vehicle can independently enter the ramp, enter the service area to find the battery swapping station, complete the battery swapping and then merge onto the highway without human intervention.

If we visualize energy replenishment scenarios, we will find that “home charging piles + destination charging piles + supercharging piles + swapping stations” are the truly viable way to achieve full-scenario energy replenishment. NIO’s energy service system, which adheres to the philosophy of chargeable, swappable, and upgradable, is no longer an operational burden, but rather a broad and deep corporate moat.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.