Author: Zhu Yulong

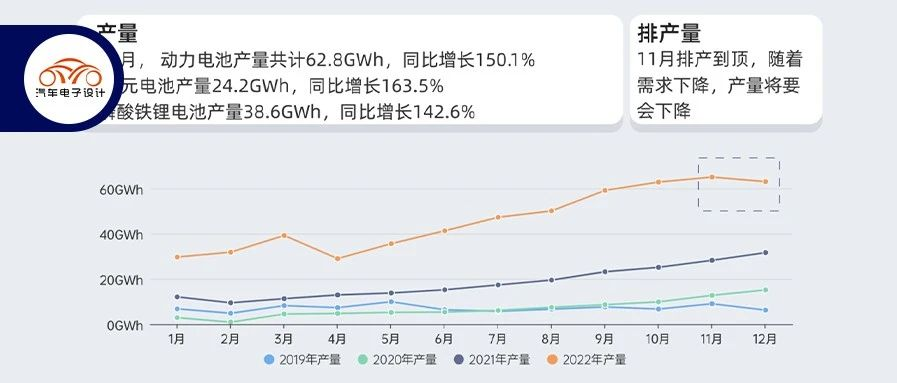

Over the weekend, Yanyan and I filmed a video about the penetration rate of new energy. Facing next year’s expectations, the main challenge is whether the battery price can quickly drop in the first half of 2023. Currently, the main considerations are:

-

With respect to current orders and actual effective sales areas of the entire vehicle enterprises, they have a good sense of how many can be sold in the last month. Recently, many enterprises have taken price protection measures, which means that there may be force majeure that prevents them from delivering goods in December (they have to abide by the current policy). Therefore, we can also foresee that there will be differences in the demand between the last month and the whole year for car companies.

-

As end demand continues to rise, materials except for the positive electrode have been basically trending downward. It is foreseeable that the price base will also trend downward. This year, the battery price was upheld due to the rise in lithium prices. As a result, there will be adjustments in Q1 as this process continues.

-

The current variable lies in the global demand. With the start of electrification globally, in Southeast Asia and India, and in the United States, where penetration rates are low, a 0-5% penetration rate may not be noticeable, but it will also increase the demand for batteries.

Personally, I lean towards an increase in global total demand in 2023, primarily in these low-sensitivity regions. The rapid penetration of the United States and these low-sensitivity regions makes it difficult for the battery price base to fall as expected.

From the CIAPS, we can see the fluctuation of China’s mainstream battery prices, which have increased significantly from their lowest point in mid-2021, with ternary up by 35% and lithium iron phosphate up by 60%.

Material Changes

From the intuitive changes in battery materials, the main driving force for the price increase of positive electrode materials is the upstream mineral, which drives the price change. The price of battery minerals, such as lithium carbonate, rose by more than 100%, and lithium hydroxide rose by more than 150%. Cobalt prices fell by nearly 30%, while nickel rose by about 30%.

From the perspective of actual battery material prices:

◎ The price of ternary materials has increased by 36%-43% since the beginning of the year, while the price of lithium iron phosphate has increased by 60%-70%. Currently, the price gap between ternary batteries and lithium iron phosphate batteries is narrowing.

◎ The prices of negative electrodes and diaphragms are stable and have not risen significantly.

◎ With the increase in production capacity, the prices of electrolyte, DMC, and lithium hexafluorophosphate have fallen by 40%-50% since the beginning of the year.

◎ Overall, as long as lithium prices continue to fall, there is room for a certain degree of reduction in battery costs and sales prices. Currently, the positive electrode accounts for a relatively high proportion of battery costs.

Production Capacity in the US and Europe

The biggest question now is the global demand. The penetration rates of pure electric vehicles (BEVs) in Europe and the United States have increased rapidly. The BEV penetration rate in Europe has reached 12%, while that in the United States is 5.1%. We can clearly see that Southeast Asia, a region lacking oil resources but with battery resources, has also begun electrification.

It is expected that the US’s production capacity in 2023 will increase from 90 GWh this year to 177 GWh. Assuming global lithium resource expansion is a long cycle, the increase in the building of super factories around the world will result in a fluctuation in the first and second quarters of 2023, which is part of the long cycle.

Summary: In my personal judgment, many companies have started planning for extended-range and plug-in hybrid vehicles because they cannot give themselves enough confidence that battery prices will have a rapid decline by 2023, and even if they do, they cannot return to the lowest price in 2021. Therefore, we see the best scenario is to return to the price level at the beginning of 2022.

Summary: In my personal judgment, many companies have started planning for extended-range and plug-in hybrid vehicles because they cannot give themselves enough confidence that battery prices will have a rapid decline by 2023, and even if they do, they cannot return to the lowest price in 2021. Therefore, we see the best scenario is to return to the price level at the beginning of 2022.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.