Passenger Vehicle Overall Data

Special Contributor | Zhu Yulong

Editor | Qiu Kaijun

With the last two weeks of 2022 approaching, automakers are finally getting anxious. From December 12th to 18th, both gasoline cars and new energy vehicles showed a significant increase.

Among all automakers, BYD hit a new weekly high with 50,462 units insured. Tesla’s decline is evident, while Changan, EAIC, and Ideal are also boosting their sales volume. At this time of sprinting, we can see whose momentum is stronger this year.

1) Passenger car sales

Total sales of 600,000, up 23.5% YoY and 29.8% MoM. With the last two weeks remaining, the domestic annual cumulative sales volume is expected to reach 20 million units, assuming a weekly sales volume of 600,000.

2) New energy vehicles

Sales volume of 162,000 units this week, up 57.0% YoY and 15.6% MoM. With two more weeks remaining, the annual cumulative sales volume reaches 4.884 million units.

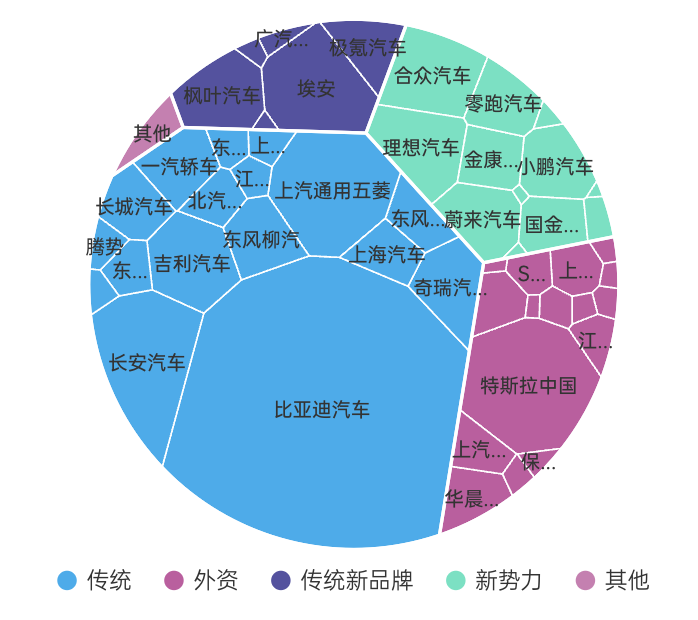

The distribution of new energy vehicles is as follows. Emerging new brands account for 15%, foreign brands account for 15%, and the remaining 70% is shared by traditional automakers and newly-emerging brands.

3) Gasoline cars

Gasoline cars have exceeded 437,500 units this week. Everyone is sprinting for the year-end data, up 14.4% YoY.

Leading New Energy Vehicle Brands

BYD sold 50462 vehicles, a new high in weekly data.

Tesla China sold 10254 vehicles, showing a weak performance in December this year. Tesla needs to figure out a way to solve this problem.

SAIC-GM-Wuling sold 8925 vehicles, completing its task.

Changan sold 8680 vehicles, mainly including Lumin 3000+, Benben 2400+, and the deep blue SL03, totaling 1500+ vehicles.

Aiways sold 6628 vehicles, also a recent high in deliveries.

Hozon sold 5001 vehicles, and Hozon’s sales have been fluctuating a lot recently.

Geely sold 4820 vehicles, and Maple Leaf Auto sold 4070 vehicles. Together, they sold nearly 9000 vehicles.

Emerging Brands

The situation of emerging brands and several main brands of concern are as follows.

1) NIO: sold 3464 vehicles this week, up 63.6% YoY and 16.2% MoM. Still constrained by delivery, with better delivery performance to come later as ET5 ramps up.

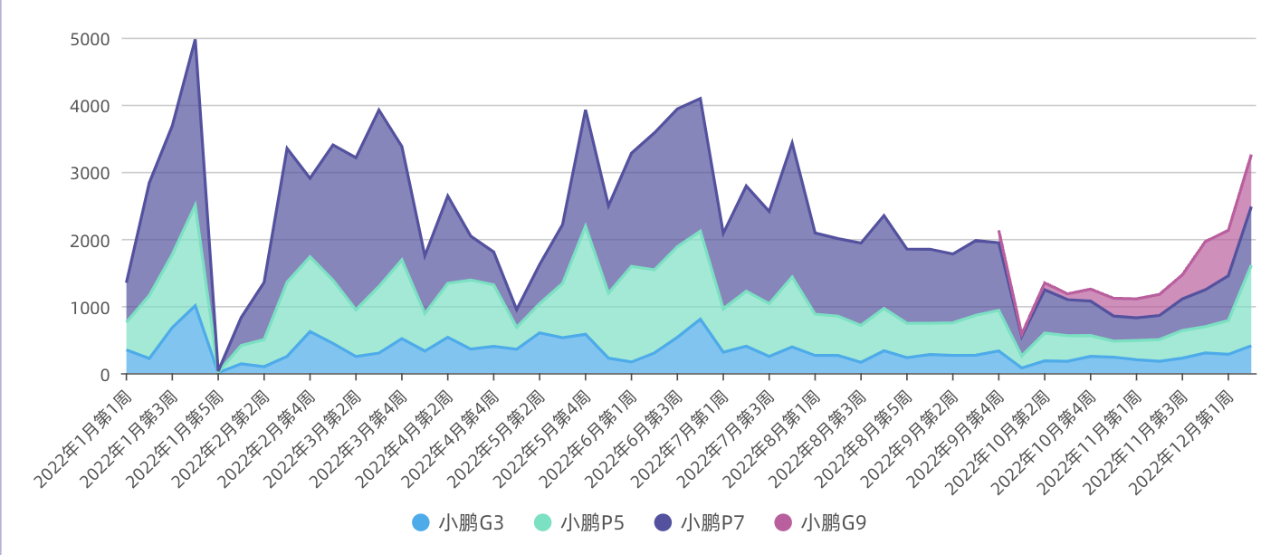

2) XPENG: sold 3257 vehicles this week, down 11.7% YoY and up 53.1% MoM. However, G9 data has not yet been released, and it is currently within the top 1000 on a weekly basis. If we exclude G9, XPENG’s sales of P7 have indeed been weaker from the beginning of this year to December.

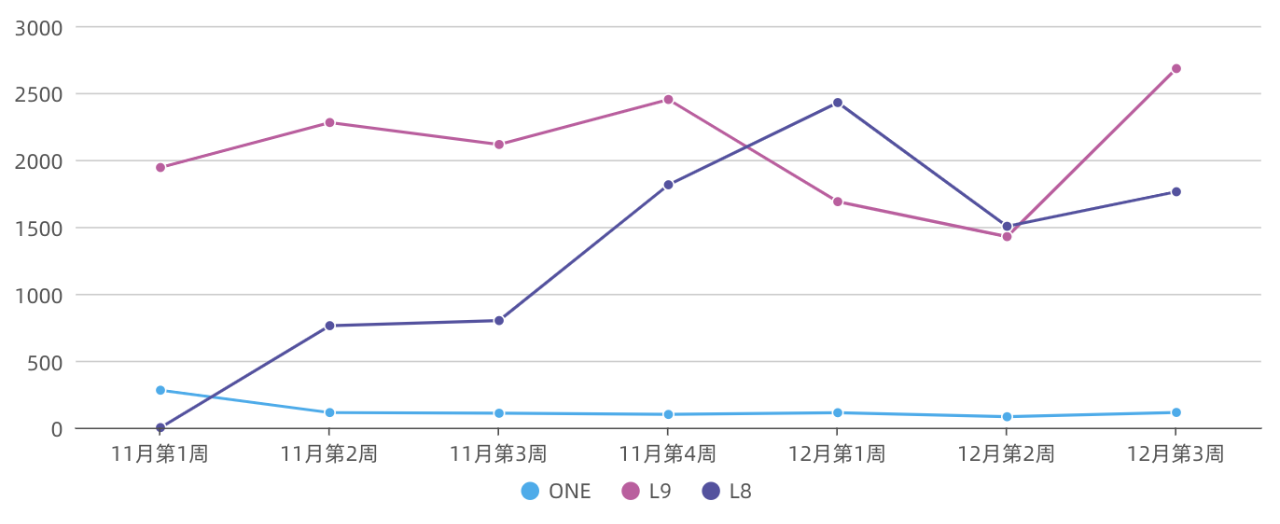

3)Target: Sell 4558 cars this week, a YoY increase by 38.5\% and a WoW increase by 51.3\%. The figures are pretty good, especially for the L9 series. Buying a car for the family is relatively easy to get the support of family leaders! Spending a little more is also worthwhile.

3)Target: Sell 4558 cars this week, a YoY increase by 38.5\% and a WoW increase by 51.3\%. The figures are pretty good, especially for the L9 series. Buying a car for the family is relatively easy to get the support of family leaders! Spending a little more is also worthwhile.

Summary: From the current data, the delivery of the insurance data is still very impressive. As there is still room for adjustment in the last two weeks, I believe that December should look very good in numbers. However, the pressure will be transferred to Q1 2023, and some continuous policies may be needed to ensure a more stable market next year.

——END——

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.