The past week has been dominated by Tesla in the automotive media headlines. On March 1, Elon Musk announced a significant price reduction across all Tesla models.

While product price cuts can have an obvious positive effect on sales, on the other hand, they can also have a negative impact on brand loyalty for existing customers. For example, on March 1, the Model X P100D was reduced by 341,100 yuan, lowering it to 848,200 yuan. If you had just bought this car on February 28 for 1.1893 million yuan, what would you think?

So, I would say that Tesla is “killing one thousand enemies as well as injuring oneself eight hundred.”

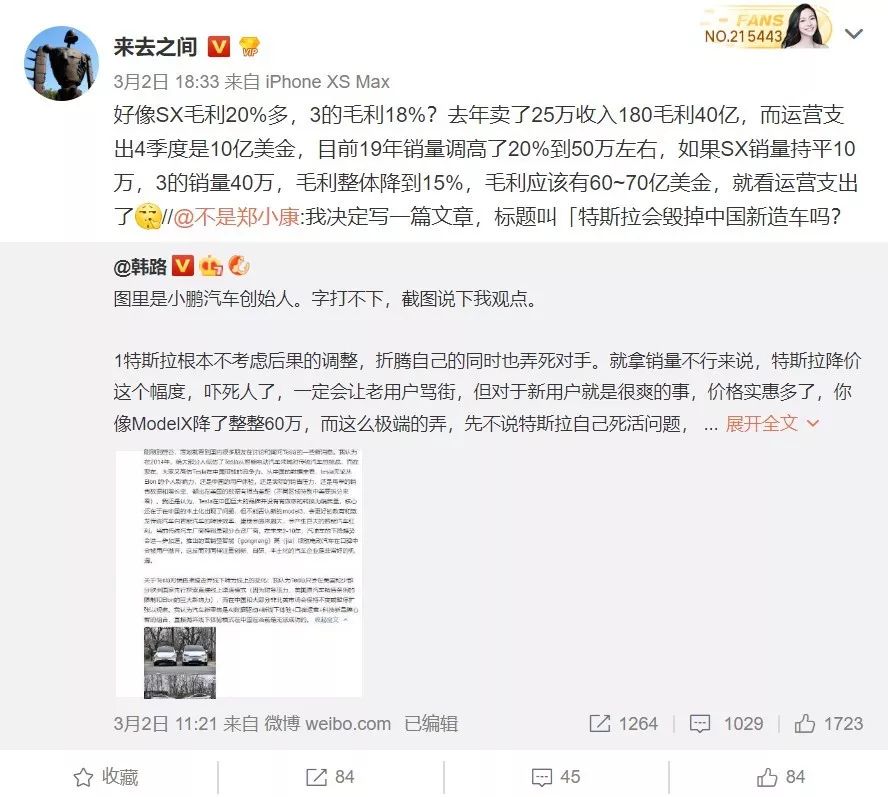

But some people are more concerned about the “killing one thousand enemies” effect. A Sina Weibo user and Tesla Model 3 fan, @来去之间, said: “This is a bit like Apple’s pricing strategy for the iPad back in the day, as long as the cash flow is positive, it’s pretty scary.”

So, what is this user saying about the “iPad pricing strategy” by Apple?

I kept scrolling until I finally found a weibo from this user on February 6th, where they also mentioned the iPad: “I’m still very curious about how the pricing strategy for the iPad was decided back then. When Steve Jobs was still alive, it wasn’t very Apple-like. They should have directly set a low to mid-range price to clear the market…”

In short, Tesla is abandoning the pursuit of an average 25%-30% high gross margin, forming a huge impact on the intelligent electric vehicle market through the iPad-style low gross profit pricing strategy + product power generating differential.

Let us briefly review the history of the iPad. On April 3, 2010, Apple released the first-generation iPad. On the first day of sale, 300,000 units were sold, and one month later, sales reached 1 million units. The lifetime sales of the first-generation iPad reached 15 million units, surpassing the sales of all other tablets combined, accounting for 75% of the sales of the entire tablet market that year.

In addition to the high-quality user experience inherited from the iPhone, another key factor in achieving this result was the low gross profit pricing strategy that went against Apple’s traditional approach.

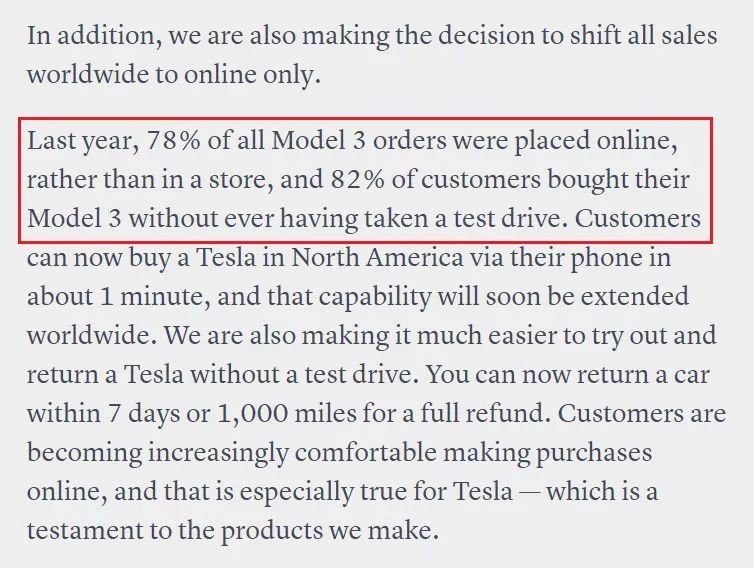

So, will the Tesla Model 3 become the iPad of the intelligent electric vehicle industry?We must acknowledge the significant challenge that Tesla China faces in maintaining an average gross profit margin of 25%, given its current pricing. Recently, Elon made significant operational adjustments, closing most of Tesla’s North American stores and retaining only those that play a branding and dissemination role, such as Galleries, Showcases, and Tesla information centers.

Through substantial reduction in store rental expenses, operational expenses, wages and salaries for product consultants, and the costs of the test drive fleet, Tesla seeks to reduce operating expenses and maintain relatively low vehicle gross profit margins, while keeping the entire company running smoothly and generating positive cash flow. Simultaneously, they aim to launch powerful product offensives against traditional automobile giants and new automakers that are progressively entering the intelligent electric vehicle market.

A rough calculation shows that this strategy is highly executable. Below is an estimate provided by a netizen:

Now, let us analyze it. Firstly, Tesla’s automotive gross profit margin in Q4 of last year was actually 24.7%, higher than the netizen’s estimate. The latest sales guidance for 2019 is between 420,000 and 600,000 vehicles. Considering that the Tesla store and sales team expenditures, which dominated the operational expenses in 2019, decreased rather than increased, it would not be difficult to record a gross profit of $6-7 billion USD, assuming the overall gross profit drops to 15%.

From Tesla’s perspective, does Elon really want to “iPadize” Tesla’s pricing strategy? And what motivates him to do so?

In Elon’s all-hands email, he mentioned that 78% of customers who ordered Model 3 in 2018 did so online, and 82% of them bought it without taking a test drive. This suggests that the offline stores that bear the conversion function from test drives to orders are of limited use. The internet brand promotion and conversion that Elon personally led have had a significant impact. Hence, for Tesla, the low-profit pricing strategy is not intended to launch price wars to pressure competitors, but rather, to make corresponding adjustments based on the organization’s overall consideration of inefficient aspects of daily operations. However, from another perspective, Tesla has invisibly put enormous pressure on its competitors.If the Tesla Shanghai factory can be put into production as scheduled with favorable policies, the combination of low-profit pricing strategy, product power that creates differentiated competition, and the reduction of localized supply chain and manufacturing costs will be able to freely dominate any traditional automaker or new car company that confronts Tesla by the end of next year, consisting of Model S/X/3/Y product lineups.

However, this conclusion requires a prerequisite, which is that Model 3 is equivalent to the status of the iPad in the market for smart electric vehicles.

Regarding this issue, another Weibo user @Hanlu also talked about the impact of Tesla’s price reduction on China’s high-end electric vehicles. (The original text is long, and you can directly read the conclusion at the end.)

Tesla adjusts without considering consequences, messing with rivals while also causing harm to itself. Just looking at the unsatisfactory sales, the extent to which Tesla lowered its prices is frightening, causing outrage among its existing customers but offering new customers a great deal with more affordable prices. For example, if Model X prices were reduced by 600K RMB, such extreme adjustments, not to mention Tesla’s own life and death issues, will definitely lead to no other option for competing products but to struggle. After the baseline version of domestically made Model 3 enters the market, its price may be around 250K-270K RMB. Accordingly, with 400 km of realistic battery life capacity, it already matches some of the high-end electric car products in China. In terms of competitive strategies, if Chinese high-end electric cars were to lower their prices, it would naturally reduce the prices of these electric cars under 200K RMB, which is a pretty scary prospect. This issue requires us to not only look at Tesla’s internal problems but also the destructive pressure that it poses on this market. The result may be that everyone believes Tesla will collapse, but instead, it is external competitors that broke down due to Tesla’s scumbag pricing.

Tesla’s marketing strategies are often arbitrary, and many are even “stupid tricks,” but they don’t matter in the face of extremely powerful product power. Their 400K RMB car can run almost 600 km, and their 500K RMB car can run for nearly 500 km with an acceleration of only over 3 seconds. Every day they’re talking about self-driving, and the highest level of domestic self-driving applications is all on Tesla. These competitive strengths are pretty scary, and crucially, the prices of these powered products have kept going down…

Furthermore, Tesla is breaking its own path, often making everyone think, “F***, how can you still have any means to make trouble after extreme adjustments like this?!” However, they simply introduce a new technological innovation or selling point that blows us away while we’re still waiting to see Tesla have trouble. Tesla has been working on this sort of thing, and their technology reserves are endless, like DJI. When everyone feels that unmanned aerial vehicles have already come to the end of their road, unable to add anything else, they come up with something even more incredible that drops our jaws….

In summary, Hanlu’s comments consist of three points.* Tesla’s price reduction will bring huge pressure to China’s high-end pure electric vehicles.

-

Tesla’s powerful product force, which has a technological gap relative to domestic electric vehicles, has dispelled negative marketing brought about by confusing marketing strategies in the market.

-

Tesla’s technological reserve is deep and bottomless.

The netizen @来去之间’s point of view is based on the position of Tesla Model 3 in the same level market, which is equivalent to the position of iPad in the tablet market.

The reserve of technology and commercialized technological capabilities largely determine Tesla’s product force, so let’s talk backwards.

The first point is that Tesla’s technological reserve is deep and bottomless. This statement is somewhat exaggerated, but it must be acknowledged that Tesla’s investment in forward-looking basic technologies such as electrochemistry, automatic driving perception/decision-making/execution, and factory automation is far greater than any domestic automobile manufacturer.

Taking batteries as an example, on January 4, 2017, Tesla officially produced the 2170 battery based on the NCM 811 formula. In Q1 2018, Tesla announced that the battery formula ratio was significantly lower than 811.

As a comparison, the first batch of models equipped with Ningde Times NCM 811 batteries, NIO ES6 and GAC Aion S, will begin delivery in June 2019.

The gap seems to be narrowing. However, on February 5, 2019, Tesla announced the acquisition of Maxwell for $218 million, opening a new round of competition for the next generation of electric drive powertrain.

It should be pointed out that Tesla established an electrochemistry team in 2006. This long-term, large-scale investment in basic technology has created a technological gap in Tesla relative to other products.

We have repeatedly mentioned Tesla’s technological gap before. It is well known that the acceleration of Model 3 is 3.5 seconds per 100 kilometers, while Porsche’s competing product Taycan, which benchmarks Model S, is also 3.5 seconds.

This is not the point. The point is that Tesla will push a vehicle OTA update for the entire Model 3 series, and the peak output power of the updated Model 3 series will increase by 5%. In addition, Elon announced today that Tesla’s third-generation supercharging station will be put into operation, and the peak charging power of Model 3 will be increased from the current 120 kW to 200 kW. It takes only 15 minutes to charge from 20% to 80%.

This means that even though it has already been delivered, Tesla still leaves enough performance redundancy for Model 3, making it easier to catch up with competitors through improvement and update.

Model 3’s powerful product force largely covers up the negative impact of marketing strategies confusion in the market. If it were any Chinese new car company, it would not receive such a tolerant reserved user base.

The third point is the pressure that Tesla’s price reduction has brought to China’s high-end electric vehicles.# Model 3 is taking the market by storm, and the biggest impact is on domestic smart EVs priced between 200,000 to 400,000 yuan, such as NIO ES6, Tang EV600, and Roewe Marvel X.

Today, before the above mentioned domestic models have been extensively delivered, Tesla is fiercely acquiring users in the same segment with highly competitive products that break through more and more psychological expectations and continuously drop prices.

As the first smart EVs from traditional automakers and new EV startups are being launched one after another, the new generation of Model S/X is also about to debut. This is a long and brutal competition.

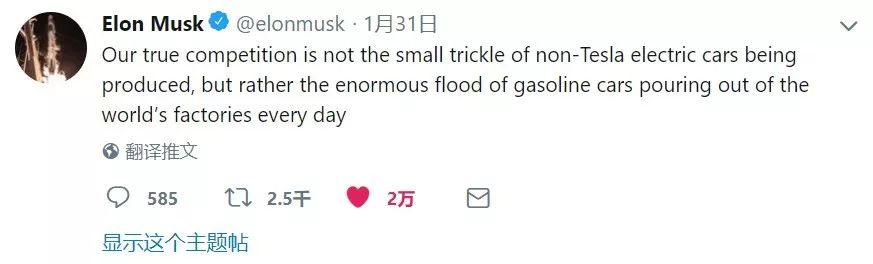

On January 31st, Elon tweeted the following:

Tesla’s true competitors are not tiny, non-Tesla electric car producers, but those gasoline car factories that produce cars every day all over the world.

But as Weibo user @李想 said, Tesla has already stormed into our backyard. Good luck to everyone.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.