Author: Zhu Yulong

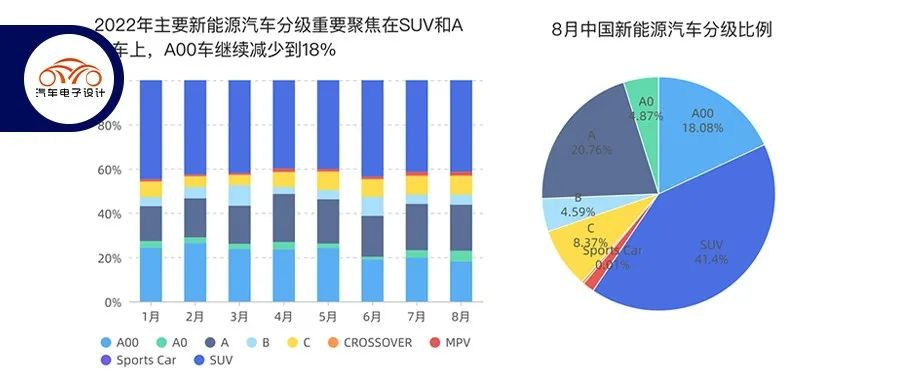

This morning, I discussed the data for August with General Manager Qiu. In August, there were 259,000 pure electric vehicles and 110,000 plug-in hybrid electric vehicles, totaling 369,000 units. The absolute data is still very good, but in-depth analysis reveals some characteristics:

-

Among the 259,000 pure electric vehicles, SUVs (134,000), A00 (86,600), and A-class cars (74,800) are currently ranked at the top. With the decline in the volume of Model 3, ET5 may be needed to increase the output of B-class cars.

-

Currently, PHEV is too concentrated by brand and too concentrated in SUVs. With the entry of Haval, Changan, Great Wall, and Chery, the market will be more balanced in 2023.

-

A00 level has stabilized below 20% throughout the lineup. Given the current cost structure, it is good for this market to remain stable at 1 million. Following Chery’s reduction in volume, only Wuling and Changan will continue.

Plug-in hybrid’s landscape

We can see that as battery costs continue to decline, PHEV/EREV with different battery capacities will have opportunities, and even HEV will have opportunities by 2023. If we exclude small cars below A0, the proportion of pure electric to plug-in hybrid in products above A-class is 2.34:1, which will be adjusted.

-

SUVs: 134,000 units versus 64,000 units. If we look at them separately, we can see that pure electric SUVs are abundant in supply, while plug-in SUVs are just beginning to be promoted on the market. Especially with the subsequent entries of Haval+WEY from Great Wall, Geely (Emgrand+Lynk & Co.), Changan, and Chery, as well as the ideal and WEY brand’s already excellent performance.

-

C-class cars: The proportion here is currently 25,300 versus 14,783, and there are no popular models in sight.

-

B-class cars: With the decline of Model 3, ET5 may be a contender for pure electric. However, there is considerable room for plug-in in this area, depending on how each company markets its products.

-

A-class cars: 75,000 versus 25,000. This area should not be too worried because the number of 2B-class vehicles is the highest. If we compare only C-end quantities, A-class plug-in cars may have more private use.Therefore, it seems that the development direction of pure electric vehicles is uncertain this year, as the momentum of new forces slows down. Most of the models are there to replace the Model 3 and Model Y, but there’s not much novelty.

The concentration of plug-in hybrids is quite high at present, with BYD taking up nearly 70% of the market share, followed by CELT and the third place is IDEAL which has decreased significantly. In my opinion, after rolling them up, the supply of this area will be very sufficient.

Why is that? Strictly speaking, there is not much difference between PHEVs and gasoline cars. After changing the powertrain, it’s done. Therefore, in terms of investment in this area, products can be developed by 2023, and thereafter, replacing a certain percentage of their own gasoline cars will increase the speed.

Inventory of Pure Electric Vehicle Models

In August, we saw familiar faces among pure electric vehicle models, like the Dolphin, which targets individual consumers, with sales of 23,000 units, along with 15,300 units of the Neo Plus and 10,600 units of the Aion Y. These cars are still more suitable for home use, with a fast growth rate in the price range of 100,000 to 150,000 yuan.

I think from the perspective of the sales growth rate of pure electric vehicles, consumers have started to pay more attention to cost-effectiveness. New energy vehicles that are relatively expensive are not meeting expectations in terms of increasing sales. It can be seen that the price of new energy vehicles is an important factor in consumers’ purchasing decisions. It’s expected that the market will be more dominated by price in 2023.

Summary: Based on current situation, pure electric vehicles will become more dominant once there is sufficient supply of plug-in vehicles. Except for a small portion of high-end consumers, those who used to choose compact sedans and SUVs, were originally consumers who bought 130,000 RMB gasoline vehicles. Now they switch to slightly more expensive new energy vehicles. In fact, the purchasing constraints of Chinese consumers have not changed.

Summary: Based on current situation, pure electric vehicles will become more dominant once there is sufficient supply of plug-in vehicles. Except for a small portion of high-end consumers, those who used to choose compact sedans and SUVs, were originally consumers who bought 130,000 RMB gasoline vehicles. Now they switch to slightly more expensive new energy vehicles. In fact, the purchasing constraints of Chinese consumers have not changed.

**Summary:** Based on current situation, pure electric vehicles will become more dominant once there is sufficient supply of plug-in vehicles. Except for a small portion of high-end consumers, those who used to choose compact sedans and SUVs, were originally consumers who bought 130,000 RMB gasoline vehicles. Now they switch to slightly more expensive new energy vehicles. In fact, the purchasing constraints of Chinese consumers have not changed.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.