Author | Zheng Wen

Editor | Zhou Changxian

NIO, XPeng, IDEAL, and some new brands launched by traditional car companies have implemented radical market strategies, which have actually nurtured China’s domestic intelligent driving industry chain.

In a sense, “ecology” has already generated single-point feedback in the pan-automatic driving industry. Laser radar has become one of the main benefiting areas (Robotaxi is another important area), and the cake is indeed getting bigger and bigger. The majority of laser radar companies’ fixed point orders come from Chinese car companies.

Just four or five years ago, at CES then, Velodyne was in the limelight, surrounded by many viewers who were interested in its products. Its HDL-64, which cost $80,000, basically monopolized the high-performance automotive laser radar market. Its internal mechanical components numbered in the hundreds or even thousands, many of which were movable parts that required a lot of manual tuning, which was labor-intensive and time-consuming.

Soon, the market realized Velodyne had not formed a competitive barrier. Speedy Group M1 from China then improved the integration of components and became the price butcher in the market; HiRain Technologies’ AT128 pursued the semiconductorization of parts and reduced moving parts, thereby enhancing product reliability. They have added market competitiveness in different dimensions.

In 2016, Speedy Group released a 16-line solid-state laser radar that surpassed Velodyne in all aspects of product parameters and was even cheaper. The following year, the same strategy was used for product updates. By 2018, while Velodyne had reduced their price by 50%, their Chinese competitors were still advancing forcefully.

At Velodyne’s home turf, HiRain announced the delivery of laser radar to North American car companies. The contrast was that Velodyne no longer sold laser radar directly in China and disbanded its Chinese office.

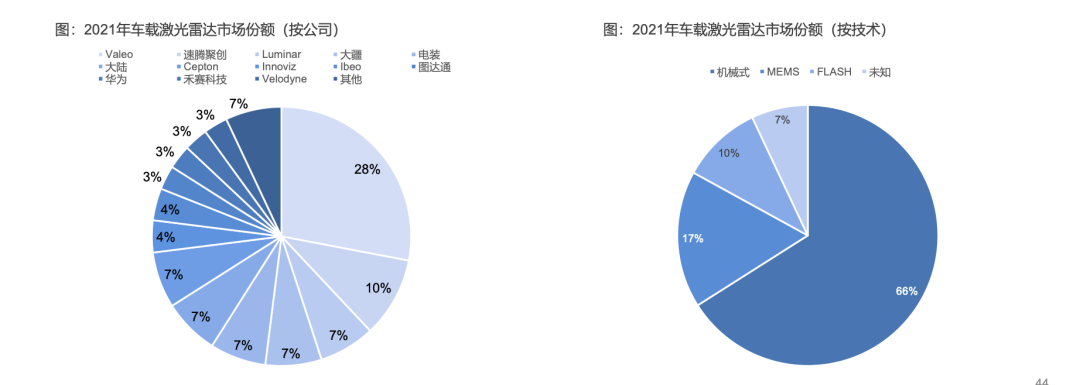

According to Yole data, China’s laser radar suppliers accounted for 50% of the global ADAS front-loading mass production fixed point volume from 2018 to 2022, ranking first in the world. HiRain Technology accounted for 27% of the global ADAS front-loading mass production fixed point volume. Meanwhile, the figures for Speedy Group M1 and Huawei were 16% and 5%, respectively.Yole predicts that the shipment volume of ADAS LiDAR will reach approximately 221,000 units in 2022, with the top five manufacturers accounting for 84% of the market share. Of these, Valeo accounts for about 29% and Hesai Technology is the second largest with about a 20% market share. Sensible 4 and Huawei rank third and fourth, respectively.

Within and beyond the boundaries of this land of the Orient lies two completely contrasting atmospheres: half is the sea and half is the flame.

Overseas, Ibeo did not wait for mass production, but bankruptcy. Ouster and Velodyne merged for unity, Quanergy was delisted, and others’ stock prices fell all the way down, being cut in half. Thus, the future of foreign LiDAR is uncertain.

However, in the domestic market, the industry is slowly advancing. After a first half of long-distance main LiDAR battles and completenessof set-pointed solutions each at different OEMs, the “last piece of the puzzle” of visual perception schemes continues to be improved through lateral supplementation.

The Second Half: Blindness Control

There are three steps to complete advanced autonomous driving behavior: perception of the environment, path planning and vehicle control. The main difficulty lies in perception.

Why is perception so difficult? Perhaps one can explore some reasons from human eyes. In the past, people seemed to only focus on the brain as the most important human organ, but few people knew that the eyeball occupies over 65% of the “memory” of the brain. The information it perceives is not only abundant but also dynamically stereoscopic. Achieving the same effect through perception hardware implementation is extremely difficult.

The principle of visual perception is to annotate local features and then match them in massive databases to determine the overall properties of objects. This process simulates the process by which the human brain recognizes objects; however, it is unable to determine distances. In the past, to solve this problem without relying on LiDAR, single-camera and multi-camera ranging were mainly used.

In practice, visual perception has brought about many problems. For example, environmental factors such as weather can cause visual sensor blindness; small target objects may cause late recognition in low-resolution visual perception systems. Irregular targets may cause an inability to match due to lack of training, among other issues.

In addition to cameras, some visual perception solutions may integrate or pre-bury millimeter-wave radar and ultrasonic radar for complementary blindness control. However, in the infinite Corner Cases of advanced intelligent driving, both cameras and millimeter wave radars may fail.The latest common solution in China’s automobile industry is the redundant combination of LiDAR and camera with millimeter-wave radar for near-field perception. The sensors have strong complementarity, with LiDAR having high-precision perception, vision providing rich semantic information, and millimeter-wave radar having good penetration, which can maintain stable perception output in harsh weather conditions.

However, the perception hardware solution is still being continuously optimized.

The main LiDAR focuses on forward vehicle perception, with a far-reaching view, but the vertical depth (small vertical field of view) is relatively limited, and the perception close to the body is also poor.

Some companies take the perspective of an overall perception solution, aiming to achieve a 360° panoramic perception effect. Based on the core functions of automatic driving in high-speed, urban, and parking scenarios, they have extracted the key performance requirements for supplemental blind spot LiDAR.

On May 13th, Luminar Technologies introduced the first pure solid-state flash side LiDAR LDSense Satellite in China, which will be available for SOP in the second half of 2023. At that time, the market seemed quiet. Six months later, Hesai and SureStar Juchuang successively released solid-state supplemental blind side LiDAR. Their SOPs are also scheduled for the second half of 2023.

The mainstream forward LiDAR is currently installed directly in front of the car, with a horizontal field of view (H-FOV) ranging from 90° to 120°. According to the calculation of a 120° H-FOV, it can only detect sudden merges when a car gets within 3.6 meters of the front. There is a high possibility of collision.

Temporary dropped objects in the lane ahead or small animals running out suddenly can be omitted by inadequate redundancy of the camera environment and the limited extreme condition data of algorithm training. The camera cannot achieve precise positioning of the roadside and lane lines, and the forward main LiDAR has a limited vertical field of view (V-FOV). Depending on the installation position height, there is a visual blind spot of 3m~7m or more.The current 1+2 scheme on the market, with the side-mounted LiDARs, is not specifically designed for blind spot scenarios, as their vertical FOV is generally only 25 degrees and cannot meet the requirements for blind spot detection.

On road sections or intersections without clear or blurred lane markings, cameras tend to plan trajectories with significant fluctuations, which undermines driving experience. However, when a sidelooking LiDAR is installed at the top position, apart from perceiving targets in the adjacent lanes, it can also obtain accurate relative position information by detecting surrounding static road markers. When combined with high-precision maps, lane-level positioning can be achieved.

Blind spot radars, on the other hand, demonstrate obvious effects in the aforementioned scenarios. They can identify sudden Cut-ins and reduce collisions effectively, enlarge the vertical FOV for detection of low-height objects, and improve lane-level positioning by identifying static objects around the road.

In addition, the previous scheme of adding a backup LiDAR was not cost-effective, while blind spot radar, with the advantage of increased vertical FOV and coverage of areas close to the vehicle body, has relatively low cost. According to Speednet Innovations, two blind spot E1s are cheaper than one main sensor M1.

Based on visible parameters, the Speednet E1 has a FOV of 120°90°, the Hesai FT120 has a FOV of 100°75°, and the LidaTech LDSense Satellite has a FOV of 120°75°. It is worth mentioning that LidaTech, as a supplier of LiDAR system solutions, has seen the last piece of the puzzle and launched its first hardware product.

Speednet Innovations co-founder and CEO Qiu Chunchao said, “If M1 truly pushed the LiDAR industry into the era of mass production, then E1 will be the ‘last piece of the puzzle’ for L4 vehicle LiDAR perception.”

Mass Production, Gaining Traction

Regarding the reasons for the half water half flame situation in domestic and foreign markets, LidaTech founder Ju Xueming attempted to provide some answers. “Take Germany as an example. In terms of the development of intelligence, especially in terms of our understanding of new things and the models and efforts we invest, the pace of development in China is now clearly different from that in foreign countries. Germany has had LiDARs in cars for a long time, but the development cycle is long.”Limited OEM opportunities are available, and once this generation of models is missed, the waiting time for overseas LiDAR hardware companies will be long, during which they will need to continuously burn money. This is also an important factor in why Ibeo has held on until bankruptcy.

Starting from August 2021, when the first batch of M1s were produced and delivered, Stoichiometric Jingjie has won over 50 fixed-point orders for more than 50 car models worldwide, including BYD, GAC Aion, FAW Red Flag, Chery, Great Wall, XPeng Motors, Zeekr Intelligent Technology, WM Motors, Lotus Technology, and Lucid. By the end of this year, Stoichiometric Jingjie will have 11 vehicle projects entering SOP.

So, is the vast sea of domestic LiDAR companies already within reach?

Although LiDAR companies have already had more perfect product layouts, the market has not yet fully heated up. CEO Li Yifan of Hesai Technology believes that “it is still unknown who will have the last laugh.” After all, examples of Velodyne waking up early and rushing to the gathering can be seen everywhere.

His and Innoviz China’s GM Su Shuping’s judgment is that the true outbreak period of LiDAR will be in 2025. Reducing costs, ensuring quantity production, and passing vehicle rules are the three important difficulties at present.

According to Ruichi Wisdom Light’s disclosure, its product LakiBeam 128/128L is priced at approximately 743/450, 498/298, 289/195 US dollars respectively in the quantities of 10,000, 100,000, and one million units. Overall, the price of LiDAR depends heavily on the scale of production. As the production volume increases, prices will gradually fall.

In fact, LiDAR is still an immature industry today. Regardless of size, no company has successfully produced LiDAR products in large quantities that meet both functional and reliability requirements.

Putting LiDAR on a car requires a series of steps, including functional definition, system design, software development, test validation, and system integration, and each stage has many details that need to be honed.

Ju Xueming stated that in terms of the product test and validation cycle, the landing speed is not optimistic. Overly rushing will make it difficult to ensure the integrity of the LiDAR function. “True mass production is built on details. Although there are no insurmountable obstacles to putting LiDAR on a car currently, there are still many details and trivial problems from perception development to testing.”Since the collaboration between Valeo and Audi in 2010, it took 8 years for the first-generation Valeo SCALA to be equipped with a car-level LiDAR and come into mass production in 2018. Moreover, it remains the only product in the world that has achieved mass production and compliance with automotive standards.

In communication with LiDAR companies, AutocarMax has noticed that these companies have been emphasizing the variety of LiDAR technologies and stating that they do not necessarily compete directly with one another. The priority is to achieve mass production and cost reduction, which could be taken as a common and default stance in the whole industry.

Ju Xueming, the chief technology officer of Hesai, pointed out that the LiDAR market is currently at a stage of diversified technology paths, and there is no one technology that needs to replace others. In other words, different technology paths will coexist. LiDARs with different technology paths have their own advantages and disadvantages, which need to be comprehensively matched. Some technology paths are suitable for medium- to long-range, or even ultra-long-range applications, while others tend to be used for medium-short-range, or even short-range applications. There is still application space for different functions in autonomous driving as well.

“As we understand it, flash LiDAR may have a better chance of landing for some medium-range or short-range applications at its current state, while MEMS-based high-resolution and cost-effective products are more suitable for forward-looking applications, which is a combined relationship,” says Ju Xueming. Due to different technology paths and practical application scenarios, LiDAR companies do not compete purely with one another.

“We tested a large number of LiDAR products with different technology paths to see if there is one type of technology that is superior to others, but I don’t think so at least for now,” he said frankly.

The biggest competitor of LiDAR companies may come from outside the industry.

Tesla is a firm advocate for vision. Musk’s conviction has made a pessimistic mood spread throughout the LiDAR industry. His public comments are brutally cold, “LiDAR is not a must-have for autonomous driving,” and “LiDAR is like an appendix on a human body.”

Tesla follows the principle of hardware-first and software-updates, upgrading from Autopilot Hardware 1.0 to 3.0 and then removing the mmWave radar, and from using external chips from Mobileye and Nvidia to developing and using FSD’s self-developed chips, and from updating to V7.0 to V10.0 software, step by step toward a pure vision-based solution.

Since May of last year, the North American Model 3 and Model Y have stopped using millimeter-wave radar, and as of mid-February of this year, the North American Model S and Model X have also cancelled millimeter-wave radar.

Since May of last year, the North American Model 3 and Model Y have stopped using millimeter-wave radar, and as of mid-February of this year, the North American Model S and Model X have also cancelled millimeter-wave radar.

Tesla chose a pure visual solution, not only because Musk regards “first-principles thinking” as his mental stamp, but also because the cost of lidar is too high.

The cost of automotive lidar has already been compressed to the thousand-yuan level, but it is still an order of magnitude more expensive than the price of a camera. In Li Yifan’s vision, the final price of lidar will be two to three times that of a camera, and the camera will focus on higher precision and confidence in visual algorithms, approaching lidar in efficiency.

Final Thoughts

A regrettable fact is that advanced technology cannot always be widely adopted in the market. Sometimes, in the competition of multiple technologies, it can slide toward one end, which may be the result of multiple factors. This situation is not uncommon in the automotive industry.

Participants can only do their best. Fortunately, more and more companies say, “We insist on doing valuable things until we succeed,” and “We persist in doing difficult but correct things.” If there are many such enterprises in a field, wouldn’t they increase the weight of the matter they adhere to? The balance may tilt in their favor.

At the end of September, Vayyar announced that the AT128 had achieved a monthly delivery of over 10,000 units, becoming the first vehicle-mounted lidar company in the world to deliver over 10,000 per month.

At the Speed Dream E1 launch event, industry leaders gathered together, including industrial capital partners such as Cainiao Technology under Alibaba, BAIC Group, BYD Group, Desay SV, GAC Group, Hubei Xiaomi Yangtze Industry Fund, Geely Holding Group and Lotus Technology, SAIC Group subsidiary Shangqi Capital, Hong Kong Lixun Co., Ltd., and Yutong Group.

Their future may not be as good, nor as bad.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.