Autonomous driving investment sector starts off with a bang in the new year, with Aurora, which had been quiet for a long time, throwing out a single financing round record of as much as $530 million in the autonomous driving field. Less than a week later, this record was broken by Silicon Valley’s unmanned car start-up Nuro with a $940 million financing round.

In 2018, we were still calling for autonomous driving start-ups to verify their commercialization models and hone their internal strength to survive the capital winter. Has spring come so soon?

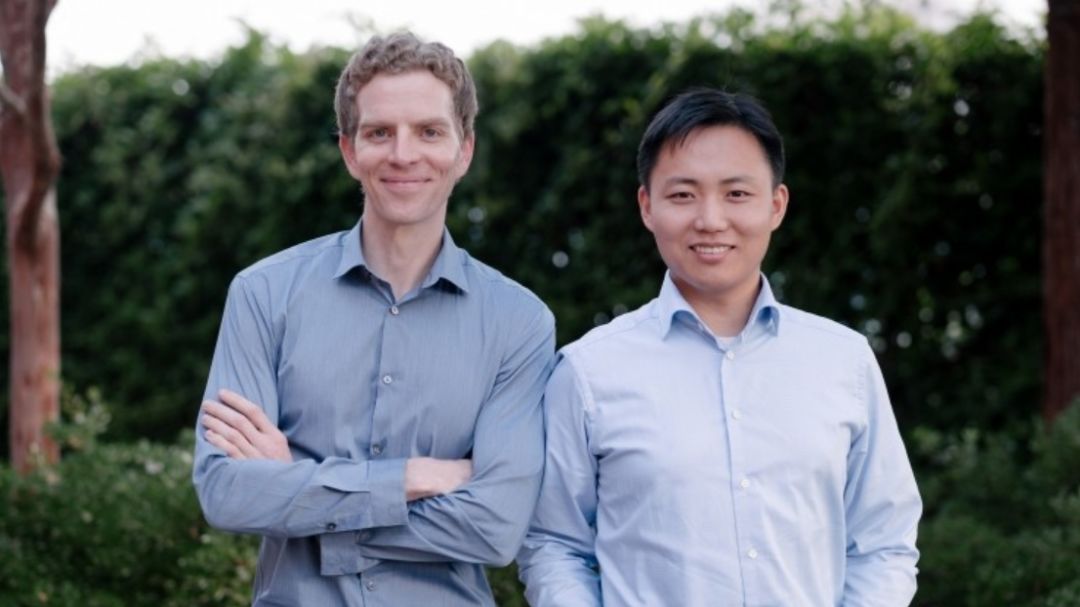

So what is Nuro all about? In August 2016, former Waymo computer vision and machine learning director Dave Ferguson and former Waymo chief software engineer Jiajun Zhu co-founded Nuro. Currently, Nuro has approximately 200 full-time and 100 part-time employees, and its team comes from Silicon Valley unmanned car giants such as Waymo, Apple, Tesla, and Uber.

In January 2018, Nuro launched an unmanned delivery vehicle with a roof equipped with a 16 or 32 line LiDAR, and the body around the car with eight or more cameras. According to Nuro, this unmanned delivery vehicle can cover scenarios such as catering, pharmacies, fresh supermarkets, and department stores.

In October 2018, Nuro announced that it would license its autonomous driving technology to truck start-up Ike, and in exchange, Nuro would obtain a share of the latter’s stock.

This is all of the information on Nuro. On February 11, 2019, Nuro announced a new financing round of $940 million investment from the SoftBank Vision Fund of Japan, with a valuation of up to $2.7 billion.

How should we view this financing? As mentioned earlier, this is the largest financing round in the autonomous driving investment sector after it was divided up among General Motors’ Cruise and Ford’s Argo.ai. What impressed the investors about Nuro?

First, the team.

Dave Ferguson and Jiajun Zhu, one of whom was the former Waymo computer vision and machine learning director and the other was one of Google’s unmanned car project founders and former chief software engineer. In addition, Nuro is located in Silicon Valley with top talent teams in autonomous driving giants such as Apple, Waymo, Uber, and Tesla, who have different technology routes.So, it’s a highly qualified team that has led to a $940 million financing?

If that’s the case, then Zoox, Drive.ai, Pony.ai, TuSimple, Plus.ai, Aurora… which one doesn’t have R&D facilities in Silicon Valley, especially Aurora, whose management team includes:

- CEO: former Waymo CTO Chris Urmson

- CTO: former Uber self-driving car perception and computer vision director Drew Bagnell

- CPO: former Tesla Autopilot Director Sterling Anderson

- Vice President of Software Engineering: former SpaceX & Tesla Vice President of Software Engineering Jinnah Hosein

The luxury of this team configuration is unparalleled in the industry, so the team is not the deciding factor, at least not the only one.

Secondly, commercialization strategy.

Despite being in Silicon Valley, Nuro did not catch Waymo’s “disease” and chose to focus on the unmanned delivery vehicle field as its first and preferred commercial direction. Since the second half of last year, companies such as Tesla and Uber, which had previously aggressively promoted the commercialization of autonomous vehicles, have made slower-than-expected progress in technology. The entire industry has become more concerned about scenarios that are easier to commercialize, such as low-speed, enclosed/semi-enclosed parks.

Nuro’s unmanned delivery vehicle has a maximum speed of no more than 40 km/h. Lower speeds can give the autonomous driving platform more decision-making and execution space in extreme road conditions. From this perspective, Nuro’s choice not to tackle the more difficult commercialization of public road autonomous vehicles is a more reasonable strategy.

However, we all know that autoX, Drive.ai have similar commercialization strategies, so it’s hard to say that doing well in this area is the decisive factor in this huge financing.

Thirdly, technical ability.

Considering the background of the founders, there is a small possibility that Nuro has first achieved the research and development of a true unmanned delivery vehicle. By “true unmanned delivery vehicle,” it means its all-weather operation reliability, perception-decision-execution full-work coverage capability, combined with lower comprehensive cost and higher efficiency over human delivery personnel.But as Chris Urmson, former CTO of Waymo, and now CEO of Aurora, said, the Waymo team that started in 2009 is incredibly strong and has an unbeatable advantage. So, what are the chances that the technology talent leaving Waymo will be able to achieve commercialization before Waymo?

To put it more transparently, a low-cost LiDAR, cameras covering the entire vehicle, a reasonably-priced computing platform, and electrically-controlled execution mechanisms can be combined to create an autonomous delivery vehicle. We are familiar with this combination of components.

Our question is, in China, companies such as Baidu Apollo, Meituan, Cainiao, and JD all have similar autonomous delivery vehicles, and the low-speed, enclosed/semi-enclosed working conditions essentially level the gap in autonomous driving technology capabilities between China and Silicon Valley.

Meanwhile, Chinese companies have better cost control, commercialization, and application innovation capabilities than Silicon Valley. In addition, mass demand for autonomous delivery in the Chinese market cannot be compared to Nuro’s partner Kroger, even though it is the largest fresh food retailer in the United States.

On the other hand, the SoftBank Vision Fund is a global investment fund. If there are better investment targets in China, why choose a more uncertain Silicon Valley company?

However, for the autonomous driving industry, where investment funding is becoming increasingly scarce, it is a good thing that Nuro is able to secure funding.

Next, let’s try to understand SoftBank’s investment logic.

As we all know, on June 1, 2018, the SoftBank Vision Fund invested $2.25 billion and acquired a 19.6% stake in General Motors’ subsidiary Cruise, valuing Cruise at $11.5 billion after the investment. What is SoftBank’s logic for investing in another autonomous driving startup just six months later?

One reasonable explanation is that General Motors + Cruise and Nuro are targeting different markets, and the two markets are relatively independent. General Motors + Cruise is targeting the robo-taxi, autonomous taxi operating market, while Nuro, as Wired describes it, is targeting the robo-delivery, autonomous delivery vehicle market. If SoftBank invests in both companies because they both have certain commercial barriers, then this investment will become even more interesting.The divergence in the field of autonomous driving is whether the algorithm of autonomous driving cars, as mentioned by XPeng Motors CEO Wu Xiaohong, can generalize in different scenarios.

We know that Tesla’s Autopilot is deployed on all sold vehicles globally. Even if the owner did not choose to purchase Autopilot at the time of purchase, Tesla continues to collect data in shadow mode to iterate and improve Autopilot algorithms. Therefore, Tesla’s idea is clearly to advance a system that understands and operates in public roads/parks/parking lots around the world under different traffic lights, regulations, and various working conditions.

However, for autonomous driving start-up companies, they will emphasize more on the differentiation and optimization of vertical scenarios, such as targeted development of automatic parking algorithms for parking lots, and even adjust sensors, infrastructure and other hardware. There is also unmanned delivery mentioned above, as well as widely discussed unmanned driving freight, port/park closed scene autonomous driving and so on. If the autonomous driving technology challenges of these scenarios are met, and commercial barriers are established, start-up company valuations will increase dramatically.

Investing in Nuro by Softbank Vision Fund can be understood as a commercial barrier that exists for unmanned delivery in Softbank’s opinion. Is it not purely a competition of technical ability? To put it more bluntly, Nuro’s progress in unmanned delivery over the past two years cannot be quickly eliminated by Waymo’s deep algorithmic capability alone. Is this true?

It is more likely that Softbank’s investment is not as complicated as imagined.

For example, in the field of travel platforms, Softbank has invested more than 20 billion US dollars in the world’s seven major travel platforms including China’s Didi, US’s Uber, India’s Ola, Southeast Asia’s Grab, Brazil’s 99Taxis, Europe’s Taxify, and Middle East’s Careem. Therefore, the PK between Didi and Uber China years ago, as well as the PK between Uber and Ola in India today, are not so important to Softbank, as Softbank is not looking for a single leader, but is willing to invest in all leading companies.

Returning to the field of autonomous driving, as mentioned earlier, General Motors + Cruise and Nuro still belong to different tracks in the short term. Even if there is competition in the future, the results are not that important to Softbank. If this is the logic, according to the several tracks in which autonomous driving commercialization is realized, Softbank will invest in a self-driving freight start-up company like TuSimple or IMa, and also in a self-parking start-up company like Yushi or Hedu.

Softbank’s requirement is to fully participate in the trillion-dollar autonomous driving industry.

How should our domestic autonomous driving start-up companies view this investment?In my opinion, SoftBank is a unique presence in the global investment field. Although they have made two large investments in the past six months, this does not necessarily mean that the capital environment for autonomous driving is warming up.

Although we have some doubts about Nuro’s financing, both Cruise and Nuro are undoubtedly the leaders among autonomous driving startups, there is no doubt about this.

The overall environment will not warm up and the capital is still accelerating towards the top, so for other startup companies, it is still the top priority to control costs and improve technology to overcome the capital winter in 2019.

Keep it up.

Stand at 2018 to See the Endgame of Autonomous Driving Industry

Apollo 3.5 + Enterprise Edition, Baidu sets business model for open ecology | CES 2019

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.