Here is the translation in English Markdown format, with HTML tags preserved:

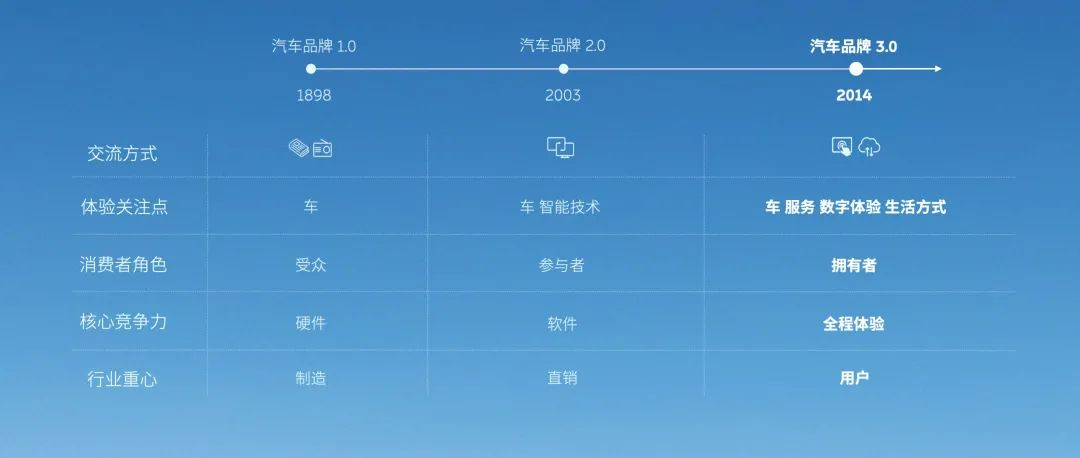

The image below was created in 2015, the second year after the founding of NIO. Upon closer observation, you will find that this PPT, drawn by Li Bin, Zhou Xin and Qin Lihong at the A+ financing stage, is actually the brand value strategy that NIO still adheres to today.

For a company that goes through stages 10 to 100, such perseverance is a methodology born out of mature experience. For NIO, it’s an all-in bet.

From 2014 to 2022, NIO has gone through its eighth year. In these eight years, some have fallen by the wayside in the new energy vehicle industry, but there have also been remarkable industry miracles. From a certain perspective, NIO’s development is more legendary than others.

Because it’s rare to see a case where someone enters the ICU and still bounces back.

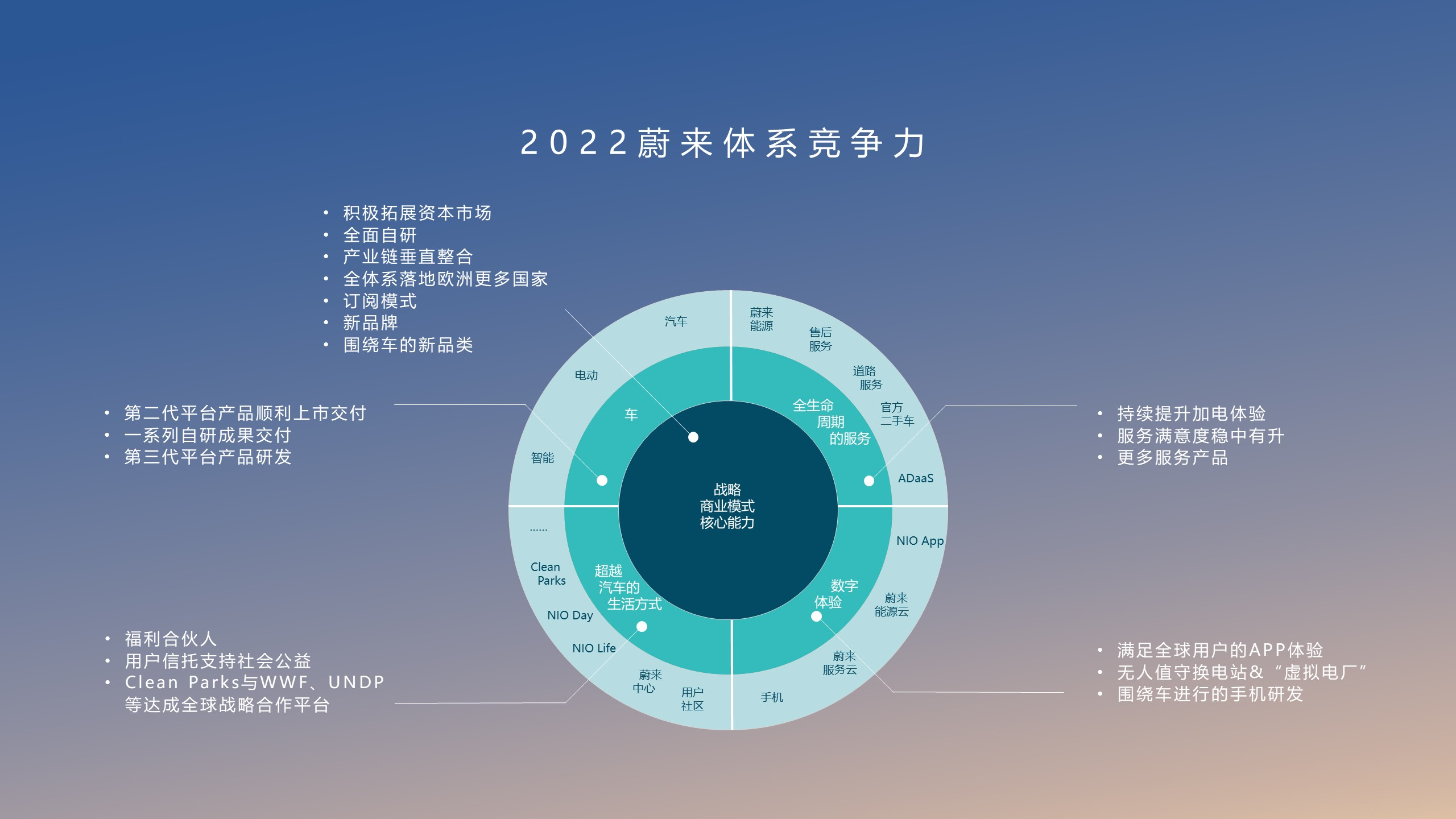

The original PPT has also evolved into a well-established system compass, with the four quadrants of the compass being the four major goals set by NIO. The center represents NIO’s original intentions, its “strategy,” “business model,” and “core competencies.” The content can be further refined from the inside out, which has been the long-term goal set by NIO since its establishment in 2014.

In the past year, major events such as the deliveries of ET7, ET5, and ES7, entry into the European market, and the launch of NOP+ Beta have all been clear indicators of NIO’s development. And supporting NIO’s overall system expansion is precisely the competitive compass of this system.

Therefore, in the final month of 2022, we met with Qin Lihong to look back at the past year and look ahead to the new year. We had an interesting and in-depth discussion about NIO’s multi-model strategy, new brand Alpine, NOP+, and the European market.

Multi-Model Strategy, New Brand, and NOP+

NT 2.0 Coverage for All Models within Six Months

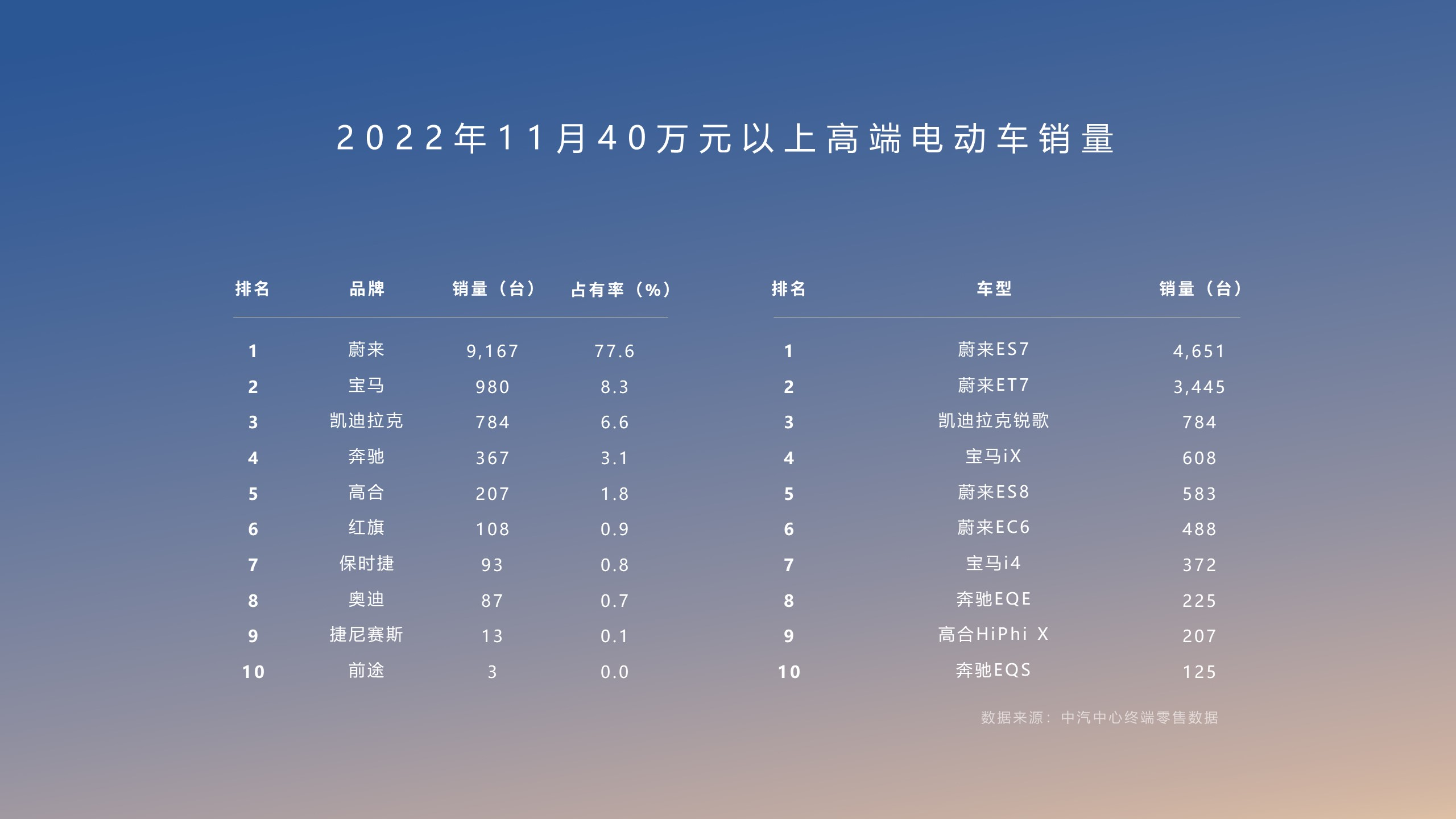

A year ago, the NT 2.0 platform was still in the conceptual stage. Today, the ET7, which began deliveries in March 2022, has already delivered more than 20,000 units, and ES7’s monthly sales have reached the level of 4,000 units, ranking first among pure electric SUVs with sales over 400,000.From the weighted average transaction price of automobile brands in October, NIO surpassed Mercedes-Benz with 466,000 yuan, BMW with 423,000 yuan, and Audi with 320,000 yuan.

If we divide the sales volume of pure electric high-end products above 400,000 yuan, NIO, with its ET7 and ES7, occupies 77.6% of this market share, far surpassing traditional automakers.

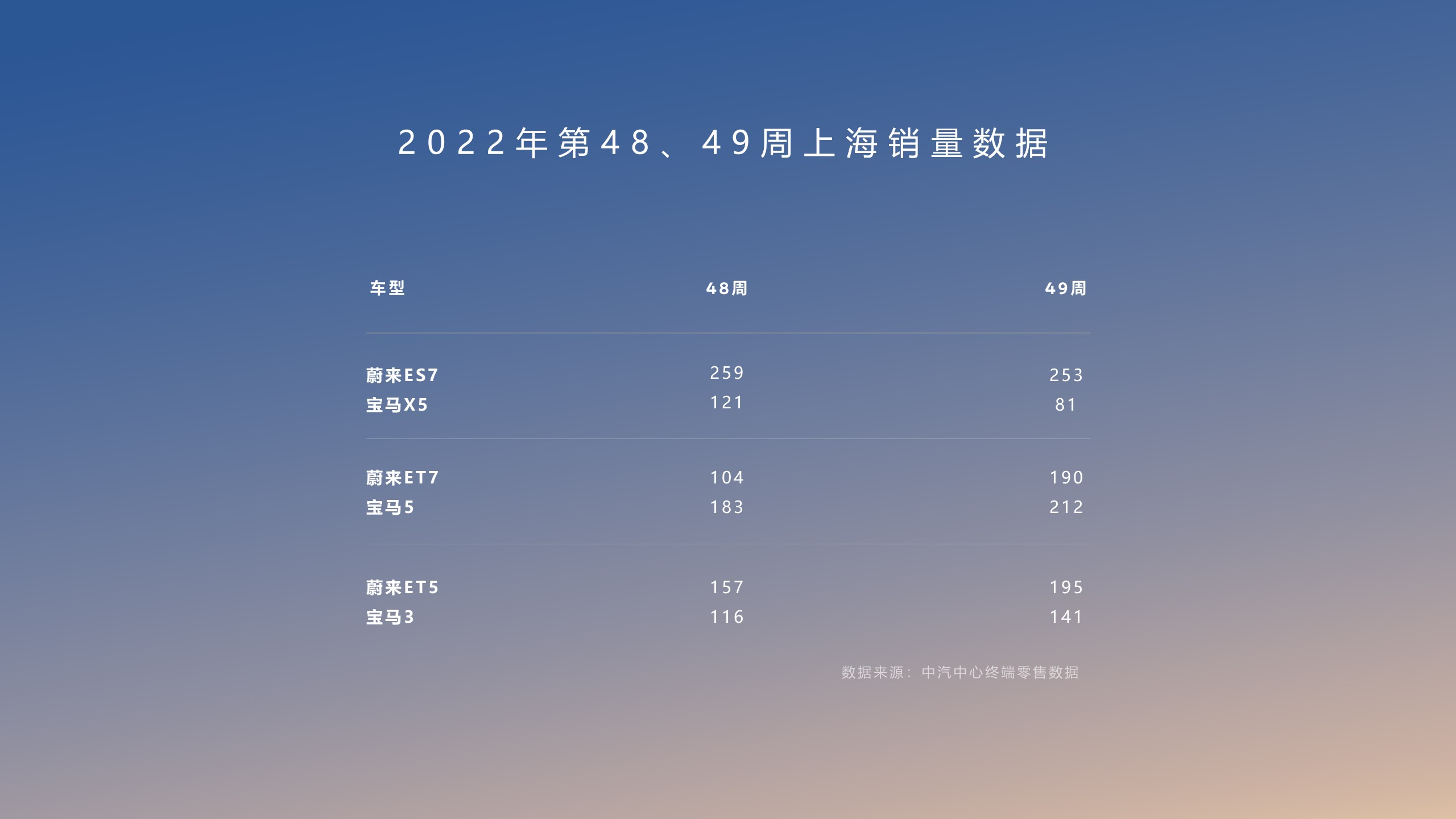

Actually, NIO has 6 cars on sale, and only three cars of the NT 2.0 can boost sales. Therefore, it is necessary to upgrade other products as soon as possible. However, from the insured amount of the three cars currently on sale in Shanghai, they can already match with BMW X5, 5 series, and 3 series.

During this face-to-face conversation, Qin Lihong also revealed: “Within six months, NIO will update its entire series to the NT 2.0 platform.” The releases of ES6, EC6, ES8, ET5 Hunting Edition, and EC7 will all come in the first half of next year. “However, Qin Lihong said that ‘7 models will be updated to the 2.0 platform,’ so I guess that the release speed of the EC6 or ET5 Hunting Edition will be slightly later.“

At that time, NIO will become the only brand to complete the full platform upgrade of the entire series. Two new cars will also be released at this year’s NIO Day. Apart from the confirmed ES8, Qin Lihong said: “There will be a car with a unique style.”

Coincidentally, today, the ES8 of the NIO NT 2.0 platform officially landed in the Ministry of Industry and Information Technology. Besides the familiar lookout tower sensor on the 2.0 platform, the new ES8 is still four-wheel drive, with a front motor of 180 kW and a rear motor of 300 kW.

We will also see detailed information about the new ES8 at this year’s NIO Day. Qin Lihong said that the second-generation iteration of the ES8 is a comprehensive practice of NIO’s product development.

Being able to quickly complete technological updates is inseparable from platformization. In addition to the mechanical part of platformization, NIO’s systems including “aspen·白杨” (“aspen·White Poplar”), “alder·赤杨” (“alder·Red Willow”), and “banyan·榕” (“banyan·Banyan Tree”) also follow the logic of platformization. It includes smart hardware (such as LiDAR sensors), computing platforms, algorithms, operating systems, and application ecology.

The core competitiveness of smart cars has shifted from “cars” to “intelligence.” Anyone can stack materials, but whether or not the smart system can be systematized and reused for each model is the key to reducing development cycles and costs.

Using the NT 2.0 platform, which is designed with a watchtower layout as an example, the same sensor layout can quickly adapt to data collected in the past. If the sensor layout is changed, it may require a considerable amount of time to re-adapt and reuse data collected from billions of closed-loop road tests.

Regarding old platforms, Qin Lihong stated that NIO has promised a maintenance period of 15 years and will not abandon old platforms or users after rapid iteration due to “arms races.” He made an interesting comparison: “just like a software property management company.”

Certainly, the development potential of the aspen platform cannot be compared to that of banyan, and the boundaries caused by hardware will eventually reach their limits. However, developing targeted features for different systems and versions of users is not an easy task. Mere maintenance of the first-generation aspen system requires a team of several hundred people to be on standby for a decade or more.

When it comes to the delicate emotions of old and new car owners, how to balance them becomes a crucial question in the company’s development.

When talking about NIO’s multi-car strategy, Qin Lihong explained that the sale of seven new models next year will definitely pose some challenges, but a multi-car strategy is what a high-end brand needs.“If the target is Tesla, XPeng or LiXiang, we don’t need to produce so many models. But if the target is BBA, we still have room in our product line”.

According to Qin Lihong, the platform thinking allows the sharing of design, chassis, core components, intelligent platforms, and battery swap architecture among various models, which is why multiple models can be launched.

Qin Lihong made an interesting analogy: wearing clothes from UNIQLO, you don’t worry about wearing the same clothes as others; while wearing luxury brands, this can be a concern.

Therefore, high-end brands need more variety, and this is an insight into consumers’ subtle psychology.

For different brands, the consumer psychology they carry varies. Therefore, for the NIO brand, it is impossible to cater to all levels. The ET5 will be the cheapest planned product. Therefore, the task of simplifying the product line to increase sales volume will be handed over to Alpine.

Alpine, target of 50,000 monthly sales

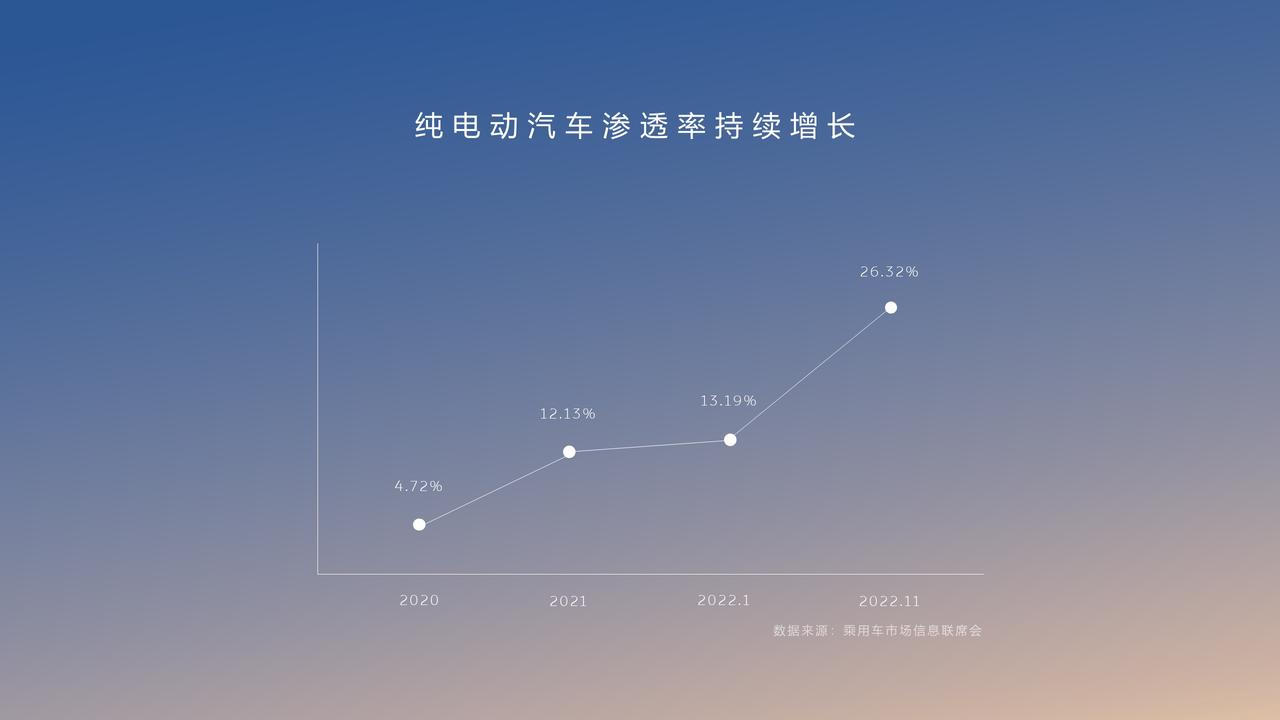

There is an objective necessity for the appearance of Alpine. From the macro market perspective, the annual sales of passenger cars are expected to be around 20 million, which is a relatively fixed number. This year, compared with last year, the penetration rate of new energy has increased from 17% to 27%.

For NIO, which mainly cultivates the segment above 400,000 yuan, the dividend of penetration rate has not been fully realized. This is because the penetration rate increase of new energy cars is mainly in the 200,000 to 300,000 yuan segment, but the direct beneficiaries of the 200,000 to 300,000 yuan segment are Tesla, BYD, and XPeng.

NIO will not miss this huge potential market.

This is the logic behind the birth of Alpine. Regarding the question that whether the battery swapping system can be shared with NIO, Qin Lihong shared his thoughts.

Firstly, it is essential to achieve cross-brand sharing of battery swapping technology, which is the foundation for subsequent fine management. For the entire NIO Group, the action of seizing battery swap resources must be quick, and there are many ways to play the battery swapping game for new brands.For example, under the premise of being compatible with the battery swapping system, can we open sharing services in the precious space inside the Shanghai Middle Ring Road? Can we share during idle hours in the evening and not during busy hours in the daytime? Can we open during the Chinese New Year?

Based on Qin Lihong’s statement, I guess that Alps is most likely compatible with NIO’s battery swapping system in terms of hardware. If the physical limitations are overcome, there will be various operating methods, which is the “luxury endorsement” that Alps did not have at birth.

Qin Lihong also boldly predicted that the monthly sales of the future main model of the new brand codenamed Alps would reach 50,000. For a new brand that has a large battery swapping network, a mature intelligent platform, and a stable supply chain channel since its inception, I do not doubt this number too much.

NOP+: Faster Speed, Delayed Payment

NOP+ Beta was just released a few days ago, and the official version is expected to be mass pushed in about ten days.

Regarding the fact that the push was delayed, Qin Lihong only said a simple sentence:

“We won’t make excuses. It’s just that we didn’t do well enough during the process. The only thing we can do is to work harder, push it out earlier, and collect payment later.”

However, if the cost of the convenient service is a slight delay, most people’s attitude will definitely be acceptable, especially in the current environment where it is difficult to collect data during road tests this year.

Qin Lihong also stated that it will take a relatively long time for NAD to reach the imagined state. The maturity of NOP+ has not been achieved at the time of its release, so NIO’s attitude is to provide it for free first and consider charging later.

This will definitely hurt the hearts of some first-generation NP platform car owners. Moving forward is inevitable, and we hope that NIO will have methods like score compensation to give old car owners the comfort they deserve.

In this conversation, Qin Lihong also revealed a major update that NOP+ will have in the future: high-speed automatic navigation to the battery swapping station. When driving on the highway and setting the navigation, the vehicle will automatically plan and head to the battery swapping station to replace the battery, and then leave on its own after the replacement is completed. It is expected that this function will be implemented first on two relatively mainstream highways, and they hope to connect most of the highway battery swapping stations by next year.

For service areas on highways, there are often complex landmarks, crowded traffic, and changing traffic conditions. It can be imagined how difficult it is to achieve automatic battery swapping in this miniature scene. The high-precision maps provided by various companies also do not provide service area scenes, so I am very curious and looking forward to the performance of this function after its implementation.Qin Lihong also stated that the “high-speed automatic navigation and battery replacement” function will be elaborated on at this year’s NIO Day.

Beyond Car Manufacturing

Services & Lifestyle That We Still Need to Talk About

Since the delivery of ET5, the biggest concerns of most potential and actual car owners are: “Will the service experience deteriorate?” Qin Lihong has an answer for that. Contrary to intuition, the number of complaints received only increased by about 30\% after NIO’s ownership increased threefold. This increased rate is palpable, but overall, the performance is not poor.

The convenience of battery charging is also improving, and this is a dynamic and dialectical issue. As of today, NIO has set up 1,255 battery swap stations across China, including 332 on highways; 2,185 charging stations with a total of 12,773 charging poles.

About 60\% of all NIO vehicles sold are equipped with a free home charging pole. Through the NIO App, NIO’s charging map integrates more than 610,000 third-party fast charging poles.

However, the convenience of battery swapping is still the most important concern. We should be able to find answers about the layout and technical highlights of third-generation battery swap stations at this year’s NIO Day.

As delivery volume increases and the number of consumers outside tier-one and tier-two cities grows, it is hoped that NIO can start expanding its layout in tier-three and tier-four cities starting with the third-generation stations.

Regarding services, NIO’s second-generation service and charging integrated “two-in-one service vehicles” have been gradually deployed nationwide. By November of this year, NIO completed a total of 1.2 million road service orders, averaging more than 100,000 per month.

As for new services, NIO has launched a new service mode this year: “NIO Joyful Driving Service”, which can be redeemed using NIO points and coupons.Apart from the traditional chauffeured services, Qin Lihong said that some car owners even use the NIO Driver to have specialists pick up their children from school, accompany the elderly to see a doctor, and even assist children with their homework.

According to Qin Lihong, there was a debate over whether to keep the “NIO Driver” service; however, it was eventually decided to keep it. Currently, the project is still in a deficit, and NIO hopes to achieve a balance between revenue and expenditure next year.

Interesting. Based on the fundamental principle of “lifetime service,” NIO is also iterating and innovating its emotional value offerings, with the roots lying in the sufficient amount of freedom offered internally.

“Perhaps in our lifetime, we’ll see the first carmaker enter the elderly care market,” said Qin Lihong.

In terms of lifestyle, the prototype store for the second-generation Nostalgic House just opened in Songshan Lake, Dongguan. What’s most interesting is the “Owner Partner” plan announced at last year’s NIO Day.

Before discussing the “Owner Partner” plan, one prerequisite should be understood: the NIO app has more than 5 million registered users, and daily active users exceed 380,000, reaching a peak of more than 400,000, which is a huge flow pool.

NIO car owners can join this program if they offer benefits or special services exclusive to NIO car owners, such as discounts, dishes, and bedding. Once the car owners join the program, NIO will open up this part of private traffic to complete the expansion of the NIO owner community from online to offline.

As you can see, whether it is the innovation in the “NIO Driver” service or the innovation in the “Owner Partner” plan for lifestyle, it cannot be achieved by simply selling cars.

Therefore, the seemingly unrelated links in the NIO system are gradually intersecting. The app, Nostalgic House, NIO Value, and the owner community are colliding at this moment, yielding the fruit of the past few years’ efforts.

### Creating Ripples Overseas

### Creating Ripples Overseas

On the early morning of November 10th, the famous German automobile magazine “AUTO BILD” announced the winners of the 2022 “Goldene Lenkrad” (Golden Steering Wheel) Award Jury, and the NIO ET7 won the annual best mid-size car award and became the first Chinese brand car model to win the “Golden Steering Wheel” award.

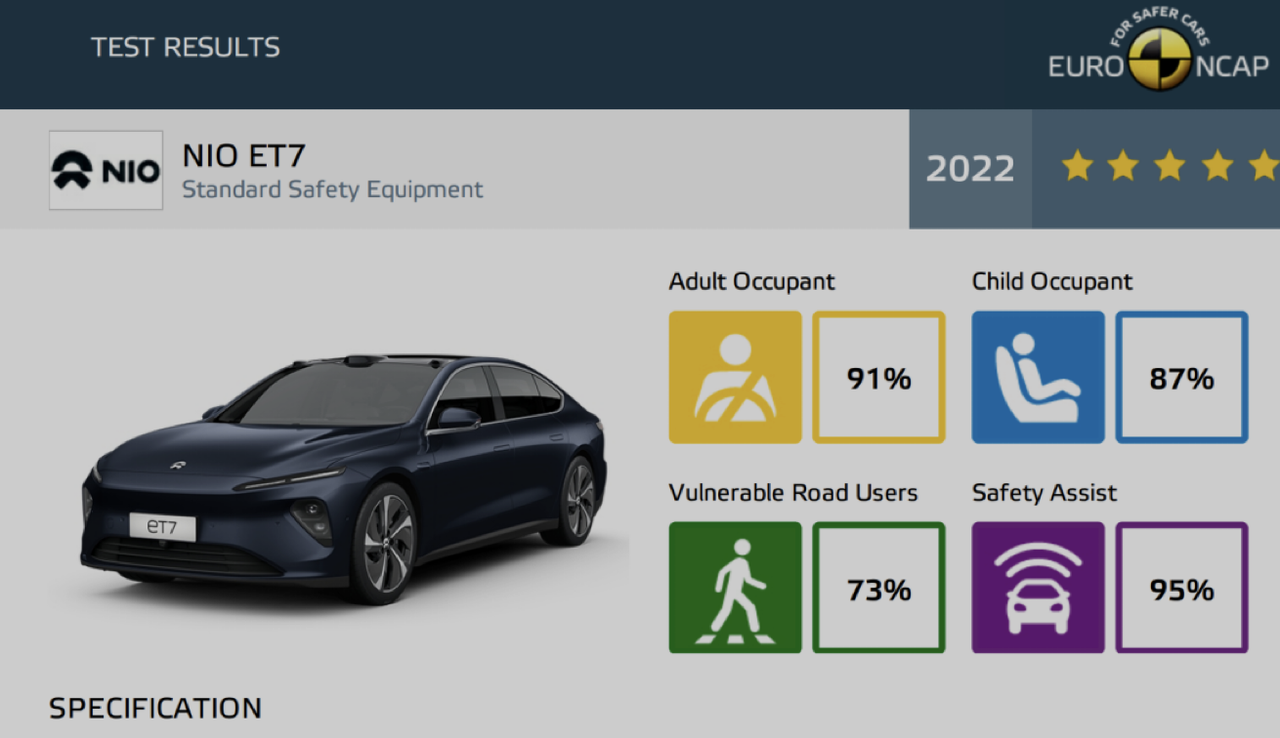

Immediately following, in the E-NCAP crash test on November 17th, the NIO ET7 achieved high scores in multiple testing items. The total score for the four items also surpassed WEY Coffee 01, ORA Funky Cat, and BYD ATTO 3, becoming the highest-rated electric vehicle model in China tested by E-NCAP.

This is a good start for NIO’s entry into Europe. With the holding of NIO Berlin 2022, NIO began to offer products and services in Germany, the Netherlands, Denmark, and Sweden.

William Li said that NIO cannot simply find a dealer to transport the cars to Europe, which would be like throwing a stone into the water and making a big splash. Whether it is a full lifecycle service, a lifestyle, or a battery swapping system, NIO must move its entire system to Europe.

Indeed, as a newborn brand in the developed automobile industry of Europe, it is bound to encounter obstacles, but NIO hopes to make an impact with the brand, products, services, and community as the foundation of European development and create ripples of influence that continuously expand.

NIO already has a research and development center in San Jose, USA, and rumors suggest that it will enter the American market in 2025. Regarding the difficulties encountered in the American market, William Li has also given an answer.

China and Europe share more similarities in the definition of automotive products, safety regulations, admission thresholds, and other aspects. China’s automobile industry is also following the European standard system. The cost of making the European version of a car may be several hundred million yuan, while the American version may cost tens of billions or more.Difficult times are difficult to pass. At least in the European market, NIO has a clear layout. By the end of this year, NIO will establish 17-18 battery swapping stations in Europe, and this number will increase to 120 by the end of next year. NIO also signed a strategic agreement with a German energy company for 17 battery swapping stations some time ago.

It is expected that NIO will make significant progress in the European market next year.

Burning money, it depends on how you burn it

Some time ago, NIO released its third-quarter financial report, and many people started to criticize it when they saw a loss of 4 billion yuan.

We can’t just look at the loss figures, but we need to see where the loss occurred. For example, NIO’s gross profit per vehicle was negative in 2019, and selling too few cars would lead to failure, but even selling a lot wouldn’t help either. It was indeed a matter of life and death.

By 2020, NIO’s gross profit had finally turned positive. If we look at NIO’s vehicle gross profit margin of 16\% in the third quarter of 2022, it exceeded the ideal and XPeng’s 12\%, forming a virtuous circle.

Not to mention the research and development investment, NIO’s investment of 2.945 billion yuan is also higher than Ideal’s 1.8 billion yuan and XPeng’s 1.5 billion yuan. All the contents mentioned earlier in this article, including the NT2.0 platform, the three generations of intelligent systems from Aspen to Banyan, the service system, the more than 1,000 battery swapping stations nationwide, and the European strategy, are all investments for the future.

The automobile industry is different from other industries, and investment and return need to be viewed over a period of at least ten years. Qin Lihong asked at the event:

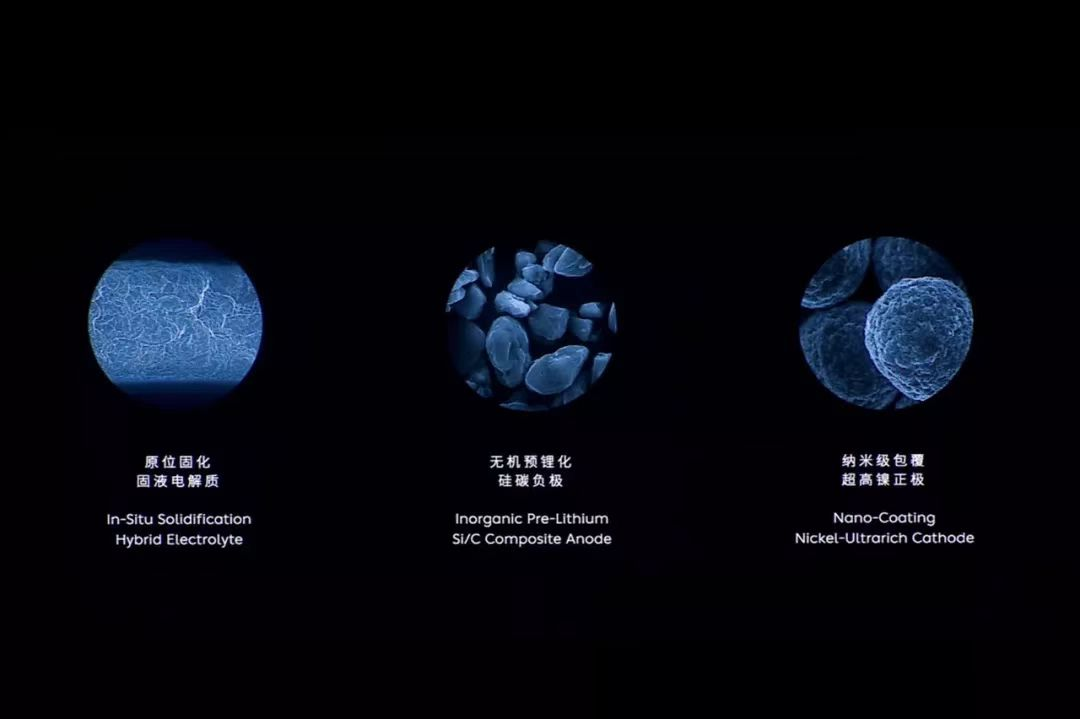

“The technological viewpoints of the new energy industry have not yet reached their peak. If pursuing maximum profit, should we follow new battery technologies and new laser radar technologies or not?”

Smart electric vehicles, a billion-dollar race every year, have just begun to emerge. If you look at long-term industries with short-term goals, you will definitely miss opportunities.

However, Qin Lihong also admitted that the final problem of the electric vehicle industry is where the commanding heights are.

In the era of gasoline vehicles, engine technology and gearbox technology were everyone’s barriers. Now, are the barriers battery technology, motor technology, self-developed chips, or software? Which one is the strategic value key point that will affect the electric vehicle industry chain for the next ten years?

There is no conclusion on everything.

For Qin Lihong and NIO, the current development situation is mostly as expected, with two unexpected events being the conception of the battery-swapping model as large stations with thousands of batteries being fully charged after a 48-hour turnover and the significant increase in battery raw material prices.

BYD relies on its self-developed batteries to obtain considerable profits under such circumstances. Qin Lihong said that this is also a problem that NIO has been thinking about recently. It is necessary to increase vertical resource integration capabilities in core components.

The prospects for the development of the new energy industry are still foggy, and no one knows if the things that are being done to the fullest now will still be correct in ten years. This is like when Tesla was not understood for doing FSD at that time and is now being imitated by everyone, or like the bubble bursting of companies that bet on L4 Robotaxi, leaving the industry in a sigh.

For the automotive industry, the seeds planted now will take 5 to 10 years to know if they can grow into big trees. This is also a hundred-billion gamble, and losing means being engulfed.

The only way is to be steadfast in one’s direction and act as quickly as possible to execute.

As Qin Lihong said: I think that the best opportunity is when there is no consensus, so let’s make it into a moat first.

Final Words

Lastly, someone asked a question:

“If time could be turned back, what would NIO most want to revise?”

Qin Lihong said:

“If time could be turned back a year, we should have mobilized our colleagues and partners in the supply chain to go to the front line as much as possible at that time. We will take every risk factor more seriously in the future. The bigger the company, the more cautious the decisions will be. We can’t blame the epidemic. If we often have a lucky mentality at work, it will make us passive.”

But he also addressed doubts about NIO’s supply chain. First of all, he acknowledged that subjectively, NIO’s supply chain management has not reached the best state, and there is room for improvement. Objectively, NIO has many models, and the average number of chips per vehicle exceeds 1,000 in hundreds of categories, which has a certain degree of unpredictability.

From 2014 to 2022, Qin Lihong said that NIO’s strategic direction has never changed. When Li Bin talked to him about the entrepreneurial project in 2014, 80% of the content that is now shown in the “NIO Competitive Compass” had already been planned out.

From 2014 to 2022, Qin Lihong said that NIO’s strategic direction has never changed. When Li Bin talked to him about the entrepreneurial project in 2014, 80% of the content that is now shown in the “NIO Competitive Compass” had already been planned out.

Li Bin even calculated the cost of battery swap stations, electricity fees, the number of people who watch each station on average, the size of cow sheds, the number of personnel, and the average salary per person. These data have an error of no more than 20% even if only half of them are accurate.

Entrepreneurship is not just a presumption. Although the problems and tactics will be reviewed and adjusted in the process of action, for NIO, the strategic framework was engraved on the core from the very beginning to insist on implementation.

In the week before meeting Qin Lihong, NIO’s 300,000th vehicle rolled off from the second advanced manufacturing base, and the “100,000 units” of NIO accelerated again to 7 months this time.

In addition to the increase in car model production and sales volume, NIO’s system layout faces heavier pressure than other brands, but at the same time, NIO also has more imagination than other brands.

Perhaps as Qin Lihong said, the evaluation of whether a decision is correct or not in the present still needs to be reviewed after ten years.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.