Author: Zhu Yulong

In the previous episode of talk (video), we talked about the poor performance of autonomous driving companies in the US stock market. So where is the way out for those autonomous driving companies that lack revenue and are struggling to survive?

Today, let’s first review the development process of autonomous driving, take a look at the leading companies including Waymo, the strongest player in the automotive industry Tesla, and China’s autonomous driving companies. Finally, we will discuss the evolution of the pattern and investment opportunities in the field of autonomous driving in the competition and elimination.

Review of the Investment Craze for Autonomous Driving Companies

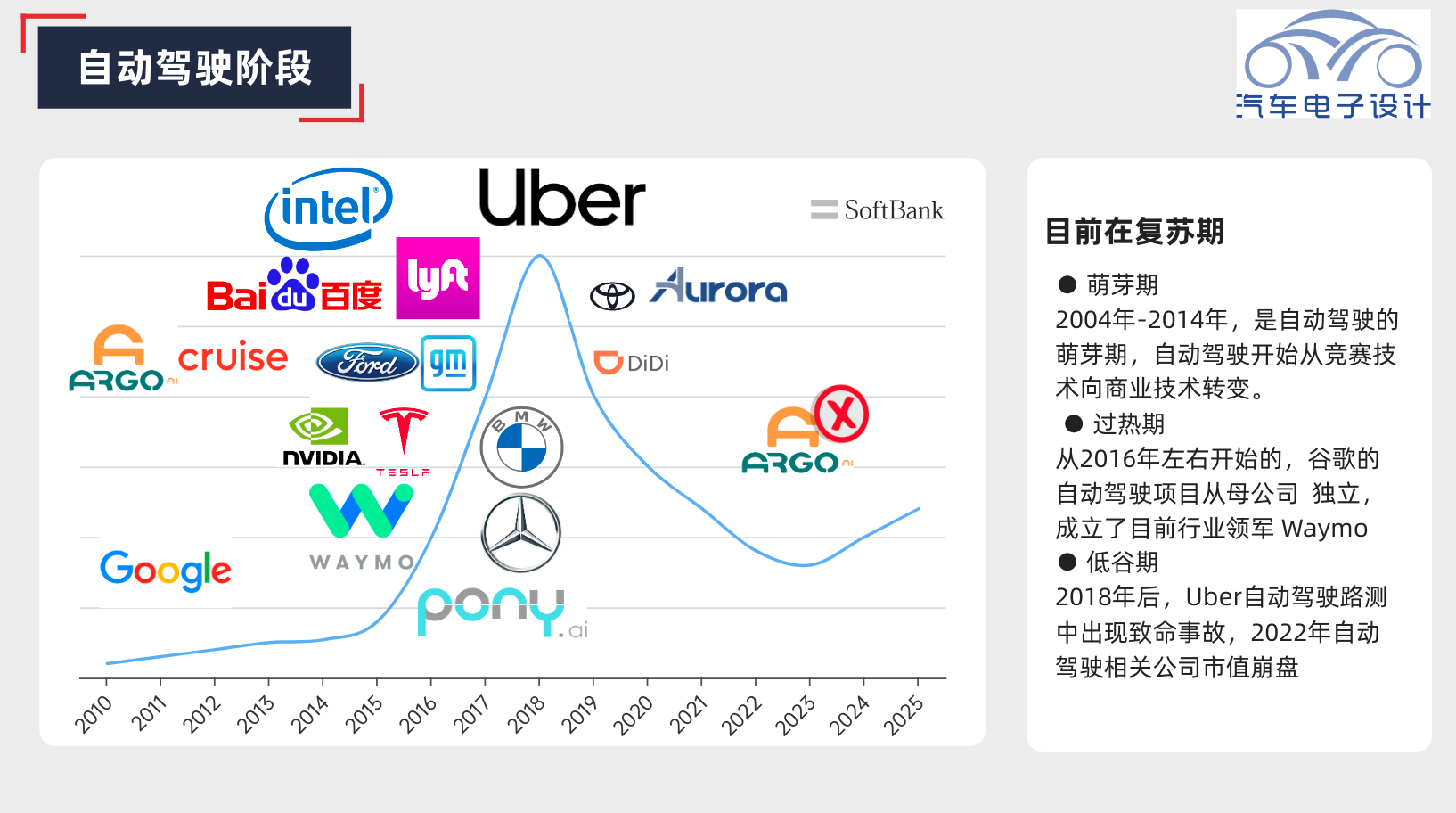

The craze for autonomous driving started with Waymo, and then many companies followed suit, mainly divided into several stages: the inception period, the overheated period, the underestimated period, and the current recovery period.

Inception Period

From 2004 to 2014, it was the inception period of autonomous driving, and autonomous driving began to transition from competition technology to commercial technology.

In 2004, the Defense Advanced Research Projects Agency (DARPA) in the United States sponsored three highway challenge competitions, verified the potential of autonomous driving, and incubated the basic route of autonomous driving. This route consists of a hardware system composed of cameras, lidars, and other sensor units, calculation units, and wire control systems, and a software system composed of algorithms such as sensor fusion, positioning, identification, and path planning, which together form the autonomous driving system of a car.

Then in 2009, Google officially launched their autonomous driving project, marking the commercialization of autonomous driving technology; this project was also the precursor to Waymo.With the example of Google, from 2013-14, tech companies such as Uber, Baidu, and NVIDIA began to enter the field of self-driving cars, ushering in the first wave of excitement. At the time, tech companies such as Uber, Baidu, and NVIDIA also joined the self-driving research and development camp.

Hype Period

The hype period began around 2016.

That year, Google’s self-driving project became independent from its parent company and established the current industry leader, Waymo.

In 2015, Waymo’s predecessor had a valuation of only $8.5 billion. However, two years later in 2017, Morgan Stanley valued Waymo at $70 billion. In 2018, the valuation skyrocketed to $175 billion, equivalent to a quarter of Google.

After 2016, traditional car companies and tech companies such as GM, Ford, and Intel quickly entered the self-driving race through investment and acquisition. In 2016, GM acquired Cruise for $1 billion. In 2017, Ford invested $1 billion in Argo. In 2018, SoftBank bet $2.25 billion on GM’s Cruise.

Large amounts of capital stimulated the industry, and self-driving cars entered a period of rapid development. This period also saw the emergence of many startups, such as Pony.ai, HoloMatic, WeRide, and Momenta.

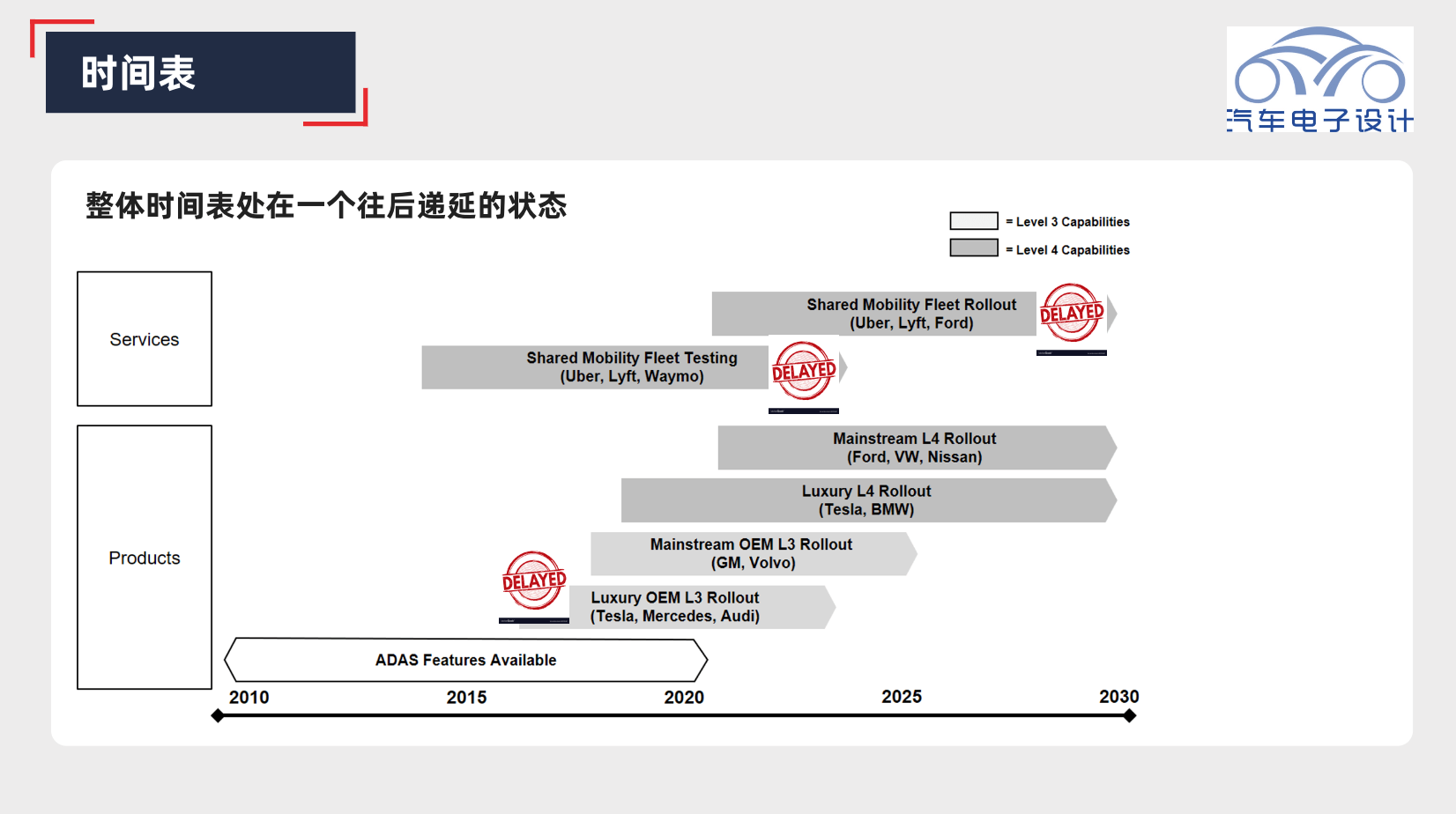

Trough PeriodThe reason why autonomous driving companies were valued so highly is that the industry was filled with optimism, believing that autonomous driving would be commercialized within 5 to 10 years. For example, in 2017, General Motors announced its autonomous driving plan, planning to deploy autonomous taxis in 2019.

However, there is always a “but” to the story. Since 2018, fatal accidents occurred during Uber’s autonomous driving road tests, marking the first time that the autonomous driving system caused human casualties. This also raised people’s concerns about the maturity of autonomous driving technology.

The world’s first fatal traffic accident caused by an unmanned vehicle brought public pressure. Coupled with slow commercialization progress, a large number of start-up companies encountered financing difficulties, and autonomous driving entered a brief low period. The entire US stock market also plummeted, generally dropping by about 80%, and the split of Intel’s Mobieye also remained flat. The development of autonomous driving is in a difficult period.

Recovery Period

Currently, autonomous driving is in the stage of transitioning from a trough to a recovery period. More and more people realize that autonomous driving may need more time and investment for technological iteration in order to truly achieve unmanned driving.

Cost and safety are the two key issues that autonomous driving technology needs to solve at present. In the not-too-distant future, with a large number of eliminated companies, mass-produced L2+ vehicles will gradually enter our lives, and the entire industry will have opportunities for development.

Tesla’s New Play

Tesla’s technical solution now seems to be the most successful, including a vertically integrated line, which even extends from vehicles to robots.

Around 2019, there was a disruptive change in the technology stack of autonomous driving, and Tesla led this change. The progress of unit technology, centered around the development from rule-driven to data-driven, has almost changed the entire technology stack, and even the way engineers think.Translation:

Simply put, the quantity and quality of data determine the effectiveness of algorithms, and this will become a key factor for autonomous driving. In the second half of 2020, Tesla released the FSD Beta (fully autonomous driving beta version), which also proved that the path from assisted driving to fully autonomous driving is feasible.

Tesla paved the way for combining autonomous driving with car production by installing low-level autonomous driving systems in production cars to collect data, constantly improving autonomous driving algorithms based on data, and ultimately achieving the transition from lower-level autonomous driving to higher-level autonomous driving.

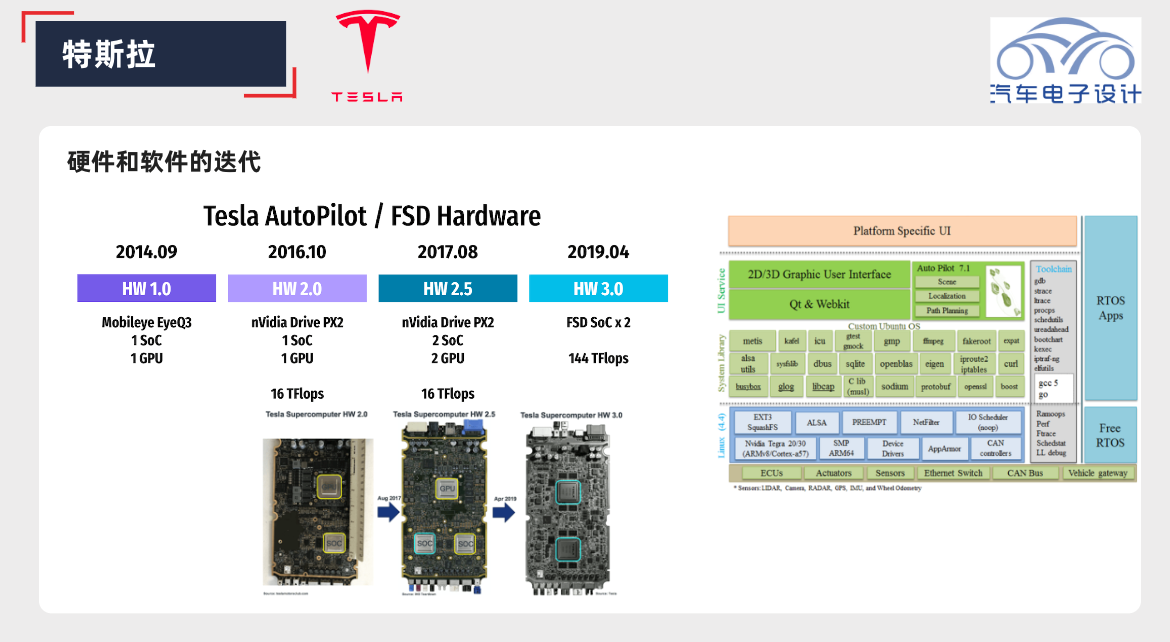

During this process, we saw Tesla constantly iterating vehicle hardware with high-performance chips and storage, advancing from HW1.0 to HW4.0. Around backend data processing, Tesla expanded the application boundaries of autonomous driving, which can be used for indoor robots in the future, broadening the use of AI in the mobile field.

◎ HW1.0

The first generation of driving assistance hardware based on the Mobileye chip, using a single EQ3 series camera, a single millimeter wave radar, and 12 medium-range ultrasonic sensors. The hardware selection was based on mature products from suppliers in the market. Tesla’s main focus was multi-sensor fusion and application layer software development.

◎ HW2.0

The second-generation driving assistance hardware designed by Tesla not only significantly increased the number of sensors (using 8 cameras, 12 remote ultrasonic sensors, and a front-facing millimeter wave radar), but also developed a new driving assistance hardware based on the NVIDIA Drive PX2 chip. At this stage, Tesla mastered image recognition algorithms, multi-sensor fusion, and application layer software development.

◎ HW2.5After HW2.0, Tesla had a minor update mainly for redundancy and slightly improved reliability. Two new features were added: driving recorder and sentry mode.

◎ HW3.0

HW3.0 is a major innovation of Tesla’s driving assistance hardware, which adopts its own self-developed autopilot chip and abandons Infineon/NVIDIA’s products. It has a highly integrated SoC+MCU chip, which includes chip design, image recognition algorithm, multi-sensor fusion, and application layer software development.

◎ HW4.0

The second-generation controller based on Tesla’s self-developed autopilot chip is currently under development and was not released at AI Day Second.

The performance improvement of the chip is based on significant improvements in computing power with each iteration of the product. As Tesla’s self-developed first-generation product, the FSD chip certainly did not reach perfect levels in certain areas due to the limitation of the times and will need to be iterated on in the second-generation product.

Chinese self-driving companies

After discussing foreign self-driving companies, it’s worth noting that domestic technology development has not fallen behind.

Currently, there are three major development directions for domestic self-driving companies:

- Mass-produced self-driving

Represented by Baidu Apollo and Xiaoma Zhixing, focusing on Robo taxi for commercial purposes to provide unmanned solutions for passenger transportation.

- High-speed commercial vehicles

Companies like Tusimple and Wayzoo mainly focus on providing unmanned Robo trucks for closed area transport.

- Low-speed commercial vehicles

Some internet companies, such as Meituan, Alibaba, and JD, mainly focus on low-speed unmanned vehicles to accomplish logistics distribution, cleaning, and mining site delivery to replace human labor.

In recent years, local policies in cities such as Shenzhen and Shanghai have continuously granted greater permission for autonomous driving on the road.

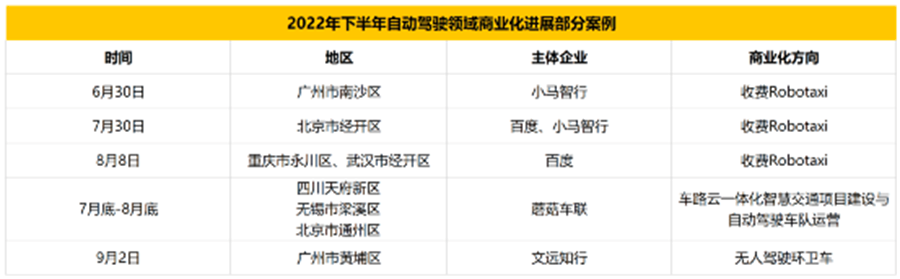

With a fruitful vehicle-to-everything (V2X) collaboration, Baidu Apollo has successfully launched its Robotaxi services for commercial operation. Meanwhile, Pony.ai has not only promoted its commercial Robotaxi services but also collaborated with Chinese automakers, Geely and SAIC, to become one of the suppliers in the market. Momenta has been quietly advancing its landing of non-passenger services, and MaaS provider, Mokumobi, has disrupted the industry with tens of billions of yuan worth of new orders, becoming the biggest dark horse in the autonomous driving commercialization field this year.

In just the second half of 2022, these companies have made the following commercial advancements:

The above represents various companies’ technological direction. For the average person, is autonomous driving a long-term investment opportunity to grow with?

The current situation facing China: Robot Taxi is the mainstay, but there is operational pressure, so many enterprises are beginning to transform into L2+ software providers to seek product opportunities. Meanwhile, the demand for low-speed commercial vehicles is clear, and the technology is relatively simple, making it easier to achieve commercialization. Currently, internet giants and startups have gradually achieved commercial landing in last-mile delivery, mines, ports, airports, and industrial parks. Among them, in the track of unmanned driving end logistics such as delivery, retail, and express, internet companies represented by Meituan and JD.com have successively entered for the purpose of consolidating their ecosystems. There are also startups such as the Neolithic Technology, which meet diverse customer needs in different scenarios by developing universal autonomous driving chassis and modular designs, to maximize economies of scale.

The current situation facing China: Robot Taxi is the mainstay, but there is operational pressure, so many enterprises are beginning to transform into L2+ software providers to seek product opportunities. Meanwhile, the demand for low-speed commercial vehicles is clear, and the technology is relatively simple, making it easier to achieve commercialization. Currently, internet giants and startups have gradually achieved commercial landing in last-mile delivery, mines, ports, airports, and industrial parks. Among them, in the track of unmanned driving end logistics such as delivery, retail, and express, internet companies represented by Meituan and JD.com have successively entered for the purpose of consolidating their ecosystems. There are also startups such as the Neolithic Technology, which meet diverse customer needs in different scenarios by developing universal autonomous driving chassis and modular designs, to maximize economies of scale.

It can be said that the development direction of autonomous driving is certain, but it is difficult to make investment decisions in this field.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.

![[In-depth discussion] Improving L4 autonomous driving technology companies, is the bubble going to burst?](https://upload.42how.com/en/2023/03/20230315033225304.png)