Author: Zhu Yulong

Let’s talk about Tesla’s “price game” in China today.

In the eyes of the entire traditional automotive industry, Tesla’s price adjustments are really a mysterious operation. A series of price increases and decreases not only affect old car owners, but also have a deep impact on the second-hand car market and some scalpers.

First, let’s review Tesla’s price operations and analyze the impact of costs through these operations. Finally, let’s predict what operations Tesla will have in the upcoming fourth quarter, which is also the traditional peak season.

Tesla’s frequent price increases and decreases

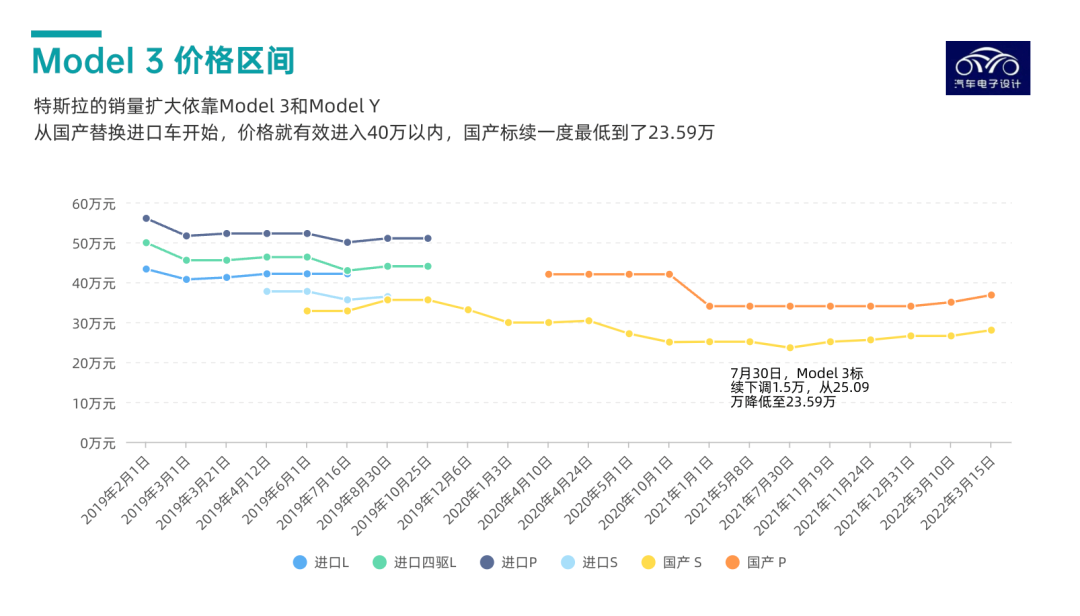

Tesla Model 3 is a familiar old model. Since its introduction to the Chinese market in 2019, Model 3 has undergone multiple rounds of price adjustments.

Let’s review the price of the standard range version together:

- In June 2019, the first price of Model 3 was announced as 328,000 yuan;

- In October, Tesla began producing Model 3 in Shanghai. The domestically-made Model 3 Standard Range version opened for pre-orders, and the price rose directly by 27,800 yuan to 355,800 yuan compared to the first announced price. This is also the highest price in history.

- In December, it received a national subsidy of 24,750 yuan, and the price dropped to 331,000 yuan;

In 2020, the price was adjusted four times:

-

In January, the standard version was lowered by 32,000 yuan, and the price was 299,000 yuan.

-

In April, the new subsidy policy was announced, and the price increased by 4,500 yuan to 303,500 yuan.

-

In May, in order to adapt to the subsidy policy, the price was lowered by 28,000 yuan to 271,000 yuan.

-

In October, Model 3 switched to CATL’s lithium iron phosphate battery, and the price was lowered by 21,100 yuan to 249,900 yuan.

In 2021, the price was adjusted five times:

- In May, the price was raised by 1,000 yuan

- In July, the price was lowered by 15,000 yuan, and it was the lowest price of Model 3 so far, which is 235,900 yuan. Note that car owners who bought the car at this price can brag about it in the bullet comments, especially those who had pre-ordered at the highest price.- In November, as the driving range increased – from 468 kilometers under NEDC test conditions to 556 kilometers under CLTC test conditions – the price also increased by 15,000 RMB to 250,900 RMB.

- In November, subsidies were further reduced, and prices rose by about 4,700 RMB to 255,600 RMB.

- In December, due to tight supply chain and shortages of batteries and chips, prices increased by 10,000 RMB to 265,600 RMB.

This year, Tesla’s prices have become stable, only rising by 14,248 RMB in March. The current price is 279,900 RMB.

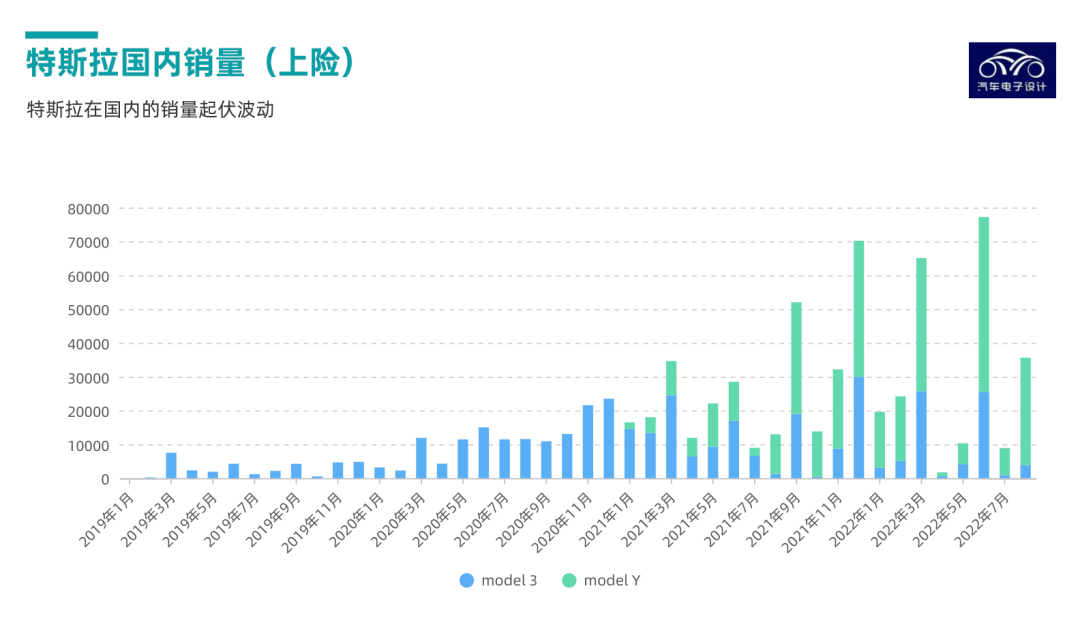

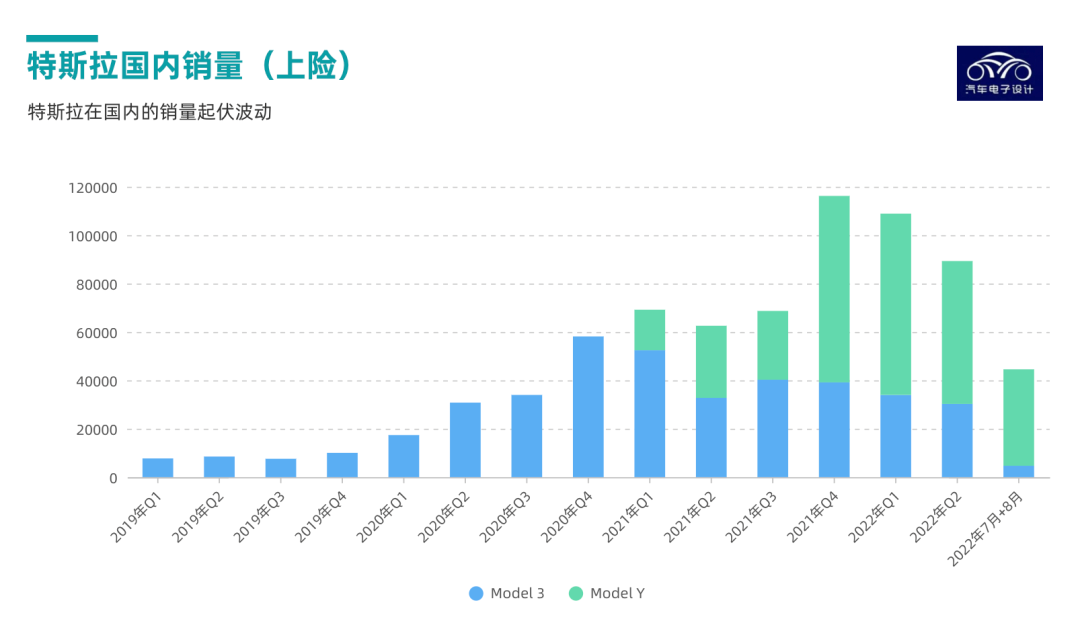

Looking back at the whole process, we can see that the sales of Model 3 in China reached a peak in Q3 2021, which was also the time when the price was lowest. However, with the substitution effect of Model Y, the demand for Model 3 is gradually decreasing.

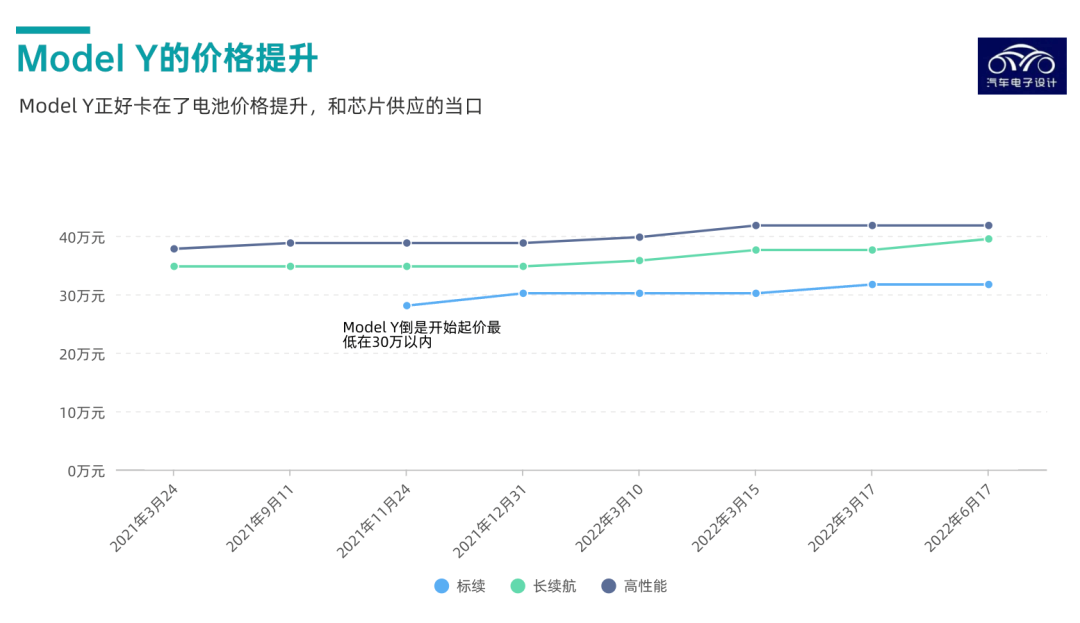

Next, let’s take a look at the price trend of Model Y together:

On January 1, 2021, according to Tesla’s official website in China, the starting price of Model Y Long Range version was 339,900 RMB, which was 148,100 RMB lower than the previous quoted price of 488,000 RMB. The starting price of the Model Y Performance high-performance version was 369,900 RMB, which was also 165,100 RMB lower than the quoted price of 535,000 RMB.

- However, due to high demand, Model Y prices increased by 8,000 RMB across the board in March 2021, with the Long Range version priced at 347,900 RMB and the Performance version priced at 377,900 RMB.

- In September, the Performance version increased by 10,000 RMB to 387,900 RMB.

- In November and December, the rear-wheel drive version increased twice by 4,752 RMB and 21,000 RMB respectively.

In 2022, the price of Model Y continued to rise, with three consecutive price increases in less than ten days in March:

- On March 10, the Long Range version increased by 10,000 RMB, and the Performance version increased by 10,000 RMB.

- On March 15, the Long Range version increased by 18,000 RMB, and the Performance version increased by 20,000 RMB.

- On March 17, the rear-wheel drive version increased by 15,000 RMB.

We have all seen price increases, but never so fast. And it’s not done yet. In June of this year, the Long Range version increased by 19,000 RMB to 316,900 RMB. The current price for the Long Range version is 316,900 RMB, and the Performance version is 417,900 RMB.

Now that we have expressed our complaints, let’s calmly consider the reasons behind frequent price increases.

The main reasons for price changes are:

Production costs

The reason for changes in Tesla’s prices is straightforward –– Tesla insists on determining vehicle prices based on production costs, making prices subject to fluctuation due to external factors. This has made it common for consumers to see frequent price changes from Tesla.

As we can see, with the start of production at the Chinese factory and an increase in localization rates, production costs have decreased, directly leading to a decrease in prices.

However, Tesla’s price increases are often due to subsidy reductions and an increase in costs. In addition, with a large number of orders and a small demand curve elasticity, prices are passed directly to consumers.

Additionally, this year, due to factors such as the pandemic and material shortages in the supply chain, many new energy vehicles have seen price hikes. Electric vehicle battery costs are relatively high, especially after the surge in lithium and lithium carbonate prices, where batteries can even account for 50% of total vehicle costs. This is also one of the reasons for Tesla’s price increases this year.

Order pool and production capacity utilization

Expectations of sales can also influence prices.

When Tesla encounters production bottlenecks or lower-than-expected sales, it may also lead to price increases or decreases for its models.

For example, at the beginning of this year, we saw a significant increase in global European and American car prices. Tesla had sufficient capacity to sell Chinese-made vehicles to other regions, so this was also a reason for the continuous and frequent price increases in March.

Possibility of price reduction

After discussing these factors that affect prices, let’s predict whether there is a possibility of Tesla reducing prices in the near future.

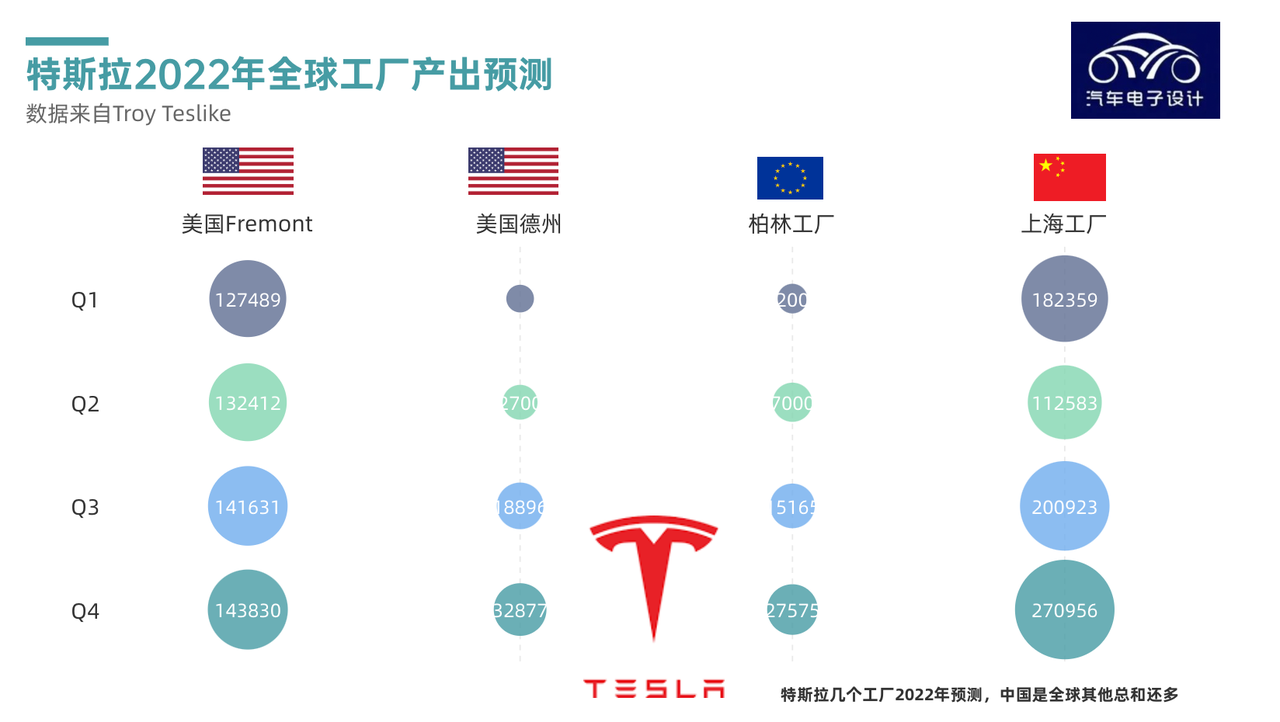

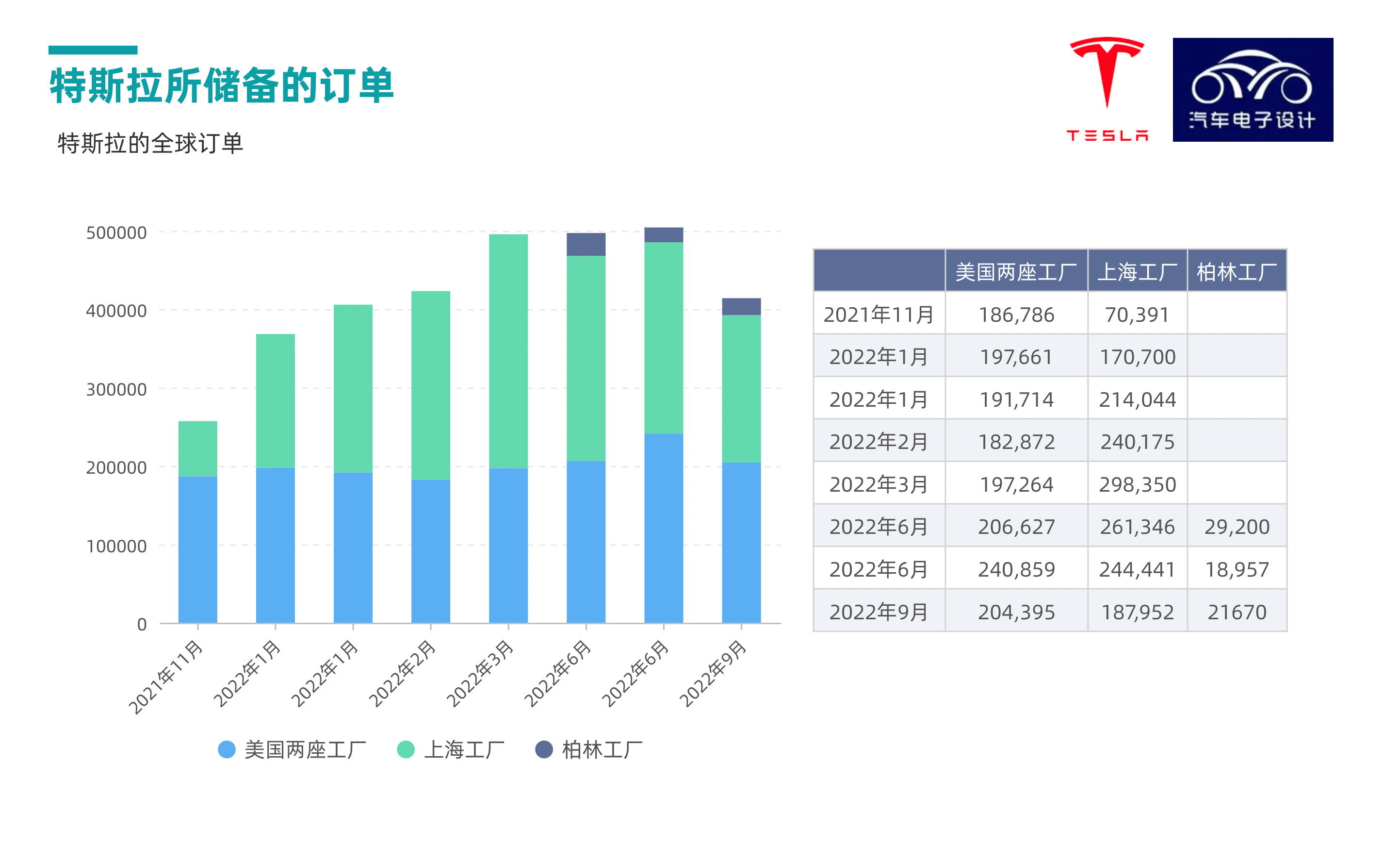

Let’s first talk about the order pool.We can see that Tesla delivered 238,533 new cars in Q2 of this year, a significant drop compared to the delivery performance of 310,048 cars in Q1. Tesla aims to achieve an annual production capacity of 1.5 million in 2022, which would require an increase of 50% to achieve 1.4 million. However, in the first half of this year, Tesla globally delivered only 564,000 cars, which is less than 40% of its annual sales target.

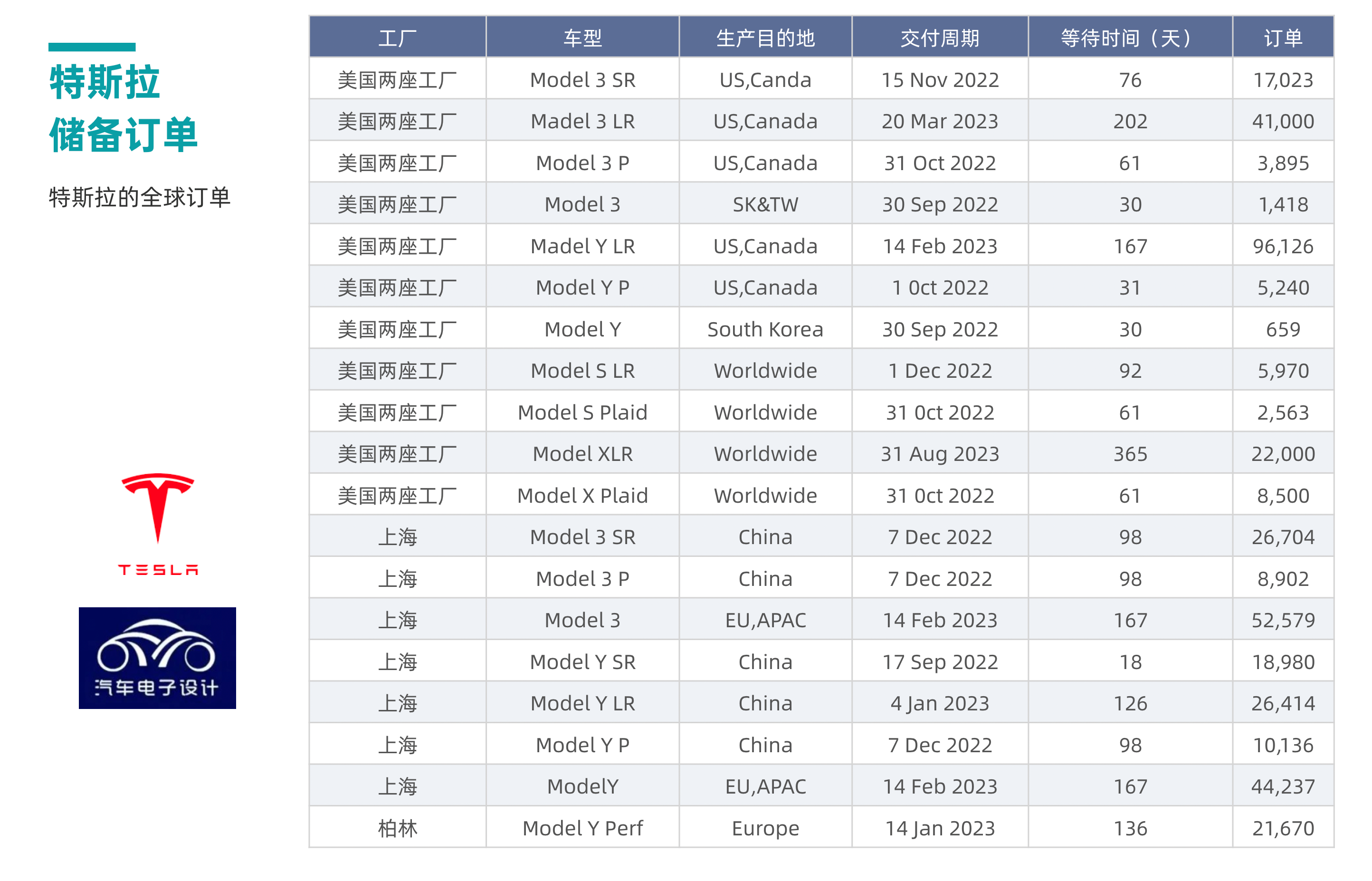

Therefore, globally speaking, as Shanghai factory’s production capacity increases, it is expected that Tesla will use “price reduction” to meet sales targets in some regions in the future. Tesla’s orders have already reached saturation levels in some regions and it currently has a large backlog of orders.

Let’s take a look at the Chinese market:

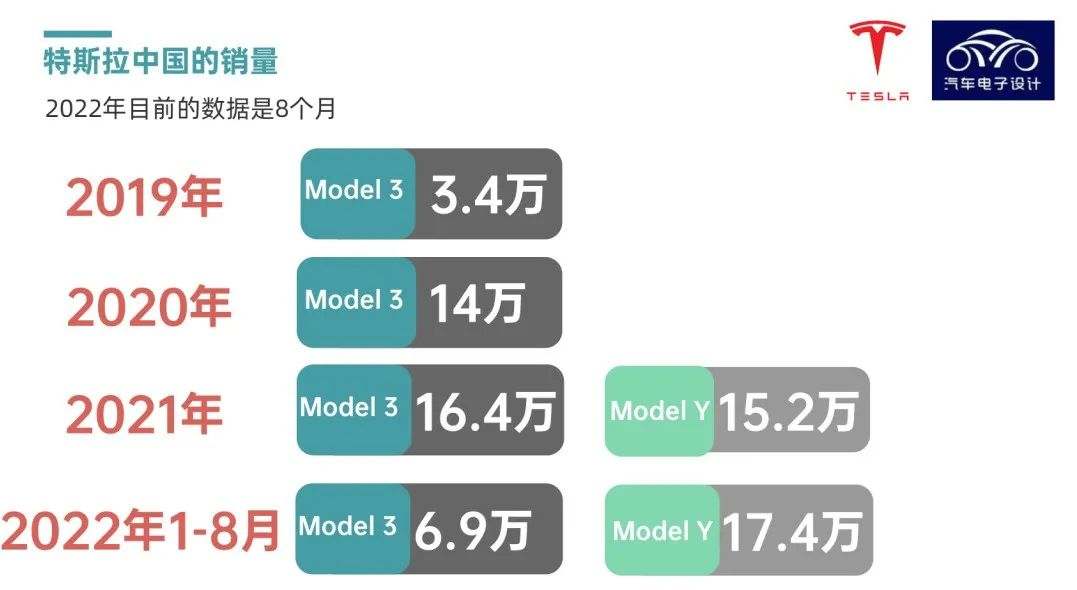

The Model 3 delivered 69,000 units this year, and the Model Y delivered 174,000 units.

Currently, the sales rate of the Model 3 is slowing, coupled with the relatively high competitive pressure it faces, many potential buyers will compare it with BYD Han, XPeng P7, Deep Blue SL01, and BYD Dolphin, and therefore, we predict that there is a high probability that the Model 3 will undergo a price reduction in October to stimulate purchase desire.

There is also a possibility of a price reduction for the Model Y as the factory renovations are completed and the production capacity in Shanghai is gradually increasing.

Conclusion: According to Troy’s prediction, Tesla is expected to deliver 369,000 cars globally in Q3, and China will deliver more than 100,000 cars in September alone. If this data is achieved, Tesla is indeed not far from a price reduction.Finally, there is one more hint of price reduction, that is insurance – Tesla may experimentally offer insurance discounts at its stores before adjusting prices, and this year Elon Musk has signaled the possibility of a price reduction, based on the effective mitigation of inflation.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.