Author: Zhu Yulong

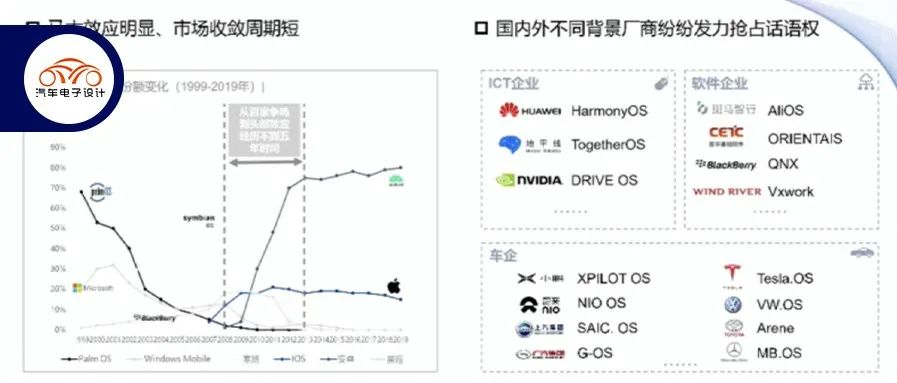

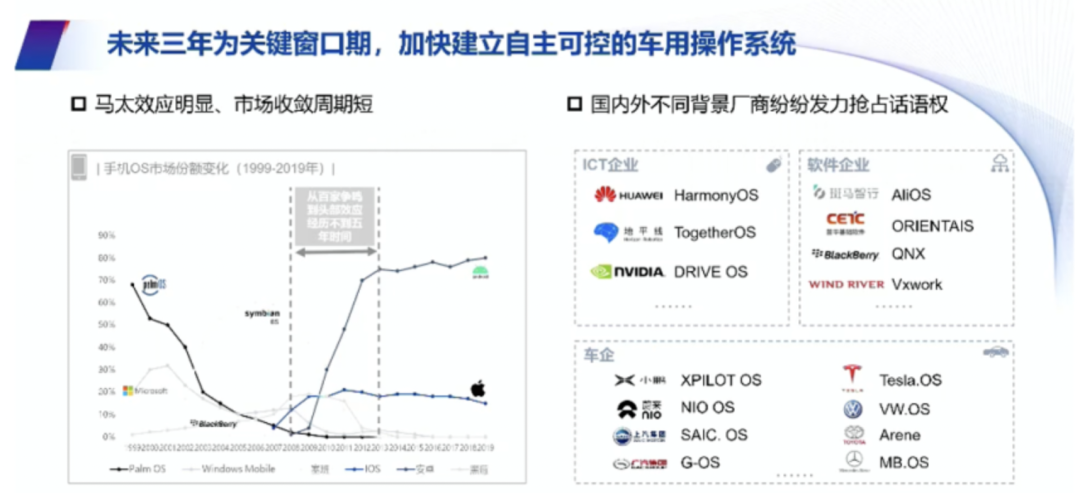

At the “Reshaping the New Pattern of Automotive Core Supply Chain” conference held by the Hundred People Club, it was mentioned that the next three years will be a critical window period for in-vehicle operating systems, and the importance of SoC chips for intelligent cars was also emphasized. From the current situation, in the areas of intelligent cockpit and intelligent driving, SoC chips are undergoing a round of matching development with operating systems. Car companies are used to spending more than 100 dollars to purchase such chips- in other words, the investment in design alone for those who want to do such designs will become bigger and bigger.

Referencing the current market structure of smartphone SoC, we can make some predictions about seat SoC (next episode) and intelligent driving SoC (next-next episode).

After NVIDIA’s AI server training chips encountered delivery problems, many things need to be considered. What should we do if we have no supply?

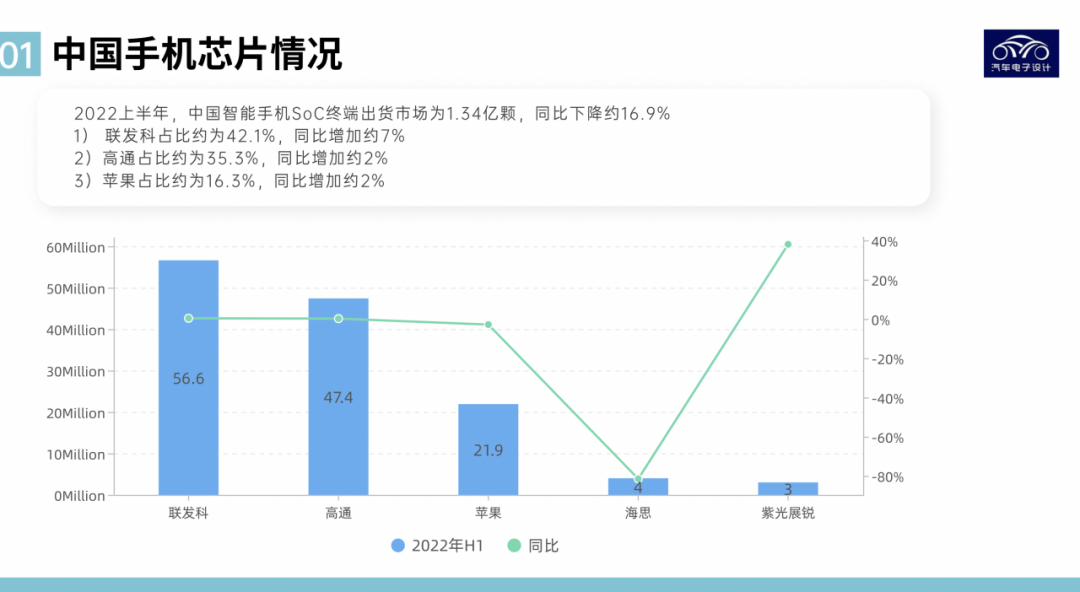

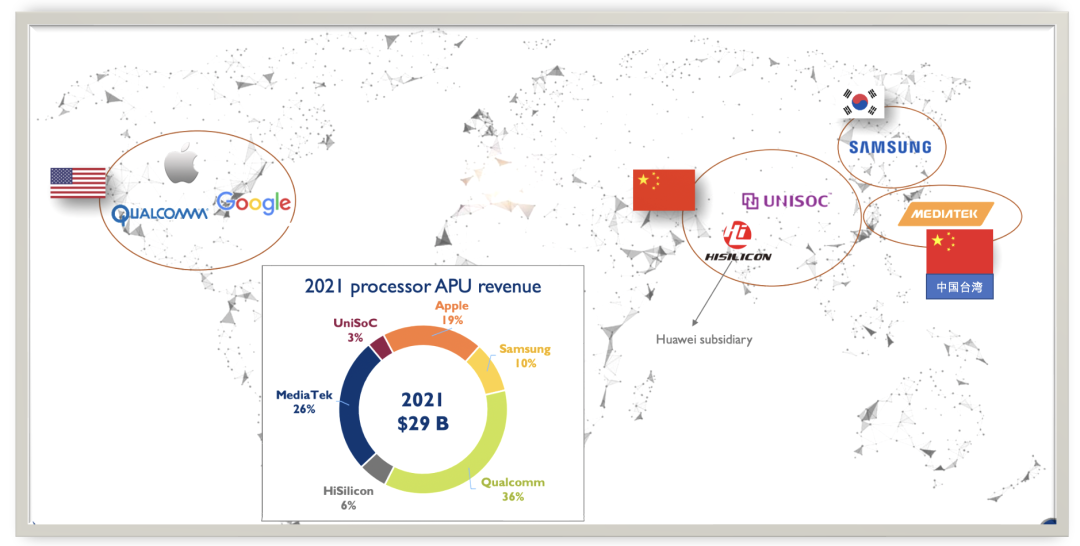

Market share of smartphone SoC

With Huawei encountering problems, the situation of Chinese smartphone chips is difficult to describe. In the first half of 2022, the number of Chinese smartphone SoCs was approximately 134 million, a year-on-year decrease of about 16.9%. The decrease in demand for smartphones has a great impact on SoCs.

-

MediaTek accounts for about 42.1% of the market share, a year-on-year increase of about 7%, mainly occupying the low-end market below 2000 yuan (about 65.3%);

-

Qualcomm accounts for about 35.3% of the market share, a year-on-year increase of about 2%, mainly in the mid-range market between 2000-3999 yuan (about 49.2%);

-

Apple accounts for about 16.3% of the market share, a year-on-year increase of about 2%, mainly in the high-end and ultra-high-end markets of 4000-5999 yuan (70.1%) and above 6000 yuan (77%).

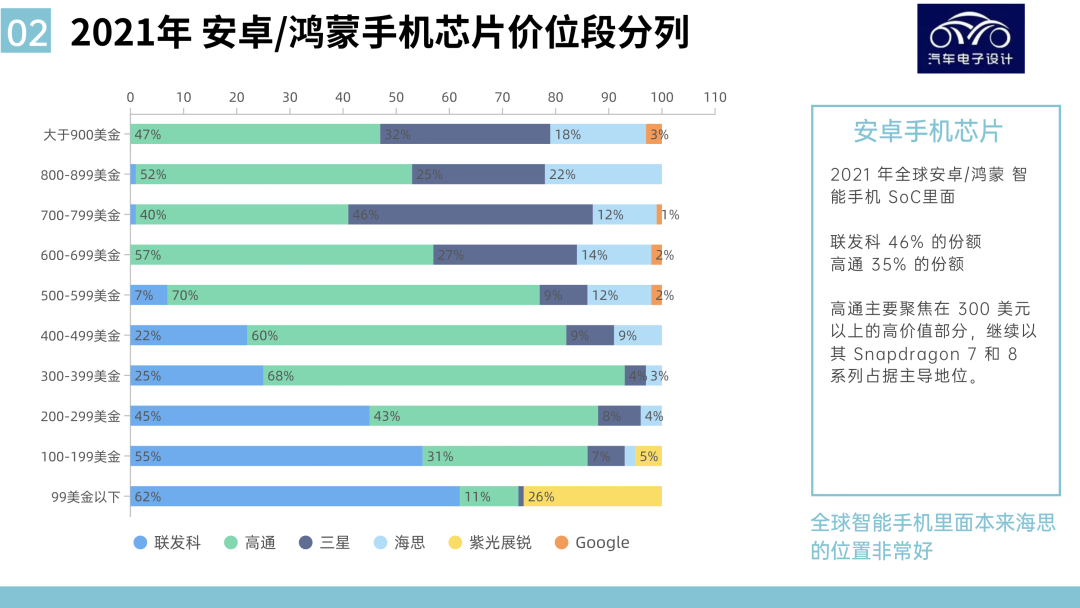

If we separate vertical integration, and mainly look at Android and Harmony, the price range globally is being constantly taken over by MediaTek and Qualcomm.

From a technical perspective, Qualcomm’s highly optimized RFFE component is the key to providing advanced connectivity experiences in terms of computing (CPU, DSP, GPU), artificial intelligence (NPU), connectivity (4G, 5G sub-6GHz, 5G mmWave, Wi-Fi6/6E), security, or gaming functions in the SoC. MediaTek entered the high-end market (above $500) with Dimensity 9000, and succeeded in partnering with OPPO, Vivo, Xiaomi, and Honor.

From a technical perspective, Qualcomm’s highly optimized RFFE component is the key to providing advanced connectivity experiences in terms of computing (CPU, DSP, GPU), artificial intelligence (NPU), connectivity (4G, 5G sub-6GHz, 5G mmWave, Wi-Fi6/6E), security, or gaming functions in the SoC. MediaTek entered the high-end market (above $500) with Dimensity 9000, and succeeded in partnering with OPPO, Vivo, Xiaomi, and Honor.

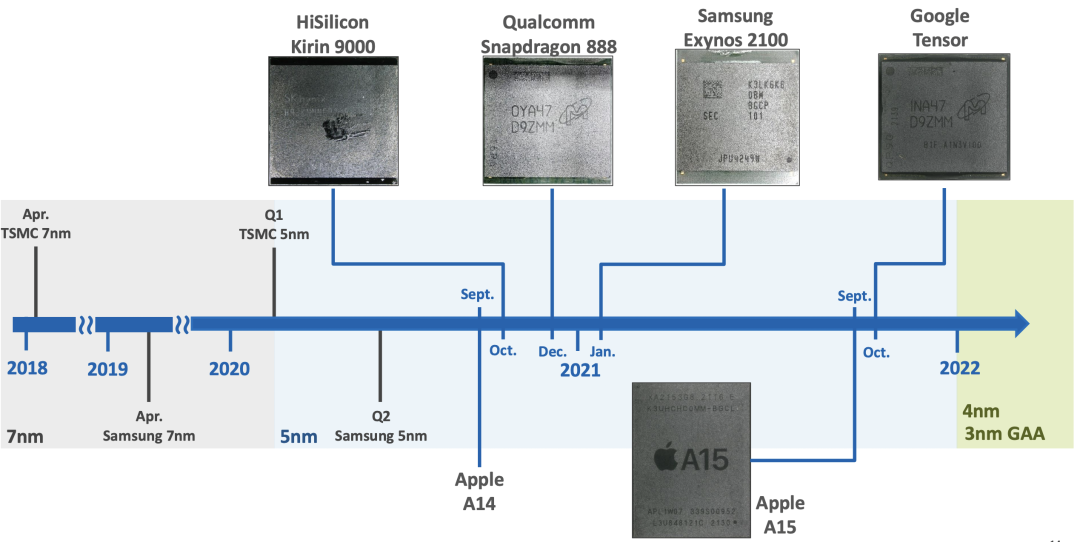

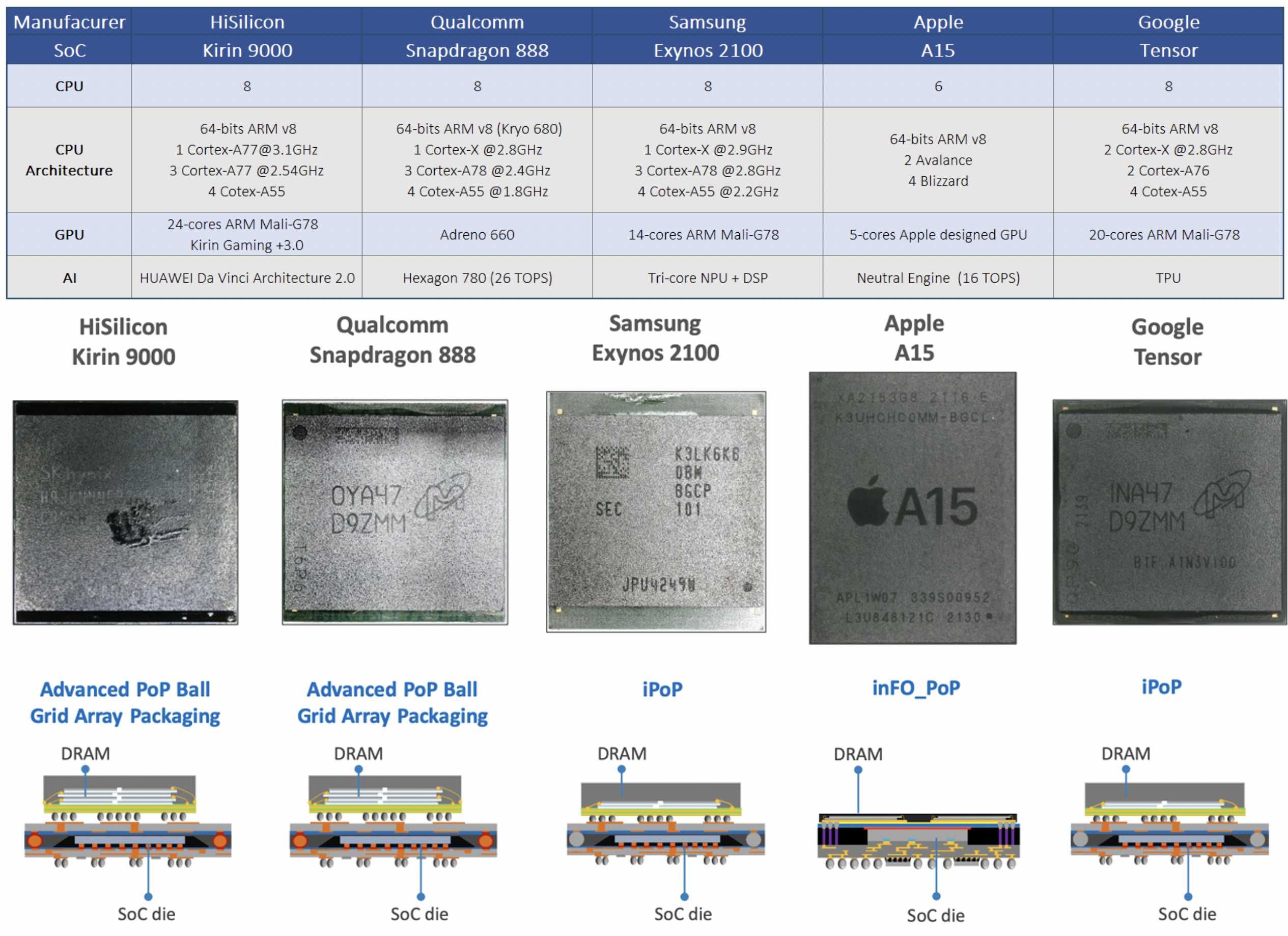

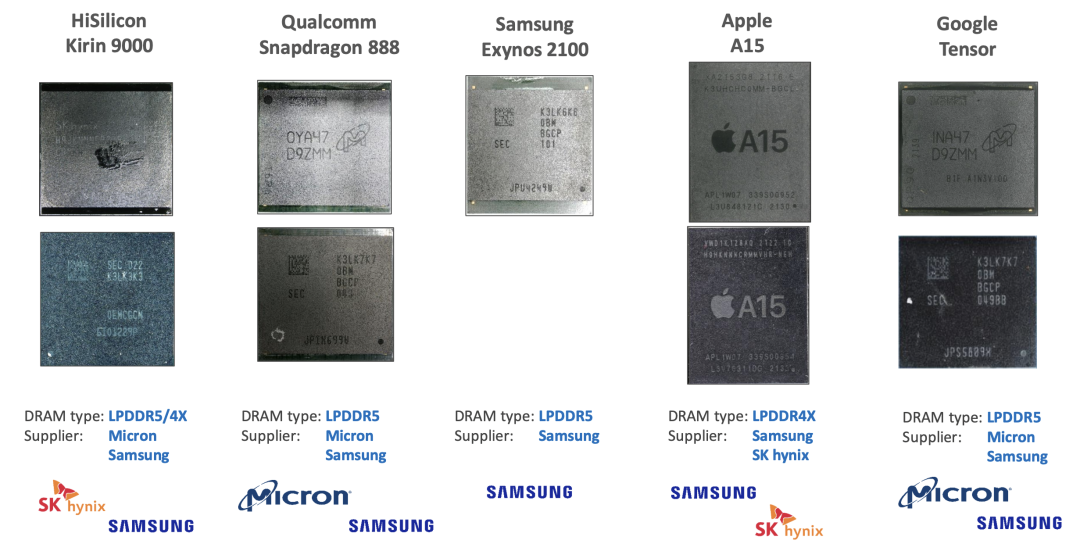

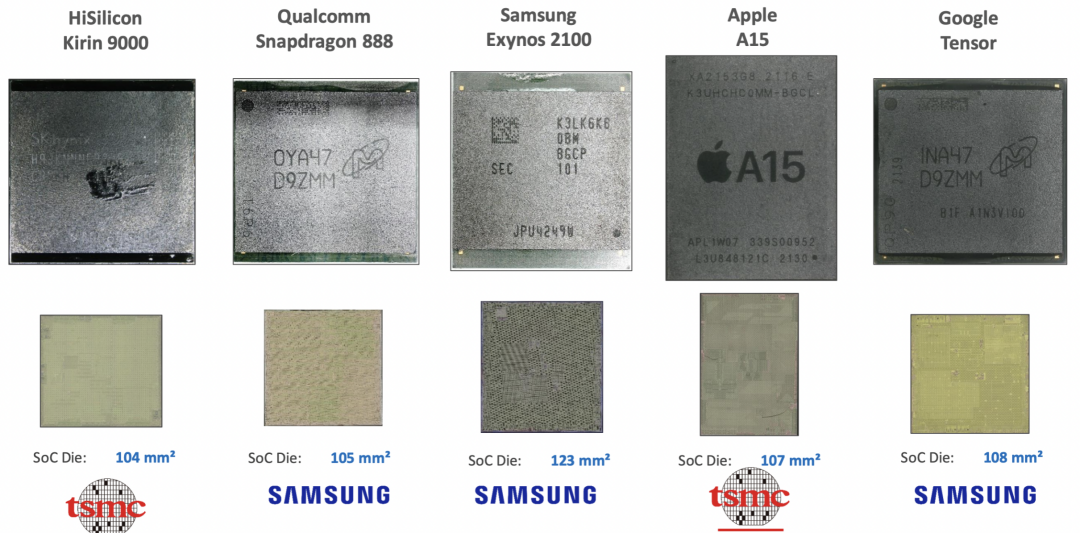

Smartphone SoC Iteration

Until now, it has been challenging for smartphone SoCs to stay ahead. It takes a lot of investment for a company to iterate a phone. Compared to cars, smartphones have enough volume and can burn the overall sales, so the chip iteration speed has been very fast in past iterations of consumer electronics, especially since the performance of the chip directly determines the potential feedback of consumers. The effect of the 8155 in the cockpit SoC seems like a rehearsal.

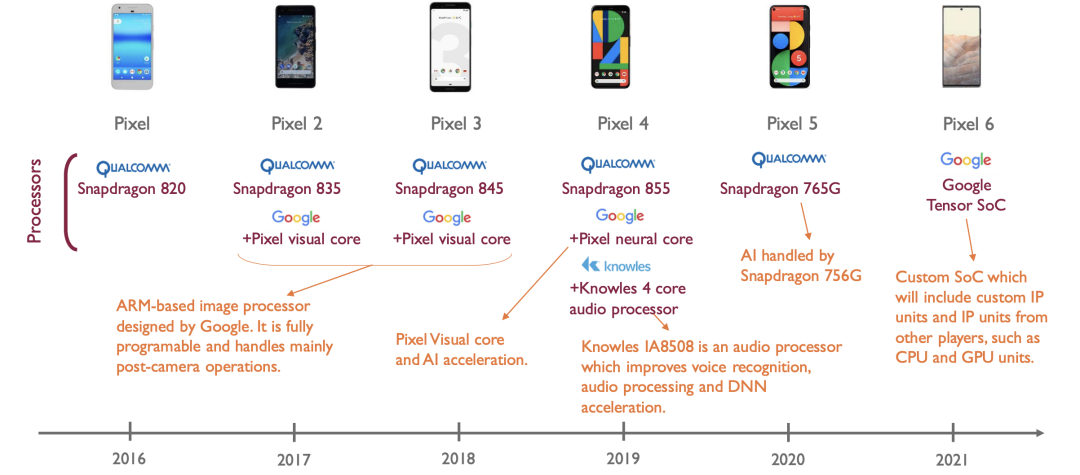

In other words, Google can make a custom Tensor SoC for the high-end as a backup.

The cost of developing mobile SoC chips comes from hardware and design. The former includes wafers, masks, packaging, and testing, while the latter includes EDA tools, IP authorization, architecture, etc. According to third-party semiconductor research institution Semi engineering, the development cost increases from $51.3 million for 28nm to $100 million for 16nm, and the cost for the 5nm node is expected to double. Moreover, without advanced manufacturing processes, the chip may not be produced.

The cost of developing mobile SoC chips comes from hardware and design. The former includes wafers, masks, packaging, and testing, while the latter includes EDA tools, IP authorization, architecture, etc. According to third-party semiconductor research institution Semi engineering, the development cost increases from $51.3 million for 28nm to $100 million for 16nm, and the cost for the 5nm node is expected to double. Moreover, without advanced manufacturing processes, the chip may not be produced.

At the end of June 2021, Samsung officially announced the successful mass production of 3nm chips, and recently announced shipments, intensifying the competition.

In summary, from the perspective of the automotive industry, we still look to the leaders in the mobile phone industry. Qualcomm has taken its products from mobile phones to cars, from cabins to intelligent driving assistants, a strategy that puts pressure on our chip and product iterations. A good system needs a matching chip to implement; otherwise, it is useless.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.