Author: Zhu Shiyun

Editor: Qiu Kaijun

“Our lives are still pretty good now,” said Dong XiaoHang, chief consulting advisor of the East Software RuiChi autonomous driving business unit, to the “Electric Vehicle Observer.”

The intelligent driving technology is moving from “Valuation Story” to “Mass Production Validation.” The “magic” of algorithm, computing power, and data can only be realized when engineered into a cost-controlled and reliably functional volume production product. This new trend has also enabled suppliers that focus on mass production to live a good life.

Capital and end markets are no longer concerned about science-fiction-like future prospects, but only care about how much it costs “per pound” for intelligent driving mass-produced products today.

At this turning point, some are losing “financial power”: Mobileye went public and Intel’s 5-year revenue rate is even worse than buying US Treasury bonds; Waymo’s valuation fell to $30 billion and Argo AI went bankrupt. While others are starting to make money, China T1 (Tier 1 Automotive Supplier) Desertec Q3’s operating profit rate is 8.1%, which is higher than Continental AG, an international front-line automotive component supplier, at 5.8%, and Mercedes-Benz at 5.3%.

In 2022, intelligent driving is becoming one of the few growth tracks. Players on the track face a common problem: how can intelligent driving technology become a scalable and profitable mass-produced product? When intelligent driving is mass-produced, how will it change the industry chain and competitive landscape that has been formed for more than 100 years?

Intelligent driving is becoming “cheaper”

One obvious change: the ability of intelligent driving has become increasingly “cheap” since this year.

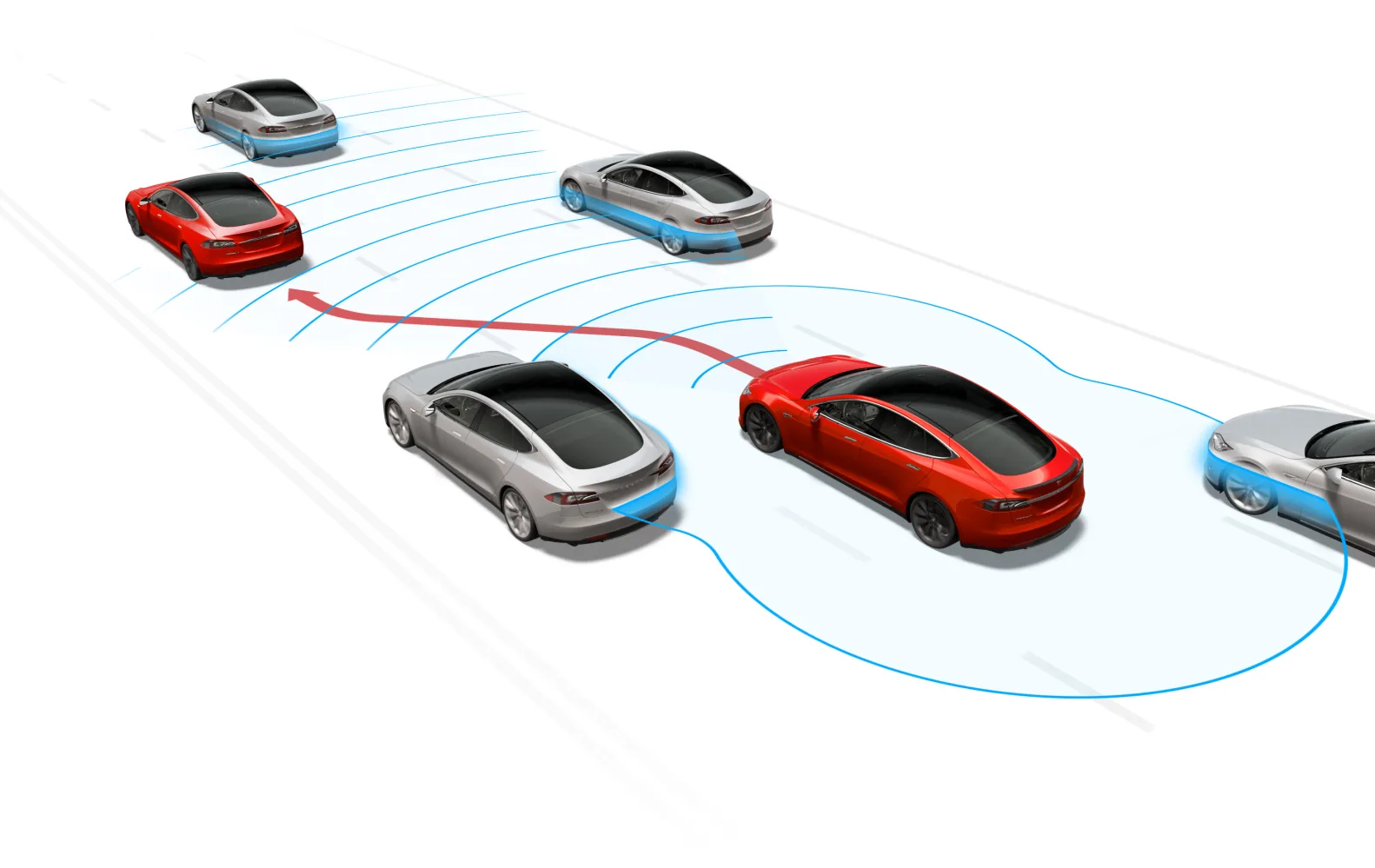

Emergency braking, lane keeping, turning signal, and automatic parking with L2 level, and even L2+ intelligent driving assistance systems that can automatically change lanes, enter and exit highway tollbooths, and park in designated parking spaces after entering the basement, are increasingly appearing on China’s mid-end mass-produced products that cost around RMB 200,000.

Only two years ago, this was a selling point for products that cost RMB 300,000 and above.

In 2020, Gu Junli, former leader of Tesla’s machine learning team and former vice president of autonomous driving at XPeng Motors, wrote: “ADAS (Advanced Driving Assistance System) charging mode is not yet completely clear for other brands (except Tesla), and more brands cannot obtain brand premium, which is equivalent to maintaining the level of cost recovery.”At that time, the accompanying prices of XPeng P7 Xpilot 3.0 and NIO Pilot from NIO were 20,000 yuan and 39,000 yuan respectively, accounting directly for about 10% of the new car selling price at that time.

However, in the past two years, the first-tier suppliers of China’s intelligent driving system industry chain (hereinafter referred to as China intelligent driving T1) have risen rapidly and have “discounted” the price of ADAS.

“In the past, Mobileye China’s driving function was sold at a relatively high price. With APA (parking assistance system), the cost is similar to that of the integrated driving and parking system now.” An insider told “Electric Vehicle Observer”,

“Now everyone (China intelligent T1) is trying to do as many functions as possible on the same cost as (international T1).“

In 2020, ADAS supplier L2 level system with Mobileye as the core was priced at more than $250 (about RMB 1,700, calculated at a rate of 6.8); L2+ level was priced at 2,380 yuan; L2+++ level was priced at RMB 20,400-27,200.

It is worth noting that these schemes do not include APA (automatic parking assistance system).

Nowadays, the passenger car industry chain in China has formed a supply system of vehicle regulation level ADAS system, which is “rich in categories and economical and practical”. It provides a supply basis for large-scale mass production and popularization.

The cost price of L2 level ADAS system is about 2,000-3,000 yuan; products that can achieve high-speed NOA and memory parking function can be “purchased” at 3,000-5,000 yuan; ADAS system above 5,000 yuan even has the ability to achieve point-to-point intelligent driving such as urban NOA.

As prices decrease and functionality increases, ADAS (Advanced Driver Assistance Systems) is entering more and more new car BOM costs, accounting for about 10% of the total cost, just like past ESP (Electronic Stability Program), parking sensors, and in-car voice systems.

As prices decrease and functionality increases, ADAS (Advanced Driver Assistance Systems) is entering more and more new car BOM costs, accounting for about 10% of the total cost, just like past ESP (Electronic Stability Program), parking sensors, and in-car voice systems.

For example, for a product priced at 200,000-300,000 yuan, the BOM cost is about 130,000-200,000 yuan (about 2/3 of the selling price). Car companies will allocate 1,300-2,000 yuan for ADAS configuration.

Of course, brands and models that focus on intelligent driving are willing to pay higher costs for it.

The market price of 45-50 yuan NIO ET7, equipped with only 1550nm Lidar and four NVIDIA Orin chips, is about $2,200, accounting for about 3% of the new car price. The 3 Huawei 96-line Lidar equipped by the Avita 11 has a market price of about $1,500, accounting for about 2.5% of the new car price, and the market price of the dual Orin dual Lidar in the XPeng G9 is about $1,600, accounting for about 2.7% of the new car price.

In the process of pursuing higher, faster and stronger ADAS computing power, response and performance in the Chinese passenger car market, the traditional international T1 based on Mobileye chips began to lose ground.

At the end of 2021, Mobileye announced that the shipments of its EyeQ chips had exceeded 100 million. However, the mainstream brands that chose to adopt its latest EyeQ5 chip were only BMW and NIO.

At the same time, a batch of Chinese ADAS scheme T1s including Desay SV’s IPU02/03/04 platform, Hongjing Intelligent Driving’s IPM, Hyperview Pilot 2.5/2.5 Pro, Eastsoft Rui Chi’s X-Box2.0/3.0, and the integrated parking and navigation domain controller won a large number of orders for front-loading production from Chinese brands and entered the forefront.

From January to August this year, the penetration rate of L2 and above intelligent driving systems for passenger cars in China reached 33%, a year-on-year increase of nearly 10 percentage points.

The Chinese ADAS T1 overtakes

“The road conversion of the integrated parking and navigation system has happened in the past year or two,” an industry insider told EV Observer. “Mobileye is slowly being abandoned by domestic manufacturers. Many new projects are starting with the integrated parking and navigation system, and the production has already started.”

For human drivers, driving and parking are two parts of a complete driving process. However, for machines, they are still separate parts.

The driving and parking functions use two sets of perception and calculation systems, which are deployed on different ECUs (electronic control units) to support ADAS functions such as 1V1R and 1R3V, and APA functions composed of ultrasonic radar, close-range cameras, 360-degree panoramic cameras, etc.

On the one hand, this is because Mobileye, the absolute mainstay of ADAS, does not do parking functions. As an Israeli company, its core customers are international car companies and international T1s in Europe and America, most of which have vast territories and few people or many experienced drivers, with little demand for parking functions.

However, fundamentally, the separation of driving and parking functions is determined by the traditional distributed electronic and electrical architecture (EEA) of automobiles.

In the distributed EEA, there is a strong binding between functions, software, and hardware. High-security functions mostly have their own set of dedicated software and hardware for each function. The advantage is high real-time and determinism, but the disadvantage is that it is impossible to upgrade and replace individual functions, and the communication bandwidth provided by the CAN bus is unable to support the data throughput required by high-performance chips.

Until the centralized domain-controlled EEA architecture based on Ethernet communication and the SOA software design concept appeared in recent years, providing an implementation environment for machines to drive and park with one set of perception system and one “brain” like humans, the ADAS model of driving and parking integrated became possible.

In terms of software algorithms, Tesla’s FSD has verified the applicability of neural network AI algorithm models in the field of autonomous driving, bypassing Mobileye’s profound logic algorithm barriers.

Therefore, even new players can use data-driven methods to create driving and parking perceptions and even decision-making models that are no less than, or even superior to, Mobileye’s.On the core hardware, the high AI computing chips provided by NVIDIA, Horizon, Qualcomm, and Texas Instruments provide hardware support for the deployment of the advanced AI algorithm models on vehicles in the form of the combined driving and parking system.

Under the joint support of the centralized EEA architecture, AI algorithm model, and high-performance chips, the Chinese self-driving T1 welcomes its own “overtaking lane” – the combined driving and parking domain control system. Moreover, the attractiveness of the combined system to the automakers is not insignificant.

“Integrating driving and parking boxes reduces the communication harness between functional modules and controllers, which corresponds to a direct cost reduction. Additionally, this lowers the system cost of the entire vehicle architecture.”

According to Ma Chao, co-founder of Hongjing Intelligent Driving and Vice President of System Integration, “In the past, automakers needed to connect with at least two suppliers for driving and parking. With the (combined driving and parking) system integration, the required resources investment in this respect have decreased.”

Driven by the Chinese self-driving T1, the integration and concentration of the combined driving and parking solution are becoming increasingly higher.

At the perception algorithm level, the comprehensive integration of driving and parking sensors through full-time or part-time reuse enhances the system’s specific performance in various intelligent driving levels: When driving, blind spots can be complemented by using the lateral omnidirectional perception of parking; when looking for a parking spot, the forward pre-impact automatic emergency braking system can quickly detect the space and familiarize itself with the terrain.

At the operating system and middleware level, by implementing the SOA concept in full or in part, standardizing communication interfaces, encapsulating the atomic service capability, and performing hardware and software decoupling, the difficulty of combining functionality between sensors, computing units, and actuators has been greatly reduced, and the possibility of infinite expansion of functionality has been achieved.

On the underlying hardware computing platform, the current mass-produced intelligent domain controller for autonomous driving still adopts a multi-chip heterogeneous packaging mode, using one or more AI chips combined with MCU or CPU chips, and integrating them through the SOA architecture and Ethernet communication within the domain.

On the underlying hardware computing platform, the current mass-produced intelligent domain controller for autonomous driving still adopts a multi-chip heterogeneous packaging mode, using one or more AI chips combined with MCU or CPU chips, and integrating them through the SOA architecture and Ethernet communication within the domain.

In some products that are approaching mass production, the perception and decision-making functions of autonomous driving will be fully realized on a high-performance chip, and even achieve deep integration between the intelligent cockpit and autonomous driving.

According to monitoring data from the Intelligent Connected Vehicle Research Institute, from January to September 2022, a total of 498,500 passenger vehicles equipped with the intelligent domain controller for autonomous driving (excluding import and export) were delivered in the Chinese market, a year-on-year growth of 117.12%, with a penetration rate of 9.75%. The average price of front-loading models equipped with L2 autonomous driving and parking was CNY 290,900.

This year, the delivery volume of intelligent domain control solutions for autonomous driving is expected to reach 800,000 units, and is expected to exceed 1.5 million units next year. The vast majority of these mass-produced products are provided by China Intelligence Driving (T1).

Time to rebuild the intelligent driving chain

If judged by the standard of reusing the perception system for autonomous driving, the traditional international T1 is not without a domain controller for autonomous driving.

In a Bosch product, by adding a controller outside of the driving and parking perception systems, the perception results of driving and parking are fused to achieve higher-level functions such as actively changing lanes and sentry mode. However, large-scale production is not solely determined by the product.

China Intelligence Driving (T1) has begun to dominate the market for the intelligent domain controller for autonomous driving, behind which is an ongoing reconfiguration of the intelligent driving industry chain:

In the terminal market, the iteration speed of intelligent vehicles has greatly accelerated.

“Nowadays, the competition in the terminal market is all about speed, and we are working hard to develop new features and performance, leading to a significant compression of development time,” said an industry insider. Previously, car companies gave suppliers one and a half to two years to develop a new product, but now they require that it be launched in one year or even eight months, which seriously challenges the project management, resource integration, and ability to cope with uncertainty at the end of the chain, where T1 is located. “Because many things are brand new, it’s very difficult once you go from the idea to implementation, with countless problems.”

The extremely compressed development time and highly customized product needs have posed customized and personalized service requirements to suppliers, which are completely contrary to the traditional development model of T1 based on platformization, modularity, long-term deep cultivation, and achieving “One-size-fits-all”.On the contrary, being in China, China smart driving T1, which has a deeper understanding of Chinese consumers and the demands of domestic auto companies, has provided an opportunity to enter the market.

On the demand side, currently, the desire of car companies to master core technology is greater than that of selling cars.

In the era of fuel vehicles, powertrain and vehicle tuning were the core barriers, which accounted for a large portion of the BOM cost, and car manufacturers mainly grasped this part of the technology.

In the era of intelligent vehicles, the proportion of software and electrical components in the overall vehicle cost is increasing, and they are the “soul” part strongly related to user experience. Car manufacturers hope to master this part of the ability to avoid the final outcome of becoming merely an OEM manufacturer.

Therefore, the “turnkey” model in which T1 completed the component system integration and handed it over to the host factory for vehicle integration is no longer applicable in the era of fuel vehicles.

Of course, the new model is not achieved overnight. Initially, against the background of software-defined cars, car companies hoped for the appearance of “software T1”, but as they lacked the ability of overall vehicle engineering and coordination with other components, the attempt failed.

Later, car companies attempted to eliminate the T1 position and directly connect with T2 suppliers of software and chips. However, the component integration ability between parts and the overall vehicle technology are still not mastered by the majority of car companies. The engineering workload is also huge, and ultimately difficult to complete.

After several twists and turns, a new intelligent T1 model gradually took shape.

First of all, intelligent T1 is still a hardware integrator, but its level of interaction with upstream software, chip suppliers and downstream car companies is completely different.

Although the EEA centralized domain control architecture is now a consensus, the landing mode of each car company is still very different. The core functional domains of the intelligent cockpit, intelligent driving, vehicle control, power, gateway, etc. are divided and integrated in different forms, with varying degrees of segmentation such as three domains, four domains, and five domains.

In order to implement the intelligent driving system on a strongly customized EEA architecture, the intelligent T1 needs to participate in the definition of the EEA architecture at a very early stage, take responsibility for the integrated system of upstream software and chips, and collaborate with the car factory in various OTA tasks in the later stage.“Entering early and exiting late, it is very different from the traditional T1 mode,” said Dong Xiaohang.

The new mode has even generated new development concepts and methods within the automotive industry.

In the traditional turnkey mode, automotive engineers only need to provide demand to suppliers, and the suppliers will deliver products according to scheduled time points. A single engineer can be responsible for multiple products.

However, the complexity of intelligent driving systems is much higher than that of traditional automotive functional components, and the centralized and simplified EEA architecture has greatly increased the interweaving degree of software and hardware, making it impossible to “trace” suppliers based on individual parts and components.

Against this background, the knowledge structure and docking objects required by system engineers far exceed the limit that a single person can bear.

Automakers also want to establish software and electrification capabilities, so thousands or even tens of thousands of talents may frequently appear in the plans of various automakers.

“Once there are people, automakers have the ability to try out the corresponding technologies on their own, and (have energy) to deep communication with us. They can pull together system engineers for the whole vehicle, hardware, and software to form a virtual team, and seek a better implementation method,” said the industry expert above.

On the product side, the intelligent capabilities of automakers vary, and the demand in the terminal market has not yet fully converged. Automakers have various requirements for the “size, software, and hardware” of intelligent driving products.

This is contrary to the platform-based and scaled product strategy of international T1 companies, but it is what Chinese companies good at making incremental progress are good at.

There are very large products. The first mass-produced intelligent central computing platform ICP Aurora released by Desay SV this year has achieved the fusion of the three domains of intelligent cabin, intelligent driving, and vehicle control on the central computing platform. The total computing power can reach more than 2000TOPS, and the hardware can be removed and replaced.

There are very small products. Hongjing Intelligent Driving has a product that has already been installed in cars, which uses 15TOPS of computing power to achieve high-speed NOA and automatic parking based on high-precision maps in addition to L2 functions, demonstrating their ability to efficiently apply small computing resources.

There are multi-level products that can be split. Hongjing Intelligent Driving provides customers who do not have self-developed intelligent driving capabilities with a complete intelligent driving system product, including functional components, software algorithms, and hardware. For customers who are highly intelligent, they can provide products that only include controllers plus bottom-layer software and middleware, so that users can carry out further development.

Modular products with atomic-level granularity. Neusoft Reach offers L2 to L4 level autonomous driving products based on an open SOA architecture, tailored to customers’ distinct capabilities, demands, and weaknesses. These products are available in modules or even individual services that include hardware, low-level software, AUTOSAR basic software, and full-stack application-layer algorithms for perception, fusion, planning and control, and sensors.

Localization is a significant strength of T1 autonomous driving in China. Machine learning technology trains on local datasets for better recognition of China-specific road conditions, such as yellow lines, stop lines, and small electric motorcycles, enabling better functionality.

“As for technology, we are not weak now and are in the process of growing stronger,” said Ma Chao.

Advantages of building China’s T1 autonomous driving

“Currently, international T1 giants may still hesitate under the influence of demand and inertia. However, they also have their own high-end domain control products and enormous capital. If Chinese suppliers only compete for first-mover advantages, they will still be easily surpassed in five years,” said Dong Xiaohang.

“We hope to accumulate and create our battlefield and racetrack from the perspectives of architecture, system, development mode, and software capabilities,” said Dong.

In the traditional fuel vehicle market, traditional suppliers have already entered a fully competitive stage, and more attention is paid to how to reduce costs and increase efficiency in mass production, relying on the progress of T2 suppliers such as semiconductors to achieve updates.

However, in the intelligent market, suppliers face an entirely new system. The ability to build and architect large-scale systems has become a new battleground for both domestic and international T1s to learn from scratch and rebuild core Know-how barriers in the mass production process.

“At this moment, T1 autonomous driving in China has a rare opportunity to build its industry barriers through the understanding of the entire vehicle system, algorithmic mastery, and bottom-level standard integration,” said Dong.

An industry insider provided a vivid example to the “Electric Vehicle Observer” to explain the difficulty of intelligent engineering.

An industry insider provided a vivid example to the “Electric Vehicle Observer” to explain the difficulty of intelligent engineering.

Due to the ability to release intelligent capabilities through OTA, many OEMs will deploy intelligent functions in stages. One OEM requires TIER 1 to first install the vertical (ACC\AEB and other functions) functions at the beginning of the year, and then the horizontal functions (LCC, etc.) in the middle of the year.

The vertical functions of the intelligent driving system are closely related to the vehicle’s power and braking components, while the horizontal functions are mainly related to more complex steering mechanisms.

The problem is that function deployment can be installed at different times through OTA, but parts related to functions are installed “in advance” during mass production. “New cars cannot be without steering wheels just because they do not have horizontal functions.”

This means that although TIER 1 has half a year to polish the horizontal capabilities, it needs to lock the performance indicators of the horizontal capabilities in advance with related parts-steering mechanism.

“It (the steering mechanism supplier) has just joined the work, and we are all debugging together, and the time window is not long.

If the indicators are loosened, it may cause the performance indicators of the entire system we compose to fail to meet the standards after half a year.

But if we don’t loosen them, it may affect the vertical system, and even the SOP time of the entire vehicle, which really tests our understanding of large-scale functions.“

The industry insider stated that based on the understanding of its own intelligent driving system and the related parts-line control chassis system, TIER 1 accurately decomposed all performance indicators, clarified the factors that may affect the performance of related parts, and gave corresponding standards.

From the results, the implementation of horizontal functions has achieved better results and exceeded the plan of the OEM by three months.

“The important thing is the way you analyze the problem, whether to hide it or solve it. The biggest challenge of engineering is not to bring more problems after solving the problem in the correct way.” The industry insider stated that “the engineering production methods and skills are one of the advantages accumulated by the mass production supplier“.China’s IMa T1 is rapidly investing in improving its technical capabilities in core areas such as algorithms and data iteration.

L4-level autonomous driving company, Arriver, has recently launched a NOA solution for urban areas with a laser radar that has a strong cost advantage in mass-produced high-end intelligent driving systems, backed by Arriver’s algorithmic capabilities.

Arriver has deployed, for the first time in the industry, its large model (OmniNet) that fuses sequential multimodal features on a mass-produced platform, which enables visual, laser radar, and millimeter wave radar to output multi-task results in both BEV (Bird’s Eye View) space and image space using a neural network.

The “spatiotemporal joint planning algorithm” allows vehicles to anticipate the optimal timing and find the optimal solution in the game when facing dynamic obstacles and interactions, thereby avoiding repeated sudden braking. In addition, when driving in multiple lanes, vehicles can flexibly change lanes and select faster routes to improve efficiency by judging the traffic flow and speed of the vehicle in front.

Compared to traditional solutions, Arriver’s OmniNet can save up to 2/3 of computing resources in practical applications, and has higher precision in perception fusion and model iteration efficiency. It can also adapt to different sensor configurations of manufacturers with low cost, lightweight, high efficiency and flexibility to meet the mass production requirements of urban NOA.

At the level of data training and iteration, China IMa T1 has invested hundreds of millions of yuan in data centers that are already in operation or are under construction, as well as other laboratories and test sites.

“What ultimately matters is data and data processing capabilities, as well as the engineering capabilities of the finalized model and product. It’s a ‘war’ of regular troops,” according to industry insiders.

While China IMa T1 is fighting its own battles, it is also engaging in broader cooperation to promote the landing and application of Chinese standards in the Chinese market.

“Dong Esoft Ruiqi’s unique feature is the full-stack self-development of software, which builds a three-dimensional open SOA automatic driving software architecture that includes a hardware platform layer integrating body, power, chassis systems, a software platform layer based on AUTOSAR-developed NeuSAR, and a service application layer that links car-to-cloud collaborative value data communication, forming a full-stack under the stable cross-platform architecture of the SOA framework.”

Dong Xiaohang said that a platform-based SOA framework can help EEA quickly adapt to various hardware through the “software first” R&D mode. No longer constrained by the adaptation process of different hardware, the algorithmic advantages accumulated in the past can be immediately released, and software assets can be flexibly reused.

“Even if the customer has not yet decided whether to use Orin or J5, it will not affect their software reuse and forward-looking technology landing.“

At present, Neusoft Reach and 20 companies including FAW, SAIC, Changan, Geely, NIO, XPeng, Zeroshot, Horizon, Jingwei Hengrun, and Shanghai Nasen have formed the China Automobile Basic Software Ecology Committee (AUTOSEMO), and hope to provide standardized basic software Kangjia, methodologies, and application programming interfaces for the next generation of automobiles in China’s automobile industry.

Standards will determine product scale and application ecology.

In 1986, German electrical business Bosch developed the CAN communication protocol for automobiles. Since then, CAN has been standardized through ISO11898 and ISO11519, and has become one of the standard protocols for automotive networks in the future. Most of the electrified automotive products are built on this.

“An open, secure, and stable SOA architecture is the future and the starting point for competitiveness in the next 5-10 years.” Dong Xiaohang said, “We do not want to change the purchasing mode of the host factory’s whole package or disassembly, but strive to reconstruct the development, operation, and cooperation mode of automotive intelligence.“

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.