European Car Market in August

Author: Zhu Yulong

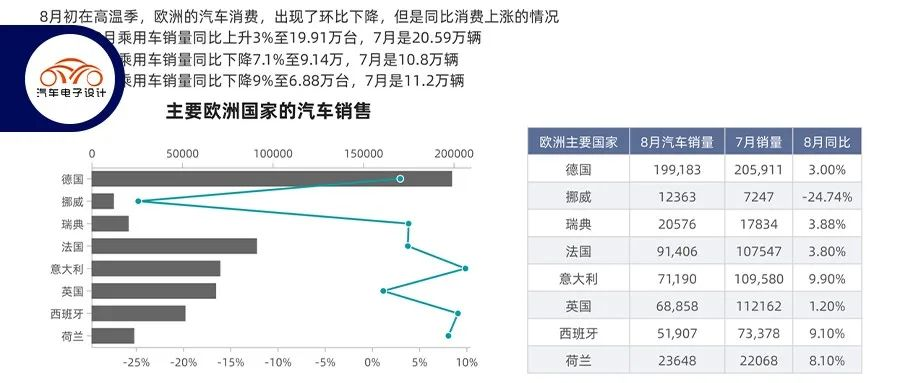

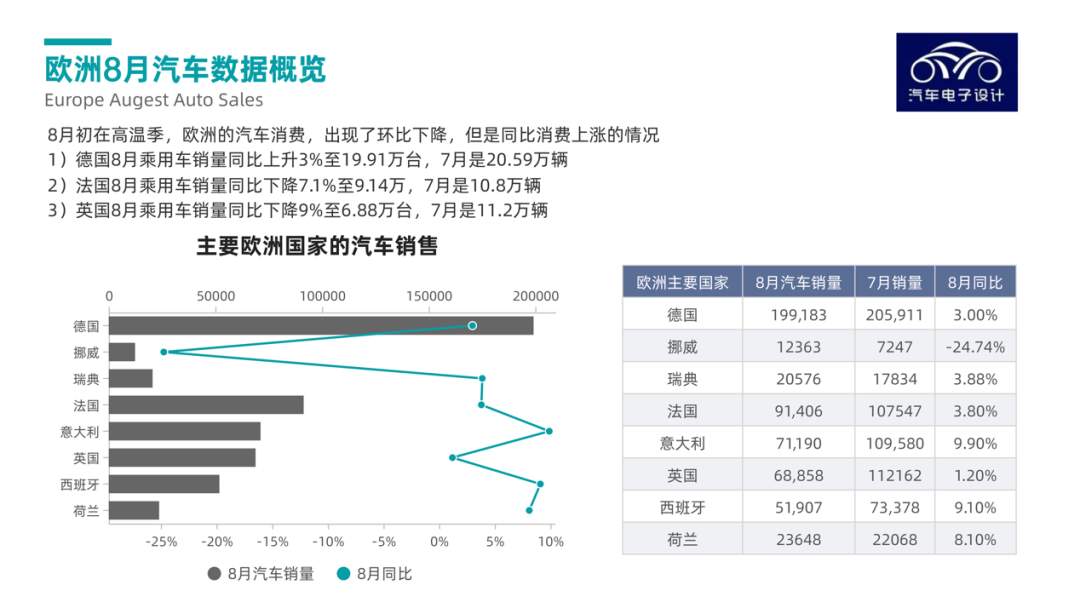

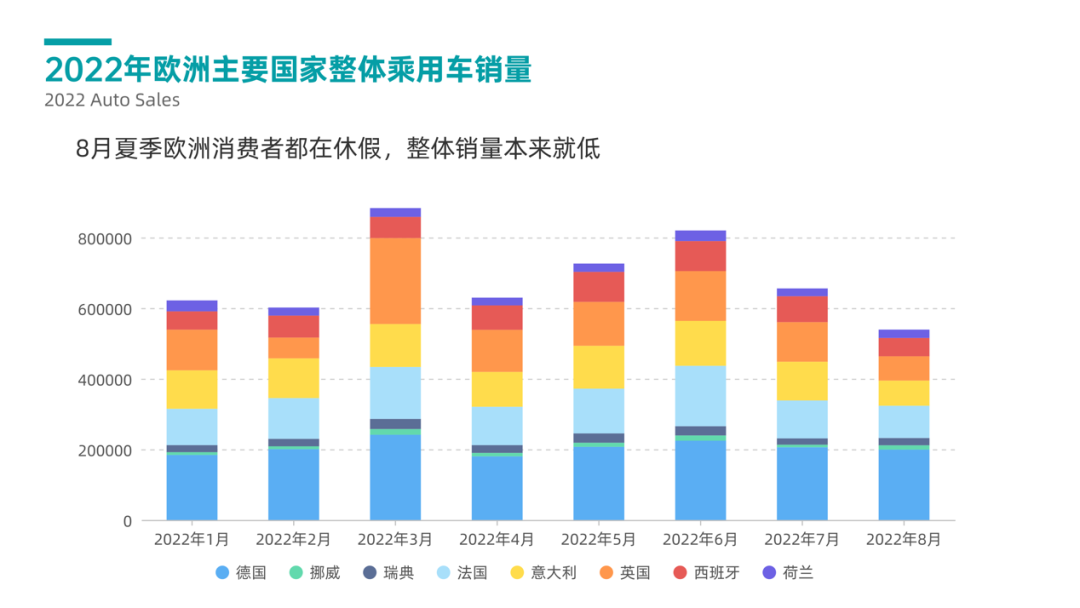

Many European consumers went on vacation in August, which also happens to be a month when the European consumer market is at its lowest. Overall, the car market in Europe may experience a downturn throughout the year. In early August, as temperatures rose, there was a month-on-month decrease in European car consumption, but a year-on-year increase.

-

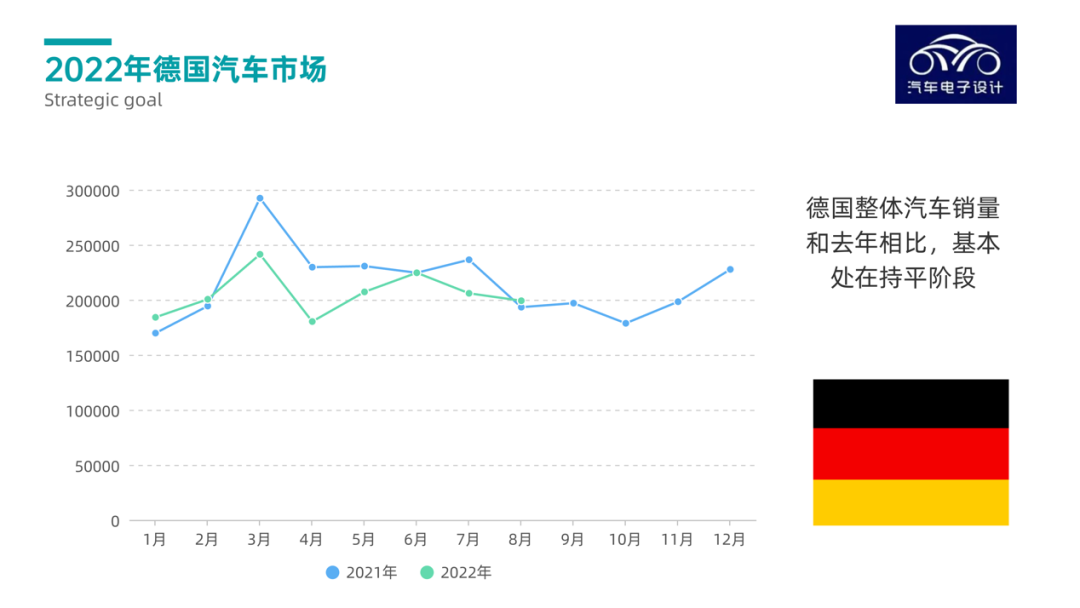

German passenger car sales in August increased by 3% year-on-year to 199,100 units, down from 205,900 units in July.

-

French passenger car sales in August decreased by 7.1% year-on-year to 91,400 units, down from 108,000 units in July.

-

British passenger car sales in August decreased by 9% year-on-year to 68,800 units, down significantly from 112,000 units in July.

As shown in the following figure, Q3 is likely to be much lower than Q2 on a month-on-month basis, and the overall car consumption in Europe will not recover in Q3. We’ll have to wait and see if there is any improvement in Q4.

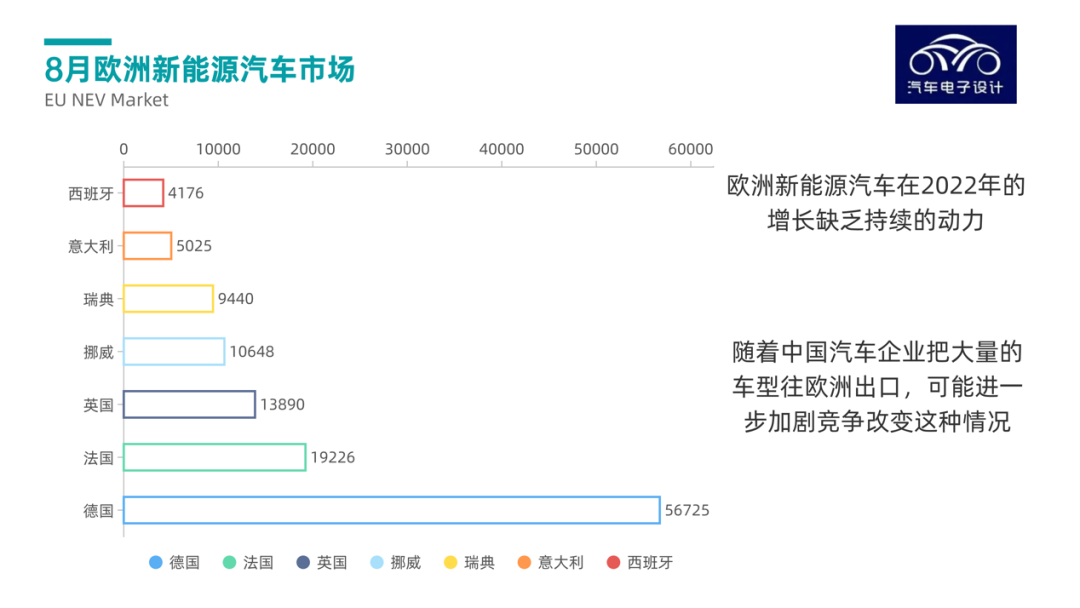

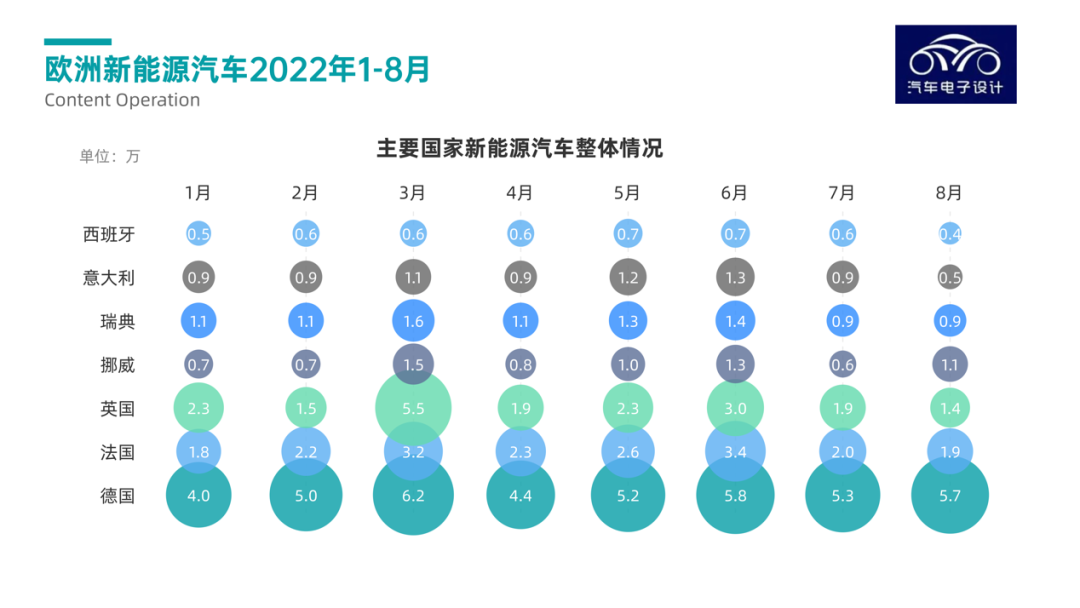

Sales of New Energy Vehicles

We are particularly concerned about the sales of new energy vehicles in Europe, which are not particularly good, as shown in the following figure. The sales bottleneck for new energy vehicles in Europe may be similar to the bottleneck period from 2017 to 2019. The first or 1.5 generation of electric vehicles developed by many automakers stand out for their relatively high product prices and little design differentiation from traditional fuel vehicles.

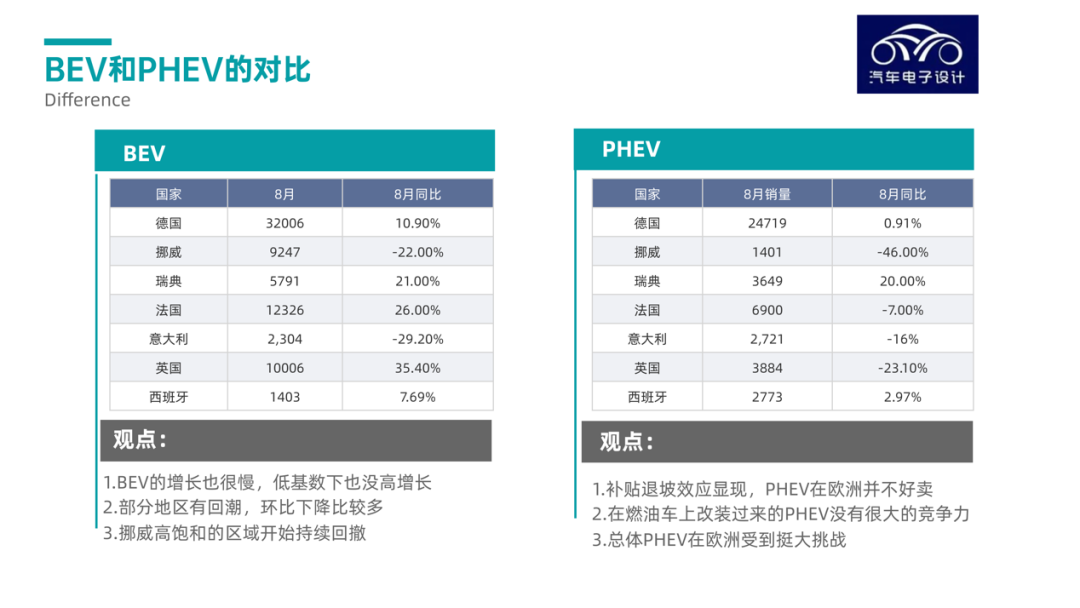

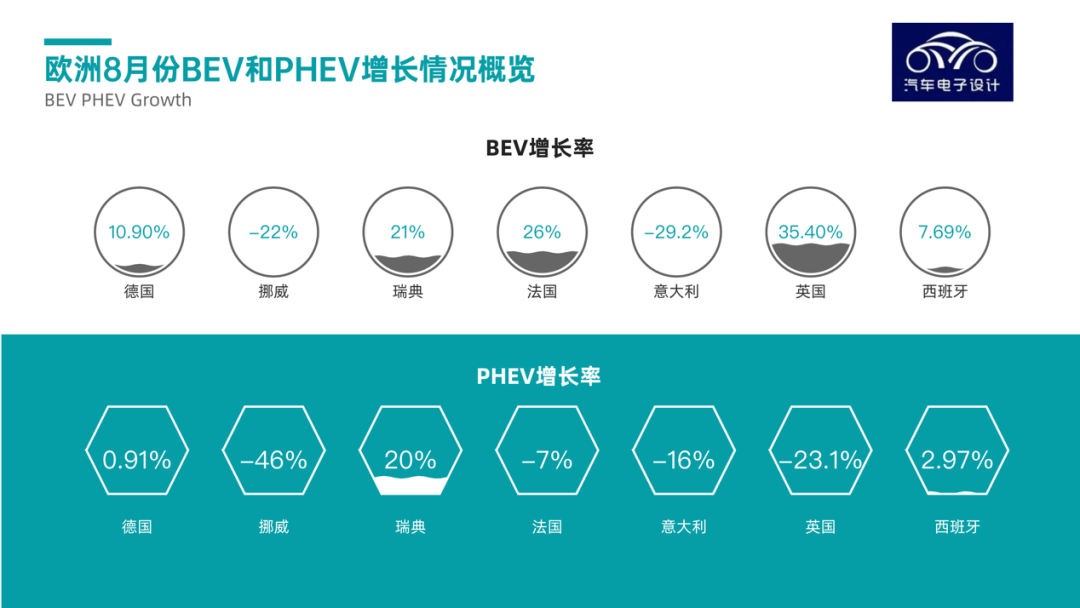

If we compare the growth of BEVs and PHEVs, the growth of BEVs has remained stable in August.

-

The growth of BEVs is also slow, and there is no high growth under the low base.

-

Some regions are rebounding, but there is a relatively large month-on-month decline.

-

Highly saturated areas in Norway are beginning to retreat.

The situation for PHEVs is relatively worse:- The subsidy reduction effect is evident, and PHEVs are not selling well in Europe.

- PHEVs converted from gasoline cars do not have significant competitiveness.

- Overall, PHEVs face significant challenges in Europe.

Currently, our team is working on a dedicated engine + DHT gearbox for DHT, and it is worth observing whether it can succeed in Europe.

In terms of the overall trend of new energy vehicles from January to August 2022, there was a temporary peak in March, but there was no breakthrough beyond this peak.

Strategies of France and Germany

If we compare the automobile industries of France and Germany, the former is built around a relatively closed market and globalized around the world’s largest markets: China, the United States, and Europe. However, now we see issues with the situation in China, so the enterprise strategies of France and Germany differ significantly.

The French automobile market is actually difficult to sustain many local car companies, such as Stellantis and Renault. Renault has also split up and plans to spin off a significant amount of equity in its internal combustion engine division. For Chinese car companies such as Geely, acquiring 40% equity is more like continuing to import Chinese engineering technology into this brand to do business in Europe and the world.

However, we also see that the penetration rate of new energy vehicles in France is stuck at around 20%.

In Germany, the overall decline of the automobile industry is relatively small. In the first eight months of this year, new car sales were down 9.8% from the same period last year. In August, the market share of pure electric vehicles (BEVs) was 16.1%, higher than the market share of plug-in hybrid vehicles at 12.4%. The market share of plug-in hybrids has reached 30.0%, which means that the electrification rate in Germany has reached 46.1% and has begun to enter a phase of saturation.

Summary: Looking at the data from Europe, I believe that when our market climbs to the range of 6-7 million, we will encounter similar situations. The good news is that our product strength is impressive and has already gone through a round of elimination. Next is nothing but the Matthew effect. It’s even more evident that many car companies that have yet to join the market are running out of time to catch up.

Summary: Looking at the data from Europe, I believe that when our market climbs to the range of 6-7 million, we will encounter similar situations. The good news is that our product strength is impressive and has already gone through a round of elimination. Next is nothing but the Matthew effect. It’s even more evident that many car companies that have yet to join the market are running out of time to catch up.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.