Exclusive author | Zhu Yulong

Editor | Zhu Shiyun

In 2022, there has been a great transformation in China’s electric vehicle industry, and the domestic passenger car penetration rate with L2 level advanced driving assistance system is close to one third. As intelligent vehicles continue to evolve in their electronic and electrical architecture, there is a need for highly coordinated development of internal software and hardware in terms of communication bandwidth, computing power, storage capacity, perception ability, and data networking.

In intelligent vehicles, the new high-performance SOC chip plays a key role in bridging software and hardware, while the importance of cloud-based high-performance server chips that support edge computing is also highly valued.

However, in August of this year, U.S. President Biden signed the “2022 Chip and Science Act”, which has set off a series of actions focused on chip technology. Subsequently, the U.S. is further restricting exports of high-end GPUs and artificial intelligence (AI) chips to China; Nvidia has stopped exporting two advanced AI chips, A100 and H100, to China due to the impact from the U.S., and these two chips can accelerate machine learning tasks.

The US’s actions will not only hinder the development of China’s cloud computing and AI industries, but will also have a direct impact on the intelligent automotive industry. Against this backdrop, how can China’s chip industry ensure safety, autonomy, and control in the next generation of intelligent connected vehicles? How can effective mechanisms be established to promote independent innovation of automotive chips? How can we avoid “neck-and-neck” problems? How can we build an open and innovative ecosystem for China’s intelligent automotive industry?

How important are automotive chips?

As traditional automakers transition towards intelligence, automotive technology is being reassembled on a global scale. The focus has moved beyond the previous focus on the development of the “three electric” systems, and are now putting more emphasis on software and chips.

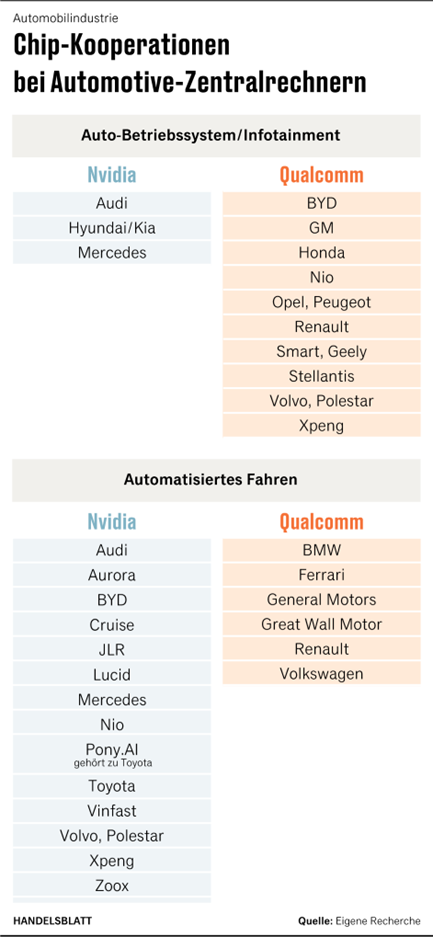

Companies such as Volkswagen, General Motors, and Toyota are starting to choose strategic chip partners, operating system ecosystems, and software strategies. For example, Cariad, a software subsidiary of Volkswagen, hopes to develop chips in collaboration with its partners, in addition to software development.

Intelligent vehicles require more powerful and standardized SOC chips and central computing platforms for autonomous driving, infotainment, and continuous updates.

Collaborative design between automakers and semiconductor manufacturers will jointly determine which systems are most effective on an equal basis.

In the long run, from 2021 to 2027, automotive semiconductors will maintain an annual healthy growth rate of 7%, and by 2030, it is estimated that nearly 50% of automotive manufacturing costs will be related to electronic products, driven by the continuous improvement of vehicle electrification and autonomous driving levels.A single electric car currently requires about 3000 chips, which increases the cost by about 400-600 dollars compared to traditional cars.

According to relevant data, with the development of electrification and intelligence, it may require 3000 dollars’ worth of automotive semiconductors by 2030.

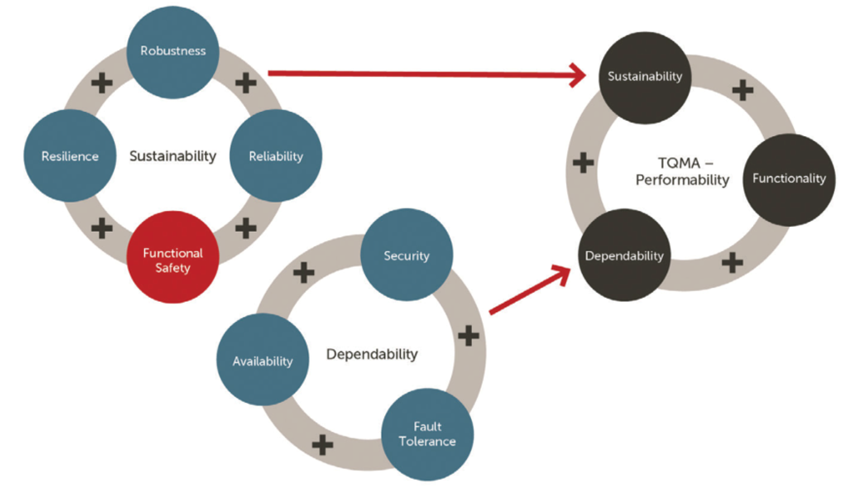

The automotive industry attaches great importance to the quality and performance of automotive chips, as they have a high value and a direct impact on the characteristics of cars. In particular, the sustainability of electronic systems is critical, including reliability, resilience, functional safety, and cybersecurity.

For automotive companies, functional safety is paramount, protecting drivers from the unforeseen consequences of system failures, far beyond the typical standards of testing, software simulation, and electronic modeling. The electrical testing coverage of SoC chips will reach 99.4%, and 0.6% of the billions of transistors remain untested.

Automotive companies delve deeper into their supply chains to identify and eliminate the root causes of potential hazards, some of which may arise during semiconductor manufacturing.

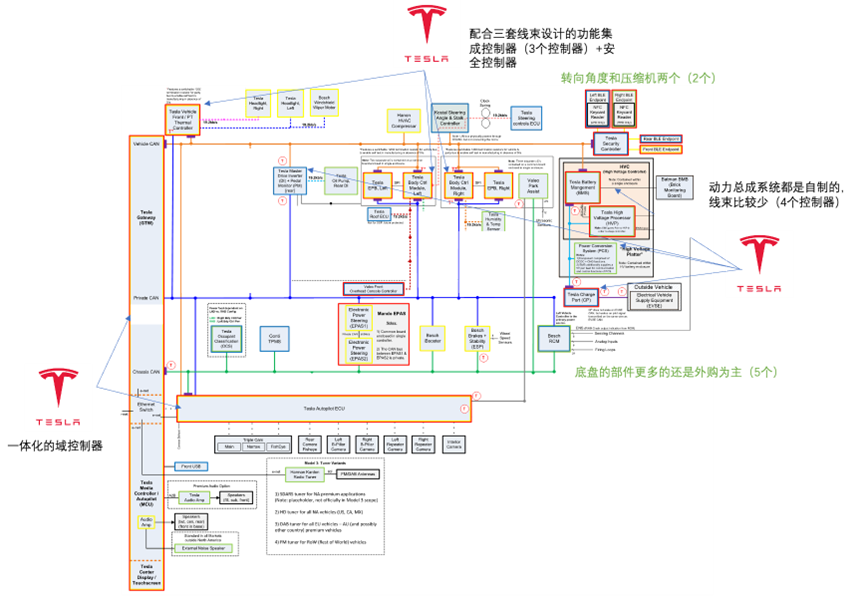

Tesla’s main logic for the transformation of automotive electronics revolves around the reconstruction of various automotive electronic modules. They even step-by-step choose their trusted chip suppliers for TPMS, Bluetooth keys, and more, then hand them over to third-party EMS companies for processing. In other words, in Tesla’s automotive electronics, most of the major chip suppliers are penetrated except for the BOM list of limited suppliers.

In Tesla’s new factory, they manufacture subsystems as complete units and enable rapid overall manufacturing. Not only in software but also in the digitalization and chip selection of the entire new generation of smart electric vehicles, Tesla has gone very far, with a strong grasp of control, design, and coordination of chip companies in all aspects.

Key Companies: Qualcomm and NVIDIA

For Chinese automotive companies, they are currently heavily reliant on Qualcomm and NVIDIA.

1) QualcommThe basic points of Qualcomm’s automotive business in 2021 revolve around vehicle network chips and digital cockpits. The digital cockpit SoC integrates CPUs, NPUs, GPUs, DPUs, and various peripherals, mainly responsible for data calculation and processing in the information entertainment system, including camera video, NPU for neural networks, audio processing, voice, and image rendering and output of multiple displays (GPUs, DPUs), Bluetooth WiFi interconnection in the car, and Ethernet data interaction of other major ECUs in the car.

In terms of the cockpit field, the turning point is the Snapdragon SA8155 series, which brings great computing power (100k DIMPS, GPU 1100 GFLOPS) with 7nm process, forming a very large differentiation in computing power compared to traditional car manufacturers (Renesas, NXP, TI), and exploding the intelligent cockpit market of car companies through mobile technology migration. At this time, a large number of car companies in China began to import this SOC chip.

Currently, Qualcomm iterates very quickly. The fourth generation uses cross-domain fusion design and is built with 5nm process technology. The SA8295 CPU has a computing power exceeding 200K DMIPS, GPU computing power exceeding 3000 GFLOPS, and supports WiFi 6 and Bluetooth 5.2. The AI computing power of the NPU reaches 30 Tops. It also adds information security, visual processing accelerators, visual perception processing and fusion of ISPs.

In terms of intelligent driving, Qualcomm’s Snapdragon Ride Vision System supports multiple cameras (high-resolution 8 MP cameras), and the SoC processor uses 4nm process, which includes visual AI processors, general data CPUs, visual accelerators for map crowdsourcing, ISPs and vehicle safety-related processors.

The intelligent driving platform includes three core processors, with the vision SoC used to process information from cameras, the ADAS Soc series supporting up to L1-L3 automatic assisted driving, and an additional accelerator chip required for L3/L4 autonomous driving.

2) NVIDIANVIDIA’s automotive business is also crucial for Chinese car companies. Since 2015, NVIDIA has launched multiple autonomous driving platforms, such as the DRIVE CX and DRIVE PX for the cockpit and the driver, followed by DRIVE PX2, Drive PX Xavier, DRIVE PX Pegasus, and DRIVE AGX Orin. In terms of SoC chips, NVIDIA has developed from Parker, Xavier, Orin to Atlan. However, there have been some setbacks during this process. Tesla was the first to use NVIDIA’s platform but was also the first to abandon it. They confirmed that for a car company committed to advanced autonomous driving (L4 or above) at a large scale (over one million units), vertical integration attempts in computing platforms are necessary. Looking at the timeline:

- Tesla was the first to use the platform but also the first to abandon it, and they confirmed the necessity of vertical integration attempts in computing platforms.

- The first group of Chinese new car companies, from XPeng Motors, to NIO, and Li Auto, quickly caught up with Tesla’s L3 automated driving experience on China’s road environment, which became NVIDIA Orin’s first batch of clients by 2022.

- With the confirmation of the Chinese new car companies’ direction, many traditional car companies, such as SAIC and BYD, believed that Orin was a good choice for them.

- Foreign traditional car companies, such as Mercedes in 2024, Jaguar in 2025, and Volvo’s subsequent 2025 models, typically require more detailed and thorough testing, so their demand comes at a later stage.

In addition to the full-stack capabilities offered by NVIDIA, the entire autonomous driving system for Chinese cars is built on top of this foundation.

So, what about China?

The issue of automotive SoCs is somewhat similar to that of smartphone SoCs. Chip makers are shifting from the proprietary IP core, IDM model, and software-sealed mode of the past to an open model. For instance, smartphone chip companies like Qualcomm rely on the open ARM IP core, paired with open toolchains and software systems. This openness can give enterprises more development privileges.

The cost of developing a SoC chip for cars comes from hardware and design costs. The former includes wafer, mask, packaging, and testing, while the latter includes EDA tools, IP authorization, architecture, etc.According to Semi engineering, a third-party semiconductor research institution, the development cost for 28-nanometer technology is 51.3 million dollars, 100 million dollars for 16-nanometer technology, and the cost for 5-nanometer technology may need to double again without advanced manufacturing processes being implemented.

Similarly, the chips in automotive SOCs also require expensive technology. Therefore, the challenge of automotive SOCs is greater because the investment does not seem to be cost-effective in terms of output.

Currently, China’s intelligent automotive chips rely heavily on the United States’ expertise in intelligent chips, which is closely related to the entire electronic industry and cannot be changed by a single automotive industry. What we can do is to consolidate our strengths and consider the entire chip process.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.