Author: Zhu Yulong

Regarding the topic discussed in the first video, we can track the overall progress of Tesla’s 4680 battery.

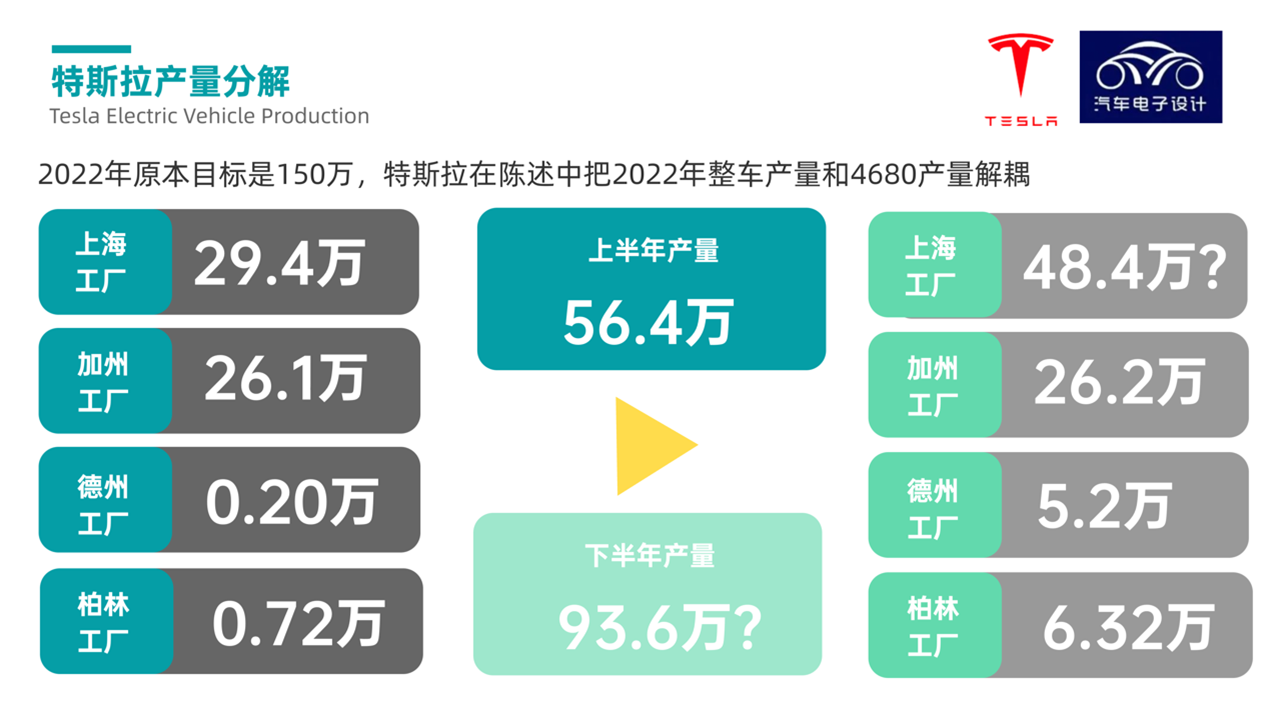

During the Q2 earnings call, Elon Musk repeatedly emphasized that the 1.5 million vehicle production target for 2022 is decoupled from the progress of the 4680 battery, in fact, it is not dependent on the production progress of the 4680 cells in California and Texas. Tesla has enough 2170 cells to support the entire vehicle production for the remaining time of this year. Logically, the proportion of 4680 batteries in Tesla’s 2022 production will only become strategically significant in 2023.

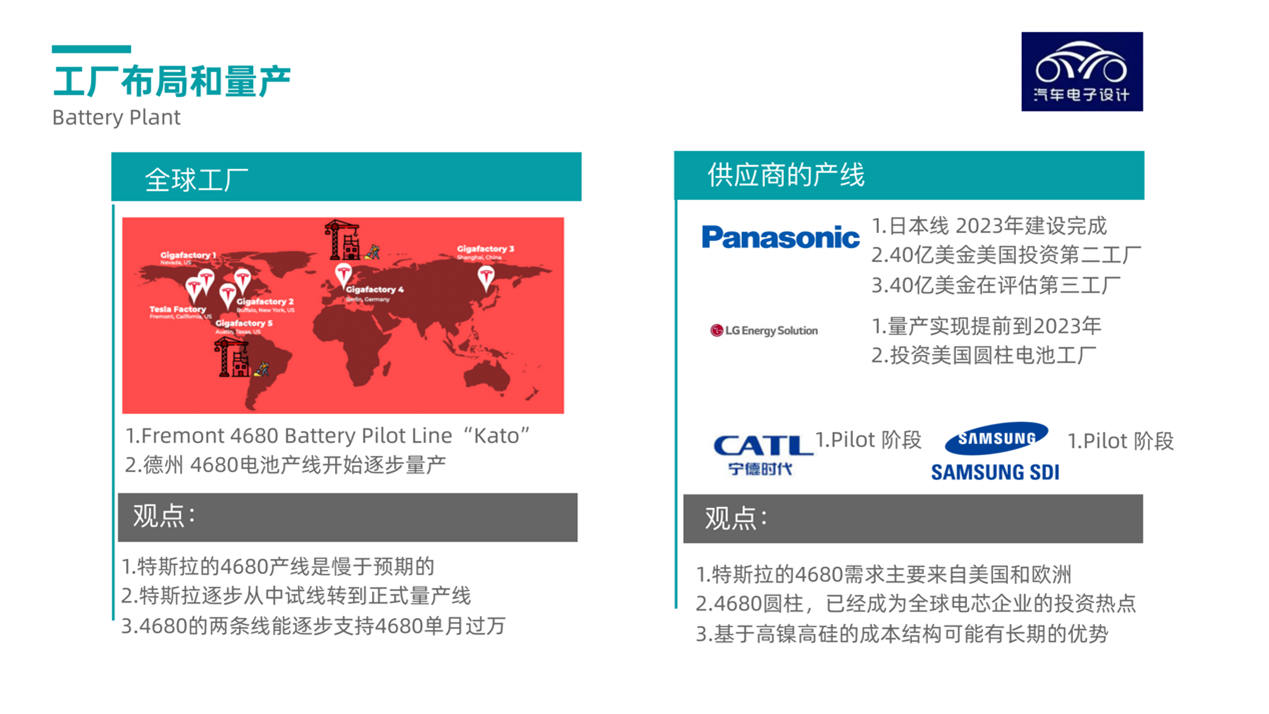

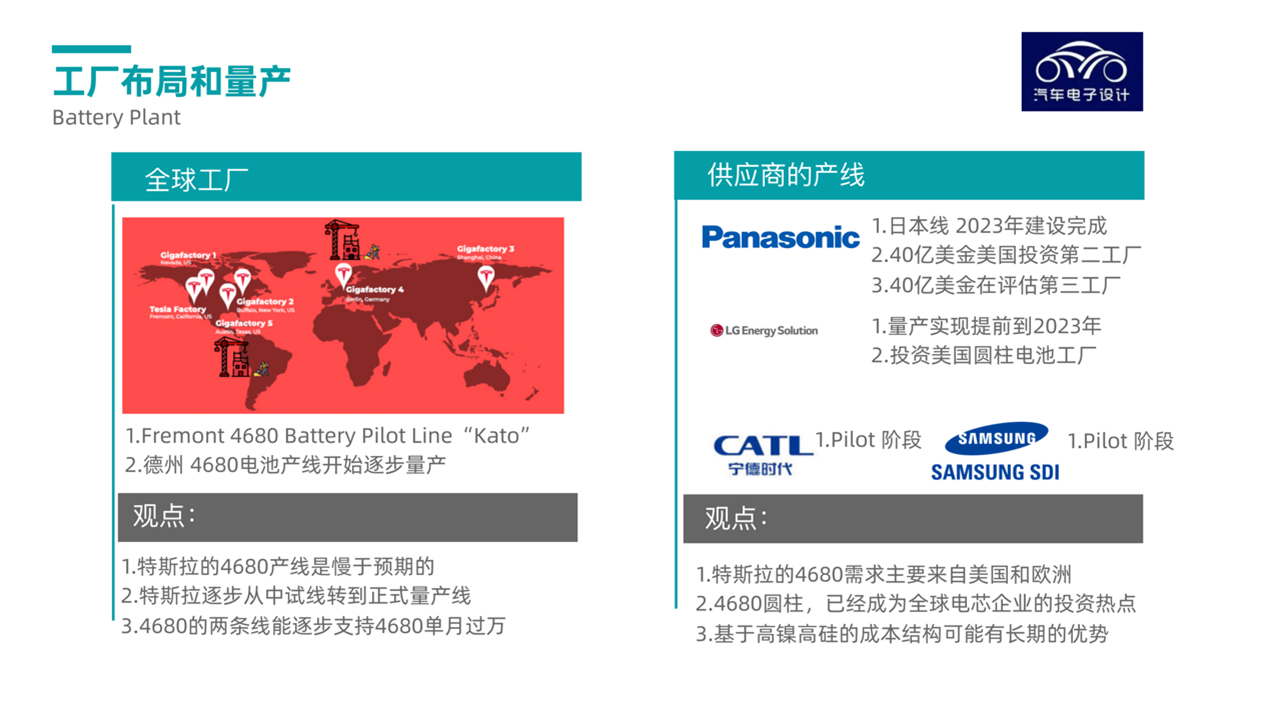

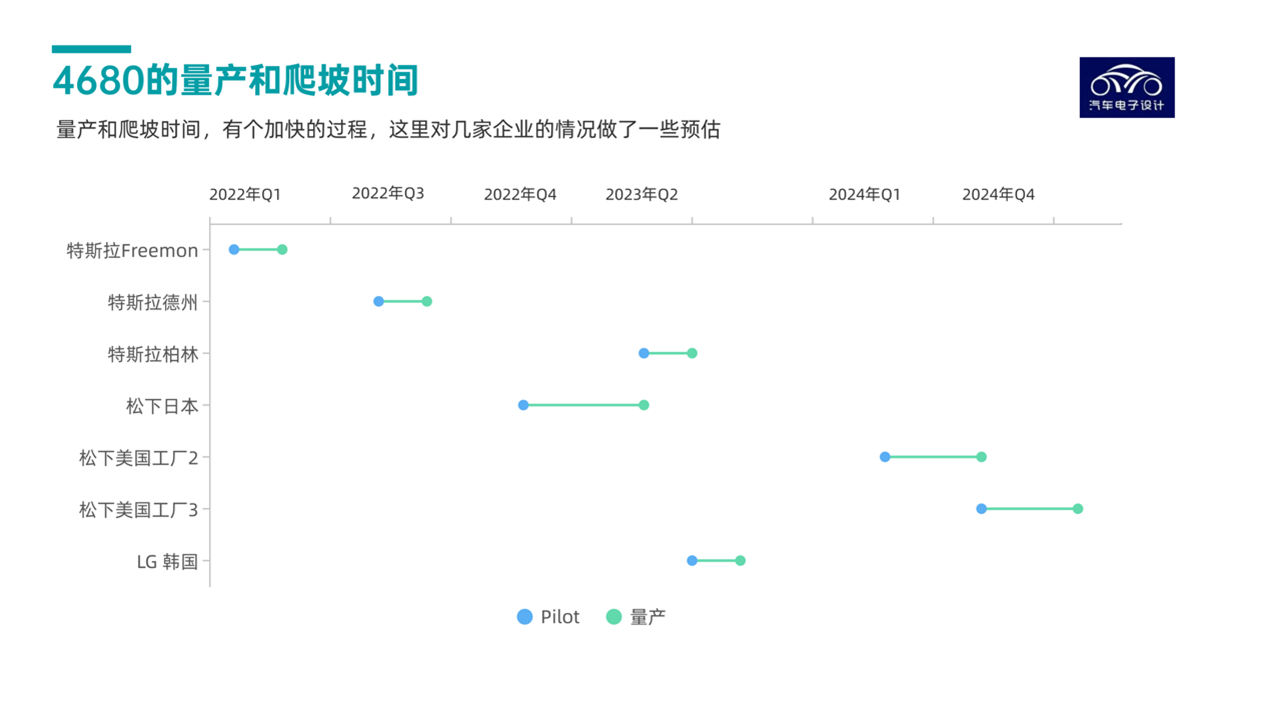

Currently, as 4680 battery continues to fall behind expectations, Tesla plans to begin production of 4680 cells at the Texas Gigafactory this quarter (Q3) to surpass the production capacity of the Kato experiment line in Fremont, California by the end of 2022. The 4680 cells currently produced on the pilot line are insufficient to meet the production needs of 1,000 vehicles per week (equivalent to an annual capacity of less than 4 GWh).

Strategic Significance of Tesla’s 4680 Battery

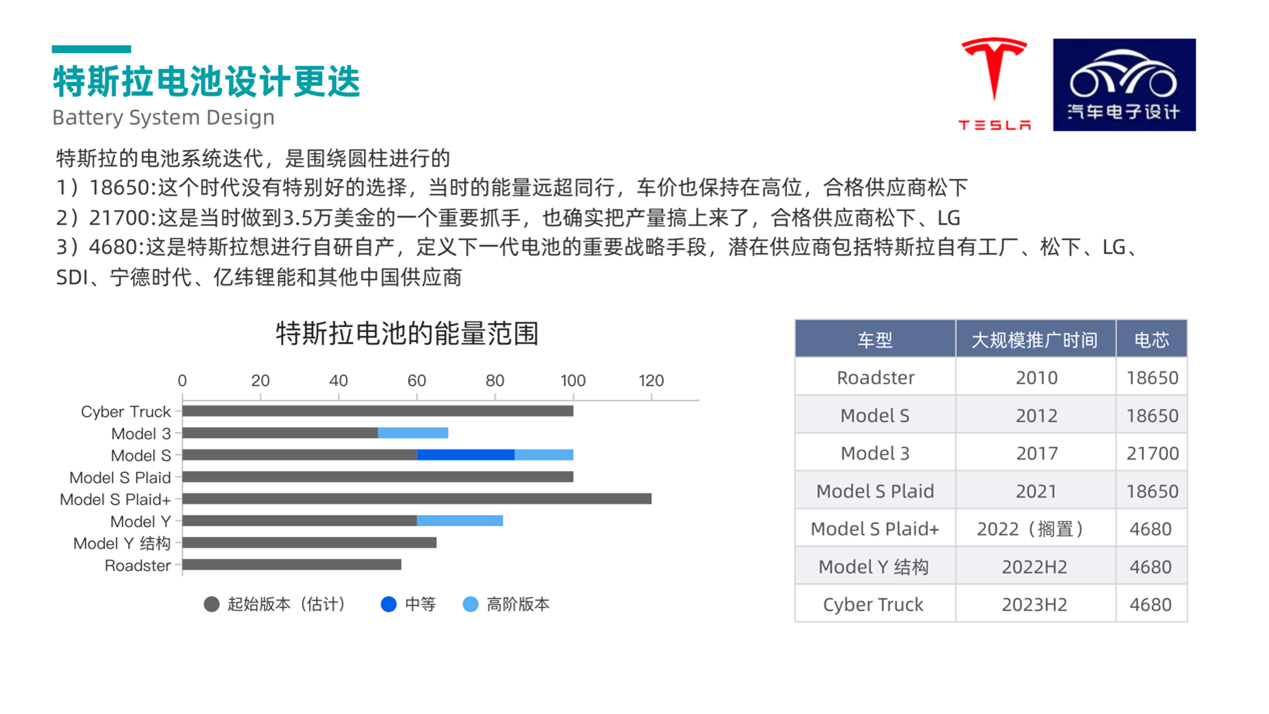

In China, we are always considering Tesla’s leading position in the three-electricity system. In fact, its battery system iteration is centered around cylindrical batteries:

- 18650

At the time, there were no particularly good options, and the energy exceeded that of its peers, while vehicle prices remained high. Panasonic was a qualified supplier.

- 21700

This was an important lever to achieve the $35,000 price point, and it truly increased production capacity, with qualified suppliers including Panasonic and LG.

- 4680

This is Tesla’s important strategic means to conduct self-development and production, and define the next generation of batteries. Potential suppliers include Tesla’s own factories, Panasonic, LG, SDI, CATL, EVE Energy, and other Chinese suppliers.

Because Ningde Times and BYD’s batteries are used in the entry-level models, if Tesla cannot make effective breakthroughs in the 4680 battery, especially in terms of chemical system, performance, and cost, then Tesla’s powertrain advantage will be completely flattened.

Since the Kato pilot line of Tesla in California was successful, the production capacity has increased by 35% every month since March. The factory in Texas is also planning to start large-scale production in Q3, which will soon change this situation. The 4680 battery equipment in Texas has been completely installed and debugged in Q2, and the first test car using Texas batteries has been produced on the production line. The goal of Texas is to start formal production this quarter, and Texas should be able to surpass Kato’s weekly production by the end of this year.

The Austin Giga Texas, which opened in April, is currently only producing the standard range Model Y sold in North America, equipped with the 4680 structured battery pack, and the long range Model Y produced with 2170 batteries transported over.

As it relates to Tesla’s battery leadership, Tesla’s vision does not just rely on its own 4680 production. Battery partner Panasonic sent the first batch of 4680 sample batteries to Tesla and started trial production in Japan in May. Due to regulations in the United States, Panasonic may invest 8 billion U.S. dollars to produce 4680 batteries for Tesla, which is directly related to its settlement in North America and Mexico with CATL before.

Note: Due to material limitations, Tesla is also evaluating the long-term idle regulations.

Samsung SDI is currently constructing its 4680 trial line in Tian’an and will then begin mass production in Malaysia.

LG Energy also needs to construct a trial line in South Korea, and then build 4680 cylindrical production lines in the United States and Europe to meet customer demand.

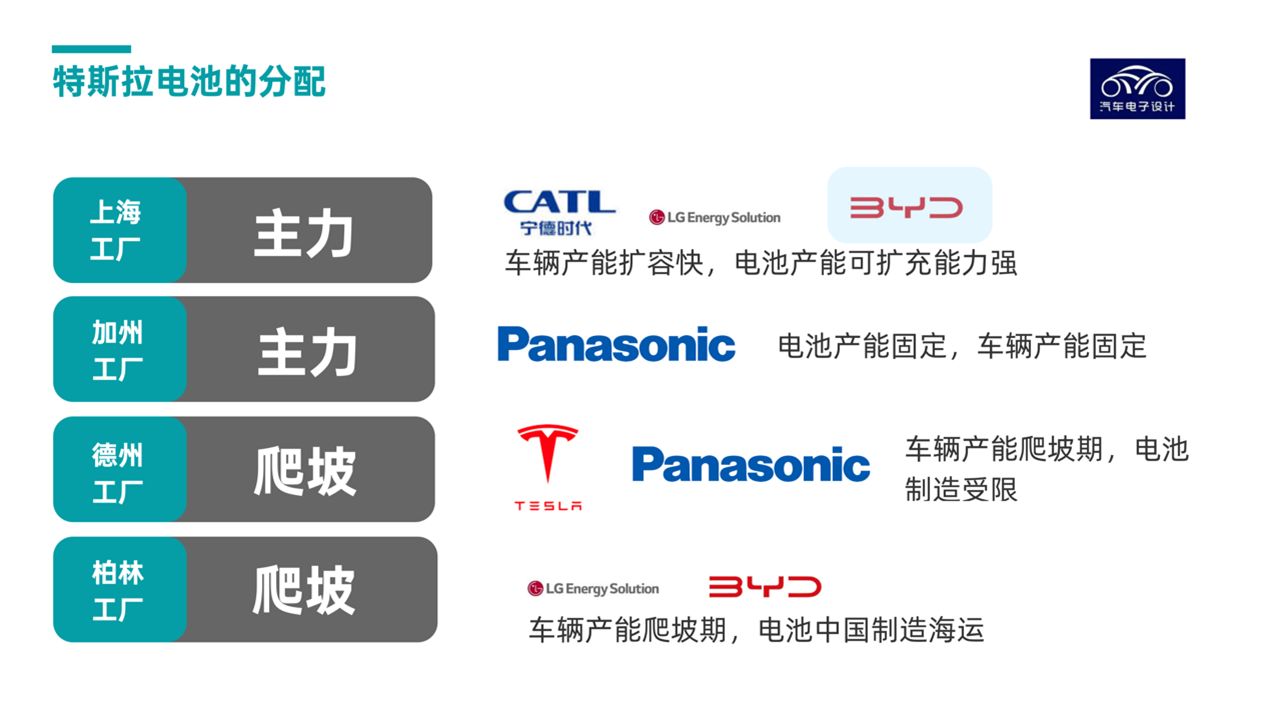

From a logical point of view, under conditions where regulations do not limit, Tesla’s entry-level battery is based on lithium iron phosphate and subsequent improved formulas. Chinese battery suppliers have strong power in battles, so the allocation plan is shown in the following figure:

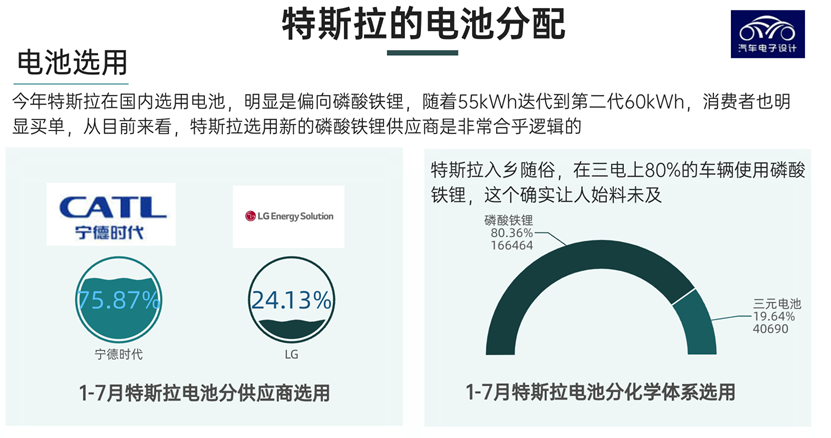

Tesla is very receptive in China. From January to July, the usage of 60kWh lithium iron phosphate has accounted for 3/4, and the corresponding LG energy products have entered the fast lane. If we calculate the vehicle quantity, it has already surpassed 80%. It remains to be seen whether Tesla will use BYD’s blade batteries in China.

Summary: In my opinion, Tesla is still in the early stages of developing its 4680 batteries, similar to the production issues encountered in 2017. Once those issues are resolved, the push towards 4680 batteries will be significant.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.