Author: Zhu Yulong

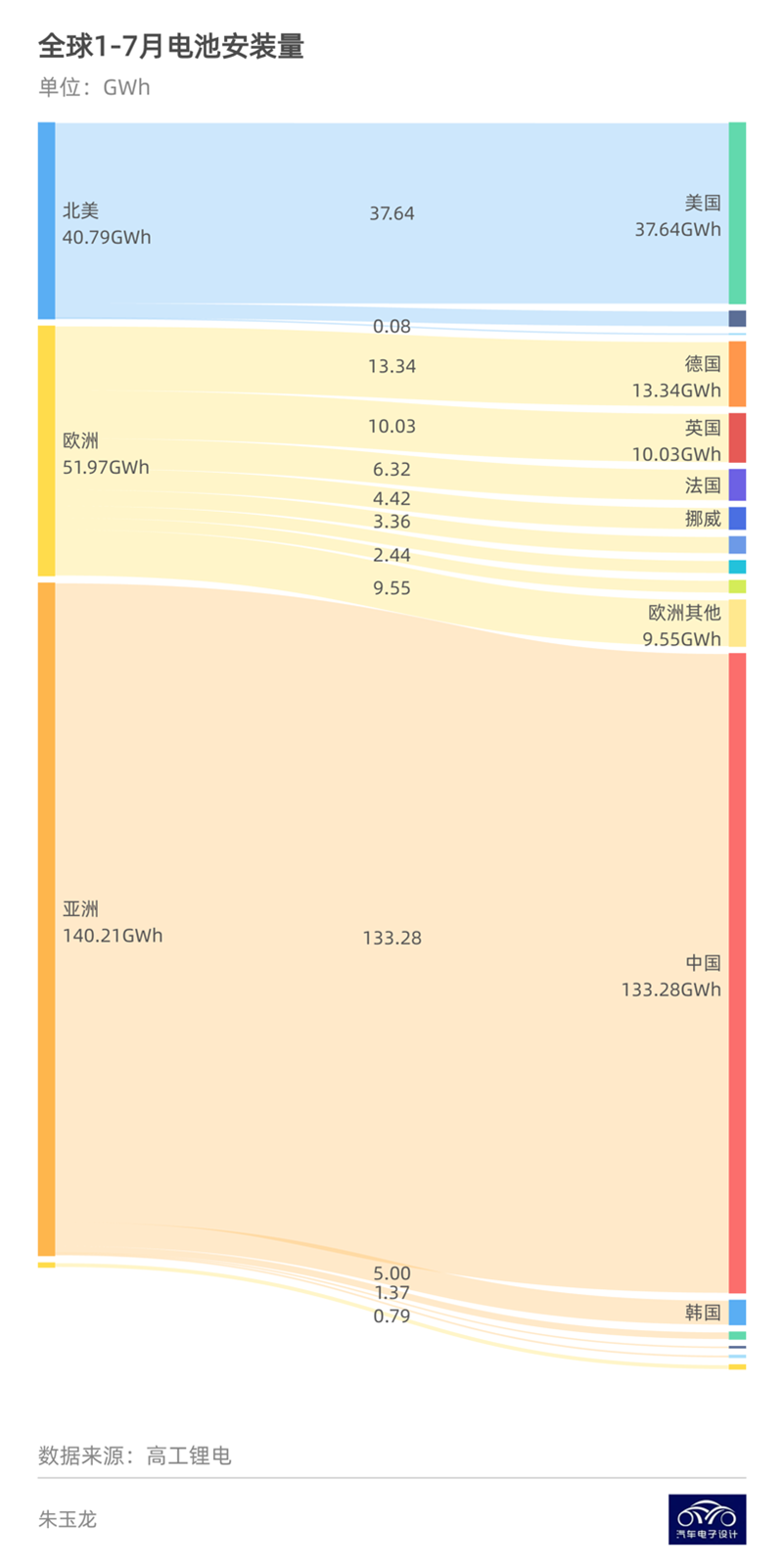

According to the data from Geely, globally speaking, the installation of power batteries depends largely on China. From January to July, the installed capacity of power batteries in the Asian region (mainly China) was 140.21 GWh, a year-on-year increase of 116%. In North America, the installed capacity of power batteries reached 40.80 GWh, a year-on-year increase of 81%. In Europe, due to the combination of inflationary pressure, economic recession, and subsidy decline, the installed capacity was 51.98 GWh, a year-on-year increase of 25%.

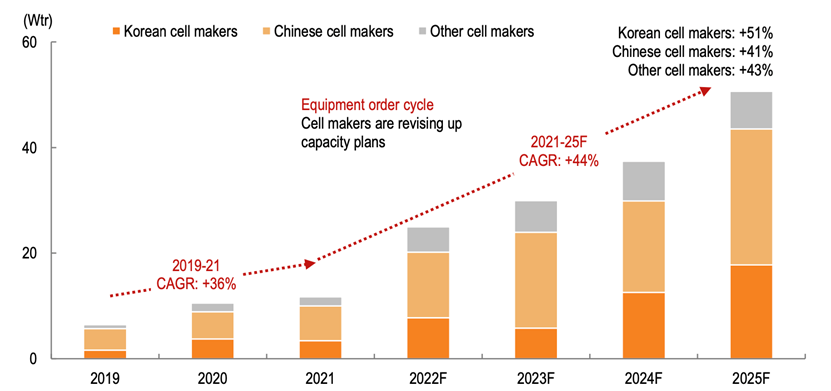

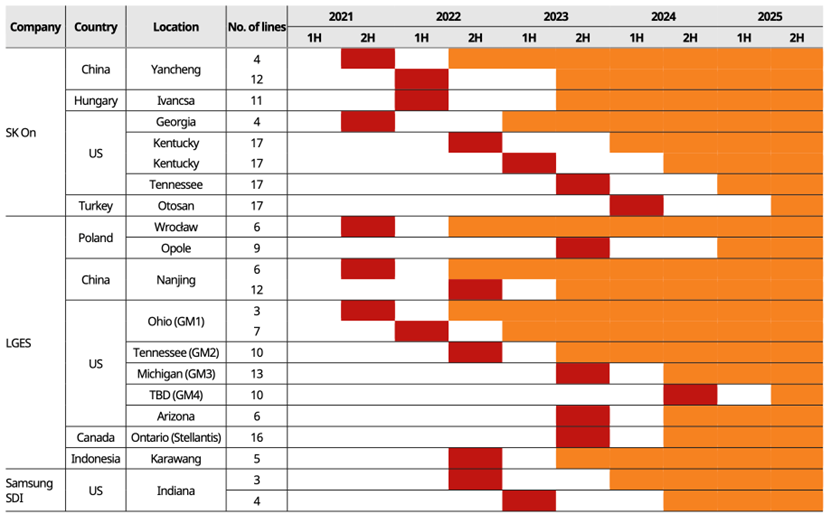

The global production and industrial chains of power batteries rely heavily on China, but we also need to look at some other trends. From a global perspective, the South Korean battery industry has begun a round of increased production capacity. SK On plans to build more than 100 production lines starting in 2022, while LGES has placed orders for the Karawang factory in Indonesia and the Tennessee factory (GM2) in the United States, and is preparing for the Michigan factory (GM3) order. Samsung SDI has also started placing orders for the Stellantis joint venture.

From the data, the Chinese battery companies will still have the largest increase in output in 2022, but from the perspective of growth rate from 2023 to 2025, with the rapid landing of the American electric vehicle market, the production capacity of Korean battery companies will gradually be realized in the United States and Europe. Chinese power battery companies have begun to expand their batteries into other fields, which is reflected differently in vehicles.

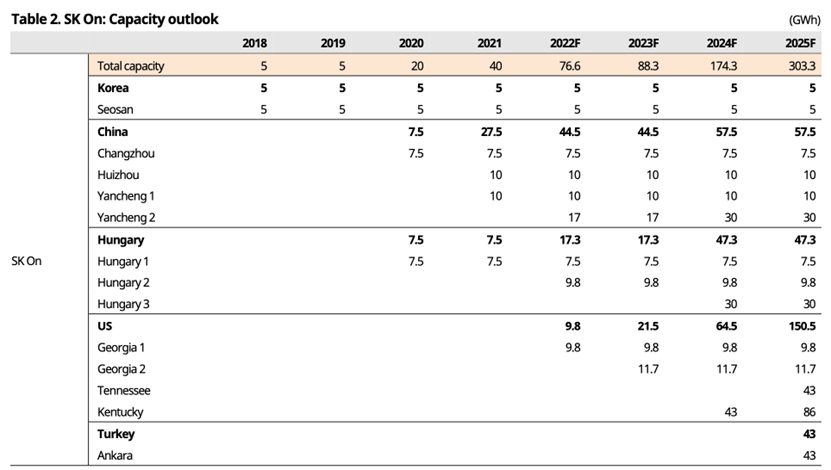

SK On’s Investment

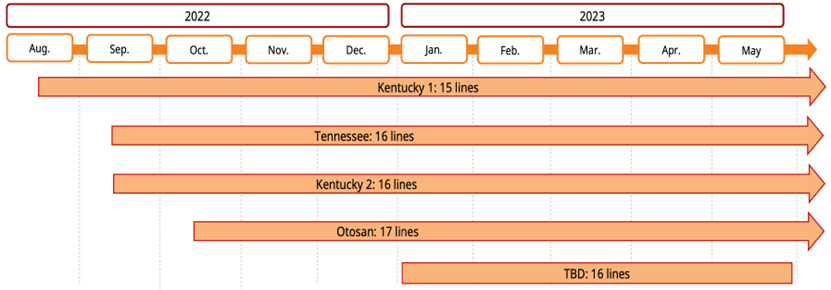

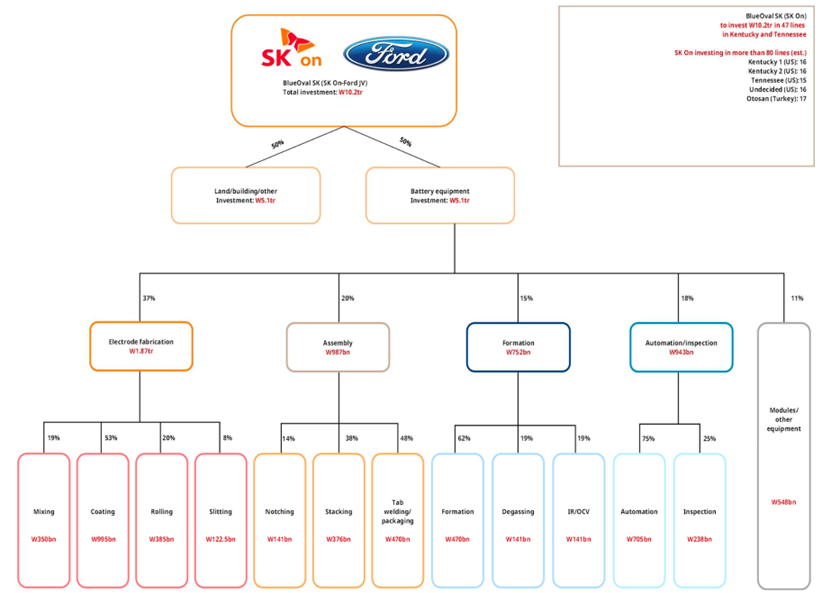

In this round of large-scale construction of production capacity, SK On, with independence and active support from financial consortiums, has the most aggressive equipment order prospects. They plan to deploy more than 100 production lines in 2022 and 2023. In addition to the 12 in Yancheng, China and 11 in Ivanca, Hungary, they will also build more than 80 lines in the second half of 2022. BlueOval SK will have a total of 47 assembly lines in Kentucky and Tennessee factories.

The large investment from SK On can be seen as a driving force for Ford, and from the perspective of value breakdown, the investment is distributed across electrode preparation (37%), cell assembly (20%), cell formation (15%), cell capacity testing (18%), and battery grouping (11%).

The large investment from SK On can be seen as a driving force for Ford, and from the perspective of value breakdown, the investment is distributed across electrode preparation (37%), cell assembly (20%), cell formation (15%), cell capacity testing (18%), and battery grouping (11%).

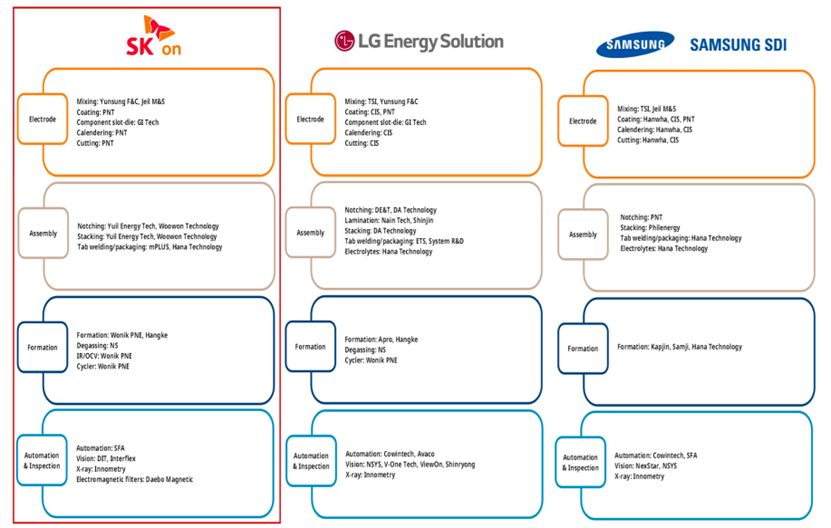

This graph shows the supply systems of three Korean battery companies.

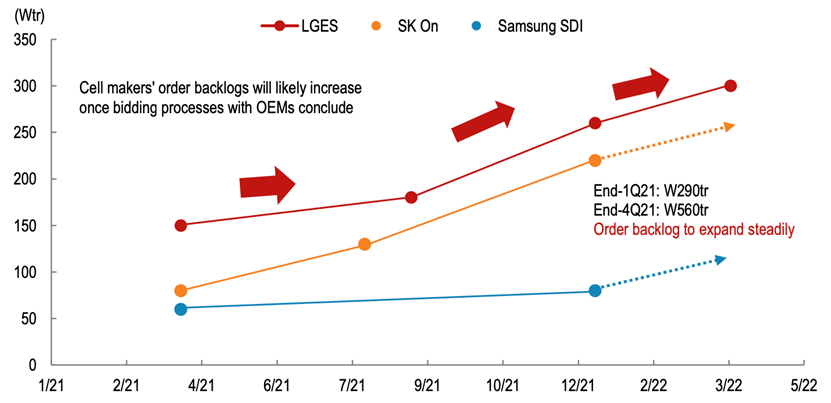

Order Trend of Korean Battery Companies

From LG’s dominance to SK On’s substantial investment, it can be seen that GM has previously made a full push for LG’s production capacity construction. This round of SK On’s investment is mainly focused on the demands of Ford and Volkswagen, and there is a significant increase in SK On’s orders in the new round of orders at the beginning of this year.

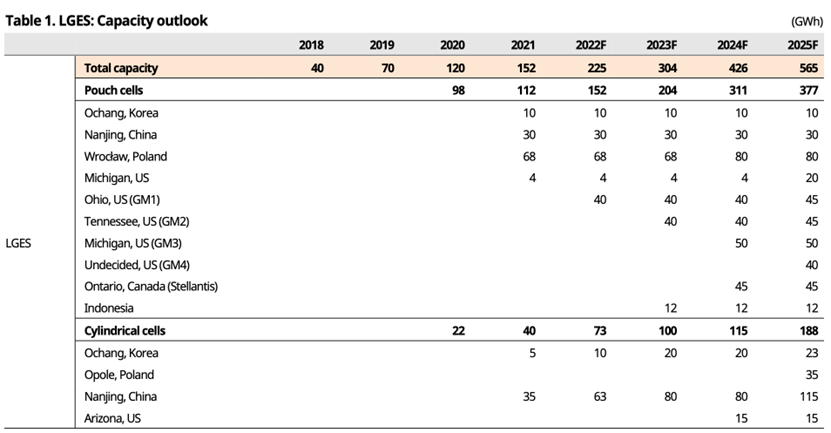

The estimated landing of the production capacity of the two major Korean battery companies is as follows:

1) LG

The latest change is that, except for the three joint ventures with GM, Stellantis, and Hyundai, LG has deployed all of its increased production capacity to cylindrical batteries. On the one hand, it is increasing the planning of cylindrical battery plants in the United States, and on the other hand, it is increasing the cylindrical battery production capacity of the European Polish plant. I am curious about whether the production capacity of the cylindrical battery plant in Nanjing can be smoothly switched to 4680.

2) SK

The following table is interesting, mainly showing the order situation of battery equipment for the three Korean battery companies.

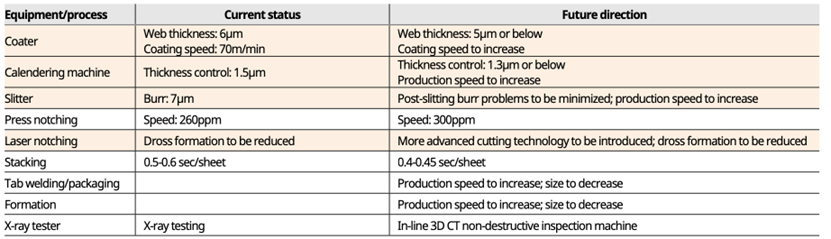

The last table, Table 4, shows some directions of progress in battery technology.

The last table, Table 4, shows some directions of progress in battery technology.

Summary: Based on the current development speed, China’s first-mover advantage in battery production capacity is already evident. The current round of capacity construction in Korea and Japan revolves around demand from the United States. We will see in a couple of years whether this system can become established.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.