Author: Zhu Yulong

The data analysis of the 2022 automotive market has already begun, and Yanyan and I are polishing the script. Today, let’s share some separate analysis about Shenzhen.

-

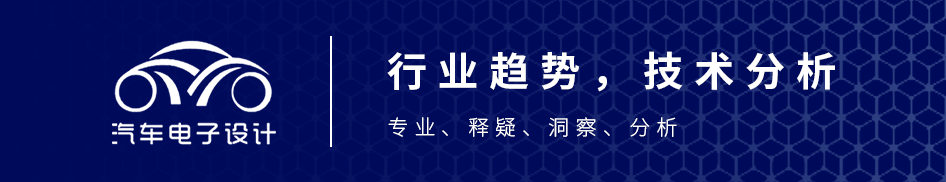

The overall insured vehicles in Shenzhen in August 2022 were 42,802, a YoY increase of 4.5%. The accumulative number of insured vehicles from January to August was 286,527;

-

The insured new energy vehicles in August were 19,909, and the accumulative number from January to August was 125,148. Currently, the penetration rate of new energy vehicles in Shenzhen is around 43%;

-

From the perspective of total amount, Shenzhen’s goal is to reach a total number of around 1 million new energy vehicles by 2025, and the total number was 514,300 by the end of 2021. With 8 months passed, it has already reached 640,000. This is inseparable from the promotion of independent subsidies (by the end of 2022).

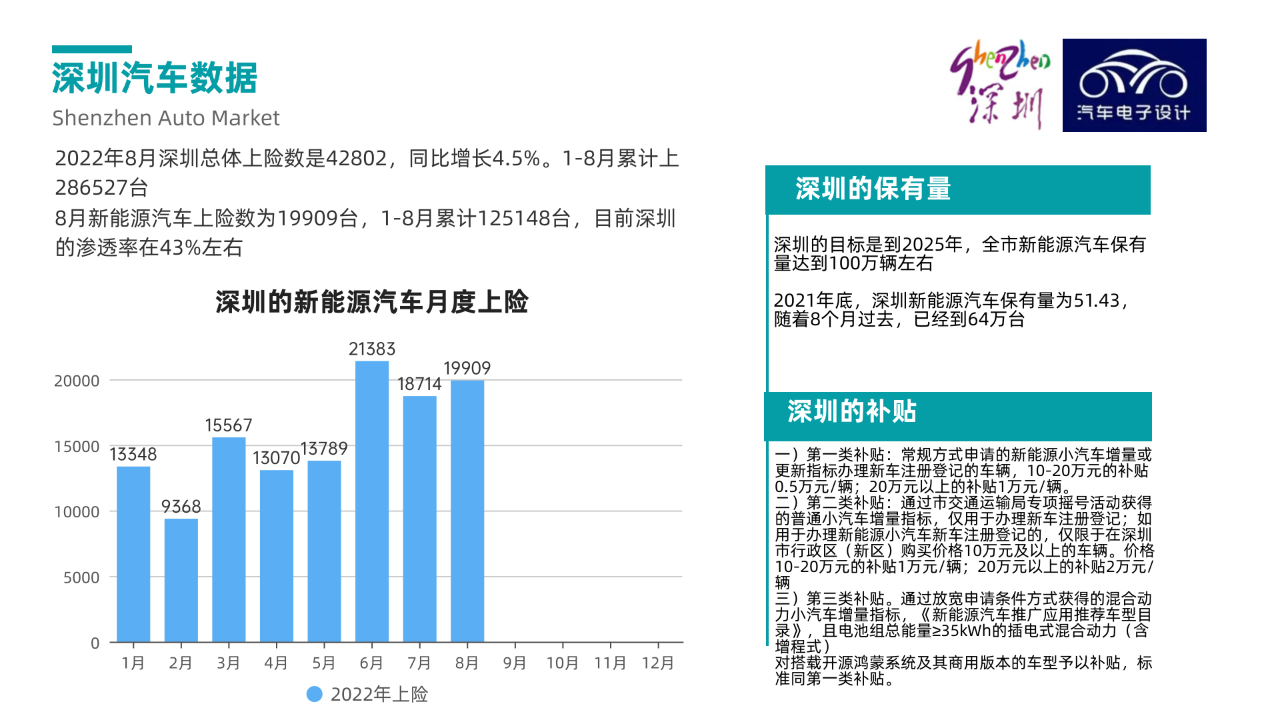

Vehicle Classification in Shenzhen’s Sales Volume

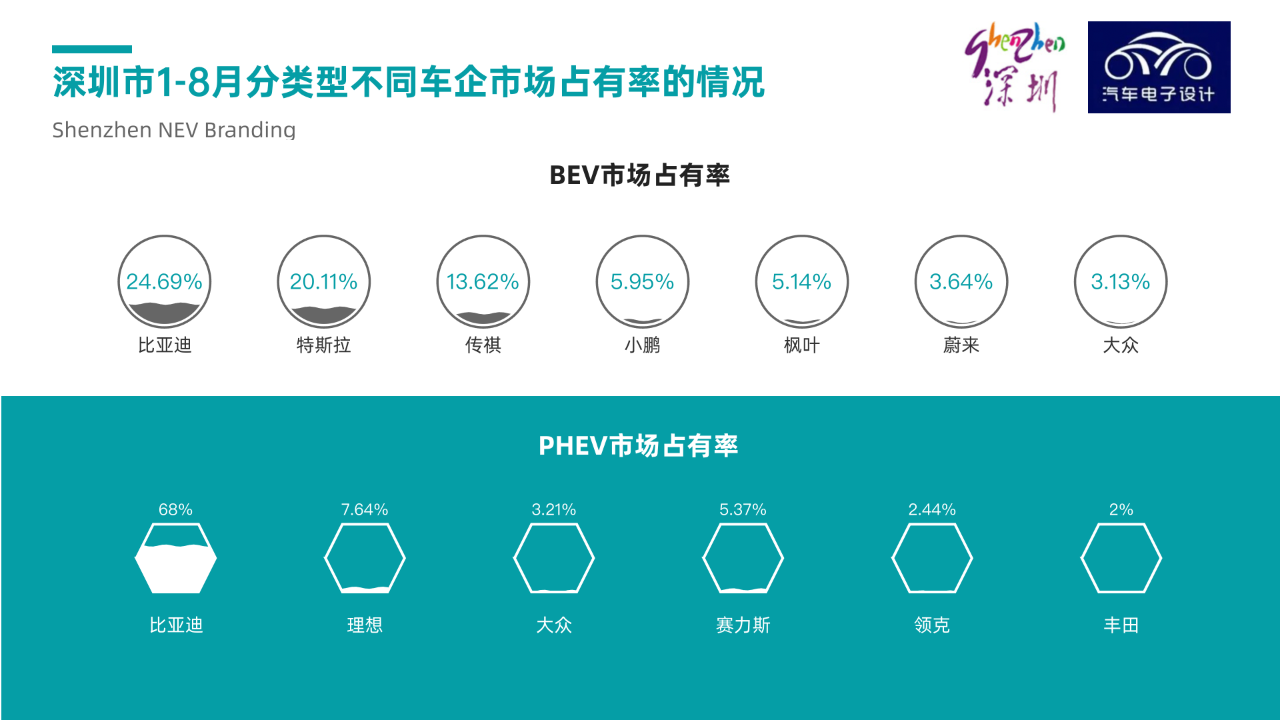

In Shenzhen’s market, the main focus is on SUVs, A-class cars, and C-class cars, with decent promotion of MPVs. From the perspective of classification, the supply of PHEVs and BEVs is relatively close, so the sales volumes of BEVs and PHEVs in Shenzhen are quite similar.

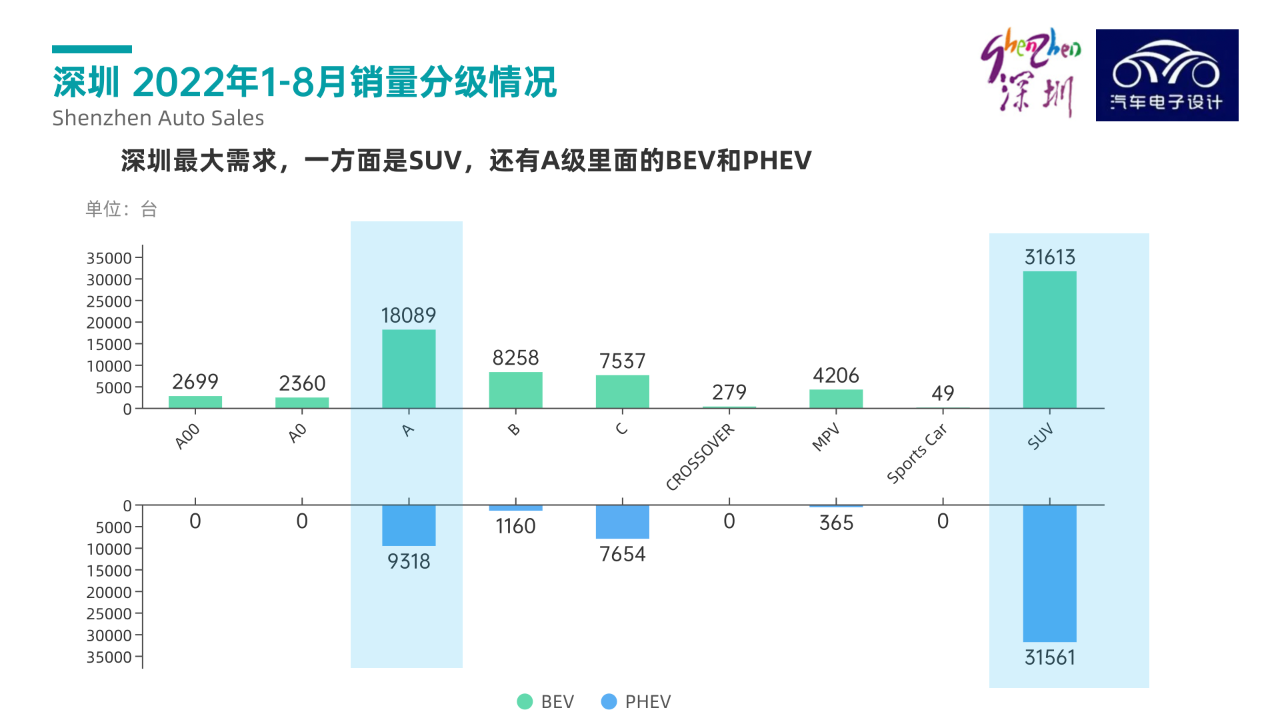

From January to August in 2022, there were 75,000 pure electric vehicles and 50,000 plug-in hybrid electric vehicles. Looking at the supply chain ratio, it seems that Shenzhen’s recent demand has been centered around PHEVs.

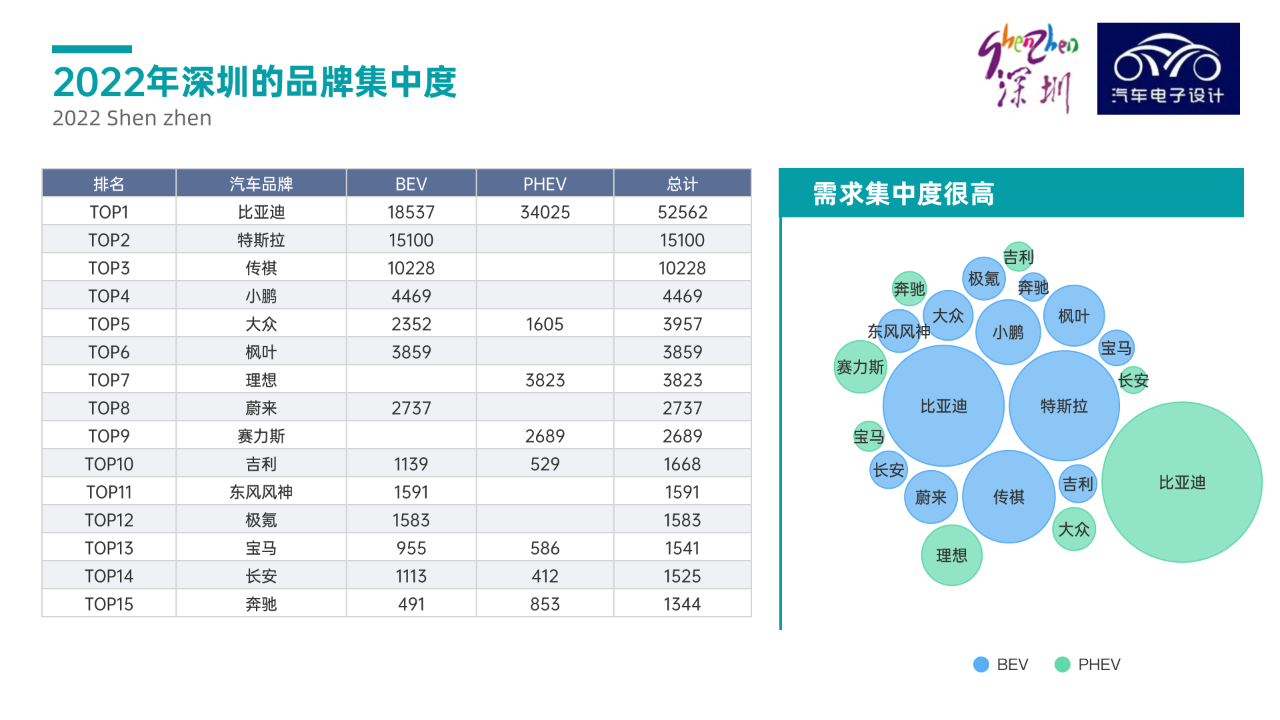

In terms of brands, BYD is the only one leading in BEVs, slightly ahead of Tesla, but is far ahead in the PHEV segment.

This year, BYD has a huge advantage in Shenzhen, mainly because its DM-i model currently needs some time for competitors to catch up. In terms of the cost-effectiveness of BEVs, it has been recognized in various regions compared to its competitors.

This year, BYD has a huge advantage in Shenzhen, mainly because its DM-i model currently needs some time for competitors to catch up. In terms of the cost-effectiveness of BEVs, it has been recognized in various regions compared to its competitors.

Analysis of Consumer Preferences by Specific Model

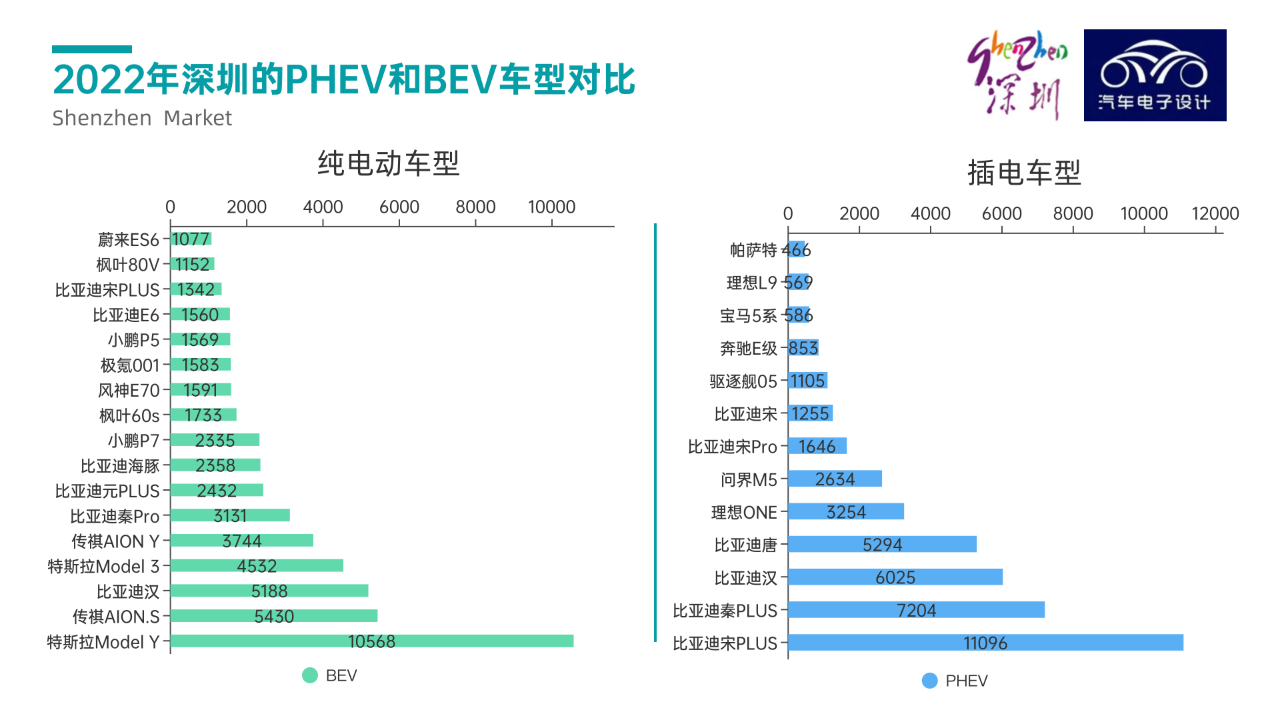

1. Pure Electric

Among pure electric vehicles, the most popular is the Model Y, whose advantages are very obvious. The second most popular model in Shenzhen is the Aion S, which is somewhat surprising, and the third is the Han EV, surpassing the Model 3. BYD’s pure electric vehicle models are relatively scattered, and have not caused a focused trend among Shenzhen consumers.

2. Plug-in Hybrid

Currently, the top-ranked models are almost all from BYD, including the Song Plus, Qin Plus, Han DM-i, and Tang DM-i. Other plug-in hybrid models that can compete with BYD in Shenzhen are mainly two models from Li Xiang and the Wanjie M5.

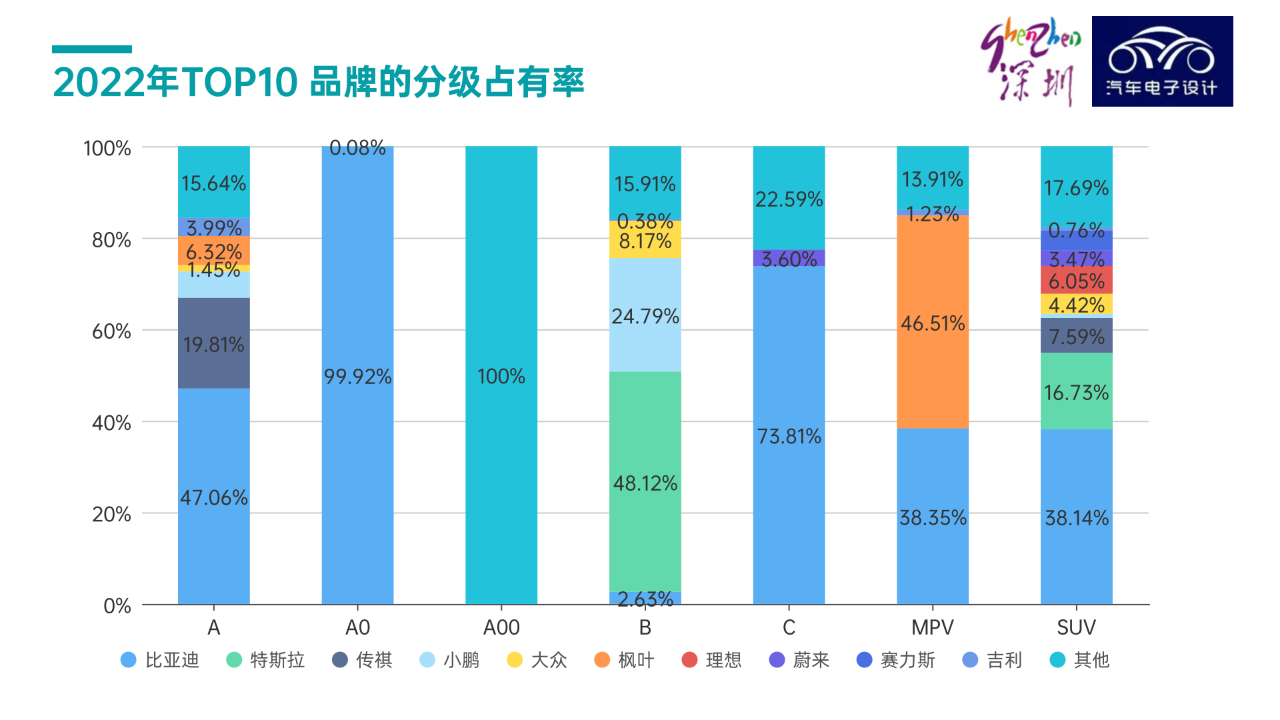

Particularly eye-catching is the A0 level, where BYD almost monopolizes the entire market. It accounts for more than one-third of the market in the A-level, C-level, and SUV segments.

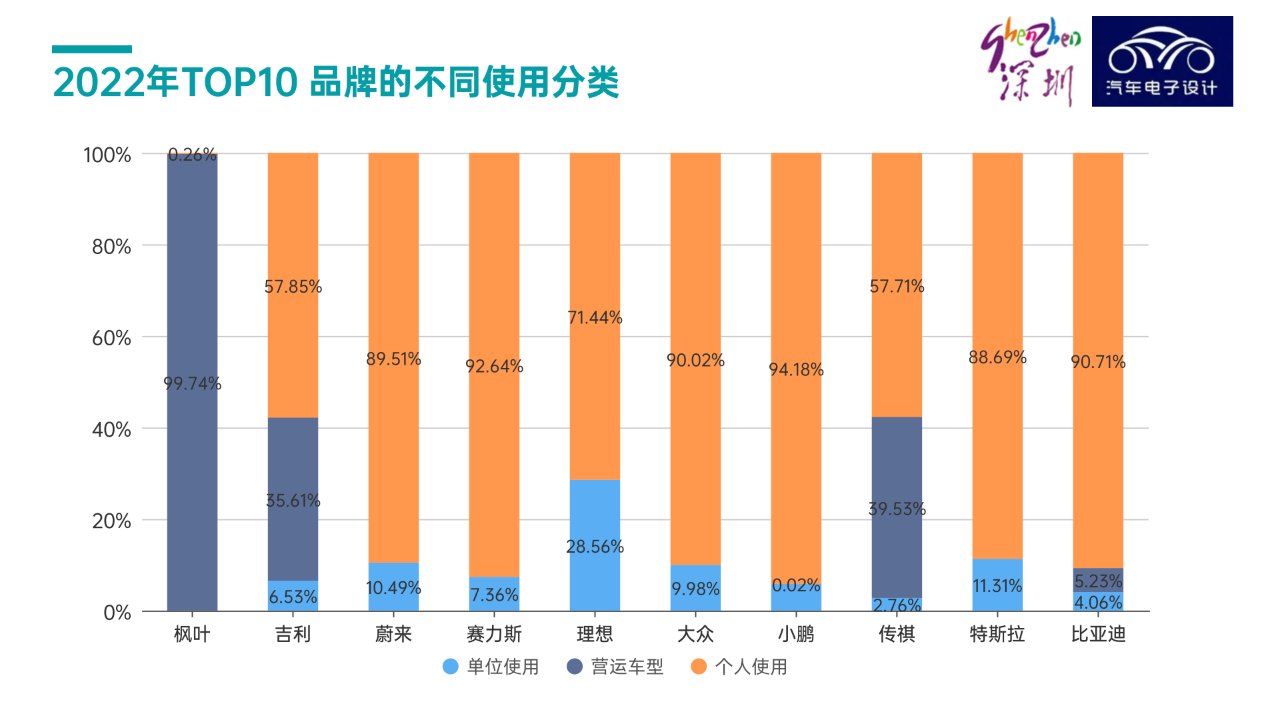

Additional Data on Operations and Unit Proportions (Figure 8)

Maple Leaf from Geely is almost entirely for operational purposes, while Geometry and AIWAYS have proportionately less operational usage in Shenzhen.

Analysis by Driving Range

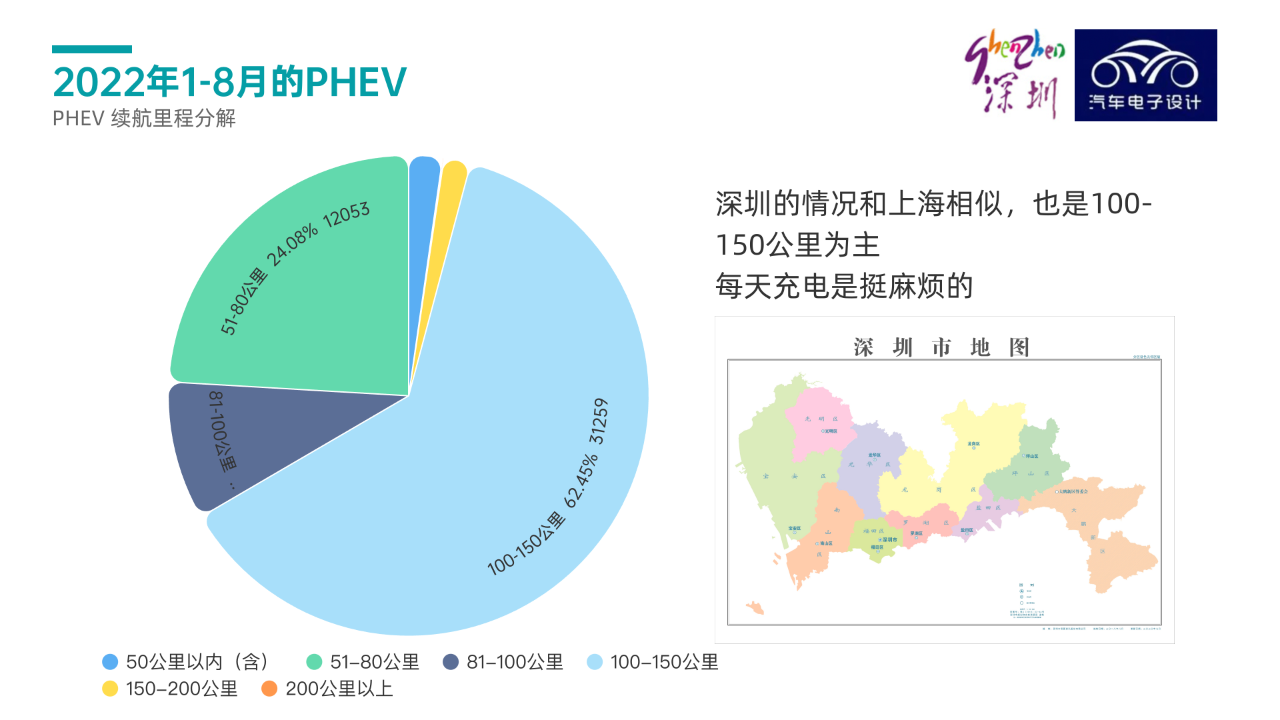

1) For PHEVs, Shenzhen is similar to Shanghai, with a market share of 100-150 kilometers for driving range being the largest.This is a balanced result: Consumers are unwilling to keep charging their vehicles; however, for automakers, larger batteries mean more complexity in vehicle layout.

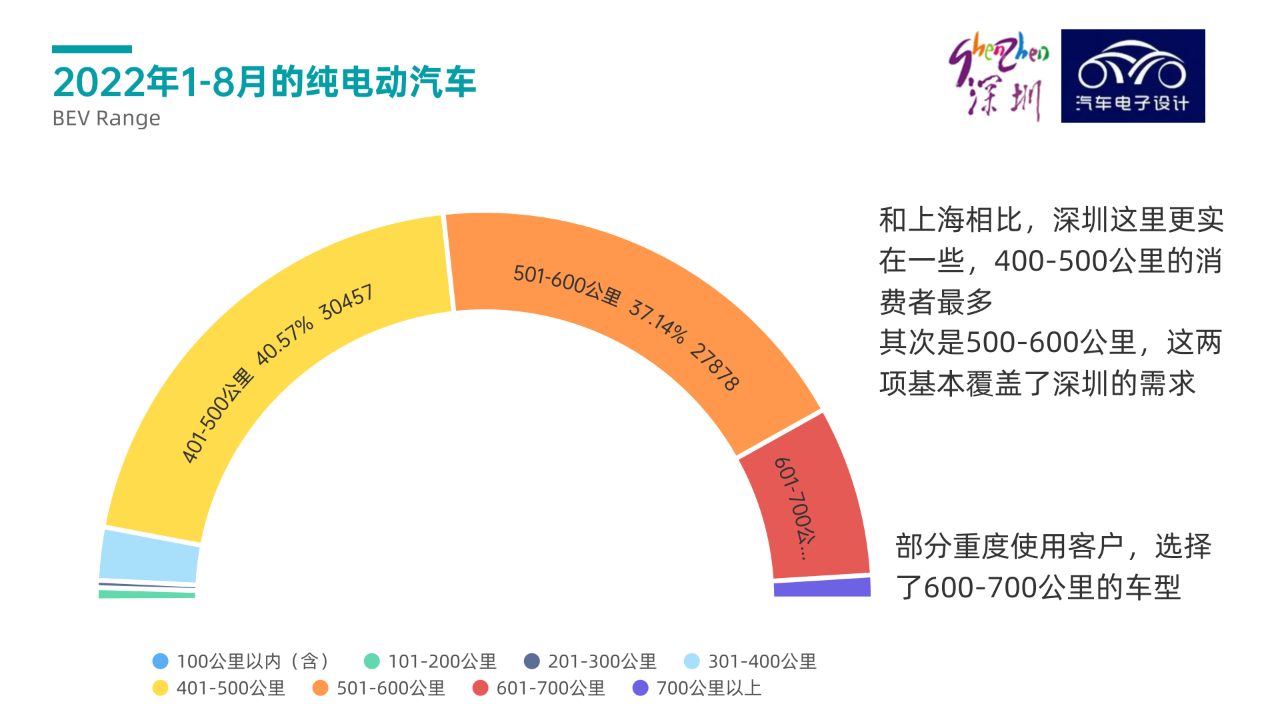

2) As for pure electric vehicle range, due to the climate in Shenzhen, most consumers choose models with a range of 400-500 kilometers, followed by those with a range of 500-600 kilometers – the two categories combined account for over 80% of choices.

This may also reflect the demand for range among mainstream Chinese consumers – demand is not as strong for ranges over 600 kilometers.

Summary: I plan to analyze the situations in these regions separately, and then produce a comprehensive video and discuss it together with everyone.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.