In 2019, the automobile industry remains turbulent. Tesla has undergone a series of adjustments due to market demand, cost control, and cash flow chain issues; Chinese new car companies face challenges such as financing difficulties, subsidy reductions, and inconsistent product quality. As for the large companies dominating the global automobile market, they have joined forces to compete against the world’s top luxury brands Mercedes-Benz and BMW after decades of rivalry.

On February 22, 2019, Daimler and BMW announced the establishment of a joint mobility service alliance. It is apparent that Mercedes-Benz and BMW attach great importance to this cooperation, as evidenced by the introduction of the historic partnership on both companies’ official websites that day.

BMW’s official website even live-streamed the press conference attended by BMW Board Chairman, Harald Krüger, and Daimler Board Chairman, Dr. Dieter Zetsche.

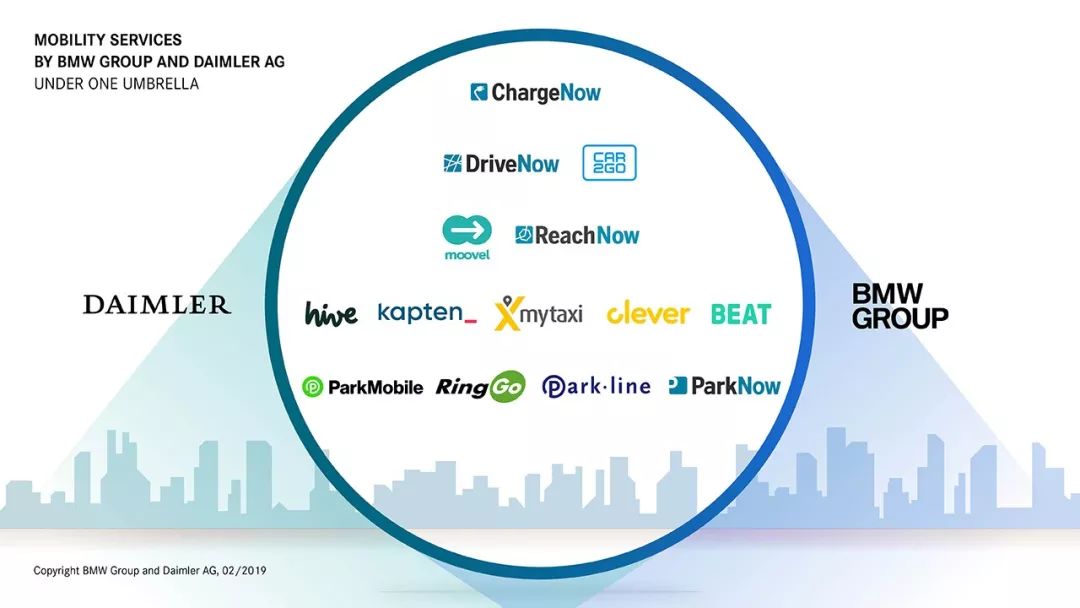

First, the details of the cooperation are provided. Mercedes-Benz and BMW will bring out their respective businesses related to mobility services and merge them into five companies, with each holding 50% of the shares in the joint ventures.

Reach Now: An online travel service platform that provides various modes of transportation from point A to point with services including car-sharing, ride-hailing, and bike-sharing. It can be understood as the “Mercedes-Benz and BMW version of Didi.”

Charge Now: An electric vehicle charging platform, operated and supported by Digital Charging Solutions GmbH (DCS), a German enterprise that has more than 100,000 charging stations in 25 countries/regions. It can be understood as the “Mercedes-Benz and BMW version of a supercharging network.”

Park Now: An online parking service platform that allows users to reserve parking spaces, manage parking time, and pay parking fees without cash. It serves 30 million customers in 1,100 cities worldwide.Free Now: Online mobility service platform that provides taxi, ride-hailing, car rental, and electric scooter services. It is the largest mobility platform in Europe and Latin America, serving 21 million users and 250,000 drivers.

Share Now: Car-sharing platform that operates in 31 cities around the world, with 200 million vehicles and 4 million users.

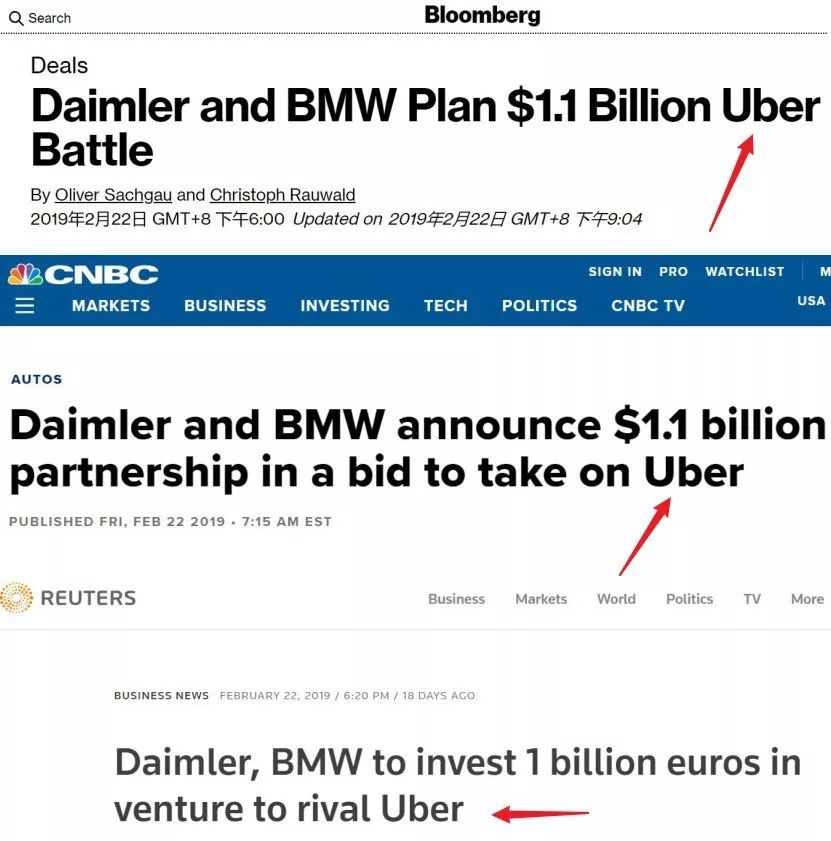

Many financial media, such as Bloomberg, CNBC, and Reuters, have pointed the BMW-Daimler Alliance as traditional OEMs’ challenge to Uber. Is this really the case?

Let’s take a look at the BMW-Daimler Alliance, which will jointly invest €1 billion (or $1.1 billion USD). Daimler CEO Dieter Zetsche said that this alliance will be a “global game changer.” But let’s not compare it to the industry giants, such as Didi, Lyft, Ola, and Grab. Let’s first compare it to Uber, which is a true global player.

In its 10 years of existence, Uber has raised $24.2 billion, operating in over 600 cities in 65 countries, serving 100 million monthly active users and has over 3 million drivers. It records more than 15 million daily trips, with a cumulative total of over 10 billion trips.

Can the BMW-Daimler Alliance, with investment of $1.1 billion and 60 million cumulative users, challenge Uber? It has no chance. However, the BMW-Daimler Alliance has some advantages that Uber cannot provide, such as Park Now, an online parking service, and Charge Now, part of a pure electric vehicle service system.

Instead of interpreting the BMW-Daimler Alliance as a challenge to Uber, it is better to see it as a card to resist Tesla and NIO. This is a user-centric mobile travel ecology service that covers charging, parking, ride-hailing, and car-sharing in the age of autonomous driving.

Have we seen similar ecosystems before? Tesla Supercharging network + Tesla Mobile Service + Tesla Network; NIO Power energy system (battery swapping + fast charging) + NIO Service system + Valet + …

# The Time-sharing Rental Platform and Ride-hailing Platform of Mercedes-Benz and BMW Alliance: A Strategic Alliance to Adapt to the Development Trend of the Industry

# The Time-sharing Rental Platform and Ride-hailing Platform of Mercedes-Benz and BMW Alliance: A Strategic Alliance to Adapt to the Development Trend of the Industry

Is the time-sharing rental platform and ride-hailing platform of Mercedes-Benz and BMW alliance aimed at NIO and Tesla or Uber and Didi? To answer this question, we should see that as the world’s top luxury brands, Mercedes-Benz and BMW are deeply aware that intelligence and sharing will become the most critical development trends in the next decade.

Intelligence reflected in the user experience layer is to complete the full life-cycle of car use more conveniently through a smartphone, such as charging and parking, while sharing is the one-stop travel platform mentioned above, including time-sharing rental, ride-hailing, electric scooters, etc.

Therefore, I think that this is a strategic alliance of two luxury companies catering to the future development trend of the industry. How should we evaluate this cooperation?

To be honest, I am not optimistic.

Firstly, the above alliance established five independent companies managed by five specialized CEOs and CFOs respectively. And we can see that the businesses of Reach Now and Free Now overlap with each other. Since they have decided to integrate and set up five independent companies to promote cross-sectional businesses, it is difficult to say what benefits it will bring to the development of the business itself.

Secondly, from the user’s perspective, let’s look at the models of Tesla and NIO. For consumers, the biggest feature of Tesla and NIO compared to BBA is that they have fully unified user interfaces (especially NIO).

If we buy a BBA model, we need to interact with different stores or companies for purchasing, insurance, refueling, maintenance, repair, and parking respectively. But for Tesla, the user interface for purchasing, insurance, charging, maintenance, and repair is unified, which means that users can just turn to Tesla whenever they have issues.

NIO is even more exaggerated. NIO President Li Hongqing said: “Apart from traffic police fines, we hope users can come to NIO for any problems.”

From the user’s perspective, such a user experience is a closed-loop, highly unified, and high-quality experience. However, from the perspective of the car manufacturer, as manufacturing a car already requires abilities in design, R&D, manufacturing, project management, supply chains, marketing, and sales, the full life-cycle of the user experience would greatly increase the complexity of a car manufacturer’s operation, which is a considerable challenge for traditional car companies like Mercedes-Benz and BMW.

Perhaps to reduce complexity, Mercedes-Benz and BMW chose to split their businesses and managed them by five independent companies. But this also means that the user experience is no longer unified for consumers.For example, if Tesla and NIO users encounter any problems, they can be resolved through their App, but for BMW and Mercedes-Benz, these five independent companies may need to download 5 different Apps to provide a complete experience, which is undoubtedly a bad user experience.

Moreover, separating the companies has significantly reduced the complexity of corporate management, but in terms of decision-making and execution efficiency, it is clearly not as good as small companies like Tesla and NIO, who integrate super complex business with highly flat management architecture.

Finally, there is the investment issue mentioned earlier. As a listed company, shareholders cannot accept BMW’s and Mercedes-Benz’s long-term large-scale loss operations in future-looking businesses, but Tesla and NIO can achieve larger business scale and economies of scale by continuously issuing bond financing.

For example, after years of continuous investment, Tesla’s supercharging station network has become a key component of Tesla’s user experience and competitive advantage.

Now let’s discuss a question: Unified user interface and providing a closed-loop high-quality user experience seems to have little connection with intelligence and sharing. So, besides being more financing-friendly, why can NIO and Tesla do better than traditional car companies?

These are companies established in two different eras and with completely different genes. New carmakers are often ridiculed for being Internet automakers, and Tesla is considered to be the pioneer in this field. So, what is “Internet car making”?

The core competitiveness of real Internet car making is not about releasing PowerPoint, delivering cars before completing testing, having lower reliability and higher failure rates than traditional automakers. Instead, it is about introducing advanced Internet methodologies into the traditional automotive industry.

For example, “customer-centric” approach: how to solve the problems that customers encounter? Develop an App to operate the car owner forum, create a communication channel between the car company and its customers, collect feedback and complaints, and this is the premise for improvement. Significantly flatten the company’s management architecture to improve problem-solving efficiency and execution. At the product end, promote intelligentisation with OTA at the core, providing convenience for further improving efficiency in problem-solving and pushing new features to enhance product competitiveness.

These strategies have inherent executable degrees in “Internet car making” companies, but in traditional carmakers, these strategies will without exception encounter serious resistance and rejection, which are closely related to their large team size, good profitability and lack of Internet thinking.At the end of the introduction of the new alliance blog, Dr. Dieter Zetsche, Chairman of the Board of Management of Daimler, said, “Will the positive competition between Stuttgart (Daimler headquarters) and Munich (BMW headquarters) become a thing of the past? No, competition is the key factor that motivates us to achieve the best performance in our core business. Our drive remains the same: we are both determined to create the world’s best cars.”

What I want to say is that good luck to Mercedes-Benz and BMW, but the competition in the next 10 years will be different from the past 30 years. If we don’t realize the significance of the internet methodology and make radical reforms to the company’s management structure to adapt to the needs of consumers in the new era, even the merger may only face being eliminated by the times.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.