Tesla achieves profitability in Q3 2018

Tesla has just released its Q3 2018 financial report, and Elon Musk and other Tesla executives have delivered on their promise from the Q2 earnings call: Tesla has finally achieved profitability. Out of 40+ quarters since its IPO on June 29th, 2010, this is only the third time that Tesla has turned a profit.

Prior to the report’s release, neither the skeptics, Wall Street analysts, shareholders, users nor the Tesla team itself had exceptionally high expectations for profitability. However, as one shareholder said, “it’s hard to analyze or rationalize Tesla anymore. What’s interesting about the company is that they have normalized ‘breakthroughs’ and ‘milestones.'”

So how did Tesla achieve a profit that far exceeded analysts’ expectations?

Victory in Consolidation and Cohesion

Q3 2018 was truly a momentous moment in Tesla’s history. This is the first sentence of the report. To achieve its ultimate goal of hitting back at short-sellers and achieving profitability, Tesla carried out comprehensive strategic consolidation outside of its core businesses.

In the past three months, Tesla has only established four new stores/service centers worldwide, bringing the total number of locations to 351. The Mobile Service fleet, which is used for on-site repair and maintenance, has 373 vehicles, but three months ago, the number of vehicles had already reached 340.

In terms of the Supercharging network, Tesla built 44 new Supercharger stations this quarter, less than half of what was built in Q2. In the Q2 earnings report, Tesla announced its ownership of 10,800 Superchargers and 19,200 Destination Chargers worldwide. Three months later, these numbers have only slightly increased to 11,000 and 20,000, respectively.

In addition, Tesla did not add any new Model 3 or battery pack production lines in the past quarter.

Furthermore, the energy business with lower gross margin revenue generated only $399 million, with a QoQ growth of only 26%.

Most importantly, except for production capacity expansion, all capital expenditures for business expansion were completely stopped. The previously mentioned “stop all expenditures over $1 million in the next 12 months until explicitly approved by Elon” in a company-wide email was not a bluff.

The final result is that Tesla’s operating expenses dropped by 11% QoQ in Q3, totaling only $1.1 billion.

Based on past experiences, Elon is very good at fostering a battle atmosphere that inspires morale. He counts media negative coverage, short-seller attacks, analyst questions and competitor evaluations as enemies, and sends company-wide emails to rally the team to win the battle.

This time, Elon’s tried and true strategy has once again proven effective. Of course, he also put extra effort into this “seeing the moon through the clouds” victory.

For example, Tesla, which usually releases its Q3 financial report in early November, suddenly announced the release on October 24th, causing the analysts to request to delay the financial report conference call for an hour until this morning at 6:30 a.m. Beijing time. In addition, after being ordered by the SEC to stop posting updates on the company’s business progress on Twitter without verification, Elon has recently been frequently sharing updates on Japanese anime, and even got locked out of his account because of recommending bitcoin, creating no atmosphere for the release of the financial report.

All these signs have made the shorts begin to waver. Two major short-selling institutions, Citron Research and Moxreports, simultaneously announced their long positions in Tesla, believing that “Tesla is the only company that can truly produce and sell electric cars.” The shorts’ turning point also prompted Morgan Stanley analysts to immediately announce their bullish position on Tesla.

The financial report has not yet been released, but Tesla’s small tricks have successfully reversed the market’s confidence and focused everyone’s attention on the financial report.

Milestones brought by Model 3

Of course, any trick is just a prelude. A real increase in stock price still depends on hardcore products and performance.

Regarding Model 3’s production and delivery progress in Q3, the key information points are as follows:

-

Model 3 has become one of the top 5 best-selling cars in the United States.

-

The average production capacity of Model 3 is 4,300 vehicles per week.

-

The gross margin of Model 3 has reached 20%, exceeding the official guidance of 15%.

-

The manufacturing hours of Model 3 have been reduced by more than 30%, which is lower than that of Model S for the first time.

-

Model 3 continues to attract users of both luxury and non-luxury brands.

For the group of people who pay attention to Tesla, many of the achievements mentioned above were already known when Tesla released the Q3 production and delivery report. Why are we releasing this again? To quote a sentence from the well-known short-selling institution Citron Research: “While everyone was watching Elon smoke weed, he quietly set the entire auto industry on fire.” This is also what we advocate: Although Elon’s unconventional behavior has attracted too much attention, when we discuss a listed company, let’s focus on performance.

For the group of people who pay attention to Tesla, many of the achievements mentioned above were already known when Tesla released the Q3 production and delivery report. Why are we releasing this again? To quote a sentence from the well-known short-selling institution Citron Research: “While everyone was watching Elon smoke weed, he quietly set the entire auto industry on fire.” This is also what we advocate: Although Elon’s unconventional behavior has attracted too much attention, when we discuss a listed company, let’s focus on performance.

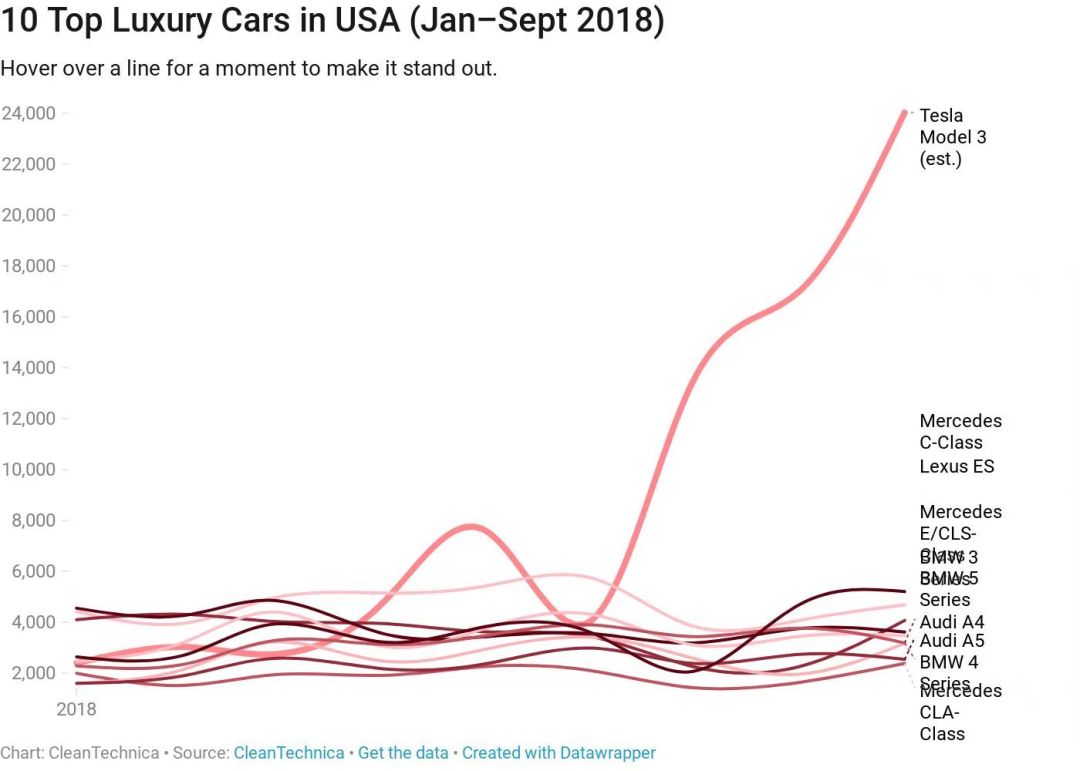

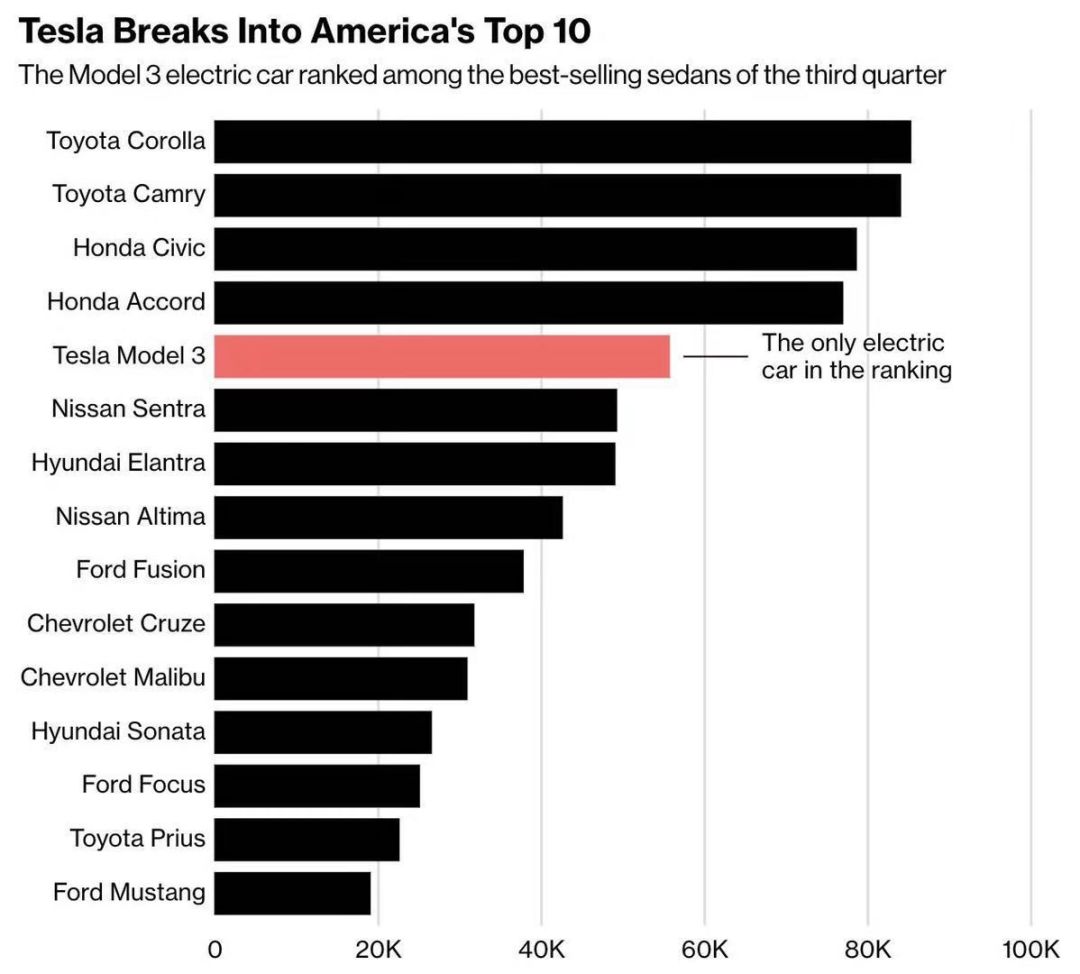

In the past quarter, Model 3’s production capacity reached 4,300 vehicles per week, with a delivery of 56,065 vehicles. Such production and delivery performance has made the Model 3 one of the Top 5 best-selling cars in the United States. For a small company that has been delivering cars for less than 9 years and has only 3 products, this sentence is already very influential.

Clearly, Tesla is not the only company in the Top 5 sales rankings. Toyota and Honda are also doing well, each occupying two seats in the top 5. The following indicators prove that Model 3 not only deserves attention from BMW, Benz, and Audi but also deserves Toyota and Honda’s attention.

In the Q2 report, Tesla mentioned that the top 5 models replaced by Model 3, except for the BMW 3 Series, were the Toyota Prius, Honda Accord, Honda Civic, and Nissan Leaf. The average price of these models are between $25,000 and $35,000. The Q3 report provides more powerful data: since the delivery of the Model 3, more than half of the previous car models owned by the car owners have a price lower than $35,000. On the other hand, in order to achieve the previously committed profit target for the second half of the year as soon as possible, Model 3’s starting price in Q3 reached $49,000, which has exceeded the average price of similar models from BMW, Benz, and Audi.This means that the estimation logic of using the market share of Model S in the luxury car market to estimate the market potential of Model 3 is no longer applicable. Model 3 has the product power to stimulate the economic car consumer group to “upgrade consumption”, and the financial report states more clearly: We believe that the total market potential of Model 3 is not limited to the same level of luxury car market. As Tesla CFO Deepak Ahuja said, for many people, Model 3 is the first luxury car they own in their life.

This conclusion, combined with the continued growth of orders, has responded to a widely existing question: Q3’s results came from the release of the backlog orders over the past two years. The truth is that the market potential of Model 3 exceeds our expectations, even beyond the official expectations. This means that even only in the US market, the sales of Model 3 reached as high as 24,040 units/month (September delivery data) are likely to be sustainable in the long-term.

With an average price of over $60,000, Model 3 also became the highest-priced model among the top 5 selling models in the US, and allowed the gross profit margin of Model 3 to reach 20% in Q3, exceeding the official expectation of 15%.

The month-on-month drop of 30% and the manufacturing hours that were lower than Model S for the first time meant that there is still room for cost optimization and efficiency improvement for Model 3.

Tesla specifically pointed out in the financial report that vehicle delivery and logistics were the main challenges of the quarter. The existing delivery capacity of 100,000 vehicles per year is completely insufficient to cope with the challenges brought by the capacity growth of Model 3. Tesla’s delivery system has experienced a “ramp-up” of delivery capacity growth. In fact, as of the end of this quarter, Tesla still had more than 8,000 Model 3s “in transit.”

How to define a product that occupies an absolute advantage in both sales and profit at the same time?

We repeatedly remind luxury brands led by BBA not to ignore Tesla Model 3. This may be a product case that is likely to be included in major business school textbooks. Today, Toyota and Honda also need to think about how Tesla successfully promoted the upgrade of economic market consumer groups.

China! China!

China, Tesla’s largest market outside the United States, is becoming a new challenge that Elon is increasingly concerned about. Due to well-known reasons, the import tariffs for cars in China were increased from 25% to 40% in the past quarter. Tesla admitted in the financial report that the demand in the Chinese market “poses challenges.” Tesla tried to offset the weak demand in the Chinese market by promoting growth in North American and European markets.But China’s influence goes beyond this, Tesla explicitly stated that due to the continuing decrease in material costs and manufacturing hours and the further improvement in production efficiency, the Model 3’s Q4 gross margin should have been “significantly higher than 20%”. However, additional tariffs on Chinese components will result in Tesla’s gross profit decreasing by approximately $50 million, which will offset the cost efficiency improvements. As a result, the gross margin of the Model 3 will remain unchanged, while the gross margin of the Model S/X will decrease.

Therefore, Tesla has decided to accelerate the construction plan of the Shanghai Gigafactory. Tesla’s goal is to bring the Model 3 to China in 2019 and gradually improve the localization level through domestic procurement and manufacturing of the supply chain. Models produced by the Shanghai factory will be exclusively for Chinese market consumers.

In the prospectus guidance of the financial report, Tesla also explicitly stated that Q4 capital expenditure plans include the purchase of land in China, initial design, and other expenses of Shanghai Gigafactory 3.

Elon previously stated that Tesla’s factory spending would not be reflected in its financial report until Q4 2019, meaning that the 40% tariff allowed Tesla to bring forward the plan of the Shanghai factory by a full year.

During the subsequent financial report conference, Elon mentioned Tesla’s plan to achieve localization production of Model 3 in 2019. From now on, the construction cycle of Gigafactory 3 has been compressed to 12-15 months. Is this Elon Time, or can we expect it in the future?

According to the speed of domestic new car companies’ factory construction, the construction cycle is approximately 14-18 months. If Tesla wants to achieve local production of Model 3 in such a short time, it will face a huge challenge. However, Tesla can achieve localization quickly through the form of CKD or SKD in the early stage.

The so-called C/SKD, namely Completely/Semi-Knocked Down, is Tesla disassembling the whole car into semi-finished products and key components, shipping them to Shanghai, and assembling them into finished products for sale at the Shanghai factory. After Tesla localizes some of the parts, it will first reduce transportation costs, followed by the significant reduction of labor costs in China compared to California. Finally, the tariffs on C/SKD models are much lower than 40%. In fact, the tariffs on all C/SKD models are below 25%, and according to previous cases, most of the import tariffs on key components were only 10%.For Chinese Model 3 reservation holders who have been eagerly awaiting, we can only say, always believe that good things are about to happen.

In the past quarter, Tesla has been extremely restrained in capital expenditures for sales, delivery, service, and charging, all in order to achieve profitability. Nevertheless, single-quarter deliveries have reached 83,500 vehicles, and at the same time, the Shanghai Gigafactory started production a year ahead of schedule. It is foreseeable that within the next year, Tesla’s sales representatives, delivery representatives, service representatives, charging station representatives, and Shanghai government affairs representatives will face very intense workloads.

In fact, the above-mentioned representatives for Tesla’s business are the same person: Ren Yuxiang, Tesla’s Vice President of Sales and Service, who is a college classmate of Elon. Keep up the great and hard work, Ren Yuxiang!

- Autopilot 9.0 released,Tesla’s L4 takes the first step* Elon Musk Writes Open Letter to Investors: Tesla Will Not Go Private

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.